Stamp Duty on Main Residence If You Own another Property

- Adil Akhtar

- Jun 20, 2025

- 14 min read

Updated: Oct 31, 2025

The Audio Summary of the Key Points of the Article:

Understanding Stamp Duty When You Own Multiple Properties

If you’re buying a new home in the UK but already own another property, you might be wondering how much Stamp Duty Land Tax (SDLT) you’ll need to pay. Let’s cut to the chase: if the new property is your main residence but you still own another residential property worth £40,000 or more, you’ll likely face a 5% surcharge on top of standard SDLT rates. This rule, effective as of April 2025, applies in England and Northern Ireland and can significantly increase your tax bill.

What Is Stamp Duty Land Tax and Who Pays It?

Now, SDLT isn’t some mysterious tax designed to catch you off guard. It’s a tax you pay when buying property or land in England or Northern Ireland above certain thresholds. For residential properties, you start paying SDLT if the purchase price exceeds £125,000 (as of April 2025). If you’re a first-time buyer, this threshold is £300,000, but that relief doesn’t apply if you already own another property. The tax is calculated on a tiered basis, meaning you pay different rates on portions of the price. Here’s the standard SDLT rate table for main residences as of April 2025:

Property Price Band | Standard SDLT Rate |

£0 - £125,000 | 0% |

£125,001 - £250,000 | 2% |

£250,001 - £925,000 | 5% |

£925,001 - £1,500,000 | 10% |

Over £1,500,000 | 12% |

But here’s the kicker: if you own another residential property (e.g., a buy-to-let, holiday home, or even a share worth £40,000 or more), you’ll pay an additional 5% on each band for the new purchase, unless specific exemptions apply. (https://www.gov.uk/stamp-duty-land-tax/residential-property-rates)

Why Does the 5% Surcharge Apply?

So why does owning another property trigger this extra cost? The government introduced the higher rates in April 2016 (increased to 5% from 3% in October 2024) to discourage second-home ownership and free up housing for main residences. The surcharge applies if, at the end of the day you complete your purchase, you own more than one residential property worth £40,000 or more. This includes properties you own outright, have a mortgage on, or even hold a share in e.g., inherited properties or those in trusts.

How Is the Surcharge Calculated?

Let’s make this crystal clear with an example. Imagine you’re Priya, a London-based professional, buying a new main residence for £400,000 in June 2025. You already own a buy-to-let flat worth £200,000. Because you own another property, the 5% surcharge applies. Here’s how your SDLT is calculated:

£0 - £125,000: 0% + 5% = 5% → £125,000 × 5% = £6,250

£125,001 - £250,000: 2% + 5% = 7% → £125,000 × 7% = £8,750

£250,001 - £400,000: 5% + 5% = 10% → £150,000 × 10% = £15,000

Total SDLT: £6,250 + £8,750 + £15,000 = £30,000

If Priya didn’t own another property, her SDLT would be just £7,500 (0% on the first £125,000, 2% on the next £125,000, and 5% on the remaining £150,000". The surcharge adds a hefty £22,500 to her bill.

You can verify this using the GOV.UK SDLT calculator or the following calculator:

When Does the Surcharge Not Apply?

Now, don’t panic just yet—there are ways to avoid the surcharge. You won’t pay the extra 5% if both of these conditions are met:

The property you’re buying is replacing your main residence (the home you live in most of the time).

You’ve sold or gifted your previous main residence within 36 months of completing the new purchase.

For example, if you’re moving from one main home to another and sell your old home on the same day, you’ll pay standard SDLT rates. But if there’s a delay (e.g., your old home doesn’t sell before you buy), you’ll pay the surcharge upfront and can claim a refund later if you sell within three years. We’ll dive into refunds in the next part.

What About Non-UK Residents?

Be careful! If you’re not a UK resident for SDLT purposes (meaning you’ve spent fewer than 183 days in the UK in the 12 months before your purchase), you’ll face an additional 2% surcharge on top of the 5% second-home surcharge. For a £400,000 property, this could push your SDLT rate to 12% on the £250,001–£400,000 band, adding thousands to your costs. This rule, in place since April 2021, applies to freehold and leasehold purchases and even affects UK companies controlled by non-residents.

