Stamp Duty First Time Buyers

- Adil Akhtar

- Jun 15, 2025

- 18 min read

Updated: Sep 8, 2025

The Audio Summary of the Key Points of the Article:

Understanding Stamp Duty for First-Time Buyers in 2025-26: What You Need to Know

Right, let’s dive into the world of stamp duty for first-time buyers in the UK for the 2025-26 tax year. If you’re eyeing your first home, you’re probably wondering how much tax you’ll need to fork out when you sign on the dotted line. Stamp Duty Land Tax (SDLT) is a tax you pay when buying a property or land over a certain price in England and Northern Ireland, and it’s a big deal for first-time buyers because it can significantly affect your budget. From April 1, 2025, the rules have shifted, and I’m here to break it all down with the latest info, practical tips, and some real-world examples to help you navigate this tax maze. Let’s get started with the basics and then dig into the nitty-gritty.

What Is Stamp Duty Land Tax and Why Does It Matter to First-Time Buyers?

Okay, so you’re about to buy your first home—exciting times! But before you pop the champagne, you need to understand SDLT. It’s a tax slapped on property purchases, whether you’re buying a freehold, leasehold, or shared ownership home. For first-time buyers, SDLT can feel like a sneaky extra cost that creeps up just when you thought you had your finances sorted. The good news? There’s relief available specifically for first-time buyers, but the bad news is that the thresholds changed on April 1, 2025, making things a bit pricier for some. Knowing the rules inside out can save you thousands, so let’s unpack the details.

What Are the Stamp Duty Rates for First-Time Buyers in 2025-26?

Now, let’s talk numbers. As of April 1, 2025, the stamp duty thresholds for first-time buyers in England and Northern Ireland have reverted to their pre-2022 levels, ending the temporary relief introduced in September 2022. Here’s the deal: if you’re a first-time buyer, you pay no SDLT on properties worth up to £300,000. For properties between £300,001 and £500,000, you’ll pay 5% on the portion above £300,000. If your dream home costs more than £500,000, you lose the first-time buyer relief entirely and pay standard SDLT rates on the full amount. Here’s a handy table to make sense of it:

Property Value | First-Time Buyer SDLT Rate | Standard SDLT Rate |

Up to £125,000 | 0% | 0% |

£125,001 - £250,000 | 0% | 2% |

£250,001 - £300,000 | 0% | 5% |

£300,001 - £500,000 | 5% (on portion above £300,000) | 5% |

£500,001 - £925,000 | Standard rates apply | 5% |

£925,001 - £1,500,000 | Standard rates apply | 10% |

Above £1,500,000 | Standard rates apply | 12% |

For example, if you’re buying a £400,000 flat in Manchester as a first-time buyer, you’d pay 0% on the first £300,000 and 5% on the remaining £100,000, which is £5,000 in SDLT. Compare that to March 31, 2025, when the threshold was £425,000, and you’d have paid nothing. That’s a big jump, especially in high-cost areas like London or the South East.

Who Qualifies for First-Time Buyer Relief?

Hold up, before you start calculating, let’s make sure you’re eligible. To claim first-time buyer relief, you (and anyone you’re buying with) must never have owned a residential property anywhere in the world—freehold or leasehold. That includes inheriting a property or owning one through a trust. The property must also be your main residence, not a buy-to-let or holiday home. If you’re buying with a partner and they’ve owned a home before, you’re both out of luck for the relief. It’s a strict rule, but HMRC’s online calculator can help you confirm eligibility before you commit.

How Do the 2025 Changes Impact First-Time Buyers?

Be careful! The changes that kicked in on April 1, 2025, have hit first-time buyers hardest in certain regions. The nil-rate threshold dropping from £425,000 to £300,000 means more buyers are now paying SDLT. According to Zoopla, the average house price in the UK is around £267,000, but in London and the South East, it’s often well above £300,000. In 91 local authorities, the average first-time buyer purchase price exceeds the new threshold, meaning thousands more buyers are now taxed. For instance, in Canterbury, where the average detached home sold for £561,605 in 2024, first-time buyers purchasing above £500,000 face standard rates, which could mean £16,250 in SDLT for a £525,000 home—compared to £5,000 under the old rules.

