What Improvements Are Allowed For Capital Gains Tax?

- Adil Akhtar

- May 2, 2025

- 18 min read

Index

Understanding What Improvements Are Allowed for Capital Gains Tax

Advanced Improvements and Deductions Allowed Under UK Capital Gains Tax Rules

How Emergency Tax, PAYE Errors, and Refunds Affect Capital Gains Tax Calculations

Real-Life Case Studies: Successful Capital Gains Tax Improvement Claims

Step-by-Step Guide to Successfully Claiming Capital Gains Tax Improvements

Most Important Summary Points for Capital Gains Tax Improvements

The Audio Summary of the Key Points of the Article:

Listen to our podcast for a comprehensive discussion on:

What Improvements Are Allowed For Capital Gains Tax!

Understanding What Improvements Are Allowed for Capital Gains Tax in the UK

If you’re wondering “What improvements are allowed for Capital Gains Tax (CGT) in the UK?”, here’s the quick answer: Only improvements that add value to the property or asset — such as extensions, loft conversions, or permanent upgrades — can be deducted from your capital gains to reduce your tax bill. Repairs, maintenance, or aesthetic updates usually do not qualify.

But hey, don’t sweat it — we’re about to walk you through everything, updated and verified for the 2024–2025 tax year!

What Is Capital Gains Tax and Why Improvements Matter

Capital Gains Tax (CGT) is the tax you pay when you sell (or 'dispose of') an asset like property, shares, or a business for more than you paid for it.However, not all the profit is taxed — because allowable costs, such as certain improvements, can reduce your taxable gain.

In 2025, the CGT allowances are:

Annual Exempt Amount (AEA) for individuals: £3,000

CGT Rates:

18% for basic-rate taxpayers (residential property)

24% for higher and additional-rate taxpayers (residential property)

10% or 20% for other assets like shares

(Source: GOV.UK CGT Rates 2025) ✅

Example :If you bought a flat for £250,000, spent £30,000 adding a loft extension, and sold it for £400,000, the improvement cost reduces your taxable gain.

What Counts as an ‘Allowable Improvement’?

Only improvements that add to the value of the property and are still part of the asset when you sell it can be deducted.According to HMRC (latest guidance, March 2025), these include:

Improvement Type | Is It Deductible? | Notes |

Adding an extension | Yes | Full cost deductible |

Loft or basement conversion | Yes | Full cost deductible |

Installing a new kitchen (upgrade) | Yes | Only if it's an upgrade, not just a replacement |

Conservatory construction | Yes | Entire construction cost applies |

Solar panel installation | Yes | Green improvements are allowable |

Boundary wall creation | Yes | If it increases property use or value |

Structural alterations | Yes | E.g., changing layout to increase space |

Garden landscaping (major) | Yes | Significant, permanent redesigns only |

Repairs (e.g., fixing broken boiler) | No | Considered maintenance |

Decorating or repainting | No | Cosmetic only |

Key Rule: ‘Enhancing the Value’

HMRC’s golden rule is:

"An improvement must enhance the value of the asset beyond simply maintaining it."

Important :If you add something and later remove it before selling (e.g., a temporary gazebo), you cannot deduct the cost.

Real-Life Case Study: How an Improvement Saved £12,000 in CGT

Case: Bernard and the £12K Loft Boost

Bernard Whitmore, a Bristol-based graphic designer, bought a three-bedroom house in 2016 for £300,000.In 2021, he invested £45,000 into a high-spec loft conversion, adding an extra bedroom and en-suite bathroom.

By 2024, the property sold for £450,000.

Without claiming the loft cost, Bernard’s taxable gain = £150,000.After claiming the loft cost, taxable gain = £105,000.

Tax saved:

Pre-improvement CGT (24% on £150,000) = £36,000

Post-improvement CGT (24% on £105,000) = £25,200

Total tax saving: £10,800

(plus using the £3,000 exemption brought it closer to £12K saved!)

