What is HMRC Form CT61?

- Adil Akhtar

- Feb 23, 2023

- 17 min read

Updated: Jul 7, 2025

Understanding HMRC Form CT61 and Its Role in UK Tax Compliance

What Exactly Is HMRC Form CT61?

Let’s kick things off with the basics: HMRC Form CT61 is a tax document used by UK companies and certain other entities to report and pay income tax deducted at source on specific payments, like interest, royalties, or alternative finance payments. If your business makes these payments to individuals, partnerships, or non-UK resident companies, you’re often required to deduct 20% income tax and send it to HM Revenue & Customs (HMRC) using this form. It’s a way for HMRC to ensure tax is collected on income that might otherwise slip through the net, like interest paid to a company director on a loan they’ve made to the business. The legal backbone for this is found in Part 15, Chapter 15 of the Income Tax Act 2007 (ITA), which sets out the rules for withholding tax.

Why Does Your Business Need to Care About CT61?

Now, if you’re running a small business or acting as a company director, you might be wondering why this form even matters. The answer lies in compliance and avoiding penalties. If your company pays interest on a director’s loan, for example, you’re legally required to deduct 20% tax and report it to HMRC via the CT61. Failing to do so can lead to fines, interest charges, or even a deeper HMRC investigation. For the 2024-2025 tax year, the basic rate of income tax remains at 20%, so if your company pays £10,000 in interest to a director, you’d withhold £2,000 and pay it to HMRC. The recipient then declares this interest on their personal tax return, potentially offsetting it against their Personal Savings Allowance (£1,000 for basic rate taxpayers, £500 for higher rate taxpayers as of April 2025).

What Types of Payments Trigger a CT61 Filing?

So, what payments actually require you to file a CT61? It’s not just about random cash transfers. The form applies to specific payments where income tax must be deducted at source. These include:

Annual interest payments: Think loans to your company from directors or shareholders.

Royalties: Payments for intellectual property, like patents or copyrights.

Alternative finance payments: Islamic finance arrangements or similar.

Manufactured payments from abroad: Certain overseas payments structured to mimic interest.

Relevant distributions: Specific payments tied to company profits or assets.

For example, if your company, say, JKL Enterprises, pays £5,000 in interest on a director’s loan, you’d deduct £1,000 (20%) and report it on the CT61. The form ensures HMRC knows about these payments and collects the tax upfront.

How Often Do You Need to File a CT61?

Here’s where things get a bit tricky: CT61 filings are typically quarterly, based on the standard calendar quarters ending 31 March, 30 June, 30 September, and 31 December. You must submit the form and pay any tax deducted within 14 days of the quarter’s end—so, by 14 April, 14 July, 14 October, and 14 January. However, if your company’s accounting period doesn’t align with these dates, you might need to file multiple CT61s for a single quarter if interest payments span a year-end. For instance, a company with a 31 October year-end might need five CT61s in a year if interest is paid monthly. In 2024-2025, HMRC still requires these filings even if no payments were made in a quarter, so you’d submit a nil return to stay compliant.

Quarter Ending | Submission Deadline | Tax Year 2024-2025 Notes |

31 March | 14 April | Ensure timely payment to avoid penalties. |

30 June | 14 July | Include all interest paid in Q1. |

30 September | 14 October | Non-standard year-ends may require split filings. |

31 December | 14 January | Nil returns needed if no payments made. |

How Do You Get Your Hands on a CT61 Form?

Be careful! You can’t just download a CT61 form from the HMRC website like you can with a VAT return. Instead, you need to request it directly from HMRC, either online via their portal or by calling the Shipley Accounts Office at 0300 051 8371 (open Monday to Thursday, 9 am to 4:30 pm; Friday, 9 am to 4 pm). If you’re a limited liability partnership (LLP), you’ll need to send a letter to HMRC with your Unique Taxpayer Reference (UTR), detailing the payment and tax deducted. This process can feel a bit old-school, but it’s HMRC’s way of controlling access to the form and ensuring accuracy.

What Happens If You Miss the Filing Deadline?