Why Did the Thresholds Change?

Now, you might be wondering why the government tweaked the rules. Back in September 2022, the Conservative government raised the nil-rate threshold to £425,000 for first-time buyers to boost the housing market. It was meant to be permanent, but the Autumn Statement 2022 announced it would end on March 31, 2025, to balance the books. The return to £300,000 reflects a push for fiscal responsibility, but it’s sparked debate. Some argue it makes homeownership less accessible, especially for young buyers in pricey areas. Others say it’s a necessary adjustment to fund public services. Either way, it’s a reality you’ll need to plan for.

How Can First-Time Buyers Calculate Their SDLT?

Let’s get practical. Calculating SDLT can feel like solving a puzzle, but it’s straightforward with the right tools. HMRC’s online SDLT calculator is your best mate here—just plug in the property price, your buyer status, and whether it’s your main residence. For a £450,000 home as a first-time buyer, you’d calculate it like this:

£0 - £300,000: 0% = £0

£300,001 - £450,000: 5% of £150,000 = £7,500

Total SDLT: £7,500

You’ve got 14 days from completion to file your SDLT return and pay the tax, usually handled by your solicitor. Miss the deadline, and HMRC might hit you with penalties or interest, so stay sharp. You can pay via online banking, CHAPS, or even at a bank with a debit card—just don’t use a credit card, as HMRC doesn’t accept it.

What Are the Regional Impacts of the New Rates?

So, the question is: where will you feel the pinch most? London and the South East are the hardest hit because average property prices often exceed £300,000. In South Hams, Devon, or Trafford, near Manchester, first-time buyers are also facing new tax bills due to high local prices. For example, in London, where the average first-time buyer home costs around £450,000, you’re looking at £7,500 in SDLT post-April 2025, compared to £1,250 before. In contrast, areas like the North East, where average prices are closer to £150,000, are largely unaffected because they’re below the £300,000 threshold. Check local property prices on sites like Zoopla or Rightmove to gauge your area’s impact.

Case Study: Aled and Siobhan’s First Home Purchase

Picture this: Aled and Siobhan, a young couple in Bristol, are buying their first home in April 2025 for £375,000. They’re both first-time buyers, so they qualify for relief. Under the new rules, they pay 0% on the first £300,000 and 5% on the £75,000 above that, which is £3,750. If they’d completed before March 31, 2025, they’d have paid nothing because the threshold was £425,000. This extra cost forces them to dip into their savings, delaying their plans to furnish the home. It’s a reminder to factor SDLT into your budget early, especially if you’re in a high-cost area like Bristol, where the average semi-detached home sold for £354,767 in 2024.

Step-by-Step Guide: How to Budget for SDLT as a First-Time Buyer

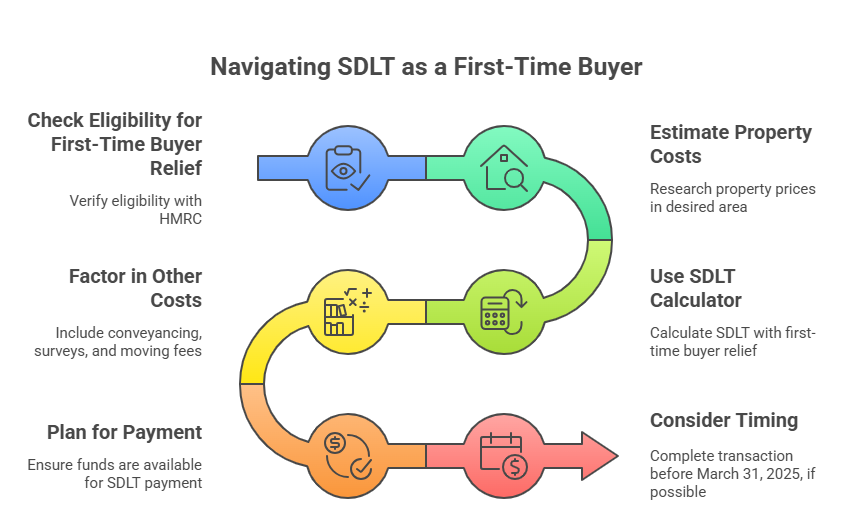

Now, here’s a practical guide to help you plan for SDLT:

Check Your Eligibility: Confirm you and any co-buyers have never owned a property. Use HMRC’s guidance to verify.

