Key Deadlines and Requirements for Provisional Taxpayers in 2026

- Adil Akhtar

- Aug 5, 2025

- 15 min read

Key Deadlines and Requirements for Provisional Taxpayers in 2026

Why January 2026 Matters for Provisional Taxpayers

Now, if you’re a provisional taxpayer—think self-employed, freelancers, or landlords—you’re probably already aware that January is a big month for taxes. The 31 January 2026 deadline is the big one for filing your online Self Assessment tax return for the 2024/25 tax year (6 April 2024 to 5 April 2025). This isn’t just about submitting your return; it’s also when you need to pay any tax owed, including your first payment on account for the 2025/26 tax year. Miss this, and you’re looking at a £100 penalty, even if you owe no tax, plus interest at 7.75% on unpaid amounts. Provisional taxpayers, who often deal with uncertain or fluctuating income, need to be extra vigilant to avoid surprises.

Who Qualifies as a Provisional Taxpayer?

Let’s clear this up: a provisional taxpayer is anyone who needs to report income that isn’t taxed at source through PAYE (Pay As You Earn). This includes self-employed sole traders earning over £1,000, landlords with rental income, or individuals with untaxed income from savings, dividends, or overseas earnings. If you’re a company director or have income exceeding £150,000, you’re likely in this boat too. For the 2024/25 tax year, HMRC’s criteria also cover those claiming Child Benefit with income over £60,000 (due to the High Income Child Benefit Charge).

Table 1: Key Self Assessment Criteria for 2024/25 Tax Year

Criteria | Details |

Self-employed income | Over £1,000 in profits requires a tax return. |

Untaxed income | Includes rental income, dividends, or savings interest over £10,000. |

High income | Taxable income over £150,000. |

Child Benefit | Claimed with income over £60,000 (High Income Child Benefit Charge). |

Capital gains | Gains above the £3,000 annual exempt amount (for 2024/25). |

Non-UK residents | UK-based self-employment or rental income requires filing with form SA109. |

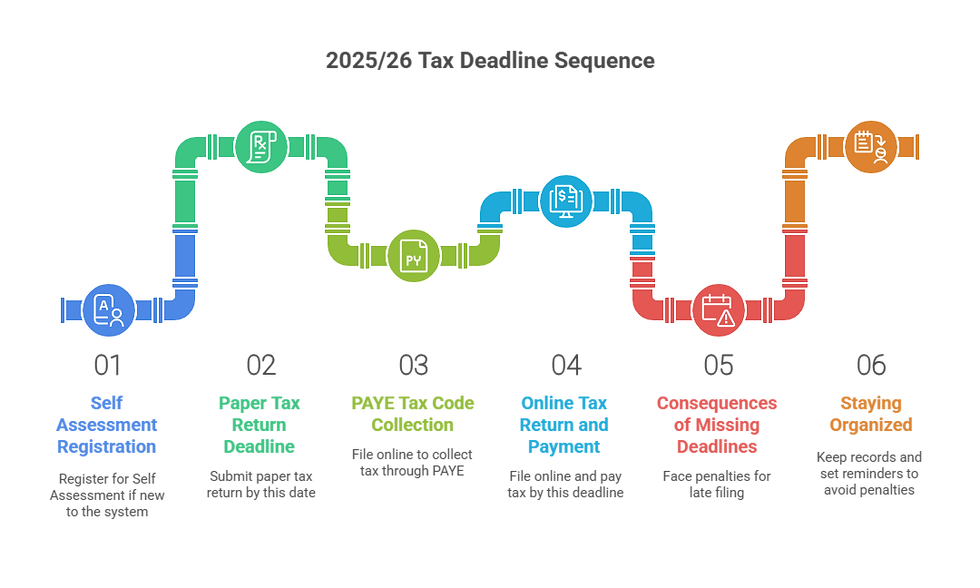

Key Deadlines You Can’t Ignore

Be careful! Missing deadlines can hit your wallet hard. Here’s what you need to mark in your calendar for the 2024/25 tax year:

● 5 October 2025: Register for Self Assessment if you’re new to it (e.g., started self-employment in 2024/25). Late registration can delay your Unique Taxpayer Reference (UTR) and complicate filing.

