5644 Tax Code

- Adil Akhtar

- Aug 6, 2025

- 13 min read

Updated: Aug 11, 2025

The Audio Summary of the Key Points of the Article:

Decoding the 5644L Tax Code for UK Taxpayers

So, you’ve just checked your payslip and spotted the tax code 5644L. What’s that all about? For most UK taxpayers, seeing an unfamiliar tax code can feel like decoding a secret message. Don’t worry—this section will break down exactly what 5644L means, why HMRC might have slapped it on your income, and how it ties into your taxes for the 2025/26 tax year. Let’s get stuck in with the basics and some hard numbers to make it crystal clear.

What Is the 5644L Tax Code?

Now, if you’re scratching your head over 5644L, here’s the deal: it’s an emergency tax code used by HMRC when they don’t have enough information about your income or tax situation. The “5644” part suggests a temporary Personal Allowance of £5,644 for the tax year, while the “L” indicates a standard tax-free allowance without additional tweaks (like “M” for Marriage Allowance or “T” for temporary). This code is typically applied to new employees, those switching jobs, or anyone whose tax details are incomplete—like if you’ve just moved to the UK or started a new gig without a P45.

In the 2025/26 tax year, the standard Personal Allowance is £12,570 [www.gov.uk/income-tax-rates].

So why only £5,644? HMRC often uses a pro-rated allowance when they’re unsure of your full-year earnings, assuming you’re only taxable for part of the year. This can lead to overtaxing, as we’ll explore later.

Why Has HMRC Given Me 5644L?

None of us love surprises on our payslips, but 5644L usually pops up for specific reasons. HMRC assigns emergency tax codes like 5644L when they lack your complete tax history. Common scenarios include:

● Starting a new job without handing over a P45 (the form detailing your previous earnings and tax paid).

● Returning to work after a period of unemployment or self-employment.

● Moving to the UK and starting employment without a full tax record.

● HMRC errors—yes, they happen! If your employer or HMRC miscommunicates, you might end up with a temporary code.

Be careful! If you’re on 5644L, it’s often a sign HMRC is working with limited info, which could mean you’re paying more tax than you should—or, in rare cases, less. Let’s look at how this code affects your income.

How Does 5644L Impact Your Taxes?

Now, consider this: If you’re on 5644L, your tax-free allowance is capped at £5,644 for the year, instead of the full £12,570. This means more of your income is taxed at your marginal rate (20% for basic rate taxpayers, 40% for higher rate, or 45% for additional rate in 2025/26). Here’s a quick table to show how it works for a £30,000 annual salary in England, Wales, or Northern Ireland:

Table 1: Tax Calculation with 5644L vs. Standard 12570L (2025/26)

Tax Code | Tax-Free Allowance | Taxable Income (£30,000 Salary) | Tax Paid (20% Basic Rate) | Net Pay After Tax |

5644L | £5,644 | £24,356 | £4,871.20 | £25,128.80 |

12570L | £12,570 | £17,430 | £3,486.00 | £26,514.00 |

Source: Based on HMRC income tax rates for 2025/26 [www.gov.uk/income-tax-rates]. Assumes no other deductions.

As you can see, 5644L results in £1,385.20 more in tax compared to the standard 12570L code, reducing your take-home pay. For business owners managing payroll, this could affect multiple employees, especially if HMRC hasn’t updated their records.

Let’s bring this to life with a scenario. Meet Amara Choudhury, a graphic designer in Manchester who started a new job in April 2025. Without a P45 from her previous employer, HMRC assigns her 5644L. On her £2,500 monthly salary (£30,000 annually), she’s taxed on £24,356 instead of £17,430, costing her an extra £115.43 per month. Amara notices her payslip looks lighter than expected—sound familiar?

How Does 5644L Fit with 2025/26 Tax Bands?

To understand the bigger picture, let’s map 5644L onto the 2025/26 tax bands for England, Wales, and Northern Ireland (Scotland has different bands, which we’ll touch on later). Here’s how your income is taxed after the allowance:

Table 2: 2025/26 Income Tax Bands (England, Wales, Northern Ireland)

Tax Band | Income Range | Tax Rate |

Personal Allowance | £0–£12,570 | 0% |

Basic Rate | £12,571–£50,270 | 20% |

Higher Rate | £50,271–£125,140 | 40% |

Additional Rate | Over £125,140 | 45% |

Source: HMRC [www.gov.uk/income-tax-rates].