None of us wants to deal with HMRC penalties, but missing a CT61 deadline can sting. For the 2024-2025 tax year, late submissions can trigger a fixed penalty of £100 for the first offence, escalating to £200 for repeated failures within the same tax year. If you’re late by more than three months, HMRC may impose additional penalties of up to £3,000 or 5% of the tax due, whichever is higher. Interest on late payments accrues at 3.25% above the Bank of England base rate (4.75% as of June 2025), so a £2,000 tax liability could rack up £65 in interest annually if unpaid. To avoid this, set calendar reminders for the 14th of each quarter and double-check your payment schedules.

Case Study: A Director’s Loan Gone Wrong

Let’s consider a real-world scenario. Imagine Priya Shah, a director of a small tech startup in Bristol, lends her company £50,000 at a 5% interest rate in January 2024. By December, the company owes her £2,500 in interest. Priya’s accountant forgets to deduct the 20% tax (£500) and file a CT61 by 14 January 2025. HMRC notices the oversight during a routine audit and slaps the company with a £100 penalty plus interest on the unpaid tax. Priya also faces complications on her personal tax return because the interest wasn’t properly reported. This could’ve been avoided by registering with HMRC for CT61 filings and setting up a clear process for quarterly submissions.

Practical Steps and In-Depth Analysis of HMRC Form CT61 for UK Businesses

How Do You Actually Fill Out a CT61 Form?

Now, let’s get into the nitty-gritty of completing a CT61 form. Once you’ve requested it from HMRC (via their online portal or by phone at 0300 051 8371), you’ll receive a form that looks a bit like a tax puzzle. The CT61 requires details about the payer (your company), the recipient (e.g., a director or creditor), the payment amount, and the tax deducted. You’ll need to include your company’s Unique Taxpayer Reference (UTR), the payment date, and the tax period (e.g., quarter ending 30 June 2025). For a £10,000 interest payment, you’d report £2,000 as tax deducted at 20%. If the recipient has a Personal Savings Allowance or other reliefs, they can reclaim overpaid tax via their Self Assessment, but that’s their responsibility, not yours. Always double-check the recipient’s tax status—non-UK residents may have different rules under double taxation treaties. For accuracy, use HMRC’s guidance at www.gov.uk/government/publications/other-non-electronic-forms.

Step-by-Step Guide to Filing a CT61

So, the question is, how do you make sure you’re filing this form correctly? Here’s a practical step-by-step guide to keep you on track for the 2024-2025 tax year:

Identify Payments Requiring Deduction: Review your accounts for interest, royalties, or alternative finance payments made in the quarter. For example, a loan from a director like Ewan McTavish at 6% interest needs 20% tax withheld.

Calculate Tax Due: Multiply the payment by 20%. For a £5,000 interest payment, deduct £1,000 and pay the recipient £4,000.

Request the CT61 Form: Contact HMRC’s Shipley Accounts Office or use the online portal. LLPs must write a letter with payment details.

Complete the Form: Enter your company’s UTR, the recipient’s details (name, address, and UTR if known), the payment amount, and tax deducted.

Submit by Deadline: File by the 14th of the month following the quarter (e.g., 14 July for Q2). Use HMRC’s online system or post to HMRC, BX9 1PR.

Pay the Tax: Transfer the deducted tax to HMRC’s bank account (sort code 08-32-10, account 12001020) using your UTR as the reference.

Keep Records: Store copies of the CT61, payment receipts, and loan agreements for at least six years, as HMRC may audit you.

This process ensures compliance and minimizes errors. For complex cases, like payments to non-residents, consult HMRC’s Double Taxation Treaty Passport Scheme at www.gov.uk/guidance/double-taxation-treaty-passport-scheme.

What Are the Common Mistakes to Avoid?

Be careful! Filing a CT61 isn’t always straightforward, and small errors can lead to big headaches. Common pitfalls include:

Forgetting Nil Returns: If no payments were made in a quarter, you still need to file a nil return to avoid penalties.

Incorrect Tax Rates: Always use the 20% basic rate for deductions unless HMRC specifies otherwise (e.g., treaty exemptions).

Missing Deadlines: Late submissions trigger automatic £100 penalties, even for nil returns.

Wrong Recipient Details: If you don’t have the recipient’s UTR, HMRC may query the filing, delaying processing.