Case Study: A Business Owner’s Surprise

Consider this: If you’re a business owner like Ewan, who runs a small tech firm in Manchester, you might own a flat through your company for employee use. In 2024, Ewan bought a new family home for £600,000 while keeping the company flat. He assumed the company-owned flat wouldn’t trigger the surcharge, but he was wrong. Companies purchasing residential properties worth over £500,000 face a 17% flat SDLT rate (up from 15% in April 2025), and individuals like Ewan are hit with the 5% surcharge if they personally own multiple properties. Ewan’s SDLT bill was £47,500, nearly double what he’d pay for a single residence. This highlights the need to plan property purchases carefully, especially for business owners.

Key Takeaways So Far

None of us loves paying extra tax, but understanding SDLT rules can save you thousands. The 5% surcharge applies broadly, but exemptions exist for replacing your main residence. Non-UK residents and business owners face additional hurdles, and missteps can be costly. In the next part, we’ll explore refunds, reliefs, and practical strategies to manage your SDLT liability, including niche scenarios like trusts and mixed-use properties.

Navigating Refunds, Reliefs, and Complex Scenarios

Now, if you’ve been hit with the 5% Stamp Duty Land Tax (SDLT) surcharge because you own another property, don’t lose hope just yet. There are ways to reduce or even reclaim that extra tax, especially if you’re replacing your main residence or dealing with unique situations like trusts or mixed-use properties. In this part, we’ll dive into practical steps for claiming refunds, explore lesser-known reliefs, and tackle complex scenarios that many UK taxpayers and business owners face. Let’s get into the nitty-gritty with real-world examples and actionable advice, all verified as of 2025.

How Can You Claim a Refund for the Surcharge?

Let’s say you’ve bought a new main residence but couldn’t sell your old one in time, so you paid the 5% surcharge. Good news: you can claim a refund if you sell your previous main residence within 36 months of completing the new purchase. For example, take Aisha, a teacher in Bristol, who bought a £350,000 home in January 2025 while still owning her old flat. She paid £23,750 in SDLT, including the surcharge. Six months later, she sold her old flat. By applying to HMRC, she reclaimed the surcharge portion (£17,500), bringing her total SDLT to the standard £6,250.

Be careful! If you don’t sell within 36 months, the surcharge is non-refundable, and you’ll need to plan your finances accordingly.

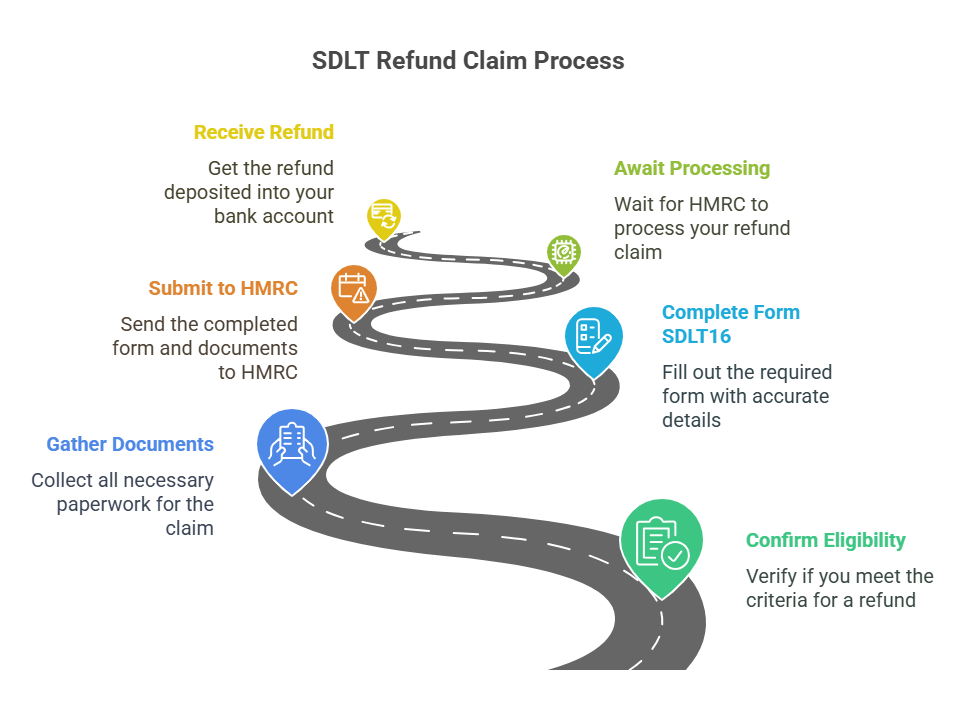

Step-by-Step Guide to Claiming an SDLT Refund

Confirm Eligibility: Ensure you’ve sold your previous main residence within 36 months of buying the new one. The sold property must have been your main home, not a second home or investment property.