With 5644L, your tax-free allowance is just £5,644, so you hit the 20% basic rate sooner. For higher earners, this can push more income into the 40% or 45% bands. In Scotland, the tax bands are different, with a starter rate of 19% (£12,571–£15,397) and additional bands like the intermediate rate (21%) and advanced rate (45%) [www.gov.uk/scottish-income-tax]. If you’re a Scottish taxpayer on 5644L, your tax code still applies, but the taxable portion of your income follows these bands.

When Does 5644L Cause Problems?

So, the question is: Why does 5644L trip people up? The main issue is overtaxing. Since £5,644 is less than half the standard Personal Allowance, you’re taxed on a larger chunk of your income. This is especially painful for:

● Low earners who should be tax-free up to £12,570 but lose out on the full allowance.

● High earners whose income pushes them into higher tax bands prematurely.

● Business owners who might see 5644L applied to employees, complicating payroll and morale.

In rare cases, 5644L might lead to under-taxing if you’ve had multiple jobs and HMRC underestimates your total income. Either way, it’s a temporary code, and fixing it is key to getting your taxes right. Let’s move on to how this plays out in practice and what you can do about it.

Navigating the Practical Impacts of the 5644L Tax Code

Right, so you’ve got a grip on what the 5644L tax code means and why it’s landed on your payslip. Now, let’s get into the nitty-gritty of how it actually affects your wallet and what you can do to sort it out. Whether you’re a taxpayer scratching your head over a lighter-than-expected paycheck or a business owner juggling payroll for your team, this section dives deep into the practical side of 5644L. We’ll cover how it messes with your take-home pay, what steps you can take to fix it, and some less obvious scenarios that might catch you out in the 2025/26 tax year. Let’s roll up our sleeves and tackle this.

How Does 5644L Affect Your Take-Home Pay?

Now, nobody likes seeing their hard-earned cash vanish into thin air, but 5644L can do exactly that. As we saw in Part 1, this emergency tax code gives you a tax-free allowance of just £5,644 instead of the standard £12,570 for 2025/26 [www.gov.uk/income-tax-rates]. That means more of your income gets taxed, often at the 20% basic rate—or higher if you earn above £50,270. For a £30,000 salary, you could be losing around £1,385 more in tax annually compared to the standard 12570L code (see Table 1 in Part 1).

Here’s where it stings: if you’re paid monthly, that’s about £115 less in your pocket each month. For someone like Declan O’Sullivan, a retail manager in Birmingham earning £40,000, the impact is even sharper. With 5644L, his taxable income jumps to £34,356 (instead of £27,430 with 12570L), costing him an extra £1,385 in tax at the 20% rate, plus potentially pushing £6,926 into the 40% higher rate band. That’s a hefty hit for an administrative glitch.

Can 5644L Lead to Over- or Under-Taxing?

Be careful! The 5644L code is a blunt tool, and it can swing both ways. Most commonly, it leads to overtaxing because your tax-free allowance is slashed. But in rare cases, it might cause under-taxing if you’ve got multiple income sources and HMRC hasn’t caught up. For example, if you’re freelancing on the side and your employer applies 5644L to your main job, HMRC might not account for your total income, leaving you with a tax bill later.

Let’s break it down with a case study. Meera Patel, a self-employed consultant in London, takes a part-time PAYE job in 2025. Without a P45, her employer applies 5644L. Her £20,000 part-time salary is taxed on £14,356, costing her £2,871 in tax instead of £1,486 with the full £12,570 allowance. Meanwhile, her self-employed income is taxed separately via Self Assessment. If HMRC later adjusts her code to 12570L, she could claim a refund—but if her combined income pushes her into the 40% band, she might owe more. This dual-income scenario is a classic trap with emergency codes.

