Universal Credit Debt Repayment Cap 2025-26

- Adil Akhtar

- Jun 1, 2025

- 18 min read

Index:

- FAQs

The Audio Summary of the Key Points of the Article:

Understanding the Universal Credit Debt Repayment Cap for 2025-26

Alright, let’s dive into the nitty-gritty of the Universal Credit (UC) debt repayment cap for the 2025-26 tax year in the UK. If you’re on Universal Credit and juggling debts, this change could make a real difference to your monthly budget. Starting 30 April 2025, the UK government introduced the Fair Repayment Rate, slashing the maximum deduction for debt repayments from 25% to 15% of your UC standard allowance. This move, announced in the Autumn Budget, is designed to ease financial pressure for over 1.2 million households, letting them keep an average of £420 more each year. But what does this mean for you as a taxpayer or business owner? Let’s break it down with clear, practical insights.

What’s the Fair Repayment Rate All About?

Now, if you’re scratching your head wondering what this “Fair Repayment Rate” actually is, don’t worry—it’s simpler than it sounds. The Department for Work and Pensions (DWP) can take money directly from your UC payments to cover debts like advance payments, overpaid benefits, or rent arrears. Before April 2025, they could deduct up to 25% of your standard allowance—the core amount you get before extras like housing or childcare costs are added. Now, that cap’s been lowered to 15%, meaning more cash stays in your pocket each month. For a single claimant over 25, with a standard allowance of £400.14 per month in 2025-26, that’s a drop from £100.04 to £60.02 in maximum deductions—a saving of £40.02 monthly or roughly £480 yearly.

Why This Change Matters

So, why should you care? Well, if you’re one of the 2.8 million UC households facing deductions each month, this tweak could be a lifeline. The cost-of-living crisis hasn’t gone away—energy bills are up 1.2% from January to March 2025, and food prices are still biting. Keeping an extra £420 a year could mean covering a month’s worth of groceries or a chunk of your energy bill. For small business owners on UC, especially the self-employed, this extra cash flow could help cover business expenses or ease personal financial strain, especially if you’re navigating the Minimum Income Floor (MIF), which assumes a baseline income regardless of actual earnings.

The Numbers Behind the Change

Let’s get a bit number-crunchy here to make things crystal clear. The table below shows how the new 15% cap affects different UC claimants based on their 2025-26 standard allowance rates, which rose by 1.7% in April to keep up with inflation.

Claimant Type | Monthly Standard Allowance (2025-26) | Old Max Deduction (25%) | New Max Deduction (15%) | Monthly Saving | Annual Saving |

Single, under 25 | £317.82 | £79.46 | £47.67 | £31.79 | £381.48 |

Single, 25 or over | £400.14 | £100.04 | £60.02 | £40.02 | £480.24 |

Couple, both under 25 | £498.89 | £124.72 | £74.83 | £49.89 | £598.68 |

Couple, one or both 25 or over | £628.10 | £157.03 | £94.22 | £62.81 | £753.72 |

Source: GOV.UK, Universal Credit Rates 2025-26

Now, consider this: If you’re a couple with one partner over 25, that £753.72 annual saving could cover a new laptop for your side hustle or a few months of childcare costs. The DWP estimates 700,000 households with children will benefit, which is huge for families stretched thin.

Who’s Affected by the Cap?

Here’s the deal—not everyone on UC faces deductions, but if you do, this cap applies to most types of debt repayments, like:

Advance payments: Money borrowed when you first apply for UC, repaid over 24 months.

Overpayments: If you were paid too much UC or legacy benefits like tax credits.

Third-party deductions: Payments for rent arrears, utility bills, or child maintenance.

Be careful, though! Some deductions, like those for fraud penalties or court-ordered fines, can still exceed the 15% cap. Also, “last resort deductions” to prevent eviction or utility cut-offs might push past this limit, but only in specific cases. If you’re unsure what’s being deducted, check your UC statement online under “Payments” and look for “What we take off – deductions.”

