Calculating and Optimising Stamp Duty Land Tax For First-Time Buyers Post-2025 Threshold Changes

- Adil Akhtar

- Jul 18, 2025

- 14 min read

The Audio Summary of the Key Points of the Article:

Navigating the New Stamp Duty Landscape for First-Time Buyers in 2025

Now, if you’re a first-time buyer in the UK, the idea of stamp duty probably feels like one more hurdle on the already steep climb to homeownership. With the Stamp Duty Land Tax (SDLT) thresholds changing from 1 April 2025, understanding the new rules is crucial to avoid overpaying or missing out on reliefs. Let’s break down the essentials—rates, thresholds, and eligibility—so you can plan your purchase with confidence.

What Are the New SDLT Thresholds for First-Time Buyers?

Let’s kick things off with the big news: the SDLT thresholds have tightened. Back in September 2022, the Conservative government temporarily bumped up the nil-rate threshold for first-time buyers to £425,000 (for properties up to £625,000). But as of 1 April 2025, that relief has reverted to its pre-2022 level. Now, you pay no SDLT on properties up to £300,000, and a discounted rate of 5% applies on the portion between £300,001 and £500,000. If your dream home costs more than £500,000, you lose the first-time buyer relief entirely and pay standard rates. Here’s a quick look at the current setup, sourced from GOV.UK:

Purchase Price (£) | First-Time Buyer SDLT Rate (Post-1 April 2025) |

Up to £300,000 | 0% |

£300,001 - £500,000 | 5% (on the portion above £300,000) |

Over £500,000 | Standard rates apply (no relief) |

For comparison, standard rates (for non-first-time buyers or properties over £500,000) start at 2% on properties above £125,000, scaling up to 12% for portions above £1.5 million. These changes hit first-time buyers hard, especially in high-cost areas like London or the South East, where average house prices often exceed £300,000. For example, Zoopla reports the average UK house price in 2025 at £292,000, but in Canterbury, a detached home averages £561,605, pushing many buyers out of relief territory.

Who Qualifies as a First-Time Buyer?

None of us wants to miss out on a tax break, so let’s clarify eligibility. To claim first-time buyer relief, you (and anyone you’re buying with) must have never owned a freehold or leasehold property anywhere in the world. This includes inherited properties or shares in a property. If you’re buying with a partner, both of you need to meet this criterion. HMRC is strict about this—your conveyancer will need to confirm your status when filing the SDLT return. A case study from Switalskis in 2025 highlighted a buyer, Priya Patel, who lost her relief because she co-owned a flat abroad with a relative, even though she’d never lived there. Be careful—check your property history thoroughly.

How Much SDLT Will You Actually Pay?

So, the question is: how do these new thresholds translate into real costs? Let’s walk through a couple of examples to make it crystal clear. Imagine you’re buying your first home in Bristol for £400,000 after 1 April 2025. Here’s the breakdown:

● First £300,000: 0% = £0

● Next £100,000 (£300,001 - £400,000): 5% = £5,000

● Total SDLT: £5,000

Now, if you’re eyeing a £525,000 house in Canterbury, you’re over the £500,000 threshold, so no relief applies. You’d pay standard rates:

Purchase Price Portion (£) | Standard Rate | SDLT Payable |

£0 - £125,000 | 0% | £0 |

£125,001 - £250,000 | 2% | £2,500 |

£250,001 - £525,000 | 5% | £13,750 |

Total SDLT |

| £16,250 |

This is a sharp jump from the pre-2025 relief, where a £525,000 purchase incurred only £5,000 in SDLT for a first-time buyer. The new rules mean budgeting an extra £11,250 for the same property, which could stretch your deposit or mortgage affordability.

Why Did These Changes Happen?