Estimate Property Costs: Research average prices in your area using Zoopla or Rightmove.

Use the SDLT Calculator: Plug your property price into HMRC’s online calculator to get an exact SDLT figure.

Factor in Other Costs: Include conveyancing fees (£1,000-£2,000), surveys (£300-£1,500), and moving costs in your budget.

Plan for Payment: Ensure your solicitor knows you’re a first-time buyer to claim relief. Set aside funds for the 14-day payment deadline.

Consider Timing: If you’re close to March 31, 2025, and can complete before, you might save thousands under the old thresholds.

This guide can help you avoid surprises and ensure you’re financially prepared when the keys are handed over.

What About Shared Ownership or Leasehold Properties?

Here’s something to watch out for: shared ownership and leasehold properties have their own quirks. With shared ownership, you pay SDLT on the share you’re buying (and sometimes the rent’s net present value). For leaseholds, SDLT applies to the lease premium and, if the rent’s net present value exceeds £125,000, you’ll pay 1% on the excess. These can get complicated, so lean on your solicitor or use HMRC’s lease calculator for clarity. For example, if you’re buying a 50% share of a £400,000 shared ownership home, you’d pay SDLT on £200,000, which is £0 as a first-time buyer, but you’d need to check the rent component too.

Navigating Stamp Duty Challenges for First-Time Buyers in 2025-26: Strategies and Insights

Alright, you’ve got the basics of Stamp Duty Land Tax (SDLT) for first-time buyers in 2025-26 under your belt. Now, let’s dig deeper into how you can tackle this tax, save where possible, and avoid common pitfalls. This part is all about practical strategies, lesser-known tips, and real-world scenarios to help UK taxpayers—especially first-time buyers and business owners dipping their toes into property—make smart moves. We’ll explore how to minimise SDLT, understand exemptions, and plan around the new rules effective from April 1, 2025. Let’s keep the momentum going and arm you with the knowledge to make your home-buying journey smoother.

How Can First-Time Buyers Minimise Their SDLT Bill?

Let’s be real: nobody wants to pay more tax than they have to. While the first-time buyer relief is a lifeline, there are ways to stretch it further. One strategy is to negotiate the property price to stay under key thresholds. For instance, if a seller’s asking £305,000, offering £300,000 could save you £5,000 in SDLT because you’d fall below the taxable threshold. Another trick is to check if fixtures and fittings (like carpets or curtains) are included in the price—HMRC doesn’t tax these, so ask the seller to list them separately. In 2024, a couple in Leeds saved £1,500 by having £30,000 of fittings excluded from their £330,000 purchase price, keeping them under £300,000. Always run these ideas by your solicitor to stay compliant.

Are There Any Exemptions or Special Cases for SDLT?

Now, here’s something not everyone knows: there are specific scenarios where you might dodge SDLT entirely. If you’re gifted a property or inherit one under £300,000, no SDLT applies, even as a first-time buyer. Transfers between spouses or civil partners are also exempt, but only if no money changes hands. Be cautious, though—if you’re taking on a mortgage as part of a transfer, SDLT might kick in. For example, in 2023, Rhiannon in Cardiff assumed her ex-partner’s £200,000 mortgage during a divorce settlement. She thought it was exempt, but HMRC charged SDLT on the mortgage value, costing her £1,500. Always double-check with HMRC’s guidance or a tax advisor for these edge cases.

What Happens If You’re Buying a Mixed-Use Property?

So, the question is: what if you’re a business owner eyeing a property with both residential and commercial elements, like a flat above a shop? Mixed-use properties are taxed at non-residential SDLT rates, which can be a game-changer. These rates are lower: 0% up to £150,000, 2% from £150,001 to £250,000, and 5% above £250,000. If you’re a first-time buyer running a small business and buy a £400,000 mixed-use property, you’d pay £9,500 in SDLT (0% on £150,000, 2% on £100,000, 5% on £150,000) instead of £10,000 under residential first-time buyer rules. The catch? You won’t qualify for first-time buyer relief, but the savings could still be worth it. Check the property’s classification with your solicitor, as HMRC is strict about definitions.