In 2024, a Manchester-based SME, Telford & Sons Ltd, faced a £200 penalty for missing two consecutive CT61 deadlines. Their accountant assumed no interest payments meant no filing was needed—a costly mistake. Setting up a quarterly compliance checklist can prevent this.

How Does CT61 Affect Your Company’s Cash Flow?

Now consider this: If your business regularly pays interest, the CT61 process can impact your cash flow. Deducting 20% from payments reduces what you owe the recipient, but you must remit that tax to HMRC promptly. For example, if your company pays £20,000 in annual interest to a shareholder, you’re sending £4,000 to HMRC yearly. This can strain smaller businesses, especially if loan repayments are frequent. To manage this, budget for tax deductions in your cash flow forecasts and consider negotiating loan terms to spread interest payments evenly across quarters. For the 2024-2025 tax year, HMRC allows electronic payments to streamline the process, so set up a standing order to avoid last-minute scrambles.

Special Scenarios: Director’s Loans and Non-Residents

Let’s dig deeper into a couple of tricky cases. First, director’s loans are a common trigger for CT61 filings. Say Aisha Khan, a director of a Leeds-based consultancy, lends her company £100,000 at 4% interest. The annual interest of £4,000 requires £800 tax to be deducted and reported on a CT61. If Aisha’s personal tax rate is 20%, she can offset the £800 against her Personal Savings Allowance, but if she’s a higher-rate taxpayer (40%), she’ll owe an additional £800 on her Self Assessment. This interplay between company and personal tax obligations can be confusing, so clear communication with your accountant is key.

Second, payments to non-UK residents add complexity. If your company pays interest to a foreign creditor, you may need to apply a reduced tax rate under a double taxation agreement. For instance, a UK company paying interest to a US-based lender might deduct only 10% tax under the UK-US tax treaty, but you’d need to confirm the lender’s status via HMRC’s treaty passport scheme. In 2023, a London tech firm incorrectly deducted 20% instead of 0% on interest paid to a German partner, leading to a refund process that took six months to resolve.

Scenario | Payment Type | Tax Rate (2024-2025) | CT61 Action |

Director’s Loan | Interest | 20% | Deduct and report £200 per £1,000 interest. |

Non-Resident Payment | Interest | 0%-20% (per treaty) | Verify treaty rate; file CT61 with adjusted tax. |

Royalty to UK Individual | Royalty | 20% | Deduct and report on CT61. |

Nil Payment Quarter | None | 0% | Submit nil return by deadline. |

How Can You Plan Ahead for CT61 Compliance?

None of us is a tax expert, but planning can make CT61 filings smoother. Start by integrating tax deductions into your accounting software—tools like Xero or QuickBooks can track interest payments and flag CT61 triggers. Next, maintain a loan register detailing all interest-bearing agreements, including rates, payment dates, and recipient details. For 2024-2025, HMRC’s online portal is increasingly user-friendly, allowing you to track submissions and payments. If you’re unsure about complex cases, like non-resident payments, consult a tax advisor familiar with HMRC’s CT600 series guidance. Proactively requesting CT61 forms at the start of each tax year (April) can also save time, as HMRC’s processing can take a few days.

How to Fill Form CT61 - A Section-by-Section and Question-by-Question Process

Why Is Filling Out Form CT61 So Important?

Let’s get straight to it: filling out HMRC Form CT61 correctly is your ticket to staying on the right side of HM Revenue & Customs (HMRC). This form, used to report income tax deducted from payments like interest or royalties, isn’t just paperwork—it’s a legal requirement under Part 15, Chapter 15 of the Income Tax Act 2007. Get it wrong, and you’re looking at penalties starting at £100, plus interest on unpaid tax at 3.25% above the Bank of England base rate (4.75% as of June 2025). The form’s structure can feel daunting, but breaking it down section by section makes it manageable. Below, I’ll walk you through each part of the CT61, question by question, using insights from HMRC’s official guidance (www.gov.uk/government/publications/corporation-tax-return-of-income-tax-on-company-payments-ct61) and related resources like the CT600 series notes, ensuring you have practical, up-to-date advice for the 2024-2025 tax year.

How Do You Start with the CT61 Header Information?