The Bigger Picture: Why Now?

Practical Implications for Taxpayers

Now, let’s talk about you. If you’re a taxpayer on UC—whether employed, self-employed, or out of work—this cap could ease your monthly budget. For example, let’s say you’re a self-employed graphic designer in Manchester, earning below the MIF of £846 per month. Your UC payment might be reduced due to assumed earnings, and deductions for an advance payment could’ve eaten up 25% of your standard allowance. Now, with the 15% cap, you’re keeping an extra £40-£60 a month, which could go toward software subscriptions or marketing your business. For employees, this extra cash might help avoid dipping into savings or taking on high-interest loans.

What’s Not Covered by the Cap?

Hold on a second—there’s a catch. The 15% cap doesn’t apply to every deduction. If you’re repaying a Hardship Payment (given during sanctions), deductions can hit 30% of your standard allowance. Also, if you’re facing sanctions for not meeting your claimant commitment (like missing a job interview), those reductions are separate and don’t count toward the cap. Always check your UC journal for messages about deductions, and if something looks off, contact the DWP Debt Management Centre at 0800 916 0647 to negotiate a lower repayment rate if you’re struggling.

How to Check Your Deductions

So, the question is: How do you know if the new cap’s being applied correctly? Log into your UC online account and check your monthly statement. Look for the “What we take off – deductions” section. If deductions exceed 15% of your standard allowance (e.g., £60.02 for a single claimant over 25), and they’re not for fraud or last-resort purposes, flag it with the DWP. Mistakes happen, and the DWP’s automated systems aren’t perfect. You can leave a note in your UC journal or call the Universal Credit helpline at 0800 328 5644.

Navigating the Universal Credit Debt Repayment Cap for Specific Groups

Now, let’s get into the weeds a bit and explore how the Universal Credit (UC) debt repayment cap for 2025-26 affects specific groups like self-employed business owners, families, and those moving from legacy benefits. The shift to a 15% cap is a game-changer, but it doesn’t play out the same for everyone. Whether you’re running a small business in Birmingham or raising kids in Cardiff, there are unique challenges and opportunities to consider. Let’s unpack this with practical advice, real-world examples, and some hard numbers to keep things clear.

Self-Employed Business Owners: A Balancing Act

So, you’re a self-employed painter, freelancer, or shop owner on UC? The 15% cap could be a lifeline, but it’s not a cure-all. Self-employed claimants face the Minimum Income Floor (MIF), which assumes you earn a set amount (roughly £846 a month for a single person over 25 in 2025-26, based on National Minimum Wage rates). If your actual earnings dip below this, your UC payment is calculated as if you earned the MIF, which can already shrink your monthly award. Add deductions for debts like advance payments, and it’s easy to feel squeezed.

Here’s the good news: With the cap dropping from 25% to 15%, you’re keeping more of your standard allowance. For example, if your standard allowance is £400.14, the maximum deduction falls from £100.04 to £60.02—a £40.02 monthly boost. That could cover fuel for client visits or a new tool for your trade. But here’s the rub: If your business is seasonal (say, you’re a landscaper with lean winter months), deductions can still sting, especially if you’re repaying a hefty advance from when you started UC.

Practical Tip: Use your UC journal to report monthly earnings accurately and on time. If deductions are hitting hard, contact the DWP to request a “financial hardship” review. They might lower your repayment rate further, especially if you can show business expenses or irregular income. For instance, Priya, a self-employed caterer from Leeds, got her advance repayment reduced to 10% after proving her income fluctuated wildly during off-peak months.

Families with Children: Easing the Burden

Now, if you’re raising kids on UC, the 15% cap is a big win. The DWP says 700,000 households with children face deductions, often for overpaid tax credits from the old benefits system. With the standard allowance for a couple over 25 at £628.10 in 2025-26, the old 25% cap meant up to £157.03 could be deducted monthly. Now, it’s capped at £94.22, saving you £62.81 a month or £753.72 a year. That’s enough to cover school uniforms, extracurricular activities, or a chunk of your childcare costs (which UC can cover up to 85%, capped at £1,014.63 for one child or £1,739.37 for two in 2025-26).

