How to Calculate UK Capital Gains Tax on Overseas Property!

- Adil Akhtar

- Jun 16, 2023

- 28 min read

Updated: Aug 24, 2025

Understanding the Basics of UK Capital Gains Tax on Overseas Property

Picture this: You’ve just sold a charming villa in Spain, pocketing a tidy profit, but now you’re wondering what HMRC wants from your windfall. Calculating UK Capital Gains Tax (CGT) on overseas property can feel like navigating a maze, but don’t worry—it’s simpler than it sounds once you break it down. As a chartered accountant with over 18 years helping UK taxpayers, I’ve seen countless clients tackle this, and I’m here to guide you through every step with practical, actionable advice. In this first part, we’ll cover the essentials—why CGT applies to overseas property, who pays it, and how to start calculating your liability for the 2025/26 tax year, with up-to-date rates and allowances.

What Is Capital Gains Tax, and Why Does It Apply to Overseas Property?

Capital Gains Tax is a levy on the profit you make when you sell—or “dispose of”—an asset that’s increased in value. For UK residents, this includes overseas property, whether it’s a holiday home in France, a rental flat in Dubai, or inherited land in Portugal. The tax isn’t on the sale price but on the gain—the difference between what you paid and what you sold it for, minus allowable costs. If you’re a UK resident, HMRC expects you to report gains on worldwide assets, including those abroad, as confirmed by HMRC’s guidance. Non-residents, however, only face CGT on UK property sales, with different rules we’ll touch on later.

Why does this matter? In my years advising clients in London, I’ve seen many caught off guard by CGT on overseas properties, especially when they assume foreign assets are outside HMRC’s reach. They’re not. For the 2025/26 tax year, the Annual Exempt Amount (AEA) is £3,000 for individuals (£1,500 for trusts), meaning you only pay CGT on gains above this threshold. But with the AEA slashed from £6,000 in 2023/24, more taxpayers are now liable, especially with rising property values abroad.

Who Needs to Pay CGT on Overseas Property?

Let’s get this straight: if you’re a UK resident for tax purposes, you’re liable for CGT on any overseas property sale, regardless of where the property sits. Residency is determined by the Statutory Residence Test, which looks at factors like days spent in the UK and ties (family, work, or home). Non-residents may face CGT if they sell UK property or return to the UK within five years of leaving, per HMRC rules. Business owners, landlords, and individuals with multiple income sources—like rental income or self-employment—need to be extra vigilant, as these can push you into higher tax bands.

Here’s a quick rundown of who’s affected:

● Individuals: UK residents selling holiday homes, rentals, or inherited properties abroad.

● Business owners: Those with overseas commercial properties or assets tied to their business.

● Non-residents: Only liable for UK property sales, but temporary non-residence rules may apply.

● Couples: Each spouse gets their own AEA (£3,000), so joint ownership can double your tax-free allowance to £6,000.

Be careful here, because I’ve seen clients trip up when they assume their non-domiciled status exempts them. If you’re non-domiciled and claim the remittance basis, you lose the AEA, and gains are taxed only when brought into the UK—a nuance worth checking with a tax advisor.

Current CGT Rates and Allowances for 2025/26

So, the big question on your mind might be: how much tax will you owe? For the 2025/26 tax year, CGT rates on overseas property depend on your income tax band, as your gains are added to your taxable income. Here’s a clear table to show the rates, updated per HMRC’s latest announcements:

Taxpayer Type | CGT Rate (Residential Property) | CGT Rate (Other Assets) |

Basic Rate (Income up to £50,270) | 18% | 10% |

Higher/Additional Rate (Above £50,270) | 24% | 20% |

Trustees/Personal Representatives | 24% | 20% |

Source: HMRC Capital Gains Tax rates

The personal allowance remains frozen at £12,570 for 2025/26, meaning your taxable income (including gains) starts here. If your total income and gains exceed £50,270, you’ll pay the higher rate of 24% on residential property gains. For example, if you earn £40,000 from employment and have a £15,000 property gain, part of your gain falls into the higher rate band, so you’d pay 18% on the portion up to £50,270 and 24% on the rest.

The National Insurance thresholds don’t directly affect CGT, but if you’re self-employed or have multiple income sources, they impact your overall tax picture. For 2025/26, the Class 4 NI threshold for self-employed individuals is £9,881, with rates at 9% up to £50,270 and 2% above. This matters because high income can push you into the 24% CGT bracket faster than you might expect.

Step-by-Step: Calculating Your CGT Liability

None of us loves tax surprises, but here’s how to avoid them with a clear process to calculate your CGT on overseas property. Follow these steps to get a grip on your liability:

Determine the Gain: Subtract the purchase price (plus acquisition costs like legal fees or stamp duty) from the sale price. For example, if you bought a property for £200,000 and sold it for £300,000, your basic gain is £100,000.

Deduct Allowable Costs: Include costs like estate agent fees, legal fees, and capital improvements (e.g., a new roof, not redecorating). Say these total £10,000—your adjusted gain is £90,000.

Apply Currency Conversion: If the property was bought or sold in a foreign currency, convert amounts to GBP using HMRC’s published exchange rates for the relevant tax year. Currency fluctuations can inflate or reduce your gain, so double-check rates.

Subtract the Annual Exempt Amount: Deduct your £3,000 AEA (or £6,000 for couples). If your adjusted gain is £90,000, this leaves £87,000 taxable.