Now, it shouldn’t be a surprise that tax policies shift with government priorities. The 2022 threshold increases were meant to stimulate the housing market, but the Labour government’s 2024 Budget, effective 1 April 2025, reversed them to boost tax revenue. According to the Office for Budget Responsibility, this change is expected to raise billions annually, but it’s left first-time buyers like you facing higher upfront costs. Mortgage brokers, as noted by the BBC, reported buyers rushing to complete purchases before March 2025 to dodge the hike. If you’re planning a purchase, timing is everything.

What About Leasehold Properties?

Be careful if you’re eyeing a leasehold flat, which is common for first-time buyers in cities. SDLT applies to both the lease premium (the purchase price) and the net present value (NPV) of the rent over the lease term. If the NPV exceeds £125,000, you’ll pay 1% SDLT on the excess. For example, if you’re buying a leasehold flat in Manchester for £250,000 with an NPV of £150,000, you’d pay:

● Lease Premium: £0 (under £300,000 for first-time buyers)

● NPV: 1% on £25,000 (£150,000 - £125,000) = £250

● Total SDLT: £250

This is a niche area where many buyers get caught out, as conveyancers may not flag NPV calculations early. Always ask your solicitor to double-check.

Smart Strategies to Calculate and Slash Your SDLT Bill

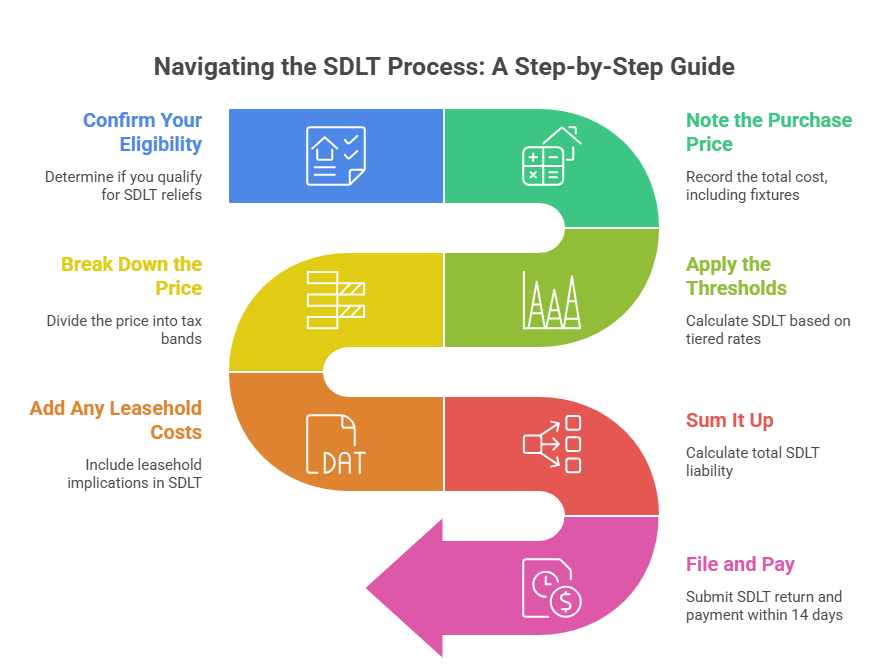

Now, if you’re a first-time buyer staring down the barrel of the new SDLT rules post-April 2025, you’re probably wondering how to keep your costs down. Calculating your Stamp Duty Land Tax (SDLT) accurately is step one, but the real magic happens when you explore ways to optimise—or even reduce—what you owe. This part dives into a practical step-by-step guide to calculate SDLT, followed by clever strategies to minimise your tax burden, tailored to UK first-time buyers.

How Do You Calculate SDLT Step-by-Step?

Let’s get practical: working out your SDLT doesn’t have to be a headache. Whether you’re buying a terraced house in Leeds or a flat in London, this step-by-step guide will help you nail the numbers. You can even use it as a worksheet to jot down your figures. Here’s how it works, based on HMRC’s latest guidance:

Confirm Your Eligibility: Ensure you and any co-buyers qualify as first-time buyers (no prior property ownership, anywhere). Double-check with your conveyancer to avoid surprises.

