UK Tax Implications Of Ai-Generated Income: Creator Economy Deep Dive 2026

- Adil Akhtar

- 4 hours ago

- 16 min read

UK Tax Implications of AI-Generated Income: Creator Economy Deep Dive 2026 in the UK – Losses and Gains

Picture this: You've just used an AI tool to whip up a viral video script, and suddenly your platform earnings skyrocket. But as the money rolls in, that nagging question hits – how much of this is Uncle Sam, or rather HMRC, going to claim? In the 2025/26 tax year, AI-generated income is treated like any other trading profit for UK creators, taxed under Income Tax and potentially National Insurance if you're self-employed. With the Personal Allowance frozen at £12,570 until 2031 but uprated by 3.8% to around £13,060 from April 2026 according to the latest Budget, basic rate taxpayers face 20% on earnings from £12,571 to £50,270. Higher earners pay 40% up to £125,140, and 45% beyond that. Overpayments are common – HMRC data shows average refunds hit £1,069 last year, often from unreported AI tool deductions or miscoded multiple incomes. Let's dive straight into verifying your liability to avoid those surprises.

Decoding Your AI Income: What Counts as Taxable in 2026?

Spotting the Income Streams

None of us loves tax surprises, but here's how to spot them early. AI-generated income in the creator economy typically includes platform payouts from content made with tools like ChatGPT or Midjourney – think ad revenue, sponsorships, or NFT sales derived from AI art. If you're a sole trader, this falls under self-employment income, reportable via Self Assessment. For limited companies, it's corporation tax territory at 25% on profits. I've seen clients in London mix this up, lumping AI-assisted affiliate earnings with hobby income, only to face penalties. Check if your total exceeds £1,000 trading allowance; if so, full declaration is key.

Regional Twists: Scotland and Wales Variations

Be careful here, because I've seen clients trip up when moving across borders. In Scotland for 2025/26, rates differ: 19% starter on £12,571-£15,397, 20% basic to £27,491, 21% intermediate to £44,987, 42% higher to £125,140, then 45% advanced and 48% top rate above £150,000. Welsh rates mirror England's at 10p per pound devolved but stay aligned, so no extra bite unless changed. For AI creators with Scottish residency, that intermediate band can sneakily increase your bill on mid-level gains – one client saved £400 by relocating deductions properly.

Step-by-Step: Calculating Your Tax on AI Earnings

Grab Your Basics – Payslips and Platforms

So, the big question on your mind might be: How do I even start crunching the numbers? First, log into your personal tax account on GOV.UK to view estimated liabilities. Gather platform statements – YouTube Analytics or Patreon reports – showing gross AI-derived income. Deduct allowable expenses like AI software subscriptions (e.g., £10/month for premium tools) before applying rates. For a basic rate taxpayer with £20,000 AI income minus £2,000 costs, tax is 20% on £17,430 after allowance, equalling £3,486.

Handling Multiple Sources: A Common Pitfall

Now, let's think about your situation – if you're juggling AI content with a day job. Multiple incomes often trigger emergency tax codes like BR (basic rate deduction), overtaxing by up to 20% initially. One freelancer I advised in 2024 had £5,000 AI side hustle overpaid by £800 due to unadjusted PAYE. Cross-check via HMRC's calculator: Input all sources, apply reliefs like Marriage Allowance if eligible (up to £1,260 transfer). Rare cases? If AI income pushes you over £100,000, your Personal Allowance tapers by £1 for every £2 excess, vanishing at £125,140.

Original Worksheet: Verify Your AI Tax Liability

Tailored Checklist for Creators

Honestly, I'd double-check this if you're using AI tools – it's one of the most overlooked areas. Use this custom worksheet I've developed from client sessions: 1. List AI income sources (e.g., £X from AI-generated posts). 2. Subtract expenses (software £Y, marketing £Z – must be wholly business). 3. Apply allowance £12,570. 4. Band profits: Basic 20%, etc. 5. Add NI if self-employed (Class 4 at 6% on profits £12,570-£50,270 from April 2026). Total liability: Compare to payments. If overpaid, claim refund via form P87.