Determine Your Tax Rate: Check your total taxable income (salary, dividends, etc.). If it’s below £50,270, you’ll pay 18% on the gain; above, it’s 24%. For £87,000, a higher-rate taxpayer owes £20,880 (£87,000 × 24%).

Here’s a table illustrating a hypothetical case for clarity:

Item | Amount (£) |

Sale Price | 300,000 |

Purchase Price | 200,000 |

Allowable Costs | 10,000 |

Basic Gain | 100,000 |

Adjusted Gain (after costs) | 90,000 |

Annual Exempt Amount | 3,000 |

Taxable Gain | 87,000 |

CGT Rate (Higher, 24%) | 20,880 |

Common Pitfalls to Watch For

I’ve had clients in similar boats who missed key deductions or miscalculated gains due to currency errors. Here are traps to avoid:

● Forgetting Currency Conversion: Use HMRC’s official exchange rates, not random online converters, to avoid HMRC disputes.

● Ignoring Double Taxation Agreements (DTAs): If you’ve paid tax abroad, check if a DTA with the UK allows you to offset it against your UK CGT liability. The UK has DTAs with over 100 countries, per HMRC.

● Missing the AEA: Don’t assume it’s automatic—non-domiciled residents on the remittance basis lose it.

● Underreporting Income: If you have rental income or self-employment earnings, these push your tax band up, increasing your CGT rate.

Why This Matters for You

Whether you’re a business owner with an overseas rental portfolio or an individual selling a holiday home, getting CGT right saves you from penalties and maximises your profit. In my practice, I’ve seen clients overpay by thousands because they didn’t claim allowable costs or misunderstood their tax band. By grasping these basics, you’re ready to dive deeper into specific scenarios and reliefs in the next part, ensuring you’re not leaving money on the table.

UK Capital Gains Tax Calculator

Advanced Calculations and Reliefs for Overseas Property CGT

So, you’ve got the basics of UK Capital Gains Tax (CGT) on overseas property under your belt—nice work! Now, let’s dig deeper into the nitty-gritty: advanced calculations, reliefs that could slash your tax bill, and how to handle tricky scenarios like multiple properties, business assets, or Scottish tax variations. As a chartered accountant with 18 years of experience advising UK taxpayers, I’ve seen clients save thousands by mastering these details. This part will arm you with practical tools, real-world examples, and a custom checklist to ensure you’re not overpaying HMRC in the 2025/26 tax year.

How Do You Handle Multiple Overseas Properties?

Picture this: You own a holiday home in Italy and a rental flat in Australia, and you’re selling both. Each property has its own gain, but you only get one Annual Exempt Amount (AEA) of £3,000 to offset across all disposals in the tax year. This catches many clients out. Here’s how to tackle it:

Calculate Gains Separately: Work out the gain for each property (sale price minus purchase price and allowable costs, as covered in Part 1). For example, your Italian villa yields a £50,000 gain, and the Australian flat £30,000.

Pool the Gains: Add them together (£80,000 total). Subtract your AEA (£3,000), leaving £77,000 taxable.

Apply the Tax Rate: If your income (say, £45,000 from self-employment) plus gains pushes you over £50,270, you’ll pay 24% on the portion in the higher-rate band. If you’re a basic-rate taxpayer, it’s 18%.

Here’s a case study to bring it to life: Take Sarah from Manchester, a freelancer who sold two overseas properties in 2024/25. Her Italian cottage had a £40,000 gain, and her Spanish flat £25,000. With a £35,000 income, her total taxable income (£60,000 after AEA) tipped her into the higher-rate band, costing her £13,680 in CGT (£57,000 × 24% for the higher-rate portion). By spreading sales over two tax years, she could’ve used two AEAs (£6,000 total), saving £720. Timing matters!

What Reliefs Can Reduce Your CGT Bill?