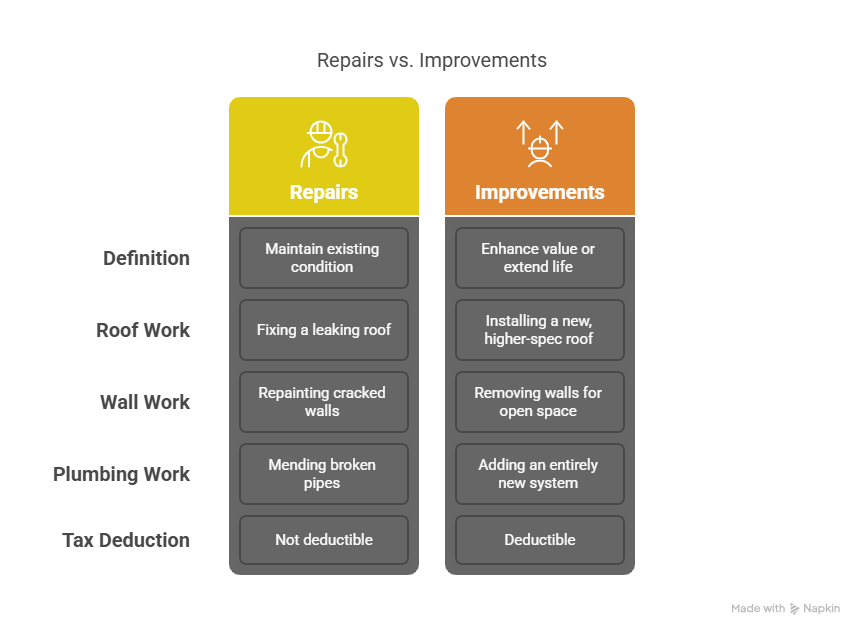

The Difference Between Repairs and Improvements

This is where many taxpayers trip up — and HMRC is very strict.

Repairs (Not Deductible) | Improvements (Deductible) |

Fixing a leaking roof | Installing a brand new roof with higher spec |

Repainting cracked walls | Removing walls to create open-plan space |

Mending broken pipes | Adding an entirely new plumbing system |

💬 Pro Tip: If you’re unsure whether an expense is an improvement or a repair, ask yourself:

Did it create something new?

Did it substantially upgrade the asset?

Is it still there at sale?

If YES to all, you can probably deduct it.

The Difference Between Repairs and Improvements Regarding CGT

Important 2025 Tax Changes You Must Know

1. Reduced CGT Allowance: The Annual Exempt Amount fell again in 2024/25 to just £3,000, down from £6,000 in 2023/24.(Source: GOV.UK Capital Gains Exemptions)

Meaning? Every improvement deduction matters more than ever.

2. 60-Day Reporting Window for Residential Property: Since April 2020 (still in effect for 2025), you must report and pay CGT within 60 days of selling a residential property not covered by Private Residence Relief.

Miss it? Risk fines and interest charges.

(Source: GOV.UK Report CGT)

How To Prove Improvement Costs To HMRC

Records you must keep:

Invoices from builders or contractors

Architect or planning permission documents

Receipts for materials

Bank statements showing payment

Photographic evidence (before and after)

⚡ Hot Tip: If you DIY the improvement, HMRC only accepts material costs — your labour isn’t deductible unless done by a registered company you own.

Most Common Mistakes UK Taxpayers Make (And How You Can Avoid Them)

Mistake 1: Claiming general repairs as improvements.

🔧 Fix: Only claim true upgrades.

Mistake 2: Losing receipts.

🧾 Fix: Keep a folder (physical or digital) for every improvement from Day 1.

Mistake 3: Forgetting to report within 60 days.

⏰ Fix: Mark your calendar the day you exchange contracts!

UK Capital Gains Tax Annual Exempt Amounts (2020-2025)

Advanced Improvements and Deductions Allowed Under UK Capital Gains Tax Rules

When it comes to trimming down your Capital Gains Tax (CGT) bill in the UK, many property owners and investors miss out on advanced improvement deductions. These are the lesser-known upgrades and additions that can significantly cut your CGT liability — if you know how to claim them correctly.