Now, before you dive into the numbers, the CT61’s header sets the stage. You’ll need to provide your company’s details to identify who’s filing and for what period. Here’s what to fill in:

Company Name and Address: Enter your full registered company name and address as listed with Companies House. For example, if you’re “Brighton Widgets Ltd” at 12 Seafront Road, Brighton, BN1 1AA, write that exactly.

Unique Taxpayer Reference (UTR): This 10-digit number, found on your HMRC correspondence, links the form to your company’s tax record. Without it, HMRC can’t process your filing.

Accounting Period: Specify the quarter ending date (31 March, 30 June, 30 September, or 31 December). If your accounting period doesn’t align with these, note the relevant period (e.g., 1 April 2024 to 30 April 2024 for a non-standard year-end).

Return Period: Indicate the specific quarter or part-period you’re reporting. For instance, a payment made on 15 May 2024 falls in the quarter ending 30 June 2024, due by 14 July 2024.

Double-check these details against your Corporation Tax records to avoid HMRC rejecting the form. If you’re unsure of your UTR, contact HMRC’s Shipley Accounts Office at 0300 051 8371.

What Goes in the Payment Details Section?

So, the question is, how do you report the actual payments? This section is the heart of the CT61, where you list payments like interest, royalties, or alternative finance payments and the tax deducted. Here’s a question-by-question breakdown:

Question 1: Type of Payment: Specify whether it’s “interest,” “royalty,” “alternative finance payment,” or “relevant distribution.” For example, interest on a director’s loan is common for small businesses.

Question 2: Recipient’s Details: Provide the recipient’s full name and address. If they’re an individual (e.g., a director like Eleri Vaughan), include their UTR if known. For non-residents, note their country of residence for potential double taxation treaty relief.

Question 3: Date of Payment: Enter the exact date the payment was made (e.g., 10 June 2024). This determines the quarter for filing.

Question 4: Gross Payment Amount: List the total payment before tax (e.g., £5,000 interest on a loan).

Question 5: Tax Deducted: Calculate 20% of the gross amount (e.g., £1,000 for a £5,000 payment) unless a treaty applies. For non-residents, check HMRC’s Double Taxation Treaty Passport Scheme (www.gov.uk/guidance/double-taxation-treaty-passport-scheme) for reduced rates.

Question 6: Net Payment: Enter the amount paid to the recipient after tax (e.g., £4,000).

If you made multiple payments, list each separately. For a nil return (no payments in the quarter), mark this section as “Nil” to confirm compliance.

Question | Field | Example Input | Notes |

1 | Type of Payment | Interest | Specify “interest” for director’s loans. |

2 | Recipient’s Details | Eleri Vaughan, 45 High St, Cardiff, CF10 1AA | Include UTR if available; note non-resident status. |

3 | Date of Payment | 10/06/2024 | Must fall within the reported quarter. |

4 | Gross Payment | £5,000 | Total before tax deduction. |

5 | Tax Deducted | £1,000 | 20% of gross unless treaty applies. |

6 | Net Payment | £4,000 | Amount paid to recipient. |

How Do You Handle the Tax Calculation and Payment Section?

Be careful! The tax calculation section is where errors often creep in. Here, you summarize the total tax deducted and confirm what’s due to HMRC:

Question 7: Total Tax Deducted: Add up all tax amounts from Question 5 across all payments in the quarter. For example, if you deducted £1,000 from one payment and £500 from another, enter £1,500.

Question 8: Tax Already Paid: If you made advance payments to HMRC for this quarter, note them here (rare for most businesses).

Question 9: Tax Due or Refundable: Subtract Question 8 from Question 7. In most cases, this is the full amount from Question 7 (e.g., £1,500). If overpaid, HMRC may refund the difference.

Question 10: Bank Details for Refunds: If expecting a refund, provide your company’s bank sort code and account number. HMRC’s payment account for tax due is sort code 08-32-10, account 12001020, using your UTR as the reference.

Ensure your calculations are exact—HMRC cross-checks against your company accounts. Use a spreadsheet to verify totals before submitting.

What About the Declaration and Submission Process?