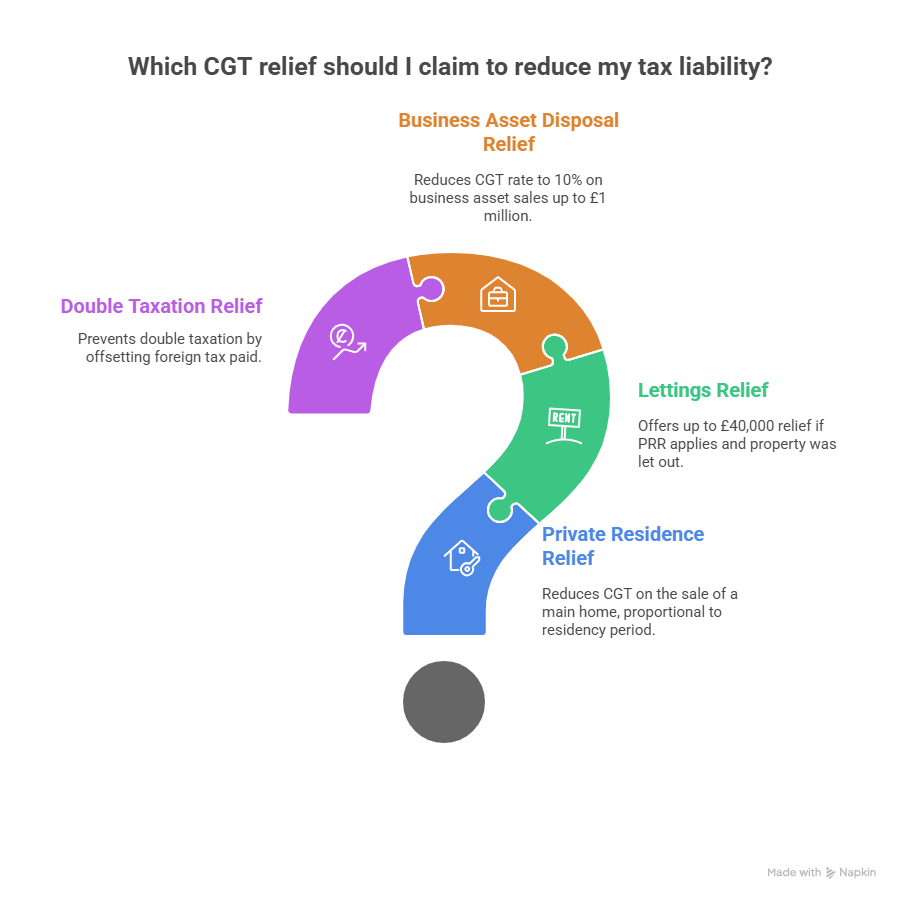

None of us loves paying more tax than necessary, so let’s explore reliefs that could lower your liability. HMRC offers several, but they’re not always obvious:

● Private Residence Relief (PRR): If the overseas property was your main home for part of your ownership period, you might qualify for partial PRR. For example, if you lived in your French villa for 5 out of 10 years owned, 50% of the gain could be exempt. However, PRR only applies if you’ve elected the property as your main residence with HMRC—many forget this step.

● Lettings Relief: If you let out a property that was once your main home, you could claim up to £40,000 relief, but only if PRR applies. For 2025/26, this is capped at the PRR amount or the gain from letting, whichever is lowest.

● Business Asset Disposal Relief: If you’re a business owner selling an overseas property used in your trade (e.g., a shop in Spain tied to your UK business), this relief cuts the CGT rate to 10% on up to £1 million in lifetime gains. I’ve seen clients miss this because they didn’t realise their property qualified as a business asset.

● Double Taxation Relief: If you’ve paid capital gains tax abroad, a Double Taxation Agreement (DTA) may allow you to offset it against your UK CGT. For instance, if you paid €10,000 tax in Spain, you could reduce your UK liability by the equivalent GBP, per HMRC’s DTA guidance.

Be careful here, because I’ve seen clients trip up when assuming reliefs apply automatically. You must claim them in your Self Assessment or real-time CGT return, due within 60 days of disposal for residential properties, per [HMRC’s rules](https://www.gov.uk/report)

Scottish and Welsh Variations: Do They Affect CGT?

If you’re based in Scotland or Wales, you might be wondering how devolved tax powers affect your CGT. Good news: CGT is a UK-wide tax, so rates and rules are consistent across England, Scotland, Wales, and Northern Ireland. However, Scottish Income Tax and Welsh Rates of Income Tax impact your overall tax band, which determines your CGT rate (18% or 24% for residential property). For 2025/26:

● Scotland: The starter rate (19%) applies up to £2,306, basic rate (20%) to £13,991, intermediate rate (21%) to £31,092, higher rate (42%) to £62,430, advanced rate (45%) to £125,140, and top rate (48%) above. If your income plus gains exceeds £31,092, you’re likely paying 24% CGT.

● Wales: Rates mirror England’s (20% basic, 40% higher, 45% additional), but devolved powers could shift this in future budgets.

This matters because high earners in Scotland face steeper income tax, pushing them into the 24% CGT bracket faster. For example, a Scottish taxpayer with £50,000 income and a £20,000 gain pays 24% on most of the gain, while an English taxpayer with the same figures might pay a mix of 18% and 24%.

Handling Complex Scenarios: Multiple Incomes and Business Owners

Now, let’s think about your situation—if you’re self-employed or juggling multiple incomes, CGT calculations get trickier. Here’s how to stay on top:

● Self-Employed Taxpayers: Your self-employment income (after Class 4 NI and expenses) counts toward your tax band. If you’re a consultant earning £60,000 and sell a property with a £30,000 gain, you’re deep in the higher-rate band, owing £6,960 (£29,000 taxable gain × 24%). Claim all allowable business expenses to lower your income, reducing your CGT rate.

● Multiple Income Sources: Employees with side hustles (e.g., Airbnb rentals or eBay sales) often miss unreported income, inflating their CGT liability. Use HMRC’s personal tax account to check your total income across PAYE, self-employment, or dividends.

● Business Owners: If your overseas property is a business asset, deduct related expenses (e.g., maintenance costs tied to trade use) and explore Business Asset Disposal Relief. For example, a client of mine, a restaurateur, sold a Spanish warehouse used for his UK import business, saving £14,000 by claiming the 10% rate.

Practical Worksheet for Complex Calculations

To keep things manageable, here’s a tailored worksheet for readers with multiple properties or incomes. Fill it out to track your liability:

Overseas Property CGT Worksheet (Complex Cases)

Property 1 Details:

○ Sale Price (£): [Enter]

○ Purchase Price + Costs (£): [Enter]

○ Gain (£): [Sale - Purchase - Costs]

Property 2 Details: [Repeat as above]

Total Gains: [Add all gains]

Annual Exempt Amount: [Enter £3,000 or £6,000 for couples]

Taxable Gain: [Total Gains - AEA]

Income Details:

○ Employment/Self-Employment (£): [Enter]

○ Other Income (e.g., dividends, rent) (£): [Enter]

○ Total Income (£): [Add above]

Tax Band: [Check if basic (18%) or higher (24%)]

Reliefs Claimed: [List PRR, Lettings, or Business Asset Disposal Relief]

CGT Due (£): [Taxable Gain × Rate, minus any DTA credits]

Tip: Save this as a spreadsheet to update annually, especially if you’re selling multiple assets.