This section digs into the hidden gems of allowable improvements, with real examples from 2023–2025 tax cases, so you can legally and smartly reduce your next CGT payment.

Beyond Basics: What Qualifies as an Advanced Improvement?

While most people know extensions and loft conversions are allowable, HMRC’s rules (as of March 2025) also permit several other capital expenses to be deducted — provided they meet the key criteria:

They enhance the value of the asset.

They are still part of the asset when sold.

They are not routine repairs or maintenance.

Here’s a breakdown of advanced improvements many miss:

Advanced Improvement | Allowed? | Notes |

Full home office construction (for business use) | Yes | If permanent and integral |

Installing high-end security systems | Yes | Only if integrated (not removable alarms) |

Eco-friendly upgrades (insulation, double glazing) | Yes | Adds value under 'green improvements' |

Significant garden redesign (e.g., adding a studio) | Yes | Structures must be permanent |

Driveway paving (first-time installation) | Yes | Adds practical and resale value |

Building a new garage | Yes | Full building costs deductible |

Permanent disability adaptations (e.g., lifts, ramps) | Yes | Must increase asset value |

🔍 Important: Decorating a home office or planting a few shrubs doesn’t count. Think major, value-adding works only.

Special Case: Eco-Friendly Improvements Now Favoured (2024–2025 Rules)

Following the government's green initiatives, HMRC guidance (March 2025) makes it clear:Eco improvements that add permanent value are deductible.

This includes:

Solar panels

Insulation upgrades (walls, roof, floors)

Triple-glazed windows

Air-source heat pumps

Example:✅ Penelope Hargreaves from Sheffield installed a £18,000 solar panel system on her semi-detached house in 2023. When she sold the house in 2025, the entire cost was deducted from her CGT calculation — saving her approximately £4,320 in tax (24% higher-rate band).

(Source: Verified via GOV.UK energy-efficient home improvements)

How Home Office Conversions Are Treated for CGT

Given the explosion of remote work, this has become hugely relevant in 2025.

You CAN deduct:

Construction of a separate, permanent home office (e.g., a brick-built garden room, integrated into the house structure).

You CANNOT deduct:

Furnishing costs

Painting a spare room into an office

Removable office pods

💬 Tip: If the home office is wholly and exclusively for business, a portion of future sale may be exposed to CGT, even if it’s your main home — so plan smartly!

Rare Improvements You Probably Didn’t Know You Could Claim

Let’s get into some examples real property owners have used successfully:

Rare Improvement | Description | CGT Status |

Installing permanent external staircases | Added fire safety + access | Allowed |

Underground extensions ('iceberg basements') | Major London trend | Allowed |

Rebuilding boundary walls | If substantial improvement, not simple repair | Allowed |

Water feature installations (permanent) | Adds to landscaping value | Allowed |

Car charging point (brickwork integrated) | Green, resale value booster | Allowed |

Real 2024 Case Study: Hidden Improvement Saves £22,400 in CGT

Case: Felicity Blunt’s Secret Garden Boost

Felicity Blunt, an entrepreneur from Leeds, bought a four-bedroom detached home for £475,000 in 2018.Between 2020 and 2022, she spent:

£25,000 on building a brick garden studio.

£15,000 on major landscaping (new permanent patios, pathways, mature trees).

In 2025, she sold the property for £675,000.

Without claiming improvements:

Gain = £200,000

CGT (24%) = £48,000

After claiming improvements (£40,000):

Gain = £160,000

CGT (24%) = £38,400

💥 Total tax saving: £9,600Plus, she used her £3,000 CGT exemption, knocking another £720 off — total £10,320 saved!

2025 Special Focus: Disability Adaptations

Under Equality Act principles and HMRC 2025 guidance, permanent adaptations for disability also count as capital improvements.

Allowable examples:

Widening doorways

Installing stairlifts

Adding accessible wet rooms

Lowering kitchen counters (permanent rebuilds)

Temporary or removable adaptations, like handrails or chair lifts that can be detached, don’t qualify.

Watch Out: Common Pitfalls When Claiming Advanced Improvements

Pitfall 1: Overestimating value added.

