Can You Be Employed and Self-Employed?

- Adil Akhtar

- Jul 15, 2025

- 15 min read

The Audio Summary of the Key Points of the Article:

Can You Be Employed and Self-Employed? Unpacking the Tax Basics

Yes, you can absolutely be employed and self-employed at the same time in the UK for tax purposes, and it’s more common than you might think. Whether you’re a full-time office worker running a side hustle or a freelancer juggling a part-time job, HMRC allows this dual status, but it comes with specific tax rules you need to nail down. In this part, we’ll break down what it means to wear both hats, how your income is taxed, and what you need to know about the 2025/26 tax year to stay on top of things.

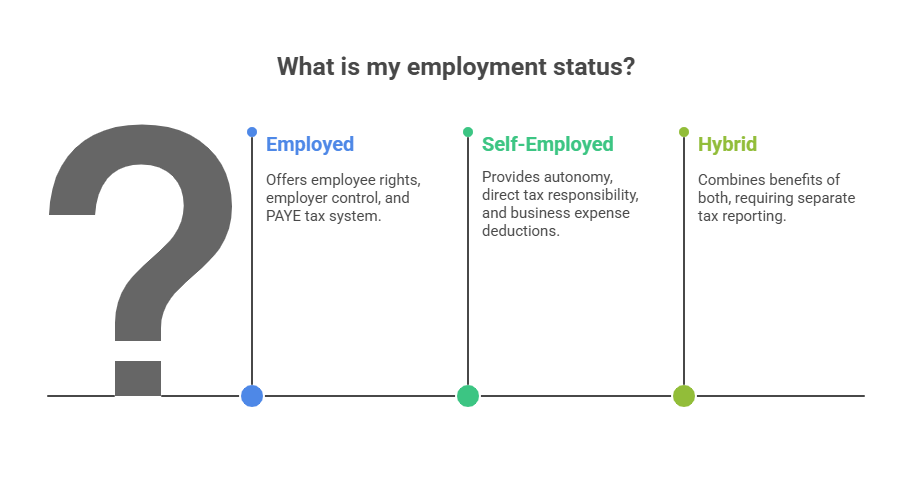

What Does It Mean to Be Employed and Self-Employed?

Let’s get the basics sorted. If you’re employed, you work for an employer who deducts Income Tax and National Insurance (NI) through the Pay As You Earn (PAYE) system before you get your payslip. Self-employment, on the other hand, means you’re your own boss—think freelancers, sole traders, or contractors running a business. You can be both if, say, you work a 9-to-5 job and run an Etsy shop on the side. HMRC treats these income streams separately for tax purposes, but they come together when calculating your overall tax liability.

Now, it’s not always straightforward. HMRC uses specific criteria to determine your status for tax purposes, which might differ from employment law (e.g., rights to sick pay). For example, you’re likely self-employed if you control your work hours, bear the financial risk, and provide your own equipment. Check HMRC’s Check Employment Status for Tax (CEST) tool to confirm your status. Misclassification—known as “false self-employment”—can lead to penalties, so it’s worth double-checking.

How Is Your Income Taxed in 2025/26?

Now, let’s talk numbers. Your employed income is taxed via PAYE, while self-employed income is handled through Self-Assessment. All your income counts towards your Personal Allowance and tax bands, so you need to understand how they combine. For the 2025/26 tax year, the Personal Allowance is £12,570, meaning you pay no Income Tax on earnings up to this amount. Above that, tax rates kick in as follows:

Income Band | Taxable Income (2025/26) | Tax Rate | NI Class 1 (Employed) | NI Class 4 (Self-Employed) |

Personal Allowance | £0 - £12,570 | 0% | 0% | 0% |

Basic Rate | £12,571 - £50,270 | 20% | 8% | 6% |

Higher Rate | £50,271 - £125,140 | 40% | 2% | 2% |

Additional Rate | Over £125,140 | 45% | 2% | 2% |

Here’s the kicker: your Personal Allowance is applied to your highest-earning job (usually employment), but all income is aggregated for tax purposes. If your total income exceeds £100,000, the Personal Allowance tapers by £1 for every £2 above, disappearing entirely at £125,140.

National Insurance: A Double Whammy?

Be careful! National Insurance is where things get tricky. As an employee, you pay Class 1 NI on earnings above £12,570 (8% up to £50,270, 2% above). As a self-employed person, you pay Class 4 NI on profits above £12,570 (6% up to £50,270, 2% above). Unlike Income Tax, NI is calculated separately for each income source, which can feel like you’re paying twice. However, there’s a cap on total NI contributions to prevent overpayment—HMRC sorts this out via Self-Assessment, but you might need to claim a refund if overpaid.