Be careful, though! If you’re repaying child maintenance arrears or utility bills via third-party deductions, these can stack up quickly. For example, a family in Bristol, let’s call them the Thompsons, faced £120 monthly deductions for rent arrears and an advance payment. The new cap cut this to £94.22, but they still struggled with rising energy costs. Their solution? They applied for a Budgeting Advance (interest-free, repayable via UC) to cover a one-off expense, spreading repayments within the 15% cap.

Deduction Type | Max Deduction (15% Cap) | Example Monthly Impact (Couple, £628.10 Allowance) | Notes |

Advance Payment | £94.22 | £30-£60 (typical) | Repaid over 24 months; can request lower rate if struggling. |

Overpaid Tax Credits | £94.22 (combined) | £20-£50 | Common for legacy benefit claimants; check for errors in overpayment. |

Rent Arrears | £94.22 (combined) | £40-£80 | Prioritised to prevent eviction; negotiate with landlord if possible. |

Utility Bills | £94.22 (combined) | £10-£30 | Can be paused if deemed unaffordable by DWP. |

Source: GOV.UK, Universal Credit Deductions Guidance

Transitioning from Legacy Benefits

Here’s something to watch out for if you’re moving from old benefits like Working Tax Credit or Housing Benefit to UC. Around 1.4 million households are still transitioning in 2025, and many face deductions for overpayments from these legacy systems. The 15% cap helps, but overpayments can be a shock. For instance, Ewan, a part-time retail worker from Glasgow, switched to UC in 2024 and discovered a £2,000 overpayment from tax credits due to an HMRC error. At 25%, he was losing £100.04 a month from his £400.14 standard allowance. Now, at 15%, it’s £60.02, giving him £480 more a year to cover rent.

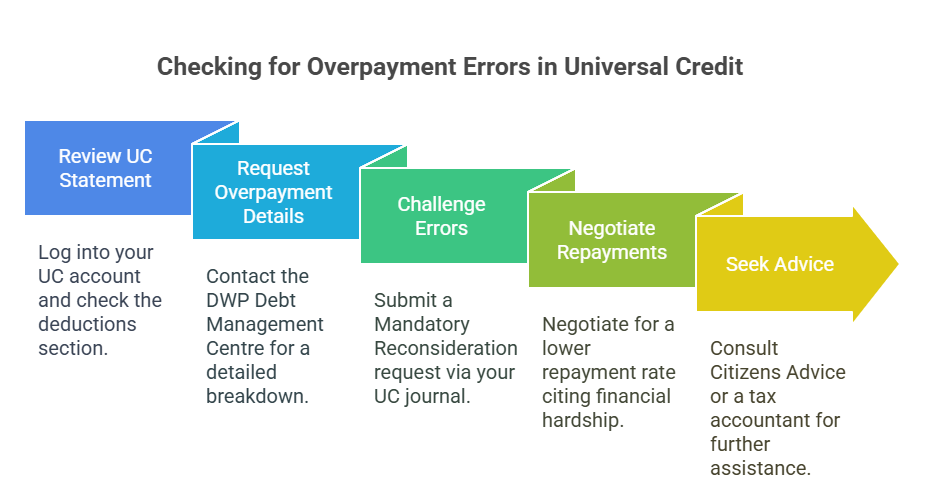

Step-by-Step Guide: Checking for Overpayment Errors

Review Your UC Statement: Log into your UC account on GOV.UK and check the “Deductions” section. Note any overpayment amounts.

Request Overpayment Details: Contact the DWP Debt Management Centre (0800 916 0647) and ask for a breakdown of the overpayment, including when and why it occurred.

Challenge Errors: If you suspect an HMRC or DWP mistake (e.g., incorrect income reporting), submit a Mandatory Reconsideration request via your UC journal within one month.