● 31 October 2025: Deadline for paper tax returns. If HMRC issues a notice to file after 31 July 2025, you get three months from the notice date.

● 30 December 2025: File online by this date if you want tax owed (under £3,000) collected through your PAYE tax code in 2026/27.

● 31 January 2026: Deadline for online tax returns and paying tax owed, including the first payment on account for 2025/26.

If you’re a partnership with an accounting period between 1 February and 5 April and a limited company partner, deadlines shift: online returns are due 12 months from the accounting date, paper returns 9 months.

Why Provisional Figures Are a Lifesaver

Now consider this: If you’re a provisional taxpayer, your income might not be set in stone by the filing deadline. Maybe you’re waiting on final invoices or expense receipts. HMRC allows you to use provisional figures if you can’t pin down exact profits. You must declare these as provisional on your return and update them within 12 months (by 31 January 2027 for 2024/25). If your final figures show you owe more tax, interest (currently 7.75%) applies from the original due date. Overpay? You’ll get interest back.

Case Study: Freya’s Freelance Dilemma

Freya, a graphic designer in Bristol, earned £45,000 in 2024/25 but was waiting on a £5,000 client payment by January 2026. She filed using provisional figures, estimating £40,000. When the payment cleared in March 2026, she amended her return, paying an extra £1,600 in tax plus £50 in interest. By acting quickly, she avoided penalties and kept her finances on track.

Payments on Account: The Double-Edged Sword

So the question is: Why does January feel like a tax double-whammy? If your tax bill exceeds £1,000 and less than 80% of your income is taxed via PAYE, you’ll need to make payments on account. These are advance payments toward your next tax year’s bill, split into two: 31 January and 31 July. Each payment is half your previous year’s tax bill. For example, if your 2024/25 tax bill is £6,000, you’ll pay £3,000 on 31 January 2026 (for 2024/25) plus £3,000 as the first payment on account for 2025/26. The second £3,000 is due 31 July 2026.

Table 2: Example Payments on Account Calculation

Tax Year | Tax Bill | 1st Payment on Account (31 Jan) | 2nd Payment on Account (31 Jul) | Total Paid by 31 Jan 2026 |

2024/25 | £6,000 | £3,000 (for 2025/26) | £3,000 (for 2025/26) | £9,000 |

If your income drops, you can apply to reduce payments on account via your HMRC online account, but you’ll need solid evidence to avoid underpayment penalties.

Step-by-Step Guide: Registering for Self Assessment

Here’s a practical guide to get you started if you’re new to Self Assessment:

Check if you need to register: Use HMRC’s checker tool at www.gov.uk/check-if-you-need-tax-return.

Register by 5 October 2025: For self-employed, use form CWF1; for non-self-employed with untaxed income, use SA1. Do this online via your Government Gateway account.

Receive your UTR: HMRC sends a 10-digit Unique Taxpayer Reference within 10 days (or longer if abroad).

Set up online filing: Use your UTR to activate your HMRC online account. You’ll need an activation code sent by post.

Gather records: Collect income details, expense receipts, and any tax relief claims (e.g., pension contributions) before filing.

By starting early, you avoid the last-minute rush and potential login issues, as over 600,000 taxpayers filed on the last day in January 2024, causing HMRC system delays.

Practical Strategies and Tools for Managing Self Assessment in January 2026

How Can You Prepare Early for January 2026?

Now, let’s get practical: nobody wants to be scrambling in January, especially when you’re juggling provisional figures or unpredictable income. Starting your Self Assessment prep early—ideally in April or May 2025—can save you from stress and costly mistakes. For the 2024/25 tax year, over 12.2 million UK taxpayers were required to file Self Assessment returns, with 1.1 million facing penalties for late filing or payments in 2024, according to HMRC data. Provisional taxpayers, like freelancers or landlords, often face extra hurdles because their income isn’t neatly recorded like PAYE employees. So, let’s break down how to stay ahead.