Case Study: Priya’s Dual Income Journey

Let’s paint a picture. Priya, a secondary school teacher in Manchester, earns £30,000 annually through PAYE. She also runs a weekend baking business, netting £10,000 in profits after expenses. Her total income is £40,000, all within the basic rate band. Her employer deducts Income Tax (£3,486) and Class 1 NI (£1,938) from her salary. For her baking business, she files a Self-Assessment return, paying 20% Income Tax (£2,000) and 6% Class 4 NI (£600) on her £10,000 profit. Her total tax bill is £5,486 in Income Tax and £2,538 in NI, but she only uses one Personal Allowance. Priya’s story shows how both incomes are taxed separately but combined for your overall liability.

How Does This Affect Your Tax Return?

None of us is a tax expert, but here’s a common question: how does being employed and self-employed affect your tax return? If you’re self-employed and earn over £1,000, you must file a Self-Assessment tax return, even if your employed income is taxed via PAYE. In your return, you declare both your PAYE income (and tax already paid) and your self-employed profits. HMRC then calculates your total tax liability, offsetting any PAYE deductions. If your self-employed income is below £1,000, you might claim the trading allowance, exempting it from tax, but you’ll still need to report it if you’re in Self-Assessment for other reasons.

Why It Matters for 2025/26

Now, consider this: the 2024/25 tax year is a transitional year due to Basis Period Reform, aligning self-employed accounting periods with the tax year (6 April to 5 April). If your business accounts don’t already end in this period, you’ll need to apportion profits, which could complicate your 2025/26 return. For example, if your accounting year ends on 31 December, you’ll need to split profits across tax years, potentially increasing your tax bill temporarily. HMRC allows spreading extra tax over five years to ease the burden, but it’s something to plan for.

Managing Taxes and Avoiding Pitfalls as a Dual-Status Taxpayer

Now that you know it’s perfectly fine to be employed and self-employed at the same time in the UK, let’s get into the nitty-gritty of making it work without tripping over tax rules. Managing taxes across two income streams can feel like juggling flaming torches, but with the right know-how, you can keep everything in check. This part dives into practical steps for registering with HMRC, handling Self-Assessment, and dodging common traps like overtaxing or IR35 complications, all tailored for the 2025/26 tax year.

How Do You Register as Self-Employed?

Let’s start with the basics. If you’re kicking off a side hustle while employed, you need to tell HMRC about your self-employment. You must register as a sole trader if your self-employed income exceeds £1,000 in a tax year (6 April to 5 April). Don’t worry, it’s straightforward, and HMRC’s online process is user-friendly. Here’s a step-by-step guide to get you started:

Step-by-Step Guide: Registering as Self-Employed

Visit GOV.UK: Head to the HMRC registration page and sign in with your Government Gateway account (or create one).

Provide Details: Enter your personal details, business name (if any), and the nature of your work (e.g., “freelance graphic designer”).

Set an Accounting Period: Choose when your business year ends—most pick 5 April to align with the tax year, especially post-Basis Period Reform.

Submit by 5 October: Register by 5 October after the tax year you started trading (e.g., 5 October 2025 for 2024/25). Late registration can mean a £100 penalty.

Get Your UTR: You’ll receive a Unique Taxpayer Reference (UTR) number for Self-Assessment.

So, the question is: what if you’re already employed? Your PAYE job doesn’t change this process—your employer won’t be notified, and it’s all handled separately through Self-Assessment.

How Does Self-Assessment Work for Dual Incomes?

None of us love paperwork, but Self-Assessment is non-negotiable if you’re self-employed. Unlike PAYE, where your employer handles tax deductions, self-employment means you’re responsible for reporting your profits and paying tax yourself. Here’s how it works when you’re also employed:

Aspect | PAYE (Employed) | Self-Assessment (Self-Employed) |

Tax Deduction | Automatic via employer | Self-reported annually |

Filing Deadline | None (handled by employer) | 31 January (online) for previous tax year |

Income Reported | Salary (P60/P45) | Profits (revenue minus expenses) |

NI Contributions | Class 1 (8%/2%) | Class 2 (£3.45/week) & Class 4 (6%/2%) |

Payment | Monthly via payroll | 31 January (and 31 July for payments on account) |

Source: GOV.UK Self-Assessment guidance

Here’s the deal: you report your PAYE income (from your P60) and self-employed profits on the same Self-Assessment return. HMRC combines these to calculate your total tax liability, subtracting PAYE tax already paid. If your PAYE job uses up your Personal Allowance (£12,570 in 2025/26), your self-employed profits are taxed at your marginal rate (e.g., 20% if your total income is under £50,270).