Negotiate Repayments: If the overpayment is valid but unaffordable, request a lower repayment rate, citing financial hardship. Provide evidence like bank statements or bills.

Seek Advice: Contact Citizens Advice or a tax accountant if the process feels overwhelming. They can help verify calculations and negotiate with the DWP.

Renters and the Risk of Arrears

Now, consider this: If you’re a renter on UC, deductions for rent arrears are common, especially if your housing element doesn’t cover your full rent. The 15% cap limits how much the DWP can take for arrears, but unpaid rent can still pile up, risking eviction. In 2024, Citizens Advice reported that 1 in 5 UC claimants fell behind on rent due to deductions. If you’re in this boat, talk to your landlord early—many are open to repayment plans. Also, check if you qualify for a Discretionary Housing Payment (DHP) from your local council to cover shortfalls. For example, Aisha, a single mum in London, used a DHP to bridge a £150 monthly rent gap while repaying an advance within the 15% cap.

Practical Strategies to Maximise Your UC

None of us wants to lose more money than necessary, so here are some actionable tips to make the most of the new cap:

Check Your UC Award Regularly: Errors in deductions or income calculations are common. Use the GOV.UK UC calculator to estimate your entitlement.

Apply for Budgeting Advances Wisely: These are interest-free loans for one-off costs (e.g., £348 for a single person in 2025-26). Repayments count toward the 15% cap, so plan carefully.

Claim Additional Support: If you’re a carer, disabled, or have children, you might qualify for extra UC elements, boosting your standard allowance and reducing the relative impact of deductions.

Track Your Spending: Use budgeting apps like Moneyhub or Yolt to see where your UC payments are going and prioritise essentials.

Tax Implications and Avoiding Pitfalls with the Universal Credit Debt Repayment Cap

Right, let’s shift gears and talk about how the Universal Credit (UC) debt repayment cap for 2025-26 ties into your broader tax picture as a UK taxpayer or business owner. The drop to a 15% cap on deductions is a welcome relief, but it doesn’t exist in a vacuum. Whether you’re earning a wage, running a side hustle, or managing a full-blown business, UC deductions interact with your income tax, National Insurance (NI), and other financial obligations in ways that can trip you up if you’re not careful. Let’s break it down with practical insights, real-life scenarios, and some number-crunching to keep things crystal clear.

How UC Deductions Affect Your Taxable Income

Now, here’s something that catches a lot of people out: UC payments, including the standard allowance, are not taxable. That’s right—whether you’re getting £400.14 as a single claimant over 25 or £628.10 as a couple, HMRC doesn’t count UC as income for tax purposes. But here’s where it gets tricky: The 15% cap means you’re keeping more of your UC payment each month, which might tempt you to rely less on earned income or dip into savings. This can affect your tax calculations, especially if you’re employed or self-employed.

For example, let’s say you’re a part-time barista in Newcastle, earning £12,000 a year (below the personal allowance of £12,570 for 2025-26, so no income tax). You’re also on UC with a £400.14 standard allowance, and deductions for an advance payment drop from £100.04 to £60.02 under the new cap. That extra £40.02 a month (£480.24 a year) might push you to work fewer hours, keeping your income tax-free. But if you’re self-employed, earning above the personal allowance, that extra UC cash could influence how you report profits or claim expenses, especially if you’re juggling the Minimum Income Floor (MIF).

The Self-Employed Tax Trap

So, the question is: How does the 15% cap affect self-employed taxpayers? If you’re running your own business—say, a dog-walking service in Bristol—the MIF assumes you earn at least £846 a month (based on 35 hours at the National Minimum Wage of £12.21 in 2025-26). If your actual profits are lower, UC tops up your income, but deductions still apply. The 15% cap helps by limiting deductions to £60.02 (for a single claimant over 25), but you still need to report your earnings monthly to the DWP. Mess this up, and you could face overpayments, which trigger more deductions down the line.

Here’s a real-world example: Meet Tariq, a freelance photographer in Birmingham.

