What is Tax Code 1257L?

- Adil Akhtar

- Dec 10, 2021

- 27 min read

Updated: Aug 31, 2025

Checking Your Tax Code: What 1257L Means (and Why It Matters)

Straightaway answer: what 1257L means for your 2025/26 tax year

1257L is HMRC’s most common PAYE tax code for 2025/26. It shows you’re entitled to the full Personal Allowance of £12,570—the amount you can earn before paying income tax. The code “1257” equals £12,570 divided by ten, while the “L” signals standard allowance, no tweaks.FreeTaxCalculator.co.ukGOV.UK

In practical terms: you get £1,047.50 tax-free per month (or £242.50 per week) before income tax starts being taken off.knowyourpound.co.ukPatterson Hall Chartered Accountants

Why this matters—and what’s unique in this guide

Picture this: you flick through your payslip and see 1257L—but that doesn’t mean you should shrug and move on. I’ve seen clients in London overpay hundreds simply because their tax code didn’t reflect side gigs, benefits—or even marriage allowance transfers. Generic blogs often say “1257L means standard allowance”—period. I want to go deeper: how to verify, correct, and use it to avoid overpaying, especially if you're balancing multiple income sources, handling Scottish or Welsh variations, or facing emergency tax situations.

How 1257L is calculated—plain English breakdown

Step-by-step, as I explain to a client with a hot tea in hand:

HMRC starts with your Personal Allowance—£12,570 for 2025/26.

Divides by ten—so it becomes 1257

Adds the letter L, meaning "standard personal allowance applies" (no marriage allowances, no benefits reductions).

Exceptions: If you live in Scotland or Wales, you may see codes beginning with S or C—like S1257L for Scotland or C1257L for Wales—reflecting different tax rate bands.

And if you've had adjustments—like benefits in kind—that reduce your allowance, you'd see codes like 1100L or 669L instead. There’s a personal case I remember: a client with a P11D medical benefit found their allowance dropped by £1,570, reducing their code to 1100L—they were surprised, to say the least.

Real-world calculation example

Let’s say Sarah from Manchester earns £41,700 per annum:

Description | Amount |

Gross Income | £41,700 |

Personal Allowance | £12,570 |

Taxable Income | £29,130 |

Income Tax @ 20% | £5,826 |

That means £5,826 tax for the year—deducted across her payslips using 1257L.

Why this matters

● Ensures fair distribution across the year (cumulative coding), adjusting if you had unusual early earnings or emergency tax.

● Spot-checking this helps catch errors early—one client discovered they were missing their marriage allowance transfer, costing them £250. By alerting HMRC, we got a code adjustment and a refund.

Who you’ll usually see with 1257L—and who won’t

You’re most likely to have 1257L if you:

● Have a single job or pension

● Don’t receive benefits in kind or untaxed income

● Haven’t transferred any allowance (e.g. Marriage Allowance)

● Are fully entitled to the standard Personal Allowance.

But watch out if:

● You have more than one job or pension—secondary jobs often use BR, D0, or D1 codes to avoid double allowance.

● You have employer benefits (car, medical), which lower your allowance—reflected in codes like 1157L, 669L.

● You’re on an emergency code like 1257LW1 or 1257LM1—used when details haven’t been set.

Why checking 1257L is so important (on the ground insight)

I've had clients come in thinking everything’s fine—until we check their payslips and they’ve been on 1257L all year, despite a mid-year bonus or side gig. Sometimes it’s incorrect emergency coding; other times, HMRC simply didn’t get updated. According to a MoneyWeek survey, 32% of adults had never checked their tax code, risking over- or under-payment.

And the financial impact is very real—a Sun report showed many people overpay by hundreds and can claim refunds going back four years.

What to do if something looks off

Here’s your quick checklist after spotting 1257L on your payslip:

● Log into your HMRC Personal Tax Account—you’ll see your current code and how it's calculated.

● Check for things you know about that may not yet reflect—benefits, side income, Marriage Allowance.

● If you've changed jobs or your circumstances, make sure those changes are updated—missing P45s or un-notified benefits can mean emergency tax.

● If you're due a refund—or owe tax—HMRC will usually notify you via a P800 letter.