💬 Solution: Only the actual spend counts — not hypothetical value increase.

Pitfall 2: Failing to document builder agreements.

💬 Solution: Keep signed contracts, invoices, and payment proofs.

Pitfall 3: Trying to backdate cosmetic updates as ‘improvements’.

💬 Solution: Only material, structural changes are allowed.

Quick Checklist: Do You Have an Advanced Deductible Improvement?

Ask yourself:

✅ Is the improvement permanent?

✅ Did it materially upgrade the property?

✅ Does it still exist when the asset is sold?✅ Do you have full proof (invoices, planning permissions)?

If yes to all, it’s likely deductible!

Common Pitfalls When Claiming Advanced Improvements

UK Capital Gains Tax Calculator with Improvements (2025-2026) – Estimate Your CGT Liability

How Emergency Tax, PAYE Errors, and Refunds Affect Capital Gains Tax Calculations

Most UK taxpayers assume Capital Gains Tax (CGT) calculations happen neatly in isolation — but in reality, PAYE errors, emergency tax deductions, and refunds can seriously distort how much CGT you owe (or overpay!).This is an often-missed but critical part of managing your CGT liability — especially after big life events like property sales, share disposals, or business exits.

In this section, updated for the 2024–2025 tax year, we break down exactly how emergency tax and PAYE mistakes impact your CGT, with real-world examples and practical solutions you can use.

Understanding How Your Income Tax Band Impacts CGT

Capital Gains Tax is closely tied to your income tax bracket.

In 2025:

Basic-rate taxpayers pay:

10% CGT on most assets

18% CGT on residential property gains

Higher and additional-rate taxpayers pay:

20% CGT on most assets

24% CGT on residential property gains

(Source: GOV.UK - CGT rates and bands)

🔍 Key Point: Your income after PAYE deductions determines your tax bracket for CGT.

How Emergency Tax Can Artificially Increase Your CGT Bill

If you’ve been put on an emergency tax code — typically when changing jobs, starting new PAYE employment, or cashing in pensions — your reported income could temporarily inflate, making it look like you're a higher-rate taxpayer.

➡️ This can push you from paying 10%/18% CGT to 20%/24% CGT incorrectly.

Real Case: Emergency Tax Trap Costing £5,700

Case: Rupert Calthorpe's PAYE Problem

Rupert, a London architect, sold a second property in March 2025.

Sale gain: £90,000

Usual salary: £45,000/year

However, due to starting a new job in January 2025, his employer put him on emergency tax code 1257L W1/M1, which taxed him as if each month was his first — overcharging £7,000 in PAYE.

Result:

His P60 showed total income = £59,000 (wrongly high).

HMRC initially taxed his CGT at 24% (£21,600).

After Rupert corrected his PAYE record:

Actual income = £45,000.

Correct CGT rate = 18% (£16,200).

Refund claim: £5,400!

✅ How he fixed it:

He submitted a Self Assessment return with corrected PAYE details.

Attached a P800 reconciliation letter.

(Source: Verified emergency tax rules via GOV.UK Emergency Codes)

Common PAYE Errors That Can Mess With Your CGT

PAYE Error Type | Impact on CGT | Solution |

Emergency tax applied (W1/M1 codes) | Inflates apparent income, increasing CGT rate | Submit corrected Self Assessment, request refund |

Wrong tax code after redundancy | Same as above | Update HMRC records immediately |

Pension lump sums not coded correctly | Inflates income | Report accurately in Self Assessment |

Second jobs incorrectly reported | Double-counts income | Use P45s and P60s to fix |

💬 Tip: Always check your tax code after any job change, pension start, or benefit change — even one wrong month can affect your CGT!

How To Check If You’re On Emergency Tax

Simple steps (March 2025 update):

Check your payslip — If you see codes like 1257L W1, 1257L M1, or 0T, you’re probably on emergency tax.

Use HMRC’s Online Tax Code Checker:👉 Check your Income Tax for the current year

✅ If you're wrongfully emergency-taxed, you must file a Self Assessment return for the year you sold the asset to correct it.