In 2024, he underreported his earnings due to a bookkeeping error, leading to a £1,500 UC overpayment. At 25%, he was losing £100.04 a month from his £400.14 standard allowance. The new 15% cap cuts this to £60.02, saving him £480.24 a year. But Tariq’s also liable for income tax and Class 4 NI on his profits above £12,570. To avoid further overpayments, he now uses accounting software like QuickBooks to track income and expenses, ensuring accurate UC reporting. If you’re self-employed, consider setting aside 20-30% of your profits for tax and NI, using a separate business account to avoid mixing funds with UC payments.

Tax Component | 2025-26 Rate/Threshold | Impact on UC Claimants |

Personal Allowance | £12,570 | No income tax on earnings up to this amount; UC payments are not taxable. |

Basic Rate Income Tax | 20% on £12,571–£50,270 | Affects employed/self-employed claimants with earnings above personal allowance. |

Class 2 NI (Self-Employed) | £3.45/week (£179.40/year) | Mandatory for profits above £6,725; not affected by UC deductions but adds to costs. |

Class 4 NI (Self-Employed) | 6% on profits £12,571–£50,270 | Reduces net income, making the 15% UC cap’s savings crucial for cash flow. |

UC Taper Rate | 55p per £1 earned above work allowance | Earned income reduces UC, but 15% cap ensures more cash stays for essentials or tax bills. |

Source: GOV.UK, Income Tax Rates and Allowances 2025-26; HMRC Self-Employment Guidance

Avoiding Overpayment Pitfalls

Be careful! Overpayments are a major headache for UC claimants, especially when transitioning from legacy benefits like tax credits. In 2024, the National Audit Office reported that 12.8% of UC payments involved errors, with overpayments costing £1.4 billion annually. The 15% cap limits how much the DWP can claw back, but it doesn’t prevent overpayments from happening. Common causes include:

Late reporting of income changes: If you get a bonus or new contract, report it immediately via your UC journal.

DWP errors: Miscalculations of housing costs or childcare elements can lead to overpayments.

Tax credit overlaps: If you were overpaid tax credits before switching to UC, deductions can linger for years.

For instance, consider Siobhan, a retail manager in Cardiff who switched from Working Tax Credit to UC in 2023. She didn’t realise her old tax credit overpayment of £2,000 would be deducted from her UC at 25% (£100.04/month). The 15% cap now saves her £40.02 a month, but she’s still paying off the debt until 2027. Siobhan challenged the overpayment with help from Citizens Advice, who found an HMRC error in her 2021 income assessment, reducing the debt by £500. Always double-check overpayment notices and request a Mandatory Reconsideration if you spot errors.

Budgeting with the Extra Cash

Now, let’s think about that extra £40-£60 a month from the 15% cap. It’s tempting to spend it on a takeaway or new trainers, but smart budgeting can make it go further. Here are some ideas:

Build an emergency fund: Save £20 a month in a separate savings account to cover unexpected bills.

Pay down high-interest debt: If you’ve got credit card debt at 20% APR, use the extra cash to chip away at it.

Invest in your business: For self-employed claimants, reinvest in tools, marketing, or training to boost profits and reduce UC dependency.

Cover tax liabilities: Set aside a portion for your Self Assessment tax bill, due by 31 January 2027 for the 2025-26 tax year.

For example, Ravi, a self-employed courier in London, uses his £480 annual saving from the cap to cover his Class 2 NI contributions (£179.40) and part of his Class 4 NI, reducing his January tax stress. He tracks this using a simple spreadsheet, allocating UC savings to a “tax pot.”

Dealing with HMRC and DWP Overlaps

None of us wants to get stuck between two government departments, but UC and tax issues often overlap. If you’re repaying tax credits via UC deductions, HMRC and the DWP share data to calculate repayments. The 15% cap applies, but if you’re also dealing with PAYE tax code errors (e.g., emergency tax codes like 1257L X), you could face unexpected deductions from your wages. Check your tax code on your payslip or via HMRC’s online portal at www.gov.uk/check-income-tax-current-year. If it’s wrong, call HMRC at 0300 200 3300 to fix it before it compounds with UC deductions.