Can You Use the Trading Allowance?

Now, consider this: if your self-employed income is low, the trading allowance could save you a headache. You can earn up to £1,000 in self-employed income tax-free without registering or filing a Self-Assessment return. If you earn more, you can deduct the £1,000 instead of actual expenses, but only if it’s more beneficial. For example, if Rhys, a part-time employee, earns £1,500 from freelance tutoring and has £200 in expenses, he could claim the trading allowance (£1,000), leaving £500 taxable, or claim £200 in expenses, leaving £1,300 taxable. The allowance is usually better for low-expense businesses.

How Do You Avoid Overtaxing?

Be careful! Overtaxing is a common issue for dual-status taxpayers. If your PAYE tax code assumes your job is your only income, it might not account for self-employed earnings, leading to underpayment of tax. When you file your Self-Assessment, you’ll owe the difference, which can sting. To fix this:

Request a Tax Code Adjustment: Contact HMRC to adjust your PAYE tax code to account for self-employed income.

Set Aside Money: Estimate your self-employed tax (e.g., 20% of profits plus 6% Class 4 NI) and save it monthly.

Check NI Caps: If your combined NI contributions exceed the annual maximum (based on Class 1 rates), apply for a refund via Form CA5610.

What About IR35 Complications?

Now, it shouldn’t be a surprise that IR35 can throw a spanner in the works. If you’re self-employed but work for a client in a way that resembles employment (e.g., fixed hours, no financial risk), HMRC might classify you as a “disguised employee” under IR35 rules. This means you pay PAYE tax and NI as if employed, which can increase your tax bill. Since April 2021, medium and large private-sector clients determine your IR35 status, not you. If you’re deemed inside IR35, they’ll deduct tax and NI before paying you.

Case Study: Jamal’s IR35 Challenge

Jamal, an IT contractor in Leeds, earns £40,000 annually through PAYE and £20,000 from a freelance contract. His client deems him inside IR35, so they deduct PAYE tax and NI, treating his £20,000 as employment income. This pushes his total income into the higher rate band (£60,000), costing him 40% tax on part of his freelance income instead of 20%. To avoid this, Jamal could negotiate more control over his work to stay outside IR35, but he’d need to pass HMRC’s CEST test.

How Does Basis Period Reform Affect You?

So, the question is: how does the 2024/25 Basis Period Reform impact dual-status taxpayers? Previously, self-employed profits were taxed based on your accounting period, which might not align with the tax year. From 2024/25, profits must align with the tax year (6 April to 5 April). If your accounting period ends on, say, 30 June, you’ll need to apportion profits, which could increase your tax bill in the transitional year. For example, if you earned 15 months of profits in 2024/25, you might pay tax on all of it, but HMRC allows spreading the extra tax over five years. Keep detailed records to make this easier.

Can You Claim Expenses for Both Roles?

Let’s clear this up: you can claim expenses for self-employment, but not for employment. Allowable self-employed expenses (e.g., equipment, travel, home office costs) reduce your taxable profits, but they must be “wholly and exclusively” for business use. For example, if you use your car 50% for business, claim 50% of running costs. Keep receipts and use tools like HMRC’s record-keeping guidance to stay compliant.

Key Takeaways and Edge Cases for UK Taxpayers with Dual Employment Status

Now, let’s wrap things up with the most critical points you need to keep in your back pocket as a UK taxpayer juggling employment and self-employment. This section pulls together the essentials in a clear, no-nonsense way, while also diving into some less common scenarios—like how Universal Credit or losses from your side hustle might shake things up. Whether you’re a seasoned freelancer or just dipping your toes into a side gig, these insights will help you stay compliant and make the most of your tax situation in the 2025/26 tax year.

What Are the Top 10 Things to Remember?

Here’s the deal: managing dual employment status is all about staying organised and proactive. Below are the 10 most important points to keep in mind, each boiled down to a single sentence for clarity.

You can legally be employed and self-employed simultaneously in the UK, with HMRC treating each income stream separately for tax purposes.

Your Personal Allowance (£12,570 in 2025/26) applies once across all income, typically allocated to your PAYE job first.

Self-employed income over £1,000 requires registration with HMRC and filing a Self-Assessment tax return by 31 January annually.