Avoiding Common Errors

I’ve had clients in similar boats who faced penalties for simple mistakes. Watch out for:

● Missing the 60-Day Reporting Deadline: Residential property sales must be reported via HMRC’s real-time CGT service within 60 days, or you face fines starting at £100.

● Overlooking Reliefs: Failing to claim PRR or Business Asset Disposal Relief can cost thousands. Document your property’s use (e.g., as a main home or business asset) with evidence like utility bills or leases.

● Currency Missteps: Use HMRC’s monthly exchange rates for the sale and purchase dates, not averages, to avoid disputes.

By mastering these advanced steps, you’re well-equipped to minimise your CGT liability and handle complex scenarios with confidence. Next, we’ll explore reporting, refunds, and optimising your tax strategy for business owners and high earners.

Reporting, Refunds, and Optimising Your CGT Strategy

Be honest—none of us loves the paperwork that comes with taxes, but getting it right when reporting UK Capital Gains Tax (CGT) on overseas property can save you from headaches and hefty fines. As a chartered accountant with 18 years guiding UK taxpayers, I’ve seen clients transform their tax outcomes by mastering reporting and spotting refund opportunities. In this final part, we’ll walk through how to report your gains, claim refunds for overpayments, optimise your tax strategy as a business owner or high earner, and wrap up with key takeaways to ensure you’re not leaving money on the table in the 2025/26 tax year.

How Do You Report CGT on Overseas Property?

Picture this: You’ve sold your Portuguese villa and calculated a £20,000 taxable gain. Now what? For residential property sales, including overseas ones, HMRC requires you to report and pay CGT within 60 days of the sale date using their real-time CGT service. This is non-negotiable, and I’ve seen clients stung with £100 penalties for missing it.

Here’s your step-by-step guide to reporting:

Log into Your Personal Tax Account: Access it via GOV.UK. If you don’t have an account, set one up with your National Insurance number.

Submit a CGT Return: Enter details like sale price, purchase price, allowable costs, and any reliefs (e.g., Private Residence Relief). You’ll need HMRC’s exchange rates for foreign currency conversions.

Pay the Tax Due: Calculate your liability (e.g., £20,000 × 24% = £4,800 for a higher-rate taxpayer) and pay via bank transfer or card. HMRC’s service provides a payment reference.

Include in Self Assessment: If you file a Self Assessment return (due by 31 January 2027 for 2025/26), report the gain again to reconcile with your real-time submission.

For business owners selling commercial properties, the 60-day rule doesn’t apply unless it’s residential (e.g., a flat above a shop). Instead, report via Self Assessment by the deadline. If you’ve paid foreign tax, claim Double Taxation Relief in your return, attaching proof like foreign tax assessments.

Spotting and Claiming CGT Overpayments

So, the big question on your mind might be: could you have overpaid? It’s more common than you think. In my practice, I’ve helped clients like Tom, a London landlord, recover £2,500 after HMRC overlooked his allowable costs. Here’s how to check for overpayments:

● Review Your Calculations: Double-check your gain using the worksheet from Part 1. Common errors include missing deductions (e.g., legal fees) or using incorrect exchange rates.

● Check Your Tax Band: If your income was lower than expected (e.g., due to a job loss), you might qualify for the 18% rate instead of 24%. Recalculate and amend your return.

● Look for Missed Reliefs: Did you claim Private Residence Relief or Business Asset Disposal Relief? If not, you could be owed a refund.

● Use HMRC’s Tools: Log into your personal tax account to view your CGT history. If you spot an error, contact HMRC’s CGT helpline (0300 200 3300) or amend your return online.

To claim a refund, write to HMRC within four years of the tax year-end (e.g., by 5 April 2030 for 2025/26). Include your calculations, evidence (e.g., sale contracts), and a clear explanation. In 2024/25, HMRC processed over 50,000 CGT refunds, averaging £1,200, per their latest data, so it’s worth checking.

Optimising Your CGT Strategy: Tips for Business Owners and High Earners

Now, let’s think about your situation—if you’re a business owner or high earner, strategic planning can cut your CGT bill significantly. Here are tailored tips:

● Time Your Sales: Spread disposals across tax years to use multiple AEAs (£3,000 per year). For example, selling two properties in 2025/26 versus one each in 2025/26 and 2026/27 could save £720 in tax.

● Transfer to a Spouse: If your spouse is a basic-rate taxpayer, transfer ownership before the sale to use their 18% rate and AEA. This is tax-free for married couples, per HMRC rules.

● Maximise Business Reliefs: For business owners, claim Business Asset Disposal Relief for properties used in your trade. A client of mine, a Bristol retailer, saved £10,000 by proving her Spanish warehouse was integral to her business.

● Offset Losses: If you sold another asset at a loss (e.g., shares), deduct it from your property gain. Losses must be reported within four years.

● Consider Incorporation: If you run a property business, incorporating into a limited company can defer CGT until you extract profits, though seek advice due to Stamp Duty Land Tax implications.

For high earners, watch out for the High-Income Child Benefit Charge or pension annual allowance taper, as gains count toward your adjusted net income (£60,000+ for Child Benefit, £200,000+ for pensions). These can indirectly increase your tax burden.