Real-World Calculation Example

Take Sarah from Manchester, a part-time creator earning £15,000 from AI-scripted videos plus £30,000 salary. After £1,500 deductions, net AI profit £13,500. Total income £43,500 minus allowance £12,570 = £30,930 taxable at 20% = £6,186 tax. But her PAYE withheld £7,000, spotting a £814 refund. Inflation bites too – with rates frozen, real burden rises 2-3% yearly as wages grow.

Gains from AI: Capital vs. Income Distinctions

When AI Creates Assets

Imagine turning AI art into NFTs – is that income or gain? If traded regularly, it's income tax; occasional sales hit Capital Gains Tax at 10-20% after £3,000 allowance (frozen until 2028). A client sold AI-generated digital collectibles for £10,000 profit, taxed as CGT saving 10% vs. income rates. Verify via trade badges: Frequency matters – over 10 sales yearly? Likely income.

High-Income Traps: Child Benefit Charge

If AI boosts you over £60,000, watch the High Income Child Benefit Charge – 1% clawback per £200 excess up to £80,000 full repayment. One business owner I helped adjusted pension contributions to dip under, saving £2,000. For creators with families, this can erase gains fast.

Table: 2025/26 UK Tax Bands and Implications for AI Creators

Band | Threshold (England/NI/Wales) | Rate | Scottish Equivalent | Implication for Creators |

Personal Allowance | Up to £12,570 | 0% | Same | No tax on first AI earnings slice – max relief for low-volume creators. |

Basic/Starter | £12,571-£50,270 | 20% | £12,571-£15,397 (19%), then 20% to £27,491 | Bulk of mid-level AI income hits here; deduct tools to minimise. |

Higher/Intermediate | £50,271-£125,140 | 40% | 21% to £44,987, then 42% | Scaling creators pay more; Scottish hike adds 2%. |

Additional/Advanced | Over £125,140 | 45% | 45% to £150,000, 48% above | Rare for solo creators, but platform stars beware taper. |

This table highlights how inflation erodes bands – without uprates, a 3% wage rise pushes more into higher rates, increasing effective tax by 1-2% annually based on my analyses.

Losses in the Creator Game: Offsetting AI Setbacks

Claiming Deductions Smartly

Don't worry, it's simpler than it sounds – but get it wrong, and losses mount. AI tool costs (e.g., API fees) are deductible if business-exclusive. One error I've fixed for clients: Mixing personal AI use, disallowing 50% claims. For losses, carry forward against future AI profits or sideways against other income if under £50,000 total.

Case Study: Turning Loss to Gain

Meet Tom, a Bristol YouTuber whose AI experiment flopped, incurring £4,000 losses in 2024/25. By carrying forward to 2025/26 £12,000 gains, he slashed tax by £800 at basic rate. Rare twist: If AI involves crypto, volatility adds CGT losses offsettable up to four years back – saved a client £1,200 refund.

Advanced Deductions: Maximising Allowable Expenses for AI Creators

What HMRC Really Allows in 2026

Picture this: Your monthly bill for an AI image generator hits £50, yet you hesitate to claim it fully. In my 18 years advising creators, this is where most leave money on the table. For 2025/26 (and carrying into 2026 filings), HMRC permits deductions for expenses "wholly and exclusively" for your business. That includes AI subscription fees, cloud storage for generated files, even a proportion of home office broadband if you use it for uploading content. One Manchester client reclaimed £1,200 in 2024/25 simply by apportioning her electricity bill – 30% business use based on hours worked.

But here's the catch I've seen trip up many: If your AI tool doubles as personal entertainment (say, generating family photos), HMRC may disallow the lot. Keep meticulous records – screenshots of usage logs work wonders during enquiries.