National Insurance contributions (Class 1 for employment, Class 4 for self-employment) are calculated separately but capped to avoid overpayment.

The trading allowance lets you earn up to £1,000 tax-free from self-employment without needing to register, if it’s your only self-employed income.

Basis Period Reform aligns self-employed profits with the tax year (6 April to 5 April) from 2024/25, potentially increasing your tax bill in the transitional year.

IR35 rules may classify you as a “disguised employee” for certain contracts, leading to PAYE tax and NI deductions on self-employed income.

Allowable expenses for self-employment (e.g., equipment, travel) can reduce your taxable profits, but they must be wholly and exclusively for business.

Overtaxing can occur if your PAYE tax code doesn’t account for self-employed income, so adjust it with HMRC to avoid a surprise tax bill.

Keep detailed records and set aside money monthly for self-employed taxes to stay compliant and avoid penalties.

Navigating Dual Employment in the UK

How Does Universal Credit Affect Dual-Status Taxpayers?

Let’s talk about something not everyone considers: Universal Credit (UC). If you’re on a low income and claiming UC, being employed and self-employed can complicate things. UC treats self-employed income differently from employment income. For your PAYE job, your earnings are reported automatically via Real Time Information (RTI). For self-employment, you report your profits monthly to the Department for Work and Pensions (DWP), after deducting expenses, tax, and NI. The catch? HMRC and DWP don’t always sync up, so you might face adjustments in your UC payments if your self-employed profits fluctuate.

For example, Aled, a part-time retail worker in Cardiff, earns £15,000 annually and makes £5,000 from freelance photography. His UC payment is reduced based on his total income, but his photography profits vary monthly, causing UC overpayments he must repay. To avoid this, Aled reports consistent monthly estimates to DWP and reconciles them annually via Self-Assessment.

What Happens If Your Side Hustle Makes a Loss?

Now, consider this: what if your side hustle isn’t exactly raking in the cash? If your self-employed business makes a loss, you can offset it against other income (like your PAYE salary) in the same tax year, reducing your overall tax bill. For example, if Sian, a nurse earning £28,000, incurs a £3,000 loss on her Etsy shop, she can deduct that loss, lowering her taxable income to £25,000. You must notify HMRC of the loss via your Self-Assessment return, and you can carry losses forward to offset future profits if you prefer. Check HMRC’s guidance on losses for details.

How Do You Handle False Self-Employment Risks?

Be careful! False self-employment—where you’re treated as self-employed but act like an employee—can land you in hot water. HMRC’s crackdown on this ensures you’re not avoiding PAYE tax or NI. For instance, if you’re a freelancer working exclusively for one client with no control over your hours, HMRC might reclassify you as an employee, requiring your client to deduct PAYE. To mitigate this, use HMRC’s CEST tool and ensure your contracts reflect true self-employment (e.g., you provide your own tools, take financial risks). A 2024 case saw a contractor in Bristol face a £10,000 tax bill after HMRC ruled their “self-employed” contract was inside IR35.

What’s a Quick Checklist for Staying Compliant?

So, the question is: how do you keep everything on track? Here’s a handy table to ensure you’re covering all bases as a dual-status taxpayer in 2025/26:

Source: Compiled from GOV.UK resources, verified as of July 2025

Can You Optimise Your Tax Position?

Let’s wrap with a practical tip: optimising your taxes. Beyond claiming expenses, consider timing your self-employed income to stay within the basic rate band (£50,270 in 2025/26). If you’re close to the higher rate, defer invoicing to the next tax year or spread profits via Basis Period Reform’s transitional relief. Also, explore pension contributions—they reduce your taxable income and boost your retirement savings. For example, contributing £2,000 to a pension could save £400 in tax if you’re a basic rate taxpayer.

FAQs

Q1: Can you claim tax relief on pension contributions as a dual-status taxpayer in the UK?

A1: Yes, pension contributions can be claimed as tax relief, reducing taxable income from both employment and self-employment, up to the annual allowance of £60,000 or total earnings, whichever is lower.

Q2: What happens if you miss the Self-Assessment registration deadline?

A2: Missing the 5 October deadline for registering as self-employed can result in a £100 penalty, plus additional fines if the delay causes late tax payments.

Q3: Can you be employed and self-employed for the same employer?

A3: Yes, but the self-employed work must meet HMRC’s criteria for self-employment, such as having control over tasks, to avoid being classified as an employee for tax purposes.

Q4: How does being employed and self-employed affect your tax-free allowance for savings interest?