Now, let’s talk about signing off and sending the form. The declaration section requires a director or authorized person to confirm the details are accurate:

Question 11: Declaration: Enter your name, position (e.g., “Director”), and signature (or digital authorization if filing online). This confirms you’ve checked the form for accuracy.

Question 12: Date: Note the submission date (must be by the 14th of the month following the quarter, e.g., 14 July 2025 for Q2).

Submit the form via HMRC’s online portal or by post to HMRC, BX9 1PR. For online submissions, ensure you’re registered with HMRC’s Corporation Tax services (www.gov.uk/guidance/register-for-corporation-tax-online). Include payment with the form, using HMRC’s bank details. For LLPs, send a letter with equivalent details to the Shipley Accounts Office.

How Do You Manage Complex Cases Like Non-Standard Periods?

None of us wants to deal with extra paperwork, but non-standard accounting periods can complicate CT61 filings. If your company’s year-end isn’t 31 March, you may need to split payments across multiple CT61s. For example, a company with a 30 September year-end paying interest on 15 August 2024 and 15 October 2024 might need two forms for the same quarter if the accounting period changes. To handle this:

Map out your accounting periods at the start of the tax year.

Request extra CT61 forms from HMRC early, as processing can take days.

Clearly note the period covered in the header (e.g., “1 August 2024 to 30 September 2024”).

In 2024, a Birmingham retailer, Patel Crafts Ltd, misfiled a CT61 by lumping all interest payments into one quarter, ignoring their 30 June year-end. HMRC issued a £100 penalty for incorrect reporting, which could’ve been avoided with clearer period allocation.

What Records Should You Keep After Filing?

Let’s wrap up with a practical tip: record-keeping is your safety net. HMRC can audit CT61 filings up to six years later, so store:

Copies of the submitted CT61 form.

Loan agreements or contracts showing payment terms.

Bank statements proving tax payments to HMRC.

Recipient details, including any treaty documentation for non-residents.

For example, in 2023, a Glasgow consultancy faced an HMRC audit and avoided penalties by providing detailed records of £12,000 in interest payments reported on CT61s. Use cloud storage like Dropbox or accounting software like QuickBooks to organize these securely.ur business.