The first step is keeping meticulous records. Use accounting software like QuickBooks or FreeAgent, which integrate with HMRC’s systems for Making Tax Digital (MTD), mandatory for self-employed taxpayers earning over £30,000 from April 2026. These tools track income, expenses, and even estimate your tax bill in real time. If software isn’t your thing, a simple spreadsheet works, but log every invoice, receipt, and allowable expense (e.g., travel, equipment, home office costs).

What Are Allowable Expenses and How Do They Help?

Here’s a game-changer for provisional taxpayers: claiming allowable expenses can significantly cut your tax bill. These are costs incurred “wholly and exclusively” for your business, like office supplies, professional fees, or mileage (45p per mile for the first 10,000 miles in 2024/25). For example, a self-employed photographer in Leeds, Idris, claimed £4,500 in expenses for camera equipment, travel, and a home office, reducing his taxable income from £35,000 to £30,500. That shaved £900 off his tax bill.

Table 3: Common Allowable Expenses for Provisional Taxpayers (2024/25)

Expense Type | Examples | Notes |

Office Costs | Stationery, phone bills, internet | Must be business-related; apportion home costs if used partly for personal. |

Travel | Fuel, train tickets, mileage (45p/mile) | Parking fines or personal trips are not allowable. |

Professional Fees | Accountant fees, legal costs | Must be for business purposes. |

Training | Courses to maintain skills | New skill courses may not qualify. |

Simplified Expenses | Flat rates for home office (£26/month max) | Ideal for small businesses; check HMRC rules. |

Be careful! Over-claiming expenses or including personal costs can trigger an HMRC enquiry. Keep receipts and records for at least six years, as HMRC can audit you within this period.

How Do Payments on Account Work for Fluctuating Income?

So the question is: what if your income swings wildly year to year? Provisional taxpayers, like consultants or seasonal workers, often face this. Payments on account assume your 2025/26 income will match 2024/25, which isn’t always true. If you expect lower earnings—say, due to a quieter year—you can reduce your payments on account via your HMRC online account by 31 January 2026. But here’s the catch: underestimate your tax, and you’ll owe interest (7.75% as of April 2025) on the shortfall.

Case Study: Malik’s Seasonal Business

Malik, a Cornwall-based wedding planner, earned £60,000 in 2023/24, triggering a £12,000 tax bill and £6,000 payments on account for 2024/25. In 2024/25, bookings dropped to £40,000. He applied to reduce his January 2025 payment to £4,000, based on estimated profits. When his final tax bill came to £8,000, he avoided penalties by paying the balance by 31 January 2026, plus minimal interest.

To estimate your tax, use HMRC’s online calculator at www.gov.uk/estimate-income-tax or create a simple worksheet:

● List all income sources (e.g., self-employment, rentals).

● Subtract allowable expenses and reliefs (e.g., pension contributions).

● Apply 2024/25 tax bands: £12,570 personal allowance, 20% on £12,571–£50,270, 40% on £50,271–£125,140, 45% above £125,140.

What Happens If You Miss the January 2026 Deadline?

None of us wants to face penalties, but mistakes happen. Missing the 31 January 2026 deadline for filing or paying triggers automatic penalties. Here’s what you’re up against:

● Late filing: £100 fixed penalty, even if no tax is owed. After three months, £10 daily penalties (up to £900). After six months, 5% of tax due or £300 (whichever is higher).

● Late payment: 5% of unpaid tax at 30 days, 6 months, and 12 months, plus 7.75% interest on overdue amounts.

If you can’t pay in full, contact HMRC’s Payment Support Service before the deadline to set up a Time to Pay arrangement. In 2024, over 70,000 taxpayers used this to spread payments, avoiding penalties. Provide evidence of financial hardship, like bank statements or reduced income forecasts.

How Does Making Tax Digital (MTD) Affect 2026?

Now it shouldn’t be a surprise: MTD for Income Tax starts in April 2026, impacting provisional taxpayers with turnover above £30,000. You’ll need to submit quarterly updates to HMRC using MTD-compatible software, with a final “End of Year” submission replacing parts of the Self Assessment return. For January 2026, MTD doesn’t directly apply to your 2024/25 return, but it’s wise to prepare now. Test software like Xero or Sage to ensure you’re ready for quarterly reporting. HMRC estimates 1.8 million taxpayers will be affected, so don’t get caught out.