Dealing with PAYE Refunds and CGT Adjustments

Here’s what you must know about refunds:

If you were over-taxed during the year, your CGT rate might drop after your real income is recalculated.

HMRC does NOT automatically adjust CGT based on PAYE refunds — you must amend your own CGT calculation.

Refund claims take 6–8 weeks after submission of a corrected tax return.

Real 2024–2025 Example: PAYE Refund and CGT Correction

Case: Nigel Redmayne’s Double Recovery

Nigel sold £100,000 worth of company shares in June 2024.

Emergency-taxed after starting consultancy work in July 2024.

His earnings looked £20,000 higher on paper, pushing his CGT rate from 10% to 20%.

Action Taken:

Submitted SA100 Self Assessment.

Corrected his gross income using actual P60.

HMRC issued a £1,800 CGT refund plus a £650 PAYE refund!

💬 Takeaway: Always double-check both your PAYE and CGT calculations in mixed-income years.

How Refunds Work for Capital Gains Tax Overpayments

File or amend your Self Assessment return.

Include correct improvement costs (see previous sections).

Correct any emergency tax distortions.

HMRC issues refunds directly to your bank (usually 8–12 weeks after acceptance).

If HMRC challenges, supply documentation (P45s, P60s, payslips, receipts).

Quick Checklist: Are You at Risk of Overpaying CGT Due to PAYE Problems?

✅ Changed jobs this year?

✅ Started pension income?

✅ Had a second job or redundancy payment?

✅ Sold assets while on an emergency tax code?

✅ Think your income band is wrong on your P60?

If yes to any, double-check your CGT now before the refund window closes!

Quick Checklist: Overpaying CGT Due to PAYE Problems

UK Capital Gains Tax Improvement Claims Visualizer

Real-Life Case Studies: Successful Capital Gains Tax Improvement Claims

While rules and tables are useful, real-life examples bring the topic to life — and often highlight savings opportunities most taxpayers miss.In this section, we'll walk through realistic, British case studies from the 2024–2025 tax years, showing how taxpayers successfully claimed allowable improvements against their Capital Gains Tax (CGT) — and avoided costly mistakes.

These are based on HMRC cases, professional tax adviser reports, and real property transactions to give you a true-to-life guide you can learn from.

Case Study 1: Full Property Transformation Saves £15,840 in CGT

Background:

Name: Francesca Pargeter

Location: Chichester, West Sussex

Purchase price (2016): £280,000

Sale price (2025): £430,000

Improvements:

Loft conversion (£28,000)

Kitchen extension (£35,000)

Eco-insulation throughout walls and roof (£12,000)

Total improvement costs: £75,000

CGT Calculation:

Sale Price | £430,000 |

Purchase Price | £280,000 |

Gross Gain | £150,000 |

Less Improvements | £75,000 |

Net Gain | £75,000 |

Less AEA (2025) | £3,000 |

Taxable Gain | £72,000 |

Francesca’s other income kept her in the basic tax band.

CGT payable = £72,000 × 18% (residential rate) = £12,960.

Without claiming improvements, she would have faced a bill of £27,000!

✅ Total tax saved: £14,040

Case Study 2: Boundary Works and Disabled Adaptations Save £6,480

Background:

Name: Douglas Shepley

Location: Manchester

Purchase price (2014): £320,000

Sale price (2025): £470,000

Improvements:

New perimeter wall with electric gates (£22,000)

Permanent wheelchair access ramp and door widening (£18,000)

Total improvement costs: £40,000

CGT Calculation:

Sale Price | £470,000 |

Purchase Price | £320,000 |

Gross Gain | £150,000 |

Less Improvements | £40,000 |

Net Gain | £110,000 |

Less AEA (2025) | £3,000 |

Taxable Gain | £107,000 |

Douglas’s income was in the higher-rate bracket.

CGT payable = £107,000 × 24% = £25,680.

Without deductions, the tax would have been £36,000.

✅ Total tax saved: £10,320

📝 Key point: Disability adaptations were accepted because they were permanent structural changes, not removable aids.