How Do Additional Costs Interact with SDLT?

Be careful! SDLT isn’t the only cost you’ll face when buying your first home. Conveyancing fees, surveys, and Land Registry fees can add £2,000-£5,000 to your bill. For business owners, if you’re buying a property for mixed use or as an investment (not your main home), you’ll lose first-time buyer relief and might face a 3% surcharge if it’s a second property. For example, Owain, a Cardiff café owner, bought a £350,000 flat in 2024 for his residence but already owned a commercial property. He paid standard rates plus the 3% surcharge, totaling £8,250, instead of £2,500 as a first-time buyer. Always clarify your property ownership history with HMRC to avoid surprises.

What Are the Risks of Getting SDLT Wrong?

None of us wants to tangle with HMRC, but mistakes with SDLT can lead to headaches. If you miscalculate or miss the 14-day filing deadline, you could face a £100 penalty, rising to £200 after three months, plus interest on unpaid tax at 7.75% (as of June 2025). In 2024, a first-time buyer in Birmingham, Cerys, underpaid SDLT by £2,000 because she didn’t realise her partner’s previous home ownership disqualified them from relief. HMRC caught it during a routine check, and she faced a £200 penalty plus interest. To avoid this, use HMRC’s calculator and double-check eligibility with your solicitor. If you’re unsure, you can also contact HMRC’s SDLT helpline for clarity.

How Do Regional Property Prices Affect SDLT Planning?

Now, consider this: your location can make or break your SDLT bill. In high-cost areas like London, where the average first-time buyer home costs £450,000, you’re almost guaranteed to pay SDLT under the new £300,000 threshold. In contrast, in places like Burnley, where average prices are around £120,000, you’re likely to pay nothing. Data from the Land Registry shows that in 2024, 68% of first-time buyers in London paid SDLT, compared to just 12% in the North East. If you’re flexible, consider nearby towns with lower prices. For instance, moving from Camden (£500,000 average) to Enfield (£350,000 average) could save you £7,500 in SDLT.

Case Study: Meera’s Mixed-Use Purchase in 2025

Let’s look at Meera, a small business owner in Liverpool, who bought a £380,000 property in April 2025—a flat above her new bakery. She initially thought she’d qualify for first-time buyer relief, but since the property was classified as mixed-use (commercial downstairs, residential upstairs), she paid non-residential rates: 0% on £150,000, 2% on £100,000 (£2,000), and 5% on £130,000 (£6,500), totaling £8,500. If it had been residential, she’d have paid £4,000 as a first-time buyer. Meera saved by ensuring the commercial portion was clearly documented, but she had to budget carefully to cover the tax alongside her business setup costs. This shows why understanding property type matters.

Can You Reclaim SDLT If You Overpay?

Here’s a ray of hope: if you overpay SDLT, you can claim a refund within 12 months of the filing deadline. Say you paid standard rates but later realise you qualified for first-time buyer relief. You can apply via HMRC’s online portal with evidence, like proof you’ve never owned a property. In 2023, Dafydd in Swansea reclaimed £3,000 after mistakenly paying standard rates on a £320,000 home. The process took six weeks, but it was worth it. Keep records of your SDLT return and payment, and act fast if you spot an error. HMRC’s guidance on refunds is clear and worth a read.

How Can Business Owners Leverage SDLT Rules?

If you’re a business owner buying your first home, you’ve got extra factors to consider. If you’re purchasing a residential property to live in, you can still claim first-time buyer relief, but any existing property ownership (like a shop or office) could disqualify you. Alternatively, if you’re buying a mixed-use property for business and living, non-residential rates might save you money, as we saw with Meera. Another tip: if you’re VAT-registered, check if the property sale is VAT-exempt, as this can affect your overall costs. In 2024, a business owner in York saved £10,000 by structuring a £500,000 mixed-use purchase to fall under non-residential rates, avoiding the 3% surcharge.