Planning for Tax Season

So, what’s the plan as we head into the 2025-26 tax year? If you’re employed, your UC award adjusts monthly based on PAYE data HMRC sends to the DWP. But errors—like unreported bonuses or overtime—can lead to UC overpayments. Self-employed claimants must submit profit/loss figures monthly, and inaccuracies can trigger deductions later. Use HMRC’s Self Assessment tools to estimate your tax liability early, and cross-check UC payments against your reported income to avoid surprises.

Summary of All the Most Important Points

The Universal Credit (UC) debt repayment cap in the UK for 2025-26 has been reduced from 25% to 15% of the standard allowance, effective 30 April 2025, saving households an average of £420 annually.

This Fair Repayment Rate applies to deductions for advance payments, overpaid benefits, and third-party debts like rent arrears, but fraud penalties or last-resort deductions may exceed the cap.

Single claimants over 25 with a £400.14 monthly standard allowance now face a maximum deduction of £60.02 instead of £100.04, freeing up £480.24 yearly.

Self-employed UC claimants, subject to the Minimum Income Floor (£846/month for a single person over 25), benefit from the 15% cap but must report earnings accurately to avoid overpayments.

Families with children, particularly the 700,000 households facing deductions, can save up to £753.72 annually for couples over 25, helping cover essentials like childcare or school costs.

Those transitioning from legacy benefits like tax credits often face deductions for overpayments, which the 15% cap limits, but errors must be challenged via Mandatory Reconsideration.

UC payments are not taxable, but the extra cash from the 15% cap can affect budgeting for income tax or National Insurance, especially for self-employed claimants.

Common overpayment causes include late income reporting or DWP errors, with 12.8% of UC payments in 2024 involving errors costing £1.4 billion annually.

Renters should monitor deductions for arrears and consider Discretionary Housing Payments from local councils to avoid eviction risks.

Practical strategies include checking UC statements regularly, using budgeting advances wisely, and setting aside savings for tax liabilities or emergencies to maximize the cap’s benefits.

FAQs

1. Q: What happens if you miss a Universal Credit debt repayment in 2025-26?A: If you miss a repayment, the DWP may increase deductions from future UC payments or pursue alternative recovery methods, but they must stay within the 15% cap unless it’s a fraud-related debt.

2. Q: Can you appeal the Universal Credit debt repayment amount in 2025-26?A: Yes, you can request a Mandatory Reconsideration within one month if you believe the repayment amount is incorrect, providing evidence like income records to support your case.

3. Q: How does the 2025-26 UC debt repayment cap affect your credit score?A: UC deductions don’t directly impact your credit score, as they’re not reported to credit agencies, but missed payments to creditors (e.g., rent or utilities) could harm your credit if not managed.

4. Q: Can you pause Universal Credit debt repayments in 2025-26 if facing financial hardship?A: You can request a temporary pause or reduction by contacting the DWP Debt Management Centre and proving hardship, such as high essential costs or low income.

5. Q: Are there any grants available to help with UC debt repayments in 2025-26?A: Local councils may offer discretionary grants or crisis payments, and charities like Turn2us provide grants to help with living costs, indirectly easing UC debt repayment pressure.

6. Q: How does the UC debt repayment cap affect your eligibility for other benefits in 2025-26?A: The 15% cap doesn’t directly affect eligibility for benefits like PIP or Carer’s Allowance, but increased disposable income from lower deductions may impact means-tested support.

7. Q: Can you consolidate UC debts with other personal debts in 2025-26?A: UC debts (e.g., advance payments) can’t be consolidated with private debts like credit cards, as they’re managed separately by the DWP through UC deductions.