Note the Purchase Price: Write down the total price of the property, including any fixtures or fittings included in the sale.

Apply the Thresholds: For properties up to £500,000, use the first-time buyer rates (0% up to £300,000; 5% on £300,001–£500,000). If over £500,000, use standard rates.

Break Down the Price: Split the price into portions based on the tax bands. Calculate each portion separately.

Add Any Leasehold Costs: If buying a leasehold, ask your solicitor for the net present value (NPV) of the rent. Add 1% of any NPV above £125,000.

Sum It Up: Add all SDLT amounts to get your total liability.

File and Pay: Submit your SDLT return via your conveyancer within 14 days of completion and pay HMRC.

For example, let’s say Aisha Khan buys her first flat in Birmingham for £350,000. Here’s her calculation:

● Step 1: Aisha confirms she’s a first-time buyer.

● Step 2: Purchase price = £350,000.

● Step 3: Apply first-time buyer rates.

● Step 4: £0–£300,000 = £0; £300,001–£350,000 = 5% of £50,000 = £2,500.

● Step 5: No leasehold, so no NPV.

● Step 6: Total SDLT = £2,500.

● Step 7: Her conveyancer files the return and pays £2,500.

You can double-check your math using HMRC’s SDLT calculator at www.gov.uk/stamp-duty-land-tax-calculator, but this manual approach ensures you understand every penny.

Can You Reduce SDLT with Shared Ownership?

Now, consider this: if you’re struggling to afford a home outright, shared ownership schemes can be a game-changer. These let you buy a share of a property (usually 25%–75%) and pay rent on the rest, with SDLT calculated only on your share. Post-2025, this is especially useful in high-cost areas. For instance, if you buy a 50% share of a £400,000 home (£200,000), you pay no SDLT as a first-time buyer (since £200,000 is below £300,000). If you later “staircase” to buy more shares, you may pay additional SDLT, but it’s spread over time.

A 2024 case study from Share to Buy highlighted Ewan Fraser, who bought a 40% share of a £300,000 flat in Bristol (£120,000). He paid no SDLT, saving £3,500 compared to buying outright under standard rates. Check eligibility via housing associations or www.gov.uk/shared-ownership-scheme to see if this fits your budget.

Does Buying Jointly Save on SDLT?

So, the question is: can buying with a partner, friend, or family member cut your SDLT? The answer depends on your combined finances and the property price. Joint purchases pool your first-time buyer status, but both buyers must qualify. For example, if you and your partner buy a £450,000 home, you split the SDLT calculation:

● £0–£300,000 = £0

● £300,001–£450,000 = 5% of £150,000 = £7,500

● Total SDLT = £7,500 (shared between you).

This doesn’t reduce the tax itself, but splitting costs can ease the burden. Be careful, though—if one buyer isn’t a first-time buyer, you lose the relief entirely. A 2023 conveyancing case from My Home Move showed a couple, Nia and Tariq, who missed out on £5,000 in relief because Tariq had inherited a property years earlier.

Can Timing Your Purchase Save Money?

Now, it shouldn’t be a surprise that timing can make a big difference. If you’re close to completing a purchase before 31 March 2025, you could lock in the old thresholds (£425,000 nil-rate, up to £625,000). For a £400,000 home, you’d pay no SDLT before April 2025, versus £5,000 after. Speak to your solicitor about speeding up conveyancing if you’re near the deadline. Post-April, consider delaying if you’re waiting for a price drop—Zoopla predicts a 1%–2% dip in 2025 prices in some regions, potentially bringing a property under £300,000.

What About Non-UK Resident First-Time Buyers?

Be careful if you’re a non-UK resident buying your first home in the UK. Since 2021, HMRC adds a 2% SDLT surcharge for non-residents, even first-time buyers. For a £350,000 property, you’d calculate:

● First-time buyer SDLT: £2,500 (as above).

● Non-resident surcharge: 2% of £350,000 = £7,000.

● Total: £9,500.