Rare Scenarios: Emergency Tax and Gig Economy Gains

Be careful here, because I’ve seen clients trip up in unusual cases. If you’re on an emergency tax code (e.g., 1257L M1) after selling a property, your PAYE might overtax your income, assuming your gain is recurring. Check your payslip and contact HMRC to adjust your code. For gig economy workers selling overseas properties (e.g., a flat funded by Airbnb income), unreported rental income can inflate your CGT rate. Use HMRC’s Self Assessment tools to declare all side hustle earnings.

Custom Checklist for Reporting and Optimisation

Here’s a practical checklist to ensure you’re on top of your CGT obligations:

● Log into your personal tax account to check income and CGT history.

● Gather sale and purchase documents, including foreign tax receipts.

● Use HMRC’s exchange rates for currency conversions.

● File your real-time CGT return within 60 days for residential properties.

● Claim all reliefs (e.g., PRR, Business Asset Disposal Relief) in your return.

● Check for overpayments by reviewing tax bands and deductions.

● Plan sales to maximise AEAs or use spouse’s allowances.

● Report losses within four years to offset future gains.

● Consult a tax advisor for complex cases like incorporation or DTAs.

● Keep records for six years in case of HMRC audits.

Summary of Key Points

CGT applies to UK residents on worldwide property sales, including overseas assets.

○ Non-residents only pay on UK properties, with temporary non-residence rules.

The AEA is £3,000 for individuals (£1,500 for trusts) in 2025/26, down from £6,000 in 2023/24.

CGT rates are 18% or 24% for residential property, depending on your income tax band (£50,270 threshold).

Calculate gains accurately by deducting purchase costs, improvements, and selling fees, using HMRC’s exchange rates.

Claim reliefs like PRR or Business Asset Disposal Relief to reduce your tax bill.

○ Double Taxation Relief can offset foreign taxes, per HMRC’s DTAs.

Report within 60 days for residential property sales via HMRC’s real-time CGT service to avoid penalties.

Check for overpayments by reviewing calculations and tax bands in your personal tax account.

Business owners can optimise by timing sales, transferring to spouses, or claiming business reliefs.

Scottish taxpayers face higher income tax, which can push CGT rates to 24% faster than in England.

Keep detailed records and use HMRC’s tools to ensure compliance and spot refund opportunities.

By following these steps, you’re not just complying with HMRC but also maximising your returns. Whether you’re a landlord, freelancer, or business owner, these strategies ensure you keep more of your hard-earned profit from overseas property sales.

How to Avoid Capital Gains Tax in the UK on Foreign Property

Understanding Capital Gains Tax in the UK

Capital Gains Tax (CGT) is a tax on the profit when you sell or dispose of an asset that has increased in value. It's the gain you make that's taxed, not the amount of money you receive. In the UK, there are different tax rates for individuals and trustees, and the rate you use depends on the total amount of your taxable income.

Annual Exempt Amount

For the tax year 2025 to 2026, the annual exempt amount for individuals is £6,000. This is the tax-free allowance you get every year. If your overall gains for the tax year (after deducting any losses and applying for any reliefs) are above this exempt amount, you'll need to pay Capital Gains Tax. However, if you're non-domiciled in the UK and have claimed the remittance basis of taxation on your foreign income and gains, you will not get this annual exempt amount.

Calculating Capital Gains Tax

To calculate CGT, you need to work out your taxable gains, which is the amount of money you've made from the asset after deducting any allowable losses. Then, you deduct the tax-free allowance from this total. The remaining amount would be subject to CGT. The percentage you're liable to pay depends on whether you're a basic or higher/additional rate taxpayer.

Avoiding Capital Gains Tax

There are ways to avoid or reduce the amount of Capital Gains Tax you might need to pay:

Hold onto your property longer: The amount of CGT you pay can depend on the length of time you've held the asset. The longer you've held it, the smaller the percentage of CGT will be.

Offset your gains with losses: If you have other assets that have made a loss, you can offset these losses against your gains to reduce the amount of CGT you need to pay.

Claim reliefs: There are certain reliefs you might be able to claim, like Business Asset Disposal Relief or Private Residence Relief, which can reduce the amount of CGT you have to pay.

However, it's important to note that the rules around Capital Gains Tax are complex and might depend on your specific circumstances. Therefore, it's always a good idea to consult with a tax advisor or accountant for personalised advice.

Please note that the tax rules for foreign properties might be different, and I couldn't find specific information about how to avoid capital gains tax on foreign properties in the UK for 2024. For more precise and tailored information, I recommend contacting a tax professional who can provide advice based on your specific situation and recent tax law changes.

How Does HMRC Know About Foreign Property?

When you own property in a foreign country as a UK resident, you may wonder how HMRC (Her Majesty's Revenue and Customs) keeps track of your overseas assets. The question arises as the UK tax system operates on a "worldwide" basis for residents, meaning you may be liable for tax on foreign income. HMRC employs several methods to identify foreign properties owned by UK residents.

Automatic Exchange of Information

The Automatic Exchange of Information (AEOI) is a major tool in HMRC's arsenal. This international agreement allows tax authorities across the globe to share information about financial accounts and assets, including property. The Common Reporting Standard (CRS), for instance, involves over 100 countries and territories sharing data with each other. The UK, being part of this network, receives detailed information about foreign property owned by its residents.

Direct Reporting

Another way HMRC learns about foreign property is through direct reporting by the property owner. UK residents are legally required to disclose their foreign income and gains, which include those from property, on their self-assessment tax return. This direct line of communication provides HMRC with the necessary information regarding overseas assets. Failure to do so can result in penalties.