Budgeting for Your Tax Bill

Here’s a practical tip: set aside 25–30% of your income monthly in a separate savings account for tax. For example, if you earn £3,000 monthly, save £750–£900. This covers income tax, National Insurance (Class 2 at £3.45/week and Class 4 at 6% on profits £12,571–£50,270), and payments on account. Use HMRC’s Budgeting for Your Tax Bill tool at www.gov.uk/budgeting-for-your-tax-bill to forecast your liability.

Worksheet: Monthly Tax Savings Planner

Month | Income (£) | Expenses (£) | Taxable Profit (£) | Tax to Save (30%) |

April | 3,000 | 800 | 2,200 | 660 |

May | 2,500 | 600 | 1,900 | 570 |

Total | 5,500 | 1,400 | 4,100 | 1,230 |

This approach ensures you’re not blindsided by a £9,000 bill in January 2026, especially if you owe payments on account.

Handling Rare Scenarios

Now consider this: what if you’re a non-resident or in a partnership? Non-residents with UK self-employment or rental income must file using form SA109, even if they don’t owe tax. Partnerships with accounting periods ending between 1 February and 5 April face shifted deadlines (e.g., 31 October 2025 for paper returns). If you’re late registering, backdate your registration to when you started earning, but expect a £100 penalty if filed after 5 October 2025. Always notify HMRC of changes, like ceasing self-employment, within three months to avoid overpayment issues.

Summary and Advanced Tips for Staying Ahead in January 2026

How Can You Avoid Common Pitfalls as a Provisional Taxpayer?

Now, let’s talk about dodging those traps that catch out even the savviest provisional taxpayers. January 2026 is a high-stakes month, and small oversights can lead to big headaches. One common mistake is underestimating your tax bill, especially if you’re using provisional figures. HMRC’s data shows that in the 2023/24 tax year, over 200,000 taxpayers faced unexpected tax demands due to inaccurate estimates. To avoid this, double-check your figures against bank statements and invoices, and consider consulting an accountant for complex cases. Another pitfall? Forgetting National Insurance contributions. For 2024/25, Class 2 (£3.45/week) and Class 4 (6% on profits £12,571–£50,270, 2% above) can add up, especially for high earners.

If you’re juggling multiple income streams—say, freelancing plus rental income—keep them separate in your records. This makes it easier to allocate expenses correctly and avoid HMRC queries. For instance, a landlord in Manchester, Saira, mixed her rental and side-hustle expenses, leading to a £1,200 overpayment in 2024. She had to amend her return and wait three months for a refund. Use HMRC’s online tools at www.gov.uk/check-income-tax-current-year to verify your calculations before filing.

What Are the Tax Rates and Reliefs for 2024/25?

Let’s break down the numbers to keep your planning sharp. For the 2024/25 tax year, the UK tax bands and reliefs are critical for provisional taxpayers to understand. Your personal allowance is £12,570 (tax-free), but it tapers by £1 for every £2 of income above £100,000, vanishing entirely at £125,140. Here’s how the rates stack up:

Table 4: Income Tax Rates and Bands for 2024/25

Tax Band | Income Range (£) | Tax Rate |

Personal Allowance | 0–12,570 | 0% |

Basic Rate | 12,571–50,270 | 20% |

Higher Rate | 50,271–125,140 | 40% |

Additional Rate | Over 125,140 | 45% |

Source: www.gov.uk/income-tax-rates

Don’t forget reliefs! Pension contributions can reduce your taxable income, with basic-rate taxpayers getting 20% relief automatically (e.g., £80 becomes £100 in your pension). Higher earners can claim additional relief via Self Assessment. Other reliefs include Gift Aid donations and business asset disposals. For example, a Cardiff freelancer, Owain, claimed £2,000 in pension relief, cutting his tax bill by £400.

How Can You Appeal Penalties or Correct Mistakes?