This applies if you’ve spent fewer than 183 days in the UK in the 12 months before purchase. A 2025 case from Knight Frank noted a buyer, Sofia Mendes, who paid £12,000 extra on a £400,000 London flat due to this surcharge. If you’re relocating, plan your UK residency to minimise this hit.

Are There Other Reliefs to Explore?

Now, don’t overlook other potential breaks. If you’re buying a new-build, some developers offer to cover SDLT as an incentive—worth asking about. Multiple dwellings relief (e.g., buying a house with a separate annexe) can also reduce SDLT by splitting the price across “dwellings,” but this is rare for first-time buyers. Always consult your conveyancer to check for niche reliefs, as HMRC’s rules are complex.

Here’s a quick table summarising key optimisation strategies:

Strategy | How It Saves SDLT | Best For |

Shared Ownership | SDLT only on your share, often £0 if under £300,000 | Buyers with limited deposits |

Timing Purchase | Lock in pre-April 2025 thresholds or wait for price dips | Buyers near deadlines or in softening markets |

Joint Purchase | Splits cost, not tax, but requires all to qualify | Couples or friends with shared finances |

Developer Incentives | Developer may cover SDLT | New-build buyers |

Key Takeaways for First-Time Buyers Tackling SDLT in 2025

Now, if you’ve made it this far, you’re well on your way to mastering Stamp Duty Land Tax (SDLT) as a first-time buyer in the UK. The new rules post-April 2025 can feel daunting, but with the right knowledge, you can navigate them confidently and maybe even save a few quid. This part sums up the most critical points to help you plan your purchase, avoid pitfalls, and make the most of available reliefs. Let’s dive into some final practical insights and rare scenarios to ensure you’re fully prepared.

What Should You Double-Check Before Buying?

Be careful! Missing a detail in your SDLT calculation can cost you thousands or lead to penalties. Always verify your first-time buyer status with your conveyancer, especially if you’ve ever owned property abroad or inherited a share. HMRC’s 14-day deadline for filing and paying SDLT is non-negotiable, so ensure your solicitor is on top of it. A 2024 case from Which? highlighted a buyer, Callum Reid, who faced a £300 penalty for a late SDLT return on a £320,000 flat, despite paying the £1,000 tax on time. Double-check all paperwork and keep records of your eligibility.

How Do Mixed-Use Properties Affect SDLT?

Now, consider this: if you’re eyeing a quirky property, like a flat above a shop, you might be dealing with a mixed-use property. These are taxed at commercial SDLT rates, which are lower than residential rates—often 0% up to £150,000 and 2% up to £250,000. For a £400,000 mixed-use property, you’d pay:

● £0–£150,000 = £0

● £150,001–£250,000 = 2% of £100,000 = £2,000

● £250,001–£400,000 = 5% of £150,000 = £7,500

● Total SDLT = £9,500

Compare that to £16,250 for a £400,000 residential property under standard rates. Mixed-use properties are rare for first-time buyers, but if you spot one, it could save you significantly. Ask your conveyancer to confirm the property’s classification with HMRC.

Can You Claim a Refund if You Overpay?

So, the question is: what happens if you or your conveyancer miscalculate and overpay SDLT? You can apply for a refund within 12 months of the filing deadline, provided you meet HMRC’s criteria. For example, if you mistakenly paid standard rates instead of first-time buyer rates on a £350,000 home, you could reclaim the difference (£7,000 vs. £2,500). A 2025 case from TaxScouts involved a buyer, Freya Choudhury, who recovered £4,500 after her solicitor overlooked her first-time buyer status. File for a refund via www.gov.uk/guidance/stamp-duty-land-tax-online-returns#refunds, but act fast.

How Do You Handle SDLT for Properties with Long Leases?