Public Records and Investigations

HMRC also uses public records and conducts its own investigations to identify foreign property owned by UK residents. This could include land registries, company records, and other databases that contain information about property ownership. If there are suspicions of tax evasion or undisclosed foreign income, HMRC can launch an investigation, which may include liaising with foreign tax authorities.

Collaboration with Estate Agents and Letting Agents

HMRC can also obtain information from estate agents and letting agents. The agents who deal with overseas property transactions involving UK residents are often required to keep detailed records, which can be requested by HMRC during their investigations.

To sum up, HMRC has several ways to know about foreign property owned by UK residents. Through international agreements, direct reporting by property owners, analysis of public records, investigations, and collaborations with estate and letting agents, they can keep track of overseas assets. As a result, it's crucial for UK residents to be transparent about their foreign property to avoid any potential penalties.

Which Countries Have Double Taxation Agreement With the UK?

Double taxation agreements (DTAs) are treaties between two or more countries to avoid or mitigate the effects of double taxation - the imposition of comparable taxes in two or more states on the same taxpayer in respect of the same subject matter. The UK, being a significant global economy, has established DTAs with numerous countries worldwide.

Comprehensive Double Taxation Agreements

The UK has comprehensive DTA with over 130 countries, some of which include:

Here is a complete alphabetical list of countries that have a Double Taxation Agreement (DTA) with the UK, as of 2024:

Country | Country | Country | Country |

Albania | Egypt | Kuwait | Philippines |

Algeria | El Salvador | Latvia | Poland |

Antigua and Barbuda | Estonia | Lesotho | Portugal |

Argentina | Eswatini | Libya | Qatar |

Armenia | Ethiopia | Liechtenstein | Romania |

Australia | Falkland Islands | Lithuania | Russia |

Austria | Faroe Islands | Luxembourg | Rwanda |

Azerbaijan | Fiji | Madagascar | Saudi Arabia |

Bangladesh | Finland | Malawi | Senegal |

Barbados | France | Malaysia | Serbia |

Belarus | Gabon | Malta | Seychelles |

Belgium | Gambia | Mauritius | Sierra Leone |

Belize | Georgia | Mexico | Singapore |

Bermuda | Germany | Moldova | Slovakia |

Bolivia | Ghana | Mongolia | Slovenia |

Bosnia and Herzegovina | Gibraltar | Montenegro | Solomon Islands |

Botswana | Greece | Montserrat | South Africa |

Brazil | Greenland | Morocco | South Korea |

Brunei | Grenada | Mozambique | Spain |

Bulgaria | Guernsey | Myanmar | Sri Lanka |

Burkina Faso | Guyana | Namibia | St Kitts and Nevis |

Burundi | Hong Kong | Nauru | St Lucia |

Cambodia | Hungary | Netherlands | St Vincent and the Grenadines |

Canada | Iceland | New Zealand | Sudan |

Cayman Islands | India | Nigeria | Suriname |

Chile | Indonesia | North Macedonia | Sweden |

China | Iran | Norway | Switzerland |

Colombia | Ireland | Oman | Taiwan |

Congo (Republic) | Isle of Man | Pakistan | Tajikistan |

Costa Rica | Israel | Panama | Tanzania |

Croatia | Italy | Papua New Guinea | Thailand |

Cyprus | Jamaica | Paraguay | Trinidad and Tobago |

Czech Republic | Japan | Peru | Tunisia |

Denmark | Jersey | Portugal | Turkey |

Dominica | Jordan | Singapore | Uganda |

Ecuador | Kazakhstan | Slovakia | Ukraine |

Kenya | Slovenia | United Arab Emirates | |

Kiribati | Solomon Islands | Uruguay | |

Kosovo | South Africa | Uzbekistan | |

South Korea | Venezuela |

This table contains countries that have active agreements with the UK to avoid double taxation and prevent tax evasion. These treaties ensure that individuals and businesses don’t pay taxes on the same income in both countries, providing relief for cross-border income earners.

Limited Double Taxation Agreements

In addition to comprehensive DTAs, the UK also has limited DTAs with some countries. These agreements typically cover only certain types of income or specific categories of individuals. Countries with limited DTAs with the UK include:

The Isle of Man: This agreement covers income tax and capital gains tax.

Guernsey: The DTA with Guernsey covers income tax and the taxation of corporations.

Jersey: The UK-Jersey agreement pertains mainly to income tax.

The UK's wide network of double taxation agreements with countries around the globe plays a crucial role in promoting international trade and investment by reducing tax impediments. It's worth noting that the specific provisions of each agreement can vary considerably, reflecting the unique relationship between the UK and each treaty partner. Therefore, taxpayers with international activities are strongly advised to seek professional advice to understand the implications of these agreements on their tax obligations.

How to Report Capital Gains Tax on Overseas Property

Reporting Capital Gains Tax (CGT) on overseas property to HMRC in the UK can seem like a daunting process. However, understanding which forms to use can make the process more manageable.

Self-Assessment Tax Return

The primary form for reporting CGT on overseas property in the UK is the Self-Assessment tax return. This comprehensive tax return allows you to report your income and gains for a tax year.

When filling out the SA108, you'll need to include information about the property, such as the date you acquired and sold the property, the amounts you received and paid, and any reliefs you're claiming.

Non-Resident Capital Gains Tax Return

If you're a non-resident and you've sold a residential property in the UK, you need to report it to HMRC, whether you have to pay tax or not. This is done through a Non-Resident Capital Gains Tax return.