A4: The Personal Savings Allowance (£1,000 for basic rate taxpayers, £500 for higher rate) is based on total income from both employment and self-employment, potentially reducing the allowance if combined income pushes you into a higher tax band.

Q5: Can you claim tax relief on home office expenses as a self-employed person while employed?

A5: Self-employed individuals can claim home office expenses like utilities and internet if used for business, but these must be apportioned based on business use, while employed income offers no such deductions.

Q6: What is the impact of dual status on student loan repayments?

A6: Student loan repayments are calculated on total income from employment (via PAYE) and self-employment (via Self-Assessment), with thresholds applying based on the loan plan type.

Q7: Can you claim tax relief for business travel expenses in self-employment?

A7: Yes, self-employed individuals can claim travel expenses like mileage or public transport costs if they are wholly and exclusively for business purposes.

Q8: How does dual employment status affect maternity or paternity pay?

A8: Statutory maternity or paternity pay is only available from employment, not self-employment, but self-employed income may affect means-tested benefits related to maternity.

Q9: Can you use simplified expenses for self-employment while employed?

A9: Yes, self-employed individuals can use simplified expenses (e.g., flat rates for vehicle or home office costs) to reduce taxable profits, regardless of employment status.

Q10: What happens if you stop being self-employed but continue employment?

A10: You must inform HMRC to deregister from self-employment, file a final Self-Assessment return, and adjust your PAYE tax code if necessary to reflect only employment income.

Q11: Can you claim tax relief for professional subscriptions as a dual-status taxpayer?

A11: Self-employed individuals can claim tax relief for subscriptions to professional bodies if relevant to their business, but employment-related subscriptions are only deductible if paid personally and required by the job.

Q12: How does dual status affect eligibility for tax credits?

A12: Tax credits consider total income from both employment and self-employment, potentially reducing eligibility if combined income exceeds the threshold for Working Tax Credit or Child Tax Credit.

Q13: Can you use cash basis accounting as a self-employed person while employed?

A13: Yes, if your self-employed business turnover is under £150,000, you can use cash basis accounting to simplify tax calculations, regardless of employment status.

Q14: What are the penalties for late Self-Assessment tax payments?

A14: Late tax payments incur a 5% penalty after 30 days, plus additional 5% penalties at 6 and 12 months, alongside daily interest on the overdue amount.

Q15: Can you claim capital allowances for equipment in self-employment?

A15: Yes, self-employed individuals can claim capital allowances for equipment like computers or tools, reducing taxable profits, but no such allowances apply to employment income.

Q16: How does dual status affect VAT registration requirements?

A16: If self-employed turnover exceeds the VAT threshold (£90,000), you must register for VAT, but employment income does not count towards this threshold.

Q17: Can you claim tax relief for training costs as a self-employed person?

A17: Training costs are deductible for self-employment if they maintain or update existing skills for your business, but not for new qualifications unrelated to current work.

Q18: How does being employed and self-employed impact your annual tax summary?

A18: The annual tax summary from HMRC will show combined tax paid from PAYE and Self-Assessment, reflecting total income and deductions from both sources.

Q19: Can you carry back self-employed losses to offset past employment income?

A19: Self-employed losses can be carried back up to four years to offset against other income, including past employment income, if claimed within the allowable timeframe.

Q20: What happens if HMRC investigates your self-employment status?

A20: If HMRC suspects false self-employment, they may reclassify you as an employee, requiring backdated PAYE tax and NI payments, plus potential penalties for non-compliance.

About The Author:

Adil Akhtar, ACMA, CGMA, CEO and Chief Accountant of Pro Tax Accountant, is an esteemed tax blog writer with over 10 years of expertise in navigating complex tax matters. For more than three years, his insightful blogs have empowered UK taxpayers with clear, actionable advice. Leading Advantax Accountants as well, Adil blends technical prowess with a passion for demystifying finance, cementing his reputation as a trusted authority in tax education.

Email: adilacma@icloud.com

Disclaimer:

The information provided in our articles is for general informational purposes only and is not intended as professional advice. While we strive to keep the information up-to-date and correct, Pro Tax Accountant makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained in the articles for any purpose. Any reliance you place on such information is therefore strictly at your own risk. Some of the data in the above graphs may to give 100% accurate data.

We encourage all readers to consult with a qualified professional before making any decisions based on the information provided. The tax and accounting rules in the UK are subject to change and can vary depending on individual circumstances. Therefore, Pro Tax Accountant cannot be held liable for any errors, omissions, or inaccuracies published. The firm is not responsible for any losses, injuries, or damages arising from the display or use of this information.

.png)