Gather Documents: You’ll need the SDLT return (SDLT1) from the original purchase, proof of sale (e.g., Land Registry documents), and details of both transactions.

Complete Form SDLT16: Download this form from www.gov.uk/government/publications/stamp-duty-land-tax-apply-for-a-repayment-of-the-higher-rates-for-additional-properties-sdlt16. Fill in details like the effective date of the new purchase and the sale date of the old property.

Submit to HMRC: Send the form and supporting documents to HMRC within 12 months of selling the old property or 12 months after the filing date of the original SDLT return, whichever is later.

Await Processing: HMRC typically processes refunds within 4–6 weeks, paying directly to your nominated bank account.

Tip: If you used a solicitor, they can handle this for you, but check their fees to ensure it’s cost-effective.

What Reliefs Can You Use to Reduce SDLT?

None of us wants to pay more tax than necessary, so let’s explore reliefs that might lower your SDLT bill. Beyond the main residence replacement rule, here are some key reliefs as of April 2025:

Multiple Dwellings Relief (MDR): If you’re buying multiple residential properties in one transaction (e.g., a block of flats), MDR can reduce your SDLT by calculating the tax based on the average price per dwelling, subject to a minimum rate of 1%. For example, buying two flats for £600,000 total (£300,000 each) could save you thousands compared to taxing the full amount at higher rates.

Mixed-Use Property Relief: Properties with both residential and non-residential elements (e.g., a shop with a flat above) are taxed at non-residential SDLT rates, which are lower (0% up to £150,000, 2% from £150,001 to £250,000, and 5% above £250,000). No 5% surcharge applies here.

Shared Ownership Relief: If you’re buying a share in a main residence through a shared ownership scheme, you can opt to pay SDLT only on your share, avoiding the surcharge if the property replaces your main residence.

For instance, consider Tariq, a business owner in Leeds, who bought a mixed-use property (a shop with a flat) for £500,000 in 2024. Instead of paying residential rates with the 5% surcharge (which would’ve been £37,500), he paid non-residential rates: £14,500 (0% on £150,000, 2% on £100,000, 5% on £250,000). This saved him £23,000, showing how understanding property classification can make a huge difference.

What Happens with Properties in Trusts?

Now, trusts can be a real head-scratcher. If you’re a beneficiary or trustee of a trust holding a residential property, the 5% surcharge might still apply. For example, if you’re buying a new main residence and have a beneficial interest in a trust owning a property worth £40,000 or more, HMRC counts this as owning another property. In 2023, Fiona, a solicitor in Edinburgh, faced this when she bought a £450,000 home while being a beneficiary of a family trust holding a £100,000 cottage. She paid £35,000 in SDLT, including the surcharge, because the trust’s property triggered the higher rates.

However, if the trust is a bare trust (where you have absolute rights to the property), you might avoid the surcharge by proving the new home replaces your main residence. Always consult a tax advisor for trusts, as HMRC’s rules are strict and errors can be costly.

How Do Non-UK Properties Affect SDLT?

So, the question is: what if your other property is abroad? Owning a holiday home in Spain or a rental in Dubai still counts for the 5% surcharge if it’s worth £40,000 or more. For non-UK residents, the additional 2% surcharge also applies. Take Luca, an Italian expat living in London part-time, who bought a £700,000 flat in 2025. Owning a villa in Tuscany triggered the 5% surcharge, and his non-UK resident status added the 2% surcharge. His SDLT was £64,500 (7% on £125,001–£250,000, 10% on £250,001–£925,000), compared to £27,500 without surcharges. Luca could’ve saved by becoming UK resident before the purchase, but residency rules are complex—check HMRC’s guidance: www.gov.uk/guidance/stamp-duty-land-tax-non-uk-resident-surcharge.

Practical Tips for Business Owners

If you’re a business owner, SDLT can hit hard, especially if you buy properties through a company. Companies pay a 17% flat rate on residential properties over £500,000, and the 5% surcharge applies if you personally own other properties. To minimize SDLT:

Time Your Transactions: Sell your old main residence before buying a new one to avoid the surcharge.

Consider Mixed-Use Classification: If buying a property with commercial elements, ensure it’s correctly classified to benefit from lower rates.

Use Professional Advice: A tax advisor can help navigate reliefs like MDR or trust-related exemptions, potentially saving thousands.

In 2024, Meera, who runs a catering business in Birmingham, bought a £400,000 flat as her main residence while owning a rental property. By consulting a tax advisor, she learned she could gift the rental to her spouse before the purchase, avoiding the surcharge and saving £20,000. Such strategies require careful planning and legal advice to stay HMRC-compliant.