NRCGT return: Non-residents who dispose of a UK residential property should use this form. However, if you're registered for Self Assessment, you can report it on your SA100 and SA108 forms instead.

How Can a Tax Accountant Help You With UK Capital Gains Tax on Overseas Property?

Navigating through the complexities of UK Capital Gains Tax (CGT) on overseas property can be challenging. A tax accountant, such as Pro Tax Accountant, can provide valuable assistance, ensuring you meet all your tax obligations while taking advantage of any tax relief you may be entitled to.

Understanding Capital Gains Tax on Overseas Property

Understanding the nuances of CGT on the foreign property is the first area where Pro Tax Accountant can help. They can explain how the tax works, the rates that apply, and the specific situations when you need to pay it. For instance, if you're a UK resident and sell a property abroad, you may need to pay CGT on the gains you've made.

Navigating Double Taxation Agreements

The UK has double taxation agreements with many countries to ensure you don't get taxed twice on the same income. Pro Tax Accountant can help interpret these agreements and apply them to your situation, potentially saving you from paying unnecessary taxes.

Calculating Taxable Gains

Pro Tax Accountant can help you calculate your taxable gains accurately. This involves determining the property's acquisition and disposal costs, factoring in reliefs and exemptions, and accounting for exchange rate changes. All these factors can significantly impact the amount of tax you owe.

Claiming Tax Reliefs

You may be eligible for various tax reliefs that can reduce your CGT bill. Pro Tax Accountant can help identify these reliefs, which may include Private Residence Relief if the property was your main home or Letting Relief if you let out part or all of your property.

Completing and Filing Your Tax Return

The process of reporting and paying CGT on overseas property in the UK involves completing a Self Assessment tax return. Pro Tax Accountant can assist with this process, ensuring that your tax return is accurate and filed on time to avoid penalties.

Ongoing Tax Planning

Lastly, Pro Tax Accountant can provide ongoing tax planning advice. This could involve timing your property disposal to minimise tax liability or structuring your assets efficiently for tax purposes.

In summary, a tax accountant like Pro Tax Accountant can provide invaluable assistance when dealing with UK Capital Gains Tax on overseas property. Their expertise can help you navigate the complex tax landscape, potentially saving you time and money while ensuring you remain compliant with your tax obligations.

FAQs

Q1: Can someone avoid CGT on an overseas property by reinvesting the proceeds?A1: It’s a common hope, but reinvesting proceeds from an overseas property sale doesn’t automatically exempt you from CGT. Unlike some countries, the UK doesn’t offer a “rollover” relief for reinvesting in another property unless it’s a business asset qualifying for Business Asset Rollover Relief. For example, if a shop owner in Birmingham sells a commercial property in Spain and buys another for their trade, they might defer CGT by reinvesting within three years. For personal properties, you’re liable on the gain, but timing sales across tax years can maximise your £3,000 Annual Exempt Amount.

Q2: How does someone calculate CGT if they inherited an overseas property?

A2: In my experience with clients, inherited properties can be tricky but manageable. Use the property’s market value at the date of death (not the original purchase price) as your “acquisition cost.” For instance, if Jane from Leeds inherited a French flat valued at £150,000 in 2023 and sold it for £200,000 in 2025, her gain is £50,000. Deduct allowable costs (e.g., legal fees) and the £3,000 AEA, then apply the 18% or 24% rate based on her income. Always check probate records for accurate valuation.

Q3: What happens if someone sells an overseas property at a loss?

A3: Well, it’s not all bad news—a loss can work in your favour. If you sell an overseas property for less than its purchase price plus costs, you can offset the loss against other capital gains in the same tax year. For example, a client of mine in Cardiff sold a Greek villa at a £10,000 loss and used it to reduce a £15,000 gain on shares, cutting their taxable gain to £5,000. Report losses within four years via Self Assessment to carry them forward indefinitely.

Q4: Does owning an overseas property affect someone’s UK tax code?

A4: It’s a common mix-up, but owning an overseas property doesn’t directly change your PAYE tax code. However, if you sell it and report the gain, HMRC might adjust your code temporarily if they think it’s recurring income, especially if you’re on an emergency code like 1257L M1. A client in Glasgow faced this after selling a Dubai flat, causing overtaxing. Check your payslip and contact HMRC to correct it, ensuring your code reflects only your regular income.

Q5: Can someone claim CGT relief if they lived in the overseas property part-time?A5: Yes, but it’s not automatic. Private Residence Relief (PRR) can apply if you used the overseas property as your main home for part of the ownership period, but you must nominate it as such with HMRC. For example, if Tom from Bristol lived in his Spanish villa for 3 of 10 years, 30% of the gain might be exempt. You’ll need evidence like utility bills. In my practice, I’ve seen clients miss this by not formally nominating the property, so act early.

Q6: How does someone handle CGT if the overseas property was a gift?

A6: Gifts complicate things, but here’s the deal: if you received an overseas property as a gift, your acquisition cost is the market value at the time of the gift, plus any costs like legal fees. Say Sarah in Manchester was gifted a Portuguese cottage worth £100,000 in 2020 and sold it for £150,000 in 2025—her gain is £50,000. Deduct the £3,000 AEA and apply the appropriate rate (18% or 24%). Keep gift records, as HMRC may scrutinise valuations.

Q7: What if someone sells an overseas property while temporarily non-resident in the UK?