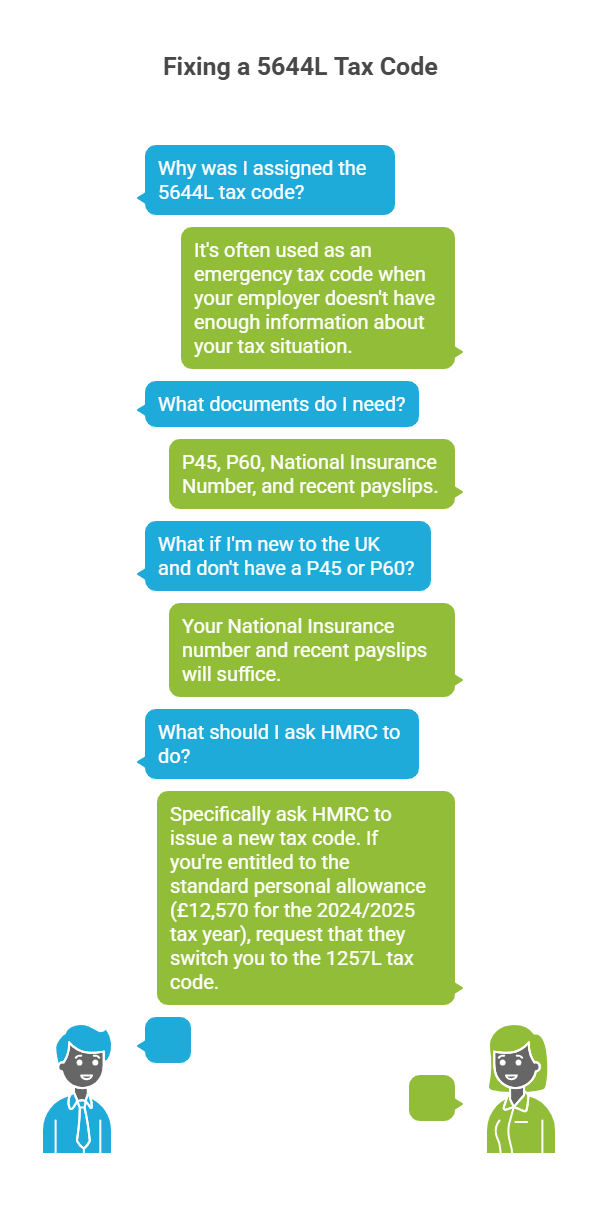

How Can You Fix a 5644L Tax Code?