Key Takeaways for Managing Stamp Duty with Multiple Properties

Now, let’s pull everything together into a clear, concise summary to ensure you’re ready to tackle Stamp Duty Land Tax (SDLT) when buying a main residence while owning another property. Whether you’re a homeowner, landlord, or business owner in the UK, these points distil the most critical information from our deep dive, verified as of April 2025. Below, I’ve outlined the top 10 takeaways in single-sentence points to keep things practical and actionable, helping you save money and avoid pitfalls.

Summary of the Most Important Points

If you own another residential property worth £40,000 or more when buying a new main residence, you’ll pay a 5% SDLT surcharge on top of standard rates, significantly increasing your tax bill.

Standard SDLT rates for main residences in England and Northern Ireland (as of April 2025) are 0% up to £125,000, 2% from £125,001 to £250,000, 5% from £250,001 to £925,000, 10% from £925,001 to £1,500,000, and 12% above £1,500,000.

You can avoid the 5% surcharge if the new property replaces your main residence and you’ve sold your previous main home before or on the same day as the purchase.

If you pay the surcharge but sell your previous main residence within 36 months, you can claim a refund by submitting Form SDLT16 to HMRC, typically processed within 4–6 weeks.

Non-UK residents face an additional 2% surcharge on top of the 5% second-home surcharge, applied if you’ve spent fewer than 183 days in the UK in the 12 months before the purchase.

Properties held in trusts or owned abroad (worth £40,000 or more) count as additional properties for the 5% surcharge, so check your ownership status carefully.

Mixed-use properties (e.g., a shop with a flat) are taxed at lower non-residential SDLT rates (0% up to £150,000, 2% from £150,001 to £250,000, 5% above £250,000) and are exempt from the 5% surcharge.

Multiple Dwellings Relief (MDR) can reduce SDLT when buying multiple residential properties in one transaction by calculating tax on the average price per dwelling, subject to a minimum 1% rate.

Business owners buying through a company face a 17% flat SDLT rate on residential properties over £500,000, making professional tax advice crucial to explore reliefs or restructuring options.

Strategic planning, such as gifting a property to a spouse or timing the sale of your old home, can legally minimize SDLT, but always consult a tax advisor to ensure HMRC compliance.

Where Can You Find More Help?

So, the question is: what’s next if you’re still unsure about your SDLT obligations? Start with HMRC’s official guidance at www.gov.uk/stamp-duty-land-tax for detailed rules and updates. For complex cases—like trusts, non-UK properties, or company purchases—consider hiring a tax advisor or conveyancing solicitor who specializes in SDLT. They can help you navigate reliefs, calculate liabilities, or file refund claims accurately. You can also use the GOV.UK SDLT calculator (www.gov.uk/stamp-duty-land-tax-calculator) to estimate your tax, but double-check the inputs, especially for surcharges or reliefs.

A better option to get help is to contact Pro Tax Accountant and get help from their SDLT-specialist accountants.

Final Thoughts for Taxpayers and Business Owners

Now, nobody wants to overpay on SDLT, but mistakes happen when you don’t know the rules or plan ahead. For example, in 2024, Khalid, a Birmingham-based landlord, nearly overpaid £15,000 by missing out on mixed-use relief for a property he bought for his catering business. By catching the error early, he saved thousands. Whether you’re moving house, expanding a property portfolio, or buying through a company, understanding SDLT surcharges, exemptions, and reliefs is crucial. Keep these takeaways handy, verify your situation with HMRC’s tools, and don’t hesitate to seek professional advice for complex deals. With the right knowledge, you can keep your tax bill as low as legally possible.

FAQs

Q1: What is the definition of a main residence for SDLT purposes?

A1: A main residence for SDLT purposes is the property where an individual or their spouse/civil partner lives most of the time, determined by factors like time spent there and personal circumstances.

Q2: Does the SDLT surcharge apply if someone owns a commercial property?

A2: The 5% SDLT surcharge does not apply if the other property owned is commercial, as it only applies to additional residential properties worth £40,000 or more.

Q3: Can joint buyers avoid the SDLT surcharge if only one owns another property?

A3: If any joint buyer owns another residential property worth £40,000 or more, the 5% surcharge applies to the entire purchase unless the new property replaces their main residence.

Q4: How does SDLT apply to married couples buying a main residence?

A4: Married couples are treated as a single unit for SDLT, so if either spouse owns another residential property, the 5% surcharge applies unless the purchase replaces their shared main residence.