Be careful! If you miss the 31 January 2026 deadline or file incorrect figures, HMRC won’t hesitate to slap on penalties. But you’ve got options. If you have a “reasonable excuse” (e.g., serious illness, IT issues, or unexpected life events), you can appeal penalties online within 30 days. In 2024, HMRC cancelled 15% of late-filing penalties after successful appeals. For errors, amend your return within 12 months (by 31 January 2027 for 2024/25) via your HMRC account. Overpaid tax? You’ll get a refund with 7.75% interest; underpaid, and you’ll owe interest from the original due date.

Case Study: Anwen’s Penalty Appeal

Anwen, a Swansea-based consultant, missed the 2024 deadline due to a family emergency. She filed on 15 February 2024 and faced a £100 penalty. She appealed, providing hospital documents, and HMRC waived the fine within two weeks. Quick action and clear evidence were key.

How Will Making Tax Digital Shape Your Future?

Now consider this: Making Tax Digital (MTD) for Income Tax, starting April 2026, will change how you manage taxes. Provisional taxpayers with turnover above £30,000 must submit quarterly updates using MTD-compatible software, replacing parts of the annual Self Assessment. For January 2026, you’re still filing for 2024/25 under the old system, but MTD’s shadow looms. Start trialling software now to avoid a steep learning curve. HMRC’s pilot program in 2024 showed 85% of early adopters found software reduced errors, so it’s worth the effort.

Practical Tools for Stress-Free Filing

Here’s a handy tip: use a checklist to stay on track. Before January 2026, ensure you’ve:

● Registered for Self Assessment by 5 October 2025.

● Collected all income records, expense receipts, and relief claims.

● Estimated your tax bill using HMRC’s calculator.

● Set aside funds for tax and payments on account.

● Tested MTD-compatible software for 2026/27 compliance.

For budgeting, revisit the monthly savings planner from Part 2. If cash flow is tight, explore HMRC’s Time to Pay at www.gov.uk/difficulties-paying-hmrc to spread payments without penalties.

Summary of Key Points

File your 2024/25 Self Assessment tax return online by 31 January 2026 to avoid a £100 penalty and 7.75% interest on unpaid tax.

Register for Self Assessment by 5 October 2025 if you’re new to self-employment or have untaxed income over £1,000.

Use provisional figures if your income isn’t finalised, but amend within 12 months to avoid interest charges.

Make payments on account (half your previous year’s tax bill) by 31 January and 31 July if your tax exceeds £1,000 and less than 80% is via PAYE.

Claim allowable expenses like travel or office costs to reduce your taxable income, keeping records for six years.

Reduce payments on account if you expect lower income, but provide evidence to avoid underpayment penalties.

Prepare for Making Tax Digital (MTD) starting April 2026 by adopting compatible software for quarterly updates.

Appeal penalties within 30 days with a reasonable excuse, like illness or IT issues, to potentially waive fines.

Use HMRC’s online tools to estimate tax, verify figures, and set up Time to Pay if you can’t pay in full.

Start budgeting 25–30% of monthly income for tax to cover income tax, National Insurance, and payments on account.

FAQs

Q1: What is a provisional taxpayer?

A1: A provisional taxpayer is an individual or entity earning income not subject to automatic tax deductions, such as self-employment income, requiring them to make estimated tax payments during the tax year.

Q2: When is the deadline for provisional taxpayers to file their income tax return?

A2: Provisional taxpayers must file their income tax return by 19 January 2026 for the 2025 tax year in South Africa, and by 31 January 2026 for the 2024-25 tax year in the UK.

Q3: What is the purpose of provisional tax payments?

A3: Provisional tax payments ensure a steady cash flow to the government by collecting tax in advance based on estimated taxable income, reducing the burden of a single large payment at year-end.

Q4: How many provisional tax payments must be made annually?

A4: Provisional taxpayers typically make two mandatory payments, one mid-year and one at year-end, with an optional third top-up payment to cover any shortfall.

Q5: What happens if a provisional taxpayer misses a filing deadline?

A5: Missing a filing deadline can result in penalties, such as a £100 fine in the UK for late Self Assessment returns, or interest charges and penalties in South Africa.