Now, don’t overlook leasehold properties with long leases, which are common for first-time buyers in urban areas. If the lease has over seven years left, SDLT is based solely on the purchase price, using first-time buyer rates if eligible. But if you’re taking over a lease with a high annual rent, the net present value (NPV) calculation can sting. For instance, a £250,000 flat with an NPV of £200,000 incurs £750 SDLT (1% of £75,000 above £125,000). Always ask your solicitor for a full breakdown, as NPV errors are common, per a 2024 conveyancing report by Today’s Conveyancer.

What’s the Deal with Multiple Dwellings Relief?

None of us wants to miss a rare tax break, so let’s touch on multiple dwellings relief (MDR). If you’re buying a property with a separate annexe (e.g., a granny flat), you might qualify for MDR, which calculates SDLT as if each dwelling were a separate purchase. For a £450,000 property with a main house (£350,000) and annexe (£100,000), you’d pay:

● Main house: £2,500 (first-time buyer rate)

● Annexe: £0 (under £300,000)

● Total: £2,500 (after averaging)

This beats the £7,500 you’d pay without MDR. It’s niche, but worth exploring if you’re buying a unique property. Check HMRC’s guidance at www.gov.uk/guidance/stamp-duty-land-tax-reliefs#multiple-dwellings.

Key Takeaways for First-Time Buyers

Here are the ten most important points to remember when navigating SDLT post-2025:

First-time buyers pay no SDLT on properties up to £300,000, and 5% on the portion between £300,001 and £500,000, as of 1 April 2025.

Properties over £500,000 lose first-time buyer relief, with standard rates applying (2%–12%).

You qualify as a first-time buyer only if you’ve never owned any property worldwide, including inherited shares.

Shared ownership schemes can reduce SDLT by taxing only your purchased share, often resulting in £0 tax.

Non-UK residents face a 2% SDLT surcharge, even as first-time buyers, based on UK residency in the prior 12 months.

Timing purchases before 31 March 2025 can save thousands under the old £425,000 nil-rate threshold.

Joint purchases require all buyers to be first-time buyers to claim relief, but costs can be split.

Mixed-use properties (e.g., flat above a shop) use lower commercial SDLT rates, potentially saving significant tax.

Refunds for overpaid SDLT are possible within 12 months of the filing deadline via HMRC’s online portal.

Leasehold properties may incur extra SDLT on the net present value of rent, so always request a full calculation.

FAQs

Q1: What is Stamp Duty Land Tax (SDLT) for first-time buyers?

A1: Stamp Duty Land Tax (SDLT) is a tax paid by buyers of property or land in England and Northern Ireland when the purchase price exceeds a certain threshold. For first-time buyers, reliefs may apply to reduce or eliminate the tax on properties up to a specific value.

Q2: Who qualifies as a first-time buyer for SDLT relief?

A2: A first-time buyer is an individual who has never owned a freehold or leasehold interest in a residential property in the UK or elsewhere and intends to occupy the purchased property as their main residence.

Q3: What are the SDLT thresholds for first-time buyers post-April 2025?

A3: From April 1, 2025, first-time buyers pay no SDLT on properties valued up to £300,000. For properties valued between £300,001 and £500,000, they pay 5% SDLT on the portion above £300,000.

Q4: What happens if a first-time buyer purchases a property over £500,000?

A4: If the property costs more than £500,000, first-time buyers cannot claim relief and must pay standard SDLT rates on the entire purchase price.

Q5: How is SDLT calculated for a first-time buyer purchasing a £400,000 property?A5: For a £400,000 property, a first-time buyer pays no SDLT on the first £300,000 and 5% on the remaining £100,000, resulting in a total SDLT of £5,000.

Q6: Can first-time buyers claim SDLT relief if they buy with someone who isn’t a first-time buyer?

A6: No, all individuals purchasing the property must be first-time buyers to qualify for the relief. If one buyer has previously owned a property, standard rates apply.

Q7: When must SDLT be paid after purchasing a property?

A7: SDLT must be paid within 14 days of the property transaction’s completion date to avoid penalties and interest from HM Revenue and Customs (HMRC).

Q8: How can first-time buyers calculate their SDLT liability?