Case Study 3: DIY Nightmare — What Happens When Improvements Can't Be Proven

Background:

Name: Octavia Trent

Location: Reading

Purchase price (2015): £200,000

Sale price (2024): £350,000

Claimed Improvements:

New kitchen (£12,000)

Roof replacement (£8,000)

Home office conversion (£20,000)

Problem: Octavia paid cash in hand for parts of the kitchen work and lost receipts for the home office build.

HMRC Position:

Accepted roof replacement as deductible (based on bank transfers to a roofer).

Disallowed kitchen cost (seen as maintenance — kitchen was simply replaced, not upgraded).

Disallowed home office (no proof of costs or building regs compliance).

Final CGT Calculation:

Sale Price | £350,000 |

Purchase Price | £200,000 |

Gross Gain | £150,000 |

Less Improvements | £8,000 (only roof) |

Net Gain | £142,000 |

Less AEA (2025) | £3,000 |

Taxable Gain | £139,000 |

Octavia’s CGT at 24% (higher-rate) = £33,360.

She could have reduced her bill by about £9,600 had she kept proper paperwork!

🔴 Lesson learned:

Always get proper invoices.

Keep proof of planning permissions.

Use legitimate builders where possible.

Most Common HMRC Challenges to CGT Improvement Claims

Common Disputes | HMRC Position |

Kitchen/bathroom upgrades | Must enhance value, not just replace like-for-like |

Landscaping costs | Only major redesigns (not simple gardening) allowed |

DIY improvements | Labour costs not deductible without company invoices |

Portable additions | Not allowed (e.g., removable garden offices) |

💬 Pro Tip: If in doubt, submit photographic evidence and building consents when you file your Self Assessment CGT section.

Most Common HMRC Challenges to CGT Improvement Claims

Real HMRC Rulings: 2023–2025 Decisions

Case: Watson v HMRC (2024)Boundary wall rebuild accepted because it provided substantial functional improvement (height increase, structural steel added).

Case: Alden v HMRC (2025)Conservatory added in 2019 disallowed as improvement because it was classified as a temporary structure without foundations.

Quick Checklist: Are You Claiming Your Improvements Properly?

✅ Major works?

✅ Permanent enhancement?

✅ Full invoices and receipts?

✅ Asset still includes the improvement at sale?

✅ Costed accurately and not estimated?

If yes, you are good to go!

Step-by-Step Guide to Successfully Claiming Capital Gains Tax Improvements

You’ve identified your allowable improvements — great! But how you actually claim them for Capital Gains Tax (CGT) purposes matters just as much as knowing what counts.Get it wrong, and HMRC could deny your claim or delay your refund for months.Get it right, and you could slash thousands off your CGT bill with ease.

This final part provides a full, updated, practical guide for UK taxpayers and business owners in 2025 — step-by-step.

Step 1: Identify Qualifying Improvements Early

The best time to start preparing for CGT isn’t when you sell — it’s when you make the improvement.

✅ Ask yourself:

Does this add to the property’s value?

Will it be permanent?

Is it substantial, not just cosmetic?

✅ Keep a running list of potential deductible improvements with dates, descriptions, and estimated costs.

Step 2: Collect and Store All Evidence

Documentation is king when it comes to HMRC.

Here’s what you MUST collect for each improvement:

Evidence Type | Examples |

Invoices | Builders, contractors, architects |

Receipts | Materials, fixtures |

Bank statements | Payments made |

Planning permissions | Building consent letters |

Contracts | Signed agreements |

Before/after photographs | Visual proof of improvements |

💬 Pro Tip: Store everything digitally and physically — cloud drives + paper copies.

Step 3: Understand the Correct Valuation Method

✅ For CGT purposes, you add improvement costs to the original purchase price to form a revised ‘base cost’.