Q6: Can provisional taxpayers file their tax returns online?

A6: Yes, provisional taxpayers can file online using platforms like SARS eFiling or the HMRC online service, which is encouraged for its convenience and extended deadlines.

Q7: What is the deadline for registering as a provisional taxpayer?

A7: In the UK, new self-employed individuals must register for Self Assessment by 5 October following the tax year they need to file for.

Q8: How is the estimated taxable income calculated for provisional tax?

A8: Estimated taxable income is calculated by subtracting business expenses, pension contributions, and exempt income from total gross income before exemptions.

Q9: What is the basic amount for provisional tax estimates?

A9: The basic amount is the taxpayer’s taxable income from the previous year, excluding certain gains, increased by 8% if the estimate is made more than 18 months later.

Q10: Can provisional taxpayers amend their tax return after submission?

A10: Yes, amendments can be made within 12 months after the filing deadline, such as until 31 January 2027 for the 2024-25 UK tax year.

Q11: What are payments on account for provisional taxpayers?

A11: Payments on account are advance payments toward the next tax bill, typically two payments of half the previous year’s tax, due on 31 January and 31 July in the UK.

Q12: Can provisional taxpayers use provisional figures in their tax return?

A12: Yes, provisional figures can be used if final data is unavailable, but taxpayers must declare their use and update them later to avoid penalties.

Q13: What penalties apply for underestimating provisional tax?

A13: Underestimating provisional tax can lead to SARS or HMRC adjusting the estimate upward, potentially imposing penalties or interest if the shortfall is significant.

Q14: How can provisional taxpayers pay their tax bill?

A14: Tax bills can be paid via online banking, postal cheque, or through PAYE adjustments if eligible, with digital payments being the preferred method.

Q15: What is the role of auto-assessments for provisional taxpayers?

A15: Auto-assessments allow tax authorities to pre-fill returns for eligible taxpayers, who can opt in or make manual adjustments by the filing deadline.

Q16: Can provisional taxpayers opt out of cash basis accounting?

A16: Yes, provisional taxpayers can opt out of cash basis accounting and use traditional accounting, but they must notify the tax authority of this choice.

Q17: What records should provisional taxpayers keep?

A17: They should maintain records of income, expenses, receipts, and calculations used for tax estimates, ideally using digital software for accuracy.

Q18: How does Making Tax Digital affect provisional taxpayers?

A18: From April 2026, UK provisional taxpayers with turnover above £50,000 must keep digital records and submit quarterly updates, replacing annual Self Assessment.

Q19: Can provisional taxpayers appeal penalties for late filing?

A19: Yes, penalties can be appealed if there’s a reasonable excuse, such as illness or technical issues, provided the return is filed promptly after the issue is resolved.

Q20: What is the benefit of filing a tax return early?

A20: Early filing helps with financial planning, reduces the risk of penalties, allows quicker refunds, and provides clarity on tax obligations well before the deadline.

About The Author:

Adil Akhtar, ACMA, CGMA, CEO and Chief Accountant of Pro Tax Accountant, is an esteemed tax blog writer with over 10 years of expertise in navigating complex tax matters. For more than three years, his insightful blogs have empowered UK taxpayers with clear, actionable advice. Leading Advantax Accountants as well, Adil blends technical prowess with a passion for demystifying finance, cementing his reputation as a trusted authority in tax education.

Email: adilacma@icloud.com

Disclaimer:

The information provided in our articles is for general informational purposes only and is not intended as professional advice. While we strive to keep the information up-to-date and correct, Pro Tax Accountant makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained in the articles for any purpose. Any reliance you place on such information is therefore strictly at your own risk. Some of the data in the above graphs may to give 100% accurate data.

We encourage all readers to consult with a qualified professional before making any decisions based on the information provided. The tax and accounting rules in the UK are subject to change and can vary depending on individual circumstances. Therefore, Pro Tax Accountant cannot be held liable for any errors, omissions, or inaccuracies published. The firm is not responsible for any losses, injuries, or damages arising from the display or use of this information.

.png)