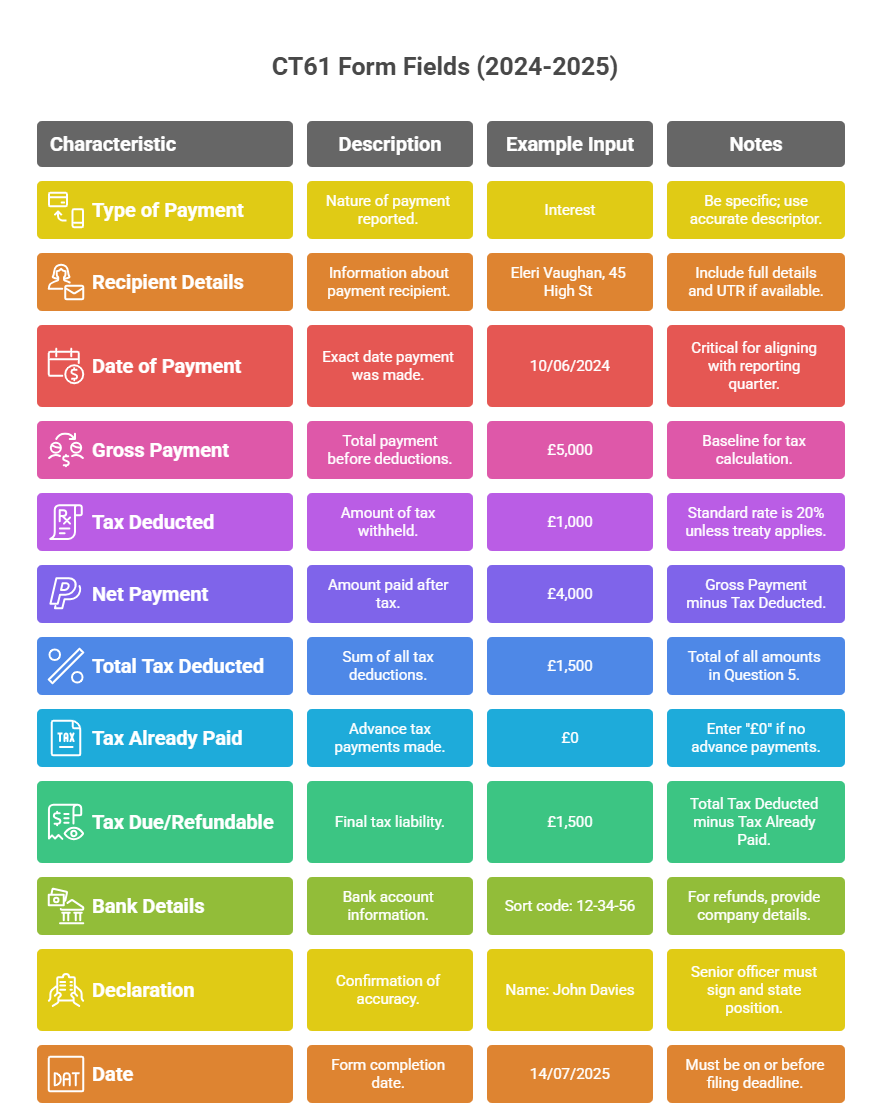

CT61 Form Fields for 2024-2025

Question | Field | Example Input | Notes |

1 | Type of Payment | Interest | Specify “interest,” “royalty,” etc. |

2 | Recipient’s Details | Eleri Vaughan, 45 High St, Cardiff, CF10 1AA | Include UTR or non-resident status. |

3 | Date of Payment | 10/06/2024 | Must align with quarter reported. |

4 | Gross Payment | £5,000 | Total before tax deduction. |

5 | Tax Deducted | £1,000 | 20% unless treaty applies. |

6 | Net Payment | £4,000 | Amount paid to recipient. |

7 | Total Tax Deducted | £1,500 | Sum of all deductions in quarter. |

8 | Tax Already Paid | £0 | Note any advance payments. |

9 | Tax Due/Refundable | £1,500 | Question 7 minus Question 8. |

10 | Bank Details | Sort code: 12-34-56, Account: 12345678 | For refunds; use HMRC’s account for payments. |

11 | Declaration | Name: John Davies, Position: Director | Confirm accuracy with signature. |

12 | Date | 14/07/2025 | Must meet submission deadline. |

Summary of Key CT61 Points

Purpose: HMRC Form CT61 reports and pays income tax deducted on payments like interest, royalties, and alternative finance payments, per Part 15, Chapter 15 of the Income Tax Act 2007.

Tax Rate and Deadlines: Deduct 20% tax from specified payments and remit to HMRC within 14 days of quarter-end (31 March, 30 June, 30 September, 31 December).

Penalties: Late filings incur £100 penalties (£200 for repeat offences), with interest at 3.25% above the 4.75% base rate for unpaid tax.

Form Access: Request CT61 from HMRC’s Shipley Accounts Office or online; LLPs submit a letter with UTR and payment details.

Exemptions: No withholding tax for UK-to-UK company payments; reduced rates may apply for non-residents under double taxation treaties.

Form Details: Include company UTR, recipient details, payment amounts, and tax deducted, reconciled with company accounts.

Director’s Loans: Interest is tax-deductible for the company but reported on the director’s personal tax return, subject to Personal Savings Allowance.

Non-Residents: Verify reduced tax rates via HMRC’s treaty passport scheme for international payments.

Compliance Tools: Use accounting software and loan registers to track payments and ensure timely filings.

Consequences: Late or incorrect filings risk penalties, interest, and HMRC audits, impacting cash flow and compliance.

FAQs

Q1: Who can request a CT61 form from HMRC?

A1: Companies, limited liability partnerships (LLPs), and certain other entities making payments like interest or royalties subject to income tax deduction can request a CT61 form from HMRC.

Q2: Is there a digital version of the CT61 form available online?

A2: No digital version is available for direct download; companies must request the CT61 form through HMRC’s online portal or by contacting the Shipley Accounts Office.

Q3: Can a company appeal a CT61 penalty?

A3: Yes, a company can appeal a CT61 penalty by contacting HMRC within 30 days, providing a reasonable excuse for late filing or payment.

Q4: What happens if a company overpays tax on a CT61?