Q5: Is the SDLT surcharge applicable to properties inherited but not lived in?

A5: An inherited residential property worth £40,000 or more triggers the 5% surcharge unless the new purchase replaces the buyer’s main residence.

Q6: Can someone claim SDLT relief if buying a main residence for a dependent relative?

A6: No specific SDLT relief exists for buying a main residence for a dependent relative, and the 5% surcharge may apply if the buyer owns another property.

Q7: Does the SDLT surcharge apply to leasehold properties?

A7: The 5% surcharge applies to leasehold residential properties if the buyer owns another residential property, with SDLT calculated on the lease premium and net present value of rent.

Q8: How does SDLT work for a main residence purchased through a partnership?

A8: If a partnership owns a residential property and a partner buys a main residence, the 5% surcharge may apply depending on the partner’s share and the partnership’s structure.

Q9: Can the SDLT surcharge be avoided by transferring a property to a child?

A9: Transferring a property to a child before buying a new main residence may avoid the 5% surcharge, but the transfer must be a genuine gift and comply with HMRC rules.

Q10: What happens to SDLT if someone buys a main residence but plans to demolish it?

A10: If a property is purchased as a main residence but is uninhabitable or demolished, it may still be treated as residential for SDLT, potentially triggering the 5% surcharge.

Q11: Does the SDLT surcharge apply to mobile homes or houseboats?

A11: Mobile homes and houseboats are generally not subject to SDLT or the 5% surcharge, as they are not considered fixed residential properties.

Q12: Can someone claim a refund if they sell their second property but not their main residence?

A12: A refund of the 5% surcharge is only available if the sold property was the buyer’s previous main residence, not a second property.

Q13: How is SDLT calculated for a main residence with a long lease?

A13: SDLT on a main residence with a long lease is based on the lease premium plus the net present value of rent, with the 5% surcharge applied if another property is owned.

Q14: Does the SDLT surcharge apply if the other property is owned by a spouse living separately?

A14: If a spouse lives separately but the couple is not legally separated or divorced, their property ownership is combined, potentially triggering the 5% surcharge.

Q15: Can first-time buyer relief apply when owning another property?

A15: First-time buyer relief is unavailable if the buyer owns or has previously owned any property, including partial ownership worth £40,000 or more.

Q16: How does SDLT apply to a main residence purchased as a gift?

A16: If a main residence is gifted rather than purchased, no SDLT is due, but any associated debt or mortgage assumption could trigger SDLT and the 5% surcharge.

Q17: Is the SDLT surcharge applicable to properties in Scotland or Wales?

A17: The 5% SDLT surcharge applies only in England and Northern Ireland; Scotland and Wales have their own land transaction taxes with different rules.

Q18: Can someone appeal an SDLT surcharge decision by HMRC?

A18: An SDLT surcharge decision can be appealed within 30 days of HMRC’s notice, provided there are grounds like incorrect property classification or eligibility errors.

Q19: Does the SDLT surcharge apply to properties bought for charity use?

A19: Properties bought by charities for charitable purposes may be exempt from SDLT, including the 5% surcharge, if specific HMRC conditions are met.

Q20: How does SDLT apply if someone buys a main residence while renting out their current home?

A20: Renting out a current home counts as owning another residential property, triggering the 5% SDLT surcharge unless the new purchase replaces the main residence.

About The Author:

Adil Akhtar, ACMA, CGMA, CEO and Chief Accountant of Pro Tax Accountant, is an esteemed tax blog writer with over 10 years of expertise in navigating complex tax matters. For more than three years, his insightful blogs have empowered UK taxpayers with clear, actionable advice. Leading Advantax Accountants as well, Adil blends technical prowess with a passion for demystifying finance, cementing his reputation as a trusted authority in tax education.

Email: adilacma@icloud.com

Disclaimer:

The information provided in our articles is for general informational purposes only and is not intended as professional advice. While we strive to keep the information up-to-date and correct, Pro Tax Accountant makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained in the articles for any purpose. Any reliance you place on such information is therefore strictly at your own risk. Some of the data in the above graphs may to give 100% accurate data.

We encourage all readers to consult with a qualified professional before making any decisions based on the information provided. The tax and accounting rules in the UK are subject to change and can vary depending on individual circumstances. Therefore, Pro Tax Accountant cannot be held liable for any errors, omissions, or inaccuracies published. The firm is not responsible for any losses, injuries, or damages arising from the display or use of this information.

.png)