What Are the Long-Term Implications of SDLT Changes?

Now, let’s think ahead. The return to a £300,000 threshold in 2025 could cool the housing market for first-time buyers, especially in high-cost areas. Property experts predict a 5-10% drop in transactions in London and the South East, as buyers delay purchases or seek cheaper areas. For business owners, higher SDLT costs might divert funds from business expansion to property taxes. On the flip side, the government expects to raise an extra £1.5 billion annually from SDLT, which could fund housing initiatives or infrastructure. Keep an eye on the Spring Budget 2026 for any tweaks, as political pressure might push for relief extensions.

Table: SDLT Costs for First-Time Buyers vs. Standard Buyers (2025-26)

Property Price | First-Time Buyer SDLT | Standard Buyer SDLT | Difference |

£250,000 | £0 | £2,500 | £2,500 |

£350,000 | £2,500 | £5,000 | £2,500 |

£450,000 | £7,500 | £10,000 | £2,500 |

£550,000 | £15,250 | £15,250 | £0 |

Source: HMRC - SDLT Rates and Reliefs

This table shows how first-time buyer relief saves money up to £500,000, but the benefit vanishes above that. Use it to compare your potential costs and plan your budget accordingly.

Making Stamp Duty Work for You in 2025-26: Advanced Tips and Key Takeaways

Right, we’ve covered the nuts and bolts of Stamp Duty Land Tax (SDLT) for first-time buyers and how to navigate the 2025-26 changes. Now, let’s wrap things up with some advanced strategies, practical advice for specific situations, and a clear summary of the most critical points. This section is designed to give UK taxpayers—whether you’re a first-time buyer or a business owner—those extra nuggets of wisdom to make informed decisions. We’ll dive into planning around SDLT, handling complex scenarios, and ensuring you’re not caught off guard by the taxman. Let’s make sure you’re fully equipped to tackle your property purchase with confidence.

How Can You Plan Your Purchase Timing to Save on SDLT?

Timing is everything, isn’t it? If you’re close to sealing the deal on a property in early 2025, you might wonder if rushing to complete before April 1, 2025, could save you money. Before the threshold dropped from £425,000 to £300,000, first-time buyers paid no SDLT on homes up to £425,000. For a £400,000 home, that’s a £5,000 saving if you completed by March 31, 2025. But here’s the catch: rushing a purchase can lead to mistakes, like skipping a thorough survey. In 2024, Elowen in Plymouth pushed to complete a £380,000 purchase before the deadline but overlooked a structural issue, costing her £10,000 in repairs. Weigh the SDLT savings against the risks, and consult your solicitor to see if a pre-April completion is feasible.

What If You’re Buying with a Help to Buy Scheme?

Now, let’s talk about schemes like Help to Buy or shared ownership, which are popular with first-time buyers. If you’re using a Help to Buy equity loan (available until March 2025 in some regions), SDLT applies only to the portion you’re buying, not the government’s share. For example, if you buy a 60% share of a £300,000 home (£180,000), you’d pay no SDLT as a first-time buyer. But when you “staircase” (buy more shares later), you might owe SDLT on the additional share, based on the property’s value at that time. In 2023, Idris in Newcastle staircased from 50% to 80% of a £250,000 home, paying £1,500 in SDLT because the property’s value had risen to £270,000. Plan for future costs by checking market trends on sites like Zoopla.

How Do SDLT Rules Affect Joint Purchases?

So, the question is: what happens if you’re buying with someone else? If you’re a first-time buyer but your co-buyer (like a partner or friend) has owned a property before, you both lose the first-time buyer relief. This can sting. For instance, in 2024, Nerys and her friend Gwilym bought a £360,000 flat in Cardiff. Nerys was a first-time buyer, but Gwilym had owned a flat years ago, so they paid standard rates: £3,500 instead of £3,000 with relief. If you’re in this situation, consider if one buyer can purchase alone to secure the relief, then add the other to the title later (but check with a solicitor, as this can trigger other taxes). HMRC’s joint ownership rules are strict, so clarify everyone’s status early.