8. Q: What is the process for requesting a lower UC repayment rate in 2025-26?A: Contact the DWP Debt Management Centre, provide evidence of financial strain (e.g., bills or bank statements), and request a reduced rate, which they’ll assess case-by-case.

9. Q: How does the UC debt repayment cap impact joint claims in 2025-26?A: For joint claims, the 15% cap applies to the combined standard allowance (e.g., £94.22 for a couple over 25), and both partners are jointly responsible for the debt.

10. Q: Can private landlords request UC deductions for rent arrears in 2025-26?A: Yes, landlords can request third-party deductions via the DWP, but these are capped at 15% of your standard allowance unless it’s a last-resort measure to prevent eviction.

11. Q: What types of UC debts are prioritised for repayment in 2025-26?A: The DWP prioritises rent arrears and utility bill deductions to prevent eviction or cut-offs, followed by advance payments and overpayment recoveries, all within the 15% cap.

12. Q: Can you get a refund if UC deductions were incorrectly applied in 2025-26?A: If deductions exceed the 15% cap due to DWP error, you can request a refund by submitting a Mandatory Reconsideration with evidence of the over-deduction.

13. Q: How does the UC debt repayment cap affect your ability to save in 2025-26?A: The lower 15% cap increases your monthly disposable income, potentially allowing you to save £40-£60 monthly, depending on your standard allowance, for emergencies or goals.

14. Q: Are UC debt repayments in 2025-26 affected by changes in your employment status?A: Changes like starting a job or increasing hours reduce your UC award due to the taper rate, but the 15% cap on deductions remains based on your standard allowance.

15. Q: Can you negotiate UC debt repayment terms with the DWP in 2025-26?A: Yes, you can negotiate lower or extended repayment terms by proving financial hardship, contacting the DWP Debt Management Centre to discuss affordable options.

16. Q: How does the UC debt repayment cap impact your mental health in 2025-26?A: Lower deductions reduce financial stress, but ongoing debt repayments can still cause anxiety, so consider free support from charities like Mind or StepChange.

17. Q: Can you use a debt management plan to handle UC deductions in 2025-26?A: UC deductions are managed separately by the DWP and can’t be included in private debt management plans, but you can coordinate with advisors to prioritise other debts.

18. Q: What happens to UC debt repayments if you move abroad in 2025-26?A: UC payments typically stop if you move abroad, but outstanding debts may still be pursued by the DWP through alternative recovery methods, depending on your location.

19. Q: Can you claim tax relief on expenses related to UC debt repayments in 2025-26?A: UC debt repayments aren’t tax-deductible, but self-employed claimants can claim business expenses on their Self Assessment to reduce taxable income, indirectly easing financial strain.

20. Q: How does the UC debt repayment cap affect your eligibility for a mortgage in 2025-26?A: The 15% cap increases your disposable income, improving affordability assessments, but lenders may still view UC as unstable income, so provide detailed financial records.

Click on the above arrow to expand the text

The Author:

Adil Akhtar, ACMA, CGMA, CEO and Chief Accountant of Pro Tax Accountant, is an esteemed tax blog writer with over 10 years of expertise in navigating complex tax matters. For more than three years, his insightful blogs have empowered UK taxpayers with clear, actionable advice. Leading Advantax Accountants as well, Adil blends technical prowess with a passion for demystifying finance, cementing his reputation as a trusted authority in tax education.

Email: adilacma@icloud.com

Disclaimer:

The information provided in our articles is for general informational purposes only and is not intended as professional advice. While we strive to keep the information up-to-date and correct, Pro Tax Accountant makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained in the articles for any purpose. Any reliance you place on such information is therefore strictly at your own risk. Some of the data in the above graphs may to give 100% accurate data.

We encourage all readers to consult with a qualified professional before making any decisions based on the information provided. The tax and accounting rules in the UK are subject to change and can vary depending on individual circumstances. Therefore, Pro Tax Accountant cannot be held liable for any errors, omissions, or inaccuracies published. The firm is not responsible for any losses, injuries, or damages arising from the display or use of this information.

.png)