A8: First-time buyers can use online SDLT calculators provided by HMRC or conveyancing websites to estimate their tax based on the property price and buyer status.

Q9: Does SDLT apply to first-time buyers purchasing leasehold properties?

A9: Yes, SDLT applies to leasehold properties. First-time buyers pay SDLT on the lease premium and may owe additional tax if the net present value of the rent exceeds £125,000.

Q10: Are there any exemptions from SDLT for first-time buyers?

A10: First-time buyers are exempt from SDLT on properties up to £300

,000, provided the total purchase price does not exceed £500,000.

Q11: What happens to SDLT relief if a first-time buyer inherits a property?

A11: Inheriting a property does not typically disqualify someone from first-time buyer relief, as inherited property is not considered a prior purchase.

Q12: Can first-time buyers claim SDLT relief for shared ownership schemes?

A12: Yes, first-time buyers can claim SDLT relief on shared ownership properties if the total market value is £500,000 or less and they meet other eligibility criteria.

Q13: How does SDLT differ for first-time buyers in Scotland or Wales?

A13: In Scotland, first-time buyers pay Land and Buildings Transaction Tax (LBTT) with relief up to £175,000. In Wales, they pay Land Transaction Tax (LTT) with no specific first-time buyer relief.

Q14: What is the impact of the April 2025 threshold changes on first-time buyers?

A14: The reduction of the nil-rate threshold from £425,000 to £300,000 means first-time buyers purchasing properties above £300,000 will face higher SDLT costs.

Q15: Can first-time buyers get a refund if they overpay SDLT?

A15: Yes, if first-time buyers overpay SDLT, they can apply for a refund from HMRC, typically within three years of the transaction, provided they meet eligibility criteria.

Q16: Does SDLT apply to first-time buyers purchasing non-residential properties?

A16: First-time buyer relief does not apply to non-residential or mixed-use properties, which are taxed at standard SDLT rates regardless of buyer status.

Q17: How does the SDLT surcharge for non-UK residents affect first-time buyers?

A17: Non-UK resident first-time buyers pay an additional 2% surcharge on top of standard or first-time buyer rates if they haven’t spent at least 183 days in the UK in the prior 12 months.

Q18: Can first-time buyers avoid SDLT by adding it to their mortgage?

A18: While SDLT can be financed through a mortgage, it must still be paid to HMRC within 14 days of completion, and adding it to a loan may increase interest costs.

Q19: What documents are needed to claim first-time buyer SDLT relief?

A19: Buyers must submit an SDLT return to HMRC, declaring their first-time buyer status, usually handled by their conveyancer, along with details of the property transaction.

Q20: How can first-time buyers optimise their SDLT costs?

A20: First-time buyers can optimise SDLT by purchasing properties below £300,000 to avoid tax entirely or below £500,000 to benefit from relief, and ensuring completion before any further threshold changes.

About The Author:

Adil Akhtar, ACMA, CGMA, CEO and Chief Accountant of Pro Tax Accountant, is an esteemed tax blog writer with over 10 years of expertise in navigating complex tax matters. For more than three years, his insightful blogs have empowered UK taxpayers with clear, actionable advice. Leading Advantax Accountants as well, Adil blends technical prowess with a passion for demystifying finance, cementing his reputation as a trusted authority in tax education.

Email: adilacma@icloud.com

Disclaimer:

The information provided in our articles is for general informational purposes only and is not intended as professional advice. While we strive to keep the information up-to-date and correct, Pro Tax Accountant makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained in the articles for any purpose. Any reliance you place on such information is therefore strictly at your own risk. Some of the data in the above graphs may to give 100% accurate data.

We encourage all readers to consult with a qualified professional before making any decisions based on the information provided. The tax and accounting rules in the UK are subject to change and can vary depending on individual circumstances. Therefore, Pro Tax Accountant cannot be held liable for any errors, omissions, or inaccuracies published. The firm is not responsible for any losses, injuries, or damages arising from the display or use of this information.

.png)