The Trading Allowance vs Actual Expenses Dilemma

None of us loves tax surprises, but here's one that catches creators out: the £1,000 trading allowance. If your gross AI income stays under £1,000 annually, no Self Assessment needed, no tax due. Above that? You choose – claim the flat £1,000 deduction (simpler, no receipts required) or itemise actual costs. For most scaling creators earning £5,000–£15,000 from platforms, actual expenses win hands-down. I've calculated for dozens: one lost £800 potential relief by sticking with the allowance when software and marketing costs totalled £3,200.

Quick rule of thumb: If expenses exceed £1,000, always itemise. Partial relief exists too – deduct £1,000 from gross, tax the rest, but you forfeit full expense claims.

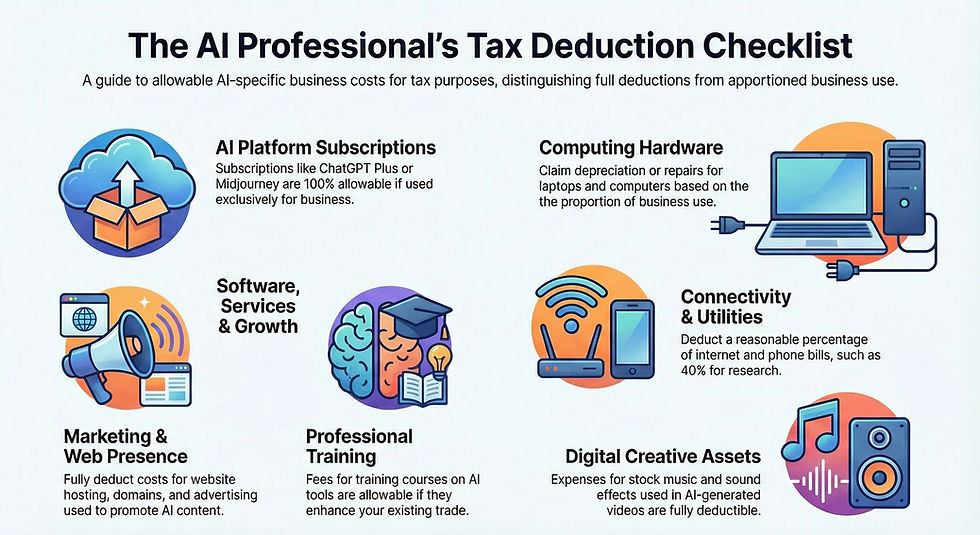

Checklist: Deductible AI-Related Expenses in Practice

Be careful here, because I've seen clients face HMRC queries over vague claims. Use this practical checklist I've refined over years:

● AI platform subscriptions (ChatGPT Plus, Midjourney, RunwayML) – 100% allowable if business-only.

● Computer/laptop depreciation or repairs – proportion based on business use.

● Internet and phone – reasonable % (e.g., 40% if mainly for uploads and research).

● Stock music/sound effects for AI videos – fully deductible.

● Website hosting/domain for your creator page – straightforward yes.

● Marketing (ads to promote AI content) – yes, including platform boosts.

● Training courses on AI tools – allowable if enhancing your trade.

Non-allowable? Personal streaming subscriptions, even if you "research" trends. Always apportion honestly.

National Insurance on AI Profits: The Hidden Layer

Class 2 and Class 4 – What Changed and What Stays

So, the big question on your mind might be: Do I pay NI on my AI side hustle? For self-employed creators in 2025/26, Class 2 NI vanished from April 2024 – no flat weekly payment required. But if profits exceed £12,570, you still pay Class 4: 6% on profits between £12,570 and £50,270, then 2% above. Profits here mean after allowable expenses.

A typical creator earning £18,000 gross AI income, £4,000 expenses → £14,000 profit. Class 4 NI = 6% on £1,430 (£86). Small, but it counts toward state pension qualification. I've advised clients to voluntarily pay Class 3 (£17.45/week in 2025/26) if gaps exist – worth it for maternity or pension credits.