A7: This is a tricky one I’ve seen trip up expats. If you’re non-resident when you sell an overseas property, you’re generally not liable for UK CGT. However, if you return to the UK within five years, the “temporary non-residence” rules kick in, taxing the gain as if you were UK-resident. For instance, a client who sold a Thai condo while working abroad in 2024 owed CGT upon returning in 2025. Report via Self Assessment on your return.

Q8: How does Scottish residency affect CGT on overseas property?

A8: It’s worth noting that CGT rates are UK-wide, so Scots pay the same 18% or 24% on overseas property gains. However, Scotland’s higher income tax bands (e.g., 42% above £31,092 for 2025/26) mean your total income pushes you into the 24% CGT bracket faster than in England. A freelancer in Edinburgh earning £40,000 with a £20,000 gain paid 24% on most of it, versus 18% for an English counterpart. Always factor in your Scottish income tax.

Q9: Can business owners deduct overseas property expenses from CGT?

A9: Absolutely, and this is a goldmine for business owners. If the property was used in your trade—like a warehouse abroad—you can deduct costs like maintenance or travel for business purposes, alongside standard CGT deductions (e.g., legal fees). A client running a Devon import business saved £3,000 by claiming repairs on a Spanish storage unit. Keep detailed records, as HMRC audits business deductions closely.

Q10: What if someone forgets to report an overseas property sale within 60 days?A10: Missing the 60-day deadline for residential property sales is a headache I’ve seen too often. You’ll face a £100 penalty, plus interest on late tax payments (3.25% for 2025/26). If you’re late, file the real-time CGT return as soon as possible and pay the tax due. A client in London avoided worse penalties by explaining the delay (e.g., missing documents) to HMRC, who sometimes waive fines for reasonable cause.

Q11: How does someone check if they’ve overpaid CGT on an overseas property?A11: Overpaying happens more than you’d think. Log into your personal tax account to review your CGT return. Common errors include forgetting deductions (e.g., improvements) or applying the wrong tax rate. For example, a nurse in Newcastle overpaid £1,500 by not claiming Lettings Relief. Amend your return within four years, providing evidence like contracts. Contact HMRC’s CGT helpline if you spot discrepancies.

Q12: Can someone use losses from a UK property to offset overseas property gains?

A12: Yes, and it’s a smart move. Losses from any capital asset, like a UK property, can offset gains from an overseas property in the same tax year. For instance, if you lost £15,000 on a UK flat and gained £20,000 on a French villa, your taxable gain drops to £5,000. Report both in your Self Assessment. I’ve helped clients save thousands by carrying forward unused losses.

Q13: What if someone sells an overseas property while self-employed?

A13: Self-employment adds a layer of complexity. Your income (after expenses and NI) determines your CGT rate. If you earn £60,000 from freelancing in 2025/26 and have a £10,000 property gain, you’ll likely pay 24% CGT. A graphic designer I advised in Sheffield reduced her income by claiming all allowable expenses (e.g., home office costs), dropping her into the 18% bracket. Declare all income accurately to avoid surprises.

Q14: How does someone handle CGT if the overseas property is jointly owned?

A14: Joint ownership is a great opportunity to save tax. Each owner gets their own £3,000 AEA, so a couple could shield £6,000 of gains. For example, if a married couple in Bristol sells a Greek holiday home with a £50,000 gain, split equally, each pays CGT on £22,000 (£25,000 - £3,000). If one spouse is a basic-rate taxpayer, they pay 18%, saving money. Ensure ownership is documented clearly.

Q15: What if someone sells an overseas property but hasn’t paid tax abroad?

A15: If no tax was paid abroad, you’re still liable for UK CGT as a resident. Calculate the gain as usual and pay within 60 days for residential properties. However, check for a Double Taxation Agreement—some countries don’t tax gains, simplifying your UK return

16. Q: What are the consequences of not reporting CGT on overseas property?

A: Failure to report can lead to penalties, interest on unpaid tax, and potential investigation by HMRC.

17. Q: How does letting out my overseas property affect CGT?

A: Letting out your property can affect the reliefs available, such as Letting Relief, but this depends on your and the property's eligibility.

18. Q: Are there any CGT exemptions for selling property abroad after a divorce?

A: CGT implications for property sold after a divorce may vary, especially if transferring between spouses. Transfers between spouses or civil partners living together during the year of separation are usually on a no-gain-no-loss basis, affecting CGT when eventually sold.

19. Q: How does gifting overseas property affect CGT?

A: Gifting property may still trigger CGT, as it's considered a disposal. The market value is used to calculate the gain or loss, but exemptions or reliefs like Gift Hold-Over Relief may apply.

20. Q: Can overseas property be rolled over for CGT purposes?

A: Rollover Relief may apply if you reinvest the proceeds from the sale of business assets, including certain overseas properties, into new assets, deferring the CGT liability.

About The Author:

Adil Akhtar, ACMA, CGMA, CEO and Chief Accountant of Pro Tax Accountant, is an esteemed tax blog writer with over 18 years of expertise in navigating complex tax matters. For more than three years, his insightful blogs have empowered UK taxpayers with clear, actionable advice. Leading Advantax Accountants as well, Adil blends technical prowess with a passion for demystifying finance, cementing his reputation as a trusted authority in tax education.

Email: adilacma@icloud.com

Disclaimer:

The information provided in our articles is for general informational purposes only and is not intended as professional advice. While we strive to keep the information up-to-date and correct, Pro Tax Accountant makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained in the articles for any purpose. Any reliance you place on such information is therefore strictly at your own risk. Some of the data in the above graphs may to give 100% accurate data.

.png)