Can You Use SDLT Reliefs for Energy-Efficient Properties?

Here’s a lesser-known angle: energy-efficient properties. While there’s no specific SDLT relief for eco-friendly homes in 2025, some new-builds qualify for relief if they’re part of a government-backed scheme like First Homes, which caps prices at £250,000 outside London or £420,000 in London. These often come with energy-efficient features, and the lower price can keep you under SDLT thresholds. For example, a first-time buyer in Bristol buying a £250,000 First Homes property in 2025 pays no SDLT and gets a discounted, eco-friendly home. Check local council websites for First Homes availability, as they’re limited but growing in popularity.

What Are the Traps for Business Owners Buying Residential Property?

Be careful if you’re a business owner! If you own commercial property or a buy-to-let, you might think you’re still a first-time buyer for a residential purchase. Nope—HMRC counts any property ownership, so you’d pay standard rates. Plus, if you’re buying a second home (even as your main residence), the 3% SDLT surcharge applies. In 2024, Sioned, a shop owner in Bangor, bought a £300,000 home to live in, expecting first-time buyer relief. Because she owned her shop, she paid £4,000 in SDLT plus a £9,000 surcharge, totaling £13,000. To avoid this, consider transferring business properties to a limited company, but get tax advice first, as this can trigger other costs.

How Can You Appeal an SDLT Decision?

Let’s say HMRC disputes your SDLT payment or eligibility. You’ve got 30 days to appeal via HMRC’s review process or go to a First-tier Tribunal. In 2023, Llywelyn in Swansea was denied first-time buyer relief because HMRC thought he’d inherited a property. He provided evidence showing it was a non-residential plot, and after a review, HMRC refunded £4,000. Keep all documents—conveyancing records, eligibility proof, and payment receipts—and act fast. HMRC’s appeals process is straightforward but requires clear evidence, so don’t delay.

Table: SDLT Scenarios for First-Time Buyers (2025-26)

Scenario | Property Price | SDLT Payable | Notes |

Solo first-time buyer, main residence | £280,000 | £0 | Below £300,000 threshold, full relief applies |

Joint purchase, one non-first-time | £350,000 | £5,000 | Standard rates apply due to co-buyer’s prior ownership |

Shared ownership (50% share) | £400,000 (£200,000) | £0 | SDLT on share only; rent may trigger additional tax |

Mixed-use property | £380,000 | £8,500 | Non-residential rates: 0% on £150,000, 2% on £100,000, 5% on £130,000 |

Source: HMRC - SDLT Manual

This table breaks down how SDLT varies by scenario, helping you estimate costs and spot potential savings.

Summary of the Most Important Points

First-time buyers pay no SDLT on properties up to £300,000 in 2025-26, but the threshold dropped from £425,000, increasing tax for many.

Properties between £300,001 and £500,000 incur 5% SDLT on the portion above £300,000 for first-time buyers.

Above £500,000, first-time buyer relief is lost, and standard rates apply (up to 12%).

You qualify for relief only if you’ve never owned a residential property anywhere and the home is your main residence.

Mixed-use properties follow non-residential SDLT rates, which can be lower but don’t qualify for first-time buyer relief.

Shared ownership SDLT is based on the share purchased, with potential additional tax on rent.

Missing the 14-day SDLT filing deadline risks penalties (£100-£200) and interest (7.75%).

Regional price differences mean London and South East buyers face higher SDLT than those in the North East.

You can reclaim overpaid SDLT within 12 months, but you need solid evidence to support your claim.

Business owners must clarify property ownership history to avoid losing relief or facing the 3% surcharge.

FAQs

**1. Q: Can you claim stamp duty relief if you’re buying a property abroad as a first-time buyer?**

A: No, first-time buyer relief for SDLT only applies to properties in England and Northern Ireland, not abroad.

**2. Q: Does stamp duty apply if you’re gifted a property as a first-time buyer?**

A: If the gift involves no payment or mortgage, you’re exempt from SDLT, regardless of property value.

**3. Q: Can you get a stamp duty refund if you sell your home within three years?**

A: No, the three-year refund rule applies to additional properties, not first-time buyer purchases.