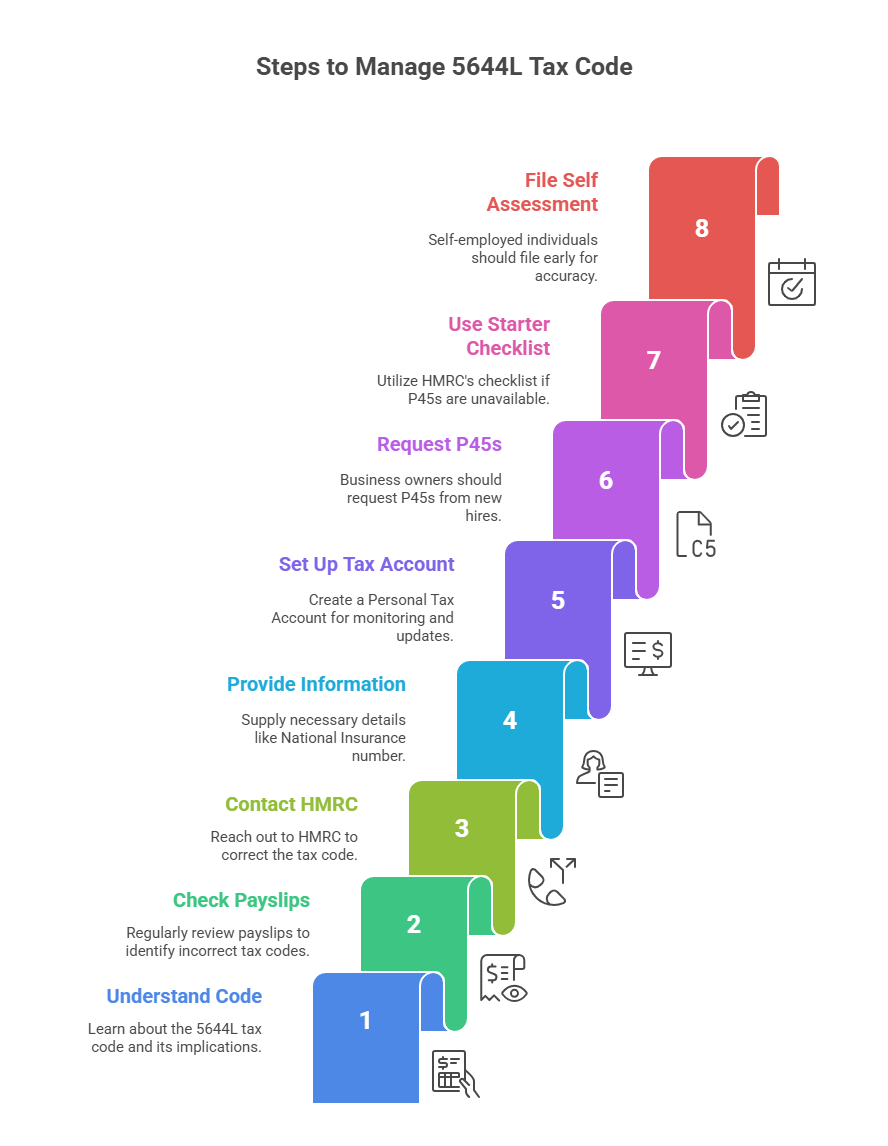

So, the question is: How do you get off this emergency code and back to normal? The good news is, it’s fixable, but it takes a bit of legwork. HMRC needs your correct tax details to assign the standard 12570L code (or another, depending on your circumstances). Here’s a step-by-step guide to sorting it out:

Check Your Payslip: Confirm you’re on 5644L and note any discrepancies in your take-home pay. Cross-check with your expected net pay using HMRC’s tax calculator [www.gov.uk/check-income-tax-current-year].

Gather Your Documents: Find your P45 (if you have one from a previous job) or P60 (from the last tax year). If you’re new to the UK or don’t have these, grab your National Insurance number and recent payslips.

Contact Your Employer: Ask your payroll team why 5644L was applied. If you didn’t provide a P45, they may have defaulted to it. Give them your P45 or confirm your tax status.

Reach Out to HMRC: If your employer can’t help, contact HMRC directly via their Income Tax helpline (0300 200 3300) or through your Personal Tax Account online [www.gov.uk/personal-tax-account]. Explain your situation and provide details like your NI number, employment history, and income sources.

Request a Tax Code Update: Ask HMRC to issue a new tax code. If you’re entitled to the full £12,570 allowance, they’ll switch you to 12570L. If you have other allowances (e.g., Marriage Allowance), they’ll adjust accordingly.

Check for Refunds: If you’ve been overtaxed, HMRC will refund the excess, usually through your next payslip or a cheque. You can track this via your Personal Tax Account.

Monitor Your Payslips: Once updated, ensure your new tax code is applied correctly. If not, follow up with HMRC immediately.

This process usually takes a few weeks, but HMRC can backdate adjustments to the start of the tax year (6 April 2025), ensuring you get any overpaid tax back.

What About Business Owners Managing 5644L?

Now, if you’re a small business owner, 5644L can be a payroll headache. Imagine you’ve hired Kieran Walsh, a new employee in Leeds, who starts without a P45. Your payroll software defaults to 5644L, and Kieran’s first payslip shows he’s overtaxed. He’s frustrated, and you’re stuck explaining HMRC’s quirks. To avoid this:

● Ask for a P45: Always request a P45 from new hires. If they don’t have one, use HMRC’s Starter Checklist to gather their tax details.

● Run Payroll Carefully: Ensure your payroll system applies 5644L only as a last resort. Double-check with HMRC if you’re unsure.

● Communicate with Employees: Be upfront about emergency codes and encourage workers to check their tax status with HMRC. This builds trust and avoids disputes.

For businesses with multiple employees on 5644L, the cumulative overtaxing can strain cash flow if refunds are delayed. Use HMRC’s Employer Helpline (0300 200 3200) to clarify bulk issues.

Are There Niche Scenarios to Watch For?

Now, consider this: 5644L isn’t just a new-job problem. It can crop up in less common situations, especially for taxpayers with complex finances. Here are two scenarios to watch for in 2025/26:

● Self-Employed Transitioning to PAYE: If you’ve been self-employed and move to a PAYE job, HMRC might apply 5644L if your Self Assessment records aren’t linked to your new employment. To fix this, update your Personal Tax Account with both income sources.