A4: If a company overpays tax, HMRC will refund the excess, provided the company includes its bank details on the CT61 form for refund processing.

Q5: Are there exemptions from filing a CT61 for small businesses?

A5: Small businesses must file a CT61 if they make qualifying payments like interest or royalties, with no general exemptions based on size.

Q6: Can a CT61 form be submitted late without penalty?

A6: Late submissions typically incur a £100 penalty, but HMRC may waive it if the company has a reasonable excuse and files promptly after resolving the issue.

Q7: How does a company know if a payment qualifies for a double taxation treaty?

A7: A company can verify if a payment qualifies for a reduced tax rate under a double taxation treaty by checking the recipient’s status via HMRC’s Double Taxation Treaty Passport Scheme.

Q8: What is the process for correcting an error on a submitted CT61?

A8: To correct an error, a company must contact HMRC’s Shipley Accounts Office, provide the corrected details, and may need to submit an amended CT61 form.

Q9: Can a CT61 form be used for payments other than interest or royalties?

A9: Yes, the CT61 form can also cover alternative finance payments and certain manufactured payments from abroad, as specified by HMRC.

Q10: Does a company need to file a CT61 if it makes payments to another UK company?

A10: Payments to another UK company are generally exempt from income tax deduction, so a CT61 is not required in such cases.

Q11: How long does HMRC take to process a CT61 form?

A11: HMRC typically processes a CT61 form within 4-6 weeks, depending on whether it’s submitted online or by post.

Q12: Can a company use accounting software to generate a CT61 form?

A12: Accounting software can track payments and calculate tax for CT61 purposes, but the form itself must still be obtained from HMRC.

Q13: What are the consequences of not deducting tax from a qualifying payment?

A13: Failing to deduct tax from a qualifying payment can lead to HMRC penalties, interest on unpaid tax, and potential audits of the company’s tax records.

Q14: Can a non-resident company file a CT61?

A14: Non-resident companies with UK tax obligations may need to file a CT61 if they make qualifying payments subject to UK income tax deduction.

Q15: How does a company handle CT61 filings for multiple recipients?

A15: A company must list each recipient’s payment details separately on the CT61 form, ensuring accurate tax deductions for each.

Q16: Is there a limit to the number of CT61 forms a company can file in a year?

A16: There’s no limit; a company files as many CT61 forms as needed based on its payment schedule and accounting periods.

Q17: Can a company claim back tax paid via CT61 if the recipient is exempt?

A17: If the recipient is exempt (e.g., under a tax treaty), the company can request a refund from HMRC by providing evidence of the exemption.

Q18: What documentation should a company provide to HMRC with a CT61?

A18: No additional documentation is typically required with the CT61, but companies should keep loan agreements and payment records for audits.

Q19: Can a CT61 form be submitted electronically?

A19: Yes, companies registered with HMRC’s online Corporation Tax services can submit the CT61 form electronically via the portal.

Q20: How does a company confirm HMRC received its CT61 form?

A20: Companies can confirm receipt by checking their HMRC online account or contacting the Shipley Accounts Office for confirmation.

About The Author:

Adil Akhtar, ACMA, CGMA, CEO and Chief Accountant of Pro Tax Accountant, is an esteemed tax blog writer with over 10 years of expertise in navigating complex tax matters. For more than three years, his insightful blogs have empowered UK taxpayers with clear, actionable advice. Leading Advantax Accountants as well, Adil blends technical prowess with a passion for demystifying finance, cementing his reputation as a trusted authority in tax education.

Email: adilacma@icloud.com

Disclaimer:

The information provided in our articles is for general informational purposes only and is not intended as professional advice. While we strive to keep the information up-to-date and correct, Pro Tax Accountant makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained in the articles for any purpose. Any reliance you place on such information is therefore strictly at your own risk. Some of the data in the above graphs may to give 100% accurate data.

We encourage all readers to consult with a qualified professional before making any decisions based on the information provided. The tax and accounting rules in the UK are subject to change and can vary depending on individual circumstances. Therefore, Pro Tax Accountant cannot be held liable for any errors, omissions, or inaccuracies published. The firm is not responsible for any losses, injuries, or damages arising from the display or use of this information.

.png)