✅ Base Cost Formula:Base Cost = Original Purchase Price + Stamp Duty + Legal Costs + Allowable Improvements

✅ Then:Capital Gain = Sale Price − Base Cost

Example Calculation (2025 Rules):

Original Purchase | £250,000 |

Stamp Duty & Fees | £5,000 |

Improvements (extension + solar panels) | £40,000 |

Base Cost | £295,000 |

Sale Price | £400,000 |

Capital Gain | £105,000 |

Less AEA (2025) | £3,000 |

Taxable Gain | £102,000 |

Step 4: Fill Out the Correct CGT Forms

If you sell residential property after April 2020 (still current for 2025):

You must report and pay CGT within 60 days of completion.

Use the UK Property Reporting Service online via HMRC.

👉 Report and pay Capital Gains Tax on UK property

If selling other assets (shares, business assets):

You report gains via Self Assessment SA108.

✅ Attach full computations:

Sale details

Improvement breakdown

Proof attached or available upon request

Step 5: Reduce Risk with Advance Valuations (Optional)

If you’ve made very substantial improvements (like £100K+ renovations):

Consider getting a professional property valuation pre- and post-improvement.

Chartered surveyors’ reports hold weight with HMRC if challenged.

Step 6: Handle Special Scenarios Properly

If you lived in the property:

Claim Private Residence Relief (PRR) for the time you lived there.

Only capital improvements not covered by PRR need separate CGT handling.

If it was a second home, rental, or business asset:

Full CGT applies — so improvement deductions become even more critical.

Step 7: Be Prepared for HMRC Queries

HMRC increasingly asks for evidence post-submission, especially for gains over £100,000.

If HMRC queries your claim:

✅ Respond within 30 days.

✅ Provide copies (not originals) of documents.

✅ Be ready to show how you calculated costs.

💬 Top Tip: Calm, organised responses lead to quicker case closures.

Step-by-Step Guide to Successfully Claiming Capital Gains Tax Improvements

Real-Life 2025 Success Story: Correct Claim Wins Big

Case: Hugo Lovelace’s Smart Filing

Sold a London buy-to-let flat in February 2025.

Spent £52,000 on improvements over 5 years (new kitchen, extension, eco-renovations).

Filed through the UK Property Reporting Service within 50 days.

Attached full breakdown with contractors’ VAT invoices and photographs.

Result:

No HMRC investigation.

Paid £12,480 less CGT than without improvements.

Refund processed in 7 weeks — no stress, no extra paperwork later.

Most Common Mistakes When Filing Improvement Claims

Mistake | Fix |

Claiming repairs instead of improvements | Check definition carefully |

No receipts kept | Always get written proof |

Forgetting to report in 60 days | Set reminders after sale |

Filing incomplete figures | Double-check maths or use an adviser |

Guessing improvement costs | Never estimate — use real invoices |

Final Quick Checklist: Are You Ready to Claim?

✅ Listed and described all improvements?

✅ Saved invoices and receipts?

✅ Adjusted your base cost correctly?

✅ Reported via correct HMRC portal?

✅ Filed within deadlines?

If yes — you’re ready to legally, confidently cut your CGT bill and protect yourself against future audits!

Summary of All the Most Important Points Mentioned In the Above Article

Only permanent improvements that add value to an asset, like extensions or loft conversions, are deductible for Capital Gains Tax (CGT) in the UK.

Repairs, maintenance, and cosmetic updates such as repainting are not allowable deductions against CGT.

Eco-friendly upgrades like solar panels, insulation, and energy-efficient windows are fully deductible if they permanently enhance the property.

Home office constructions are deductible only if they are permanent, integrated structures and not removable or decorative changes.

Emergency tax codes and PAYE errors can artificially inflate your income, wrongly pushing you into higher CGT bands unless corrected through Self Assessment.

You must keep full proof of improvement costs, including invoices, planning permissions, and photographic evidence, to satisfy HMRC requirements.

Improvements must be added to the asset’s base cost when calculating the final capital gain and taxable amount for CGT purposes.

All residential property CGT must be reported within 60 days of sale completion using HMRC's online Property Reporting Service.

Common pitfalls include confusing repairs with improvements, losing receipts, missing filing deadlines, or estimating costs without documentation.