● Multiple Jobs or Pensions: If you’ve got two jobs or a pension alongside employment, 5644L might be applied to one income source, skewing your tax. HMRC should split your £12,570 allowance across sources, but errors happen. Contact HMRC to allocate your allowance correctly.

Let’s look at a case study. Sofia Mendes, a nurse in Glasgow, works part-time for the NHS and picks up agency shifts in 2025. Her agency applies 5644L, assuming it’s her only job, while the NHS uses 12570L. This double-dipping into her allowance causes overtaxing on her agency income. After contacting HMRC, Sofia gets a new code (e.g., 6285L for one job, 6285L for the other, splitting the £12,570 allowance). She claims a £900 refund for overpaid tax.

How Can You Plan for 2025/26 with 5644L?

None of us want to be caught off guard by tax codes, so proactive planning is key. For taxpayers, set up a Personal Tax Account to monitor your code in real-time. For business owners, invest in reliable payroll software that flags emergency codes like 5644L. If you’re self-employed or have multiple incomes, file your Self Assessment early (by October 2025 for paper returns, January 2026 for online) to ensure HMRC has your full income picture.

Here’s a quick checklist to stay ahead:

● Check your tax code monthly on payslips or P60s.

● Update HMRC with any job or income changes via [www.gov.uk/personal-tax-account].

● Keep records of all employment documents (P45, P60, payslips).

● If overtaxed, claim refunds promptly to avoid cash flow issues.

By tackling 5644L head-on, you can save money and stress.

Key Takeaways for Managing Your 5644L Tax Code

Right, we’ve dug deep into the 5644L tax code, from what it means to how it messes with your pay and what you can do to fix it. Now, let’s tie it all together with a clear, no-nonsense summary of the most important points for UK taxpayers and business owners in the 2025/26 tax year. This section boils down everything you need to know into bite-sized, actionable insights. Whether you’re an employee wondering why your payslip looks off or a business owner sorting out payroll, these takeaways will help you stay on top of things. Let’s wrap this up with clarity and confidence.

Key Takeaways for 2025/26

The 5644L tax code is an emergency measure used by HMRC when they lack full details about your income, often applied to new employees, job switchers, or those new to the UK, giving you a reduced tax-free allowance of £5,644 instead of the standard £12,570.

It can lead to overtaxing because the lower £5,644 allowance means more of your income is taxed, potentially costing you hundreds or thousands of pounds annually, depending on your salary.

Undertaxing is a rare risk if you have multiple income sources and HMRC underestimates your total earnings, which could result in a surprise tax bill later.

You can fix 5644L by contacting HMRC through their helpline (0300 200 3300) or your Personal Tax Account [www.gov.uk/personal-tax-account], providing details like your National Insurance number and employment history to get the correct code, usually 12570L.

Check your payslips regularly to spot 5644L or other incorrect tax codes early, ensuring you’re not overpaying tax unnecessarily.

Business owners must manage 5644L in payroll by requesting P45s from new hires and using HMRC’s Starter Checklist to avoid defaulting to emergency codes, which can frustrate employees and complicate finances.

Refunds are possible if overtaxed—HMRC can backdate adjustments to 6 April 2025, returning overpaid tax via your payslip or a cheque.

Niche scenarios like multiple jobs or self-employment can complicate 5644L’s impact, so update HMRC with all income sources to ensure your tax-free allowance is allocated correctly.

Proactive planning prevents problems—set up a Personal Tax Account, file Self Assessment early, and keep records like P45s and P60s to stay ahead of tax code issues.

Use HMRC tools for clarity—check your tax code and calculate your tax liability with HMRC’s online calculator [www.gov.uk/check-income-tax-current-year] to stay informed and in control

FAQs

Q1: What does the ‘L’ in the 5644L tax code stand for?

A1: The ‘L’ in the 5644L tax code indicates a standard tax-free Personal Allowance, but the code itself provides a reduced allowance of £5,644, typically used as an emergency measure.

Q2: Why might someone be assigned the 5644L tax code?

A2: HMRC assigns the 5644L tax code when they lack complete information about a person’s income, such as for new employees without a P45, those returning to work, or individuals new to the UK.

Q3: How does the 5644L tax code differ from the standard 12570L code?