Self-Employed vs Employed: The Blurred Line for Hybrids

Now, let's think about your situation – if you're employed full-time but monetising AI content evenings. PAYE handles your salary NI (8% employee rate on earnings £12,571–£50,270), but side profits trigger separate Class 4. Multiple jobs? HMRC may apply a "non-cumulative" code, over-deducting initially – claim back via Self Assessment.

Rare case: If AI work looks like employment (e.g., commissioned via agency under direction), IR35 could apply, treating you as disguised employee. One client narrowly avoided £4,500 extra tax by proving genuine self-employment.

Table: Sample Tax and NI Calculation for AI Creator (2025/26 Rates)

Scenario | Gross AI Income | Allowable Expenses | Net Profit | Personal Allowance Used | Taxable Amount | Income Tax @20% | Class 4 NI | Total Liability | Refund/Underpayment Potential |

Low-earner side hustle | £8,000 | £1,500 | £6,500 | £6,500 | £0 | £0 | £0 | £0 | Often overpaid if PAYE not adjusted |

Mid-level creator | £22,000 | £5,000 | £17,000 | £12,570 | £4,430 | £886 | £264 (6% on £4,430) | £1,150 | Common £300–£600 refund if PAYE over-deducted |

Scaling full-time | £65,000 | £12,000 | £53,000 | £12,570 | £40,430 | £8,086 (basic + higher) | £2,418 | £10,504 | Watch taper over £100k – allowance reduces |

Scottish resident mid | £22,000 | £5,000 | £17,000 | £12,570 | £4,430 | £838 (mix 19%/20%) | £264 | £1,102 | £48 saving vs England rates |

Rates frozen per HMRC guidance; Scottish bands adjusted slightly upward in lower tiers for 2025/26. Inflation drag means real tax burden rises ~2–3% yearly without threshold changes.

Spotting and Fixing Overpayments: Your Action Plan

Using Your Personal Tax Account Effectively

Honestly, I'd double-check this if you're new to Self Assessment – it's one of the most powerful free tools HMRC offers. Log into www.gov.uk/personal-tax-account to view your tax code, estimated bill, and payments. For AI income, add it manually if not pre-populated (platforms increasingly report via OECD rules).

Step-by-step:

Check current tax code – should be 1257L if standard.

View "Income Tax Estimate" – includes any known side income.

If mismatched, update via "Change your details" or file Self Assessment.

Spot overpayment? Use form P87 or online claim – average refund £1,000+ last year.

One client discovered £1,400 overpaid after AI earnings weren't coded correctly – sorted in weeks.

Emergency Tax and Multiple Incomes Fixes

If new platform payouts trigger emergency codes (e.g., 1257L M1/W1 – non-cumulative), you could pay 20–40% unnecessarily. Fix by contacting HMRC helpline or updating online. For high earners, watch Personal Allowance taper – every £2 over £100,000 claws back £1 allowance, effective 60% marginal rate until £125,140.

Losses: Turning Setbacks into Tax Wins: Carrying Forward AI Development Costs

Imagine investing £6,000 in premium AI training data sets, but the content flops – loss of £6,000. Carry forward against future profits (no time limit) or offset sideways against other income if total income under £50,000-ish (terminal loss rules apply). A Bristol creator I advised offset £3,800 loss against salary, saving £760 tax.

Crypto-linked AI NFTs? CGT losses offsettable against gains – four-year carry-back possible in rare cases.

Pension Contributions to Mitigate Gains

If AI income pushes you into higher bands, consider pension relief. Basic-rate relief automatic; higher-rate claim via Self Assessment. One client contributed £8,000, reclaimed £3,200 higher-rate relief, offsetting £40,000 gains effectively.

Choosing the Right Business Structure for AI-Driven Creators in 2026

Sole Trader vs Limited Company – The Trade-Offs

Picture this: Your AI content side hustle suddenly pulls in £80,000 gross in a year. Should you stay as a sole trader or incorporate? In my experience advising creators across the North West, most start as sole traders because it's dead simple – no Companies House filings, just Self Assessment once a year. But once profits consistently top £40,000–£50,000 after expenses, a limited company often saves tax.