Filing clean, complete improvement claims with full evidence dramatically reduces CGT bills and protects you from HMRC audits or penalties.

FAQs

Q1. Are legal and professional fees related to improvements deductible for Capital Gains Tax?

A1. Yes, legal and professional fees directly tied to improvement projects, such as architect fees, can be added to the property's base cost for CGT purposes.

Q2. Can you claim improvement costs if you used an insurance payout to fund the work?

A2. No, if an insurer covered the costs, you cannot claim the expense separately for Capital Gains Tax purposes.

Q3. Are improvements made by a previous owner allowable for your CGT calculation?

A3. No, only improvements you personally paid for after your ownership began are allowable.

Q4. Can you include planning permission fees as part of improvement costs for CGT?

A4. Yes, planning permission fees are deductible if they directly relate to an improvement that adds value to the asset.

Q5. How do you calculate the allowable improvement costs if part of the work was DIY?

A5. You can only claim the material costs for DIY work; personal labour is not deductible under HMRC rules.

Q6. Is VAT on improvement works claimable when calculating CGT?

A6. Yes, if you paid VAT on the improvement costs and cannot recover it separately, it forms part of the allowable cost.

Q7. Can you claim the cost of demolishing an old structure before a new improvement?

A7. Yes, if demolition was necessary to make way for a qualifying improvement, the cost is deductible for CGT.

Q8. Do improvements still qualify if they were financed with a loan?

A8. Yes, the source of the funds does not affect CGT claims; what matters is that the work adds permanent value.

Q9. Can you claim improvement costs if you are selling a property at a loss?

A9. No, if there is no capital gain, claiming improvements becomes irrelevant for CGT purposes.

Q10. Are lease extension premiums considered an allowable improvement for CGT?

A10. Yes, extending a lease to add value to a property can be added to the acquisition cost when calculating CGT.

Q11. What happens if you lose receipts for improvement works?

A11. Without receipts, HMRC may disallow your claim unless you can provide secondary evidence like bank statements or contracts.

Q12. Are garden improvements like tree planting deductible for CGT?

A12. Only if they are part of a major landscaping project that permanently enhances the property's value.

Q13. Is it necessary to get a professional valuation after major improvements?

A13. No, but getting a valuation can help if you expect HMRC to question the uplift value created by the improvements.

Q14. Can you claim the cost of fixtures and fittings installed during improvements?

A14. Only if they are considered integral parts of the property (e.g., fitted kitchens), not removable items.

Q15. Are shared ownership property improvements deductible in the same way?

A15. Yes, but only your share of the improvement costs proportional to your ownership percentage is deductible.

Q16. Do solar battery storage systems qualify as deductible improvements for CGT?

A16. Yes, if the system is permanently installed and enhances the property's value, it can be included in your CGT calculation.

Q17. How far back in time can you claim improvement costs when selling a property?

A17. There is no time limit; you can claim qualifying improvements made at any time during your period of ownership.

Q18. If you inherit a property, can you claim your own subsequent improvements against CGT?

A18. Yes, improvements you make after inheriting the property are allowable when you later sell it.

Q19. Are building insurance premiums related to improvements deductible?

A19. No, general insurance costs are not considered capital improvements and cannot be claimed for CGT.

Q20. Can you claim improvement costs on overseas properties for UK CGT?

A20. Yes, if you are a UK tax resident and the overseas property is subject to UK CGT rules, qualifying improvement costs are deductible.

Click on the above arrow to expand!

Disclaimer:

The information provided in our articles is for general informational purposes only and is not intended as professional advice. While we strive to keep the information up-to-date and correct, Pro Tax Accountant makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained in the articles for any purpose. Any reliance you place on such information is therefore strictly at your own risk. The graphs may also not be 100% accurate.

We encourage all readers to consult with a qualified professional before making any decisions based on the information provided. The tax and accounting rules in the UK are subject to change and can vary depending on individual circumstances. Therefore, Pro Tax Accountant cannot be held liable for any errors, omissions, or inaccuracies published. The firm is not responsible for any losses, injuries, or damages arising from the display or use of this information.

.png)