**4. Q: How does stamp duty work if you’re buying a new-build home in 2025?**

A: New-builds follow the same SDLT rates: 0% up to £300,000 for first-time buyers, 5% on £300,001-£500,000.

**5. Q: Are there stamp duty discounts for first-time buyers in affordable housing schemes?**

A: First Homes scheme caps prices, often keeping properties under £300,000, so you may pay no SDLT.

**6. Q: Does stamp duty apply to mobile homes or houseboats for first-time buyers?**

A: Mobile homes and houseboats are typically exempt from SDLT as they’re not considered land or buildings.

**7. Q: Can you claim first-time buyer relief if you’re buying through a company?**

A: No, relief is only for individuals, not companies, even if you’ve never owned a property.

**8. Q: Is stamp duty different for first-time buyers in Scotland or Wales in 2025?**

A: Yes, Scotland uses LBTT and Wales uses LTT, with different rates and no first-time buyer relief.

**9. Q: What happens to stamp duty if you buy a property at auction?**

A: SDLT applies the same way; first-time buyer relief is available if the price is under £500,000.

**10. Q: Can you avoid stamp duty by buying a property in instalments?**

A: No, SDLT is based on the total property value, not payment structure, for first-time buyers.

**11. Q: Does stamp duty apply to land purchases for first-time buyers?**

A: Yes, SDLT applies to land if it’s residential, but relief is available up to £300,000.

**12. Q: Can you claim stamp duty relief if you’re under 18?**

A: Yes, as long as you meet first-time buyer criteria, age doesn’t affect eligibility.

**13. Q: How does stamp duty work if you’re buying a property with a garden annexe?**

A: If the annexe is part of the main residence, first-time buyer relief applies; otherwise, it’s a second property.

**14. Q: Are there stamp duty exemptions for first-time buyers with disabilities?**

A: No specific exemptions exist, but First Homes or shared ownership schemes may reduce SDLT.

**15. Q: Can you claim first-time buyer relief if you’re relocating from abroad?**

A: Yes, if you’ve never owned a residential property worldwide and the home is your main residence.

**16. Q: Does stamp duty apply to properties bought through a trust for first-time buyers?**

A: If you benefit from the trust and it’s your first home, relief may apply; consult a solicitor.

**17. Q: Can you defer stamp duty payments as a first-time buyer in 2025?**

A: No, SDLT must be paid within 14 days of completion; deferral isn’t allowed.

**18. Q: How does stamp duty affect first-time buyers purchasing off-plan properties?**

A: SDLT applies when the property is completed, using 2025-26 rates and reliefs based on the final price.

**19. Q: Is stamp duty different for first-time buyers purchasing listed buildings?**

A: No, listed buildings follow the same SDLT rules; relief applies if the price is under £500,000.

**20. Q: Can you claim first-time buyer relief if you’re buying a property for a family member?**

A: No, relief requires the property to be your main residence, not for someone else’s use.

The Author:

Adil Akhtar, ACMA, CGMA, CEO and Chief Accountant of Pro Tax Accountant, is an esteemed tax blog writer with over 10 years of expertise in navigating complex tax matters. For more than three years, his insightful blogs have empowered UK taxpayers with clear, actionable advice. Leading Advantax Accountants as well, Adil blends technical prowess with a passion for demystifying finance, cementing his reputation as a trusted authority in tax education.

Email: adilacma@icloud.com

Disclaimer:

The information provided in our articles is for general informational purposes only and is not intended as professional advice. While we strive to keep the information up-to-date and correct, Pro Tax Accountant makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained in the articles for any purpose. Any reliance you place on such information is therefore strictly at your own risk. Some of the data in the above graphs may to give 100% accurate data.

We encourage all readers to consult with a qualified professional before making any decisions based on the information provided. The tax and accounting rules in the UK are subject to change and can vary depending on individual circumstances. Therefore, Pro Tax Accountant cannot be held liable for any errors, omissions, or inaccuracies published. The firm is not responsible for any losses, injuries, or damages arising from the display or use of this information.

.png)