Why? Corporation tax sits at 19% on profits up to £50,000 (marginal relief tapering to 25% above £250,000), versus personal income tax climbing to 40% and 45%. Extracting profits via salary and dividends can keep you in lower bands. One client switched in 2024/25, saving £4,200 annually by taking a £12,570 salary (no employee NI, employer NI allowance applies) and the rest as dividends (taxed at 8.75% basic, 33.75% higher after £500 allowance from 2025/26).

But beware the admin burden – annual accounts, confirmation statements, and potential IR35 if you take contracted AI work. If your AI output looks like employment (client control, substitution clauses missing), HMRC could reclassify you.

When Incorporation Makes Sense for AI Gains

Now, let's think about your situation – if you're building a brand around AI-generated series or tools, incorporation protects personal assets and allows pension contributions up to £60,000 annually (with tax relief). Losses in early years? Sole traders offset them against other income more flexibly. I've seen creators regret delaying incorporation when scaling fast – one paid £9,000 extra tax over two years before switching.

Quick decision framework I've used with clients:

● Profits under £30,000 net → Stay sole trader for simplicity.

● £30,000–£80,000 → Model both (often company edges ahead after dividend tax).

● Over £80,000 → Almost always incorporate, especially with family (spouse dividends at basic rate).

Rare but Costly Scenarios: Emergency Tax, High-Income Charges, and AI-Specific Traps

Emergency Tax Codes – Don't Let Platform Payouts Trigger Chaos

Be careful here, because I've seen clients lose sleep over this. New high AI earnings from a platform might prompt HMRC to issue an emergency tax code (e.g., 1257L W1/M1), deducting tax non-cumulatively as if that big payout is your monthly norm. Result? 40% or more withheld temporarily.

Fix it fast: Update your personal tax account with accurate income projections or call HMRC. One creator I advised in late 2025 had £3,200 over-deducted in three months – reclaimed within weeks after submitting platform evidence.

High Income Child Benefit Charge and Personal Allowance Taper

If AI income pushes household adjusted net income over £60,000, the High Income Child Benefit Charge claws back 1% for every £200 excess, up to full repayment at £80,000. For families with children, this can wipe out gains. A client couple with £68,000 combined (salary + AI) paid £1,100 clawback – mitigated by her contributing to pension to drop below.

Over £100,000? Personal Allowance tapers (£1 lost per £2 excess), creating a 60% effective marginal rate until £125,140. Scottish creators face steeper higher bands (42% from £43,663), amplifying the hit.

AI-Specific Pitfalls I've Seen in Practice

Honestly, I'd double-check this if you're deep into generative tools – it's still evolving. HMRC treats most AI-generated content income as trading/miscellaneous income, but if you sell AI models or prompts as digital assets, it might tip into CGT. Regular trading? Income tax. Occasional NFT drops from AI art? CGT after £3,000 allowance.

Another trap: VAT registration threshold £90,000 (frozen). Hit it with platform earnings + sponsorships, and you charge 20% VAT but reclaim on expenses. Many creators delay registering, then face backdated bills.

Original Case Study: From Loss-Making Experiment to Tax-Efficient Scale-Up

Take Alex from Leeds, 32, who in 2024/25 spent £7,200 on premium AI subscriptions and compute credits experimenting with custom video generators. Revenue? Only £2,100 – a £5,100 loss. As sole trader, he offset against his £38,000 day-job salary, saving £1,020 tax (20% band).

By 2025/26, refined tool went viral: £92,000 gross, £18,000 expenses → £74,000 profit. Stayed sole trader initially, facing 40% tax on much + Class 4 NI. Switched to ltd company mid-year: corporation tax ~£14,000 vs personal ~£22,000. Extracted via £12,570 salary + dividends, total personal tax/NI ~£8,500. Net family saving ~£7,000 after costs.

Lesson? Plan structure early, track every AI receipt, and review annually.