A3: The 5644L code provides a tax-free allowance of £5,644, while the 12570L code offers the full Personal Allowance of £12,570, leading to higher tax deductions with 5644L.

Q4: Can the 5644L tax code be applied to pensions?

A4: Yes, the 5644L tax code can be applied to pensions if HMRC lacks full details about a pensioner’s income, often leading to temporary overtaxing.

Q5: What happens if someone stays on the 5644L tax code for the entire tax year?

A5: Staying on 5644L all year usually results in overtaxing, as the reduced £5,644 allowance means more income is taxed, but a refund can be claimed if corrected.

Q6: Can the 5644L tax code affect tax credits?

A6: Yes, an incorrect tax code like 5644L can reduce take-home pay, potentially affecting eligibility for tax credits, which depend on income levels.

Q7: How long does it take to correct a 5644L tax code?

A7: Correcting a 5644L tax code typically takes a few weeks after contacting HMRC, with adjustments often backdated to the start of the tax year.

Q8: Does the 5644L tax code apply in Scotland?

A8: Yes, the 5644L tax code applies in Scotland, but the taxable income is subject to Scottish income tax rates, which differ from those in England, Wales, and Northern Ireland.

Q9: Can someone on 5644L claim a tax refund online?

A9: Yes, individuals can claim a refund for overpaid tax due to the 5644L code through their Personal Tax Account on the HMRC website.

Q10: What documents are needed to correct a 5644L tax code?

A10: A P45, P60, National Insurance number, or recent payslips are typically needed to provide HMRC with accurate income details to correct the 5644L code.

Q11: Can the 5644L tax code affect student loan repayments?

A11: Yes, as 5644L increases taxable income, it may lead to higher student loan repayments, which are calculated based on income above a threshold.

Q12: Is the 5644L tax code used for self-employed individuals?

A12: The 5644L code is typically for PAYE employees, but self-employed individuals transitioning to PAYE jobs may be assigned it if their tax details are incomplete.

Q13: How does 5644L affect someone with a side hustle?

A13: For someone with a side hustle, 5644L on their main job may lead to overtaxing, but their self-employed income is taxed separately via Self Assessment.

Q14: Can an employer change the 5644L tax code themselves?

A14: Employers cannot change tax codes directly; they must use the code provided by HMRC, but they can submit updated employee details to prompt a change.

Q15: What are the risks of ignoring the 5644L tax code?

A15: Ignoring 5644L risks overpaying tax throughout the year, reducing take-home pay, though a refund can be claimed once corrected.

Q16: Does the 5644L tax code affect Universal Credit payments?

A16: Yes, as 5644L reduces net income, it may increase Universal Credit payments, which are based on take-home pay, until the tax code is corrected.

Q17: Can someone appeal a 5644L tax code decision?

A17: There’s no formal appeal for tax codes, but individuals can contact HMRC to provide evidence and request a correction to their tax code.

Q18: How does 5644L impact high earners?

A18: For high earners, 5644L pushes more income into the 40% or 45% tax bands due to the reduced allowance, significantly increasing their tax liability.

Q19: Can the 5644L tax code be applied to temporary workers?

A19: Yes, temporary workers are often assigned 5644L if they lack a P45 or prior tax records, leading to potential overtaxing during their employment.

Q20: What should someone do if they suspect their 5644L code is incorrect?

A20: They should check their payslips, gather employment documents, and contact HMRC via their helpline or Personal Tax Account to request a corrected tax code.

About The Author:

Adil Akhtar, ACMA, CGMA, CEO and Chief Accountant of Pro Tax Accountant, is an esteemed tax blog writer with over 18 years of expertise in navigating complex tax matters. For more than three years, his insightful blogs have empowered UK taxpayers with clear, actionable advice. Leading Advantax Accountants as well, Adil blends technical prowess with a passion for demystifying finance, cementing his reputation as a trusted authority in tax education.

Email: adilacma@icloud.com

Disclaimer:

The information provided in our articles is for general informational purposes only and is not intended as professional advice. While we strive to keep the information up-to-date and correct, Pro Tax Accountant makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained in the articles for any purpose. Any reliance you place on such information is therefore strictly at your own risk. Some of the data in the above graphs may to give 100% accurate data.

.png)