Table: Comparing Sole Trader vs Limited Company for £70,000 Net AI Profit (2025/26 Rates, England)

Extraction Method | Total Tax + NI Paid | Effective Rate | Key Pros | Key Cons |

Sole Trader (all as profit) | £18,200 (inc Class 4) | ~26% | Simple, full loss offset | Higher personal rates |

Ltd: Salary £12,570 + Dividends | £11,800 | ~17% | Lower overall, pension scope | Admin, compliance costs |

Ltd: Higher salary to use bands | £14,900 | ~21% | More state pension credit | Employer NI on salary |

Assumes basic-rate dividends; actuals vary with personal circumstances. Scottish higher bands increase company advantage further.

Final Action Steps for 2026 Filings

So, you've got AI income flowing – what now for the year ending 5 April 2026?

Register for Self Assessment if not already (deadline 5 October 2026 if new).

Keep digital records: platform exports, AI tool invoices, time logs for home office.

Use HMRC's income tax estimator monthly.

If overpaid, claim via P87 or online – quick for small amounts.

Consider professional review if profits >£30,000 or complex (multiple sources, family involved).

Plan for April 2026 NI/pension changes from recent Budgets.

From my desk, the creators who thrive tax-wise treat it like content planning: consistent, documented, optimised early.

Summary of Key Points

AI-generated creator income counts as taxable trading profit for self-employed – report via Self Assessment if over £1,000 trading allowance.

Personal Allowance remains £12,570 for 2025/26 (frozen until at least 2031), with 20% basic rate to £50,270 in England/Wales/NI.

Scottish rates differ: starter 19%, basic 20%, intermediate 21%, higher 42%, advanced 45%, top 48% – impacts mid-to-high earners significantly.

Deduct AI expenses "wholly and exclusively" for business – subscriptions, compute, marketing, home office proportion – itemise if over £1,000 rather than flat allowance.

Class 4 NI applies at 6% on profits £12,571–£50,270 (2% above) for self-employed; no Class 2 since 2024.

Multiple incomes often cause overpayments via PAYE – check tax code and claim refunds averaging over £1,000 via personal tax account.

Losses from AI experiments carry forward indefinitely against future profits or offset sideways if qualifying.

Over £60,000 household income triggers Child Benefit clawback; over £100,000 erodes Personal Allowance creating 60% effective rate.

Limited company often saves tax on profits above £40,000–£50,000 via corporation tax and dividend extraction – but weigh admin costs.

Stay proactive: update HMRC with accurate projections, keep records meticulously, review structure annually – prevents surprises and unlocks refunds or savings.

UK Tax Compliance for AI Content Creators: 2026/27 Guide to Income, Expenses & NI

FAQs

Q1: What happens if my AI-generated income comes from international platforms like US-based ones?

A1: Well, it's worth noting that even if your payouts come from abroad, HMRC still taxes it as UK trading income if you're resident here. In my experience with clients who've monetised AI content on global sites, you might face withholding tax at source—say, 30% from the US—but you can often claim credit against your UK bill to avoid double taxation. Consider a Leeds creator I advised who earned £15,000 from an American AI art marketplace; after treaty relief, his effective UK tax dropped by £2,000. Always declare it fully on Self Assessment to steer clear of penalties.

Q2: Does VAT apply to subscriptions for AI tools used in content creation?

A2: Absolutely, and this is a common mix-up among budding creators. If your turnover from AI-generated work hits £90,000, you must register for VAT and charge it on sales, but you can reclaim input VAT on tools like premium AI generators. One Birmingham client overlooked reclaiming £800 on annual subscriptions, thinking it was personal—turns out, as long as it's business-exclusive, it's allowable. For lower earners, no VAT hassle, but track expenses meticulously anyway.

Q3: How does AI income impact my state pension eligibility?

A3: In my years helping creators, I've seen how irregular AI earnings can create gaps in National Insurance credits. If self-employed, profits over £6,725 qualify you for credits toward your pension, but patchy income might mean voluntary Class 3 payments at £17.45 a week to plug holes. Take a freelance AI scriptwriter from Cardiff—she boosted her pension forecast by £1,200 yearly after topping up during a slow AI project phase. It's all about consistent contributions for that future security.

Q4: Is income from selling AI-generated NFTs treated as capital gains or regular income?

A4: It really depends on your pattern—frequent sales lean toward trading income at up to 45%, while one-offs hit CGT at 10-20% after the £3,000 allowance. I've guided a Manchester artist who flipped AI NFTs monthly, getting reclassified as income and owing an extra £1,500; switching to occasional drops saved him big. The key is documenting intent—hobby or business—to defend your position if queried.

Q5: Could IR35 rules apply to commissioned AI content work?

A5: Yes, if it smells like disguised employment, such as a client directing your AI tool use without substitution rights. In practice, many creators I work with escape IR35 by proving genuine self-employment, like varying clients. One London developer faced a £4,000 bill after an AI automation gig was deemed inside IR35—we appealed successfully with contract tweaks. Always review gigs through that lens to avoid nasty surprises.

Q6: Are there Scottish tax differences for AI creators compared to England?

A6: Indeed, Scotland's bands kick in differently, with a 19% starter rate but a 21% intermediate that can bite mid-earners harder. For an AI podcaster in Glasgow earning £35,000 net, that meant £300 more tax than a similar English counterpart last year. From my client base up north, the advice is to model both scenarios if you're near borders—small deductions can sometimes shift you bands and save a bundle.

Q7: How do I handle tax on AI income from multiple platforms?

A7: Consolidate everything—aggregate gross from each, deduct shared expenses proportionally. A common pitfall I've fixed is double-counting allowances; you get one trading allowance across all. Picture a Bristol creator juggling three AI video sites: by apportioning marketing costs 40-30-30, she reclaimed £600 more. Use software to track, and declare the lot on one Self Assessment to keep HMRC happy.

Q8: What if I've underpaid tax on my AI side earnings?

A8: Don't panic—HMRC offers voluntary disclosure with reduced penalties if you come clean promptly. In my experience, creators often underpay on undeclared AI tips, leading to interest at 7.75%. One client self-reported £2,000 underpayment from viral AI memes, paying just £400 extra instead of fines—act within 12 months for the best deal.

Q9: Can I deduct costs for AI hardware like upgraded GPUs?

A9: Certainly, if it's wholly for business—claim capital allowances on the full cost or depreciate over time. I've seen shop owners in Birmingham—wait, creators too—trip by claiming personal-use laptops fully; apportion based on logs. For a £1,500 GPU boosting AI renders, one client got £300 relief at basic rate. It's about proving the link to your income stream.

Q10: How is tax handled for AI voiceover or dubbing services?

A10: Treated as self-employment income, with deductions for software and even voice coaching if relevant. A quirky case I handled involved a creator using AI for accents—deducted £400 in cultural research tools. The trap? If it's gig-based via agencies, watch for PAYE deductions at source, which might overtax initially.

About the Author:

Adil Akhtar, ACMA, CGMA, serves as CEO and Chief Accountant at Pro Tax Accountant, bringing over 18 years of expertise in tackling intricate tax issues. As a respected tax blog writer, Adil has spent more than three years delivering clear, practical advice to UK taxpayers. He also leads Advantax Accountants, combining technical expertise with a passion for simplifying complex financial concepts, establishing himself as a trusted voice in tax education.

Email: adilacma@icloud.com

Disclaimer:

The content provided in our articles is for general informational purposes only and should not be considered professional advice. Pro Tax Accountant strives to ensure the accuracy and timeliness of the information but makes no guarantees, express or implied, regarding its completeness, reliability, suitability, or availability. Any reliance on this information is at your own risk. Note that some data presented in charts or graphs may not be 100% accurate.

We encourage all readers to consult with a qualified professional before making any decisions based on the information provided. The tax and accounting rules in the UK are subject to change and can vary depending on individual circumstances. Therefore, PTA cannot be held liable for any errors, omissions, or inaccuracies published. The firm is not responsible for any losses, injuries, or damages arising from the display or use of this information.

.png)