UK Tax Code 1257L Dashboard

Step-by-Step: Checking Your Tax Code and Spotting Errors

Why step-by-step checks matter more than you think

None of us likes tax surprises. Yet in my 18-plus years advising clients, I’ve lost count of the number who discovered—far too late—that their 1257L tax code wasn’t right for their situation. By then, HMRC had collected hundreds more than they should, or under-collected—triggering a nasty year-end bill. The trick is catching it early. That’s where a structured, step-by-step check comes in.

Step 1: Log into your HMRC Personal Tax Account

Your HMRC Personal Tax Account (via gov.uk) is the goldmine.

Here’s what you’ll see:

● Current tax code for each employment or pension.

● Breakdown of how HMRC calculated it—allowances, deductions, adjustments.

● Pay-to-date figures sent by your employer each month under RTI.

Pro insight: I often ask clients to screenshot their allowance breakdown. That way, when they say “but I don’t get private health insurance”, I can show them exactly where HMRC has reduced their code incorrectly.

Step 2: Check your payslip against HMRC’s numbers

Picture this: You’re staring at your payslip and it shows 1257L. Now ask—does it match the “pay-to-date” HMRC shows?

Here’s how to compare:

Look at Gross Pay Year-to-Date on your payslip.

Log into your account—compare with HMRC’s record.

If they’re mismatched, HMRC may not have your latest P45 or your employer may be reporting incorrectly.

Case study: A client in Leeds switched jobs in September 2024. Her new employer mistakenly treated her as having the full £12,570 allowance again. By January 2025, she owed HMRC £1,100 in underpaid tax. A five-minute payslip check could have caught it.

Step 3: Re-work the calculation manually

Now, let’s say you want to sanity-check the actual numbers yourself. Here’s a manual method I use with junior accountants in training:

Take your annual salary (e.g. £38,000).

Subtract £12,570 (Personal Allowance).

Apply bands:

○ 20% basic rate on income up to £50,270.

○ 40% higher rate between £50,271 and £125,140.

○ 45% additional rate above £125,140.

Worked example – James in Bristol earns £60,000:

● Salary: £60,000

● Less allowance: £12,570 → £47,430 taxable

● First £37,700 @ 20% = £7,540

● Remaining £9,730 @ 40% = £3,892

● Total tax = £11,432

If James’ payslips don’t broadly line up with that across the year, something’s off.

Step 4: Watch for emergency codes

If you see 1257L W1, 1257L M1, or 1257L X, alarm bells should ring.

These are emergency tax codes, used when HMRC doesn’t have full details. Instead of spreading your allowance across the year (cumulative), they tax each week/month in isolation.

Real-life trap: One contractor I worked with in Birmingham earned £4,500 in their first month. On 1257L M1, HMRC treated that as if they’d earn £54,000 a year—so they paid higher rate tax right away. It took three months before we straightened it, but the overpayment wasn’t refunded until after the year-end.

Step 5: Adjust for multiple incomes

Now let’s think about your situation if you’ve got more than one job, pension, or side hustle.

● HMRC usually gives the full 1257L to your main job.

● Secondary jobs/pensions get a BR (Basic Rate) or D0/D1 (Higher/Additional Rate) code.

● This avoids you wrongly receiving two allowances.

Checklist for multiple incomes:

● Confirm which job HMRC has tagged as your “main” income.

● If the wrong one has 1257L, call HMRC—switching it can stop mis-deductions.

● Keep an eye on Self Assessment—side gigs often need extra reporting.

Case study: A retired teacher with two pensions came to me last year. Both pensions were coded 1257L. She effectively got a £25,140 allowance—but HMRC spotted it the next year and clawed back £4,800. Painful.

Step 6: Look out for Marriage Allowance

If your partner has unused allowance, you can transfer £1,260 to you—adjusting codes to M or N.

● Example: If you receive, your code might become 1373M.

● If you give, it’ll show as 1144N.

Common mistake: Couples apply but HMRC doesn’t adjust until the next year—so you miss the benefit in-year. Always check the code actually reflects the transfer.

Step 7: Benefits in kind and deductions

Employer perks—cars, fuel, medical cover—reduce your allowance. HMRC codes them in as “deductions”.

Client anecdote: I had a City banker who swore his car benefit was already taxed. Turns out HMRC reduced his allowance by £8,000 via code 457L. He hadn’t checked, so when his employer also deducted benefit tax at payroll, he was double-hit. We corrected it, but not before months of cash flow strain.

What if you’re self-employed?

So, the big question on your mind might be: what if you’re self-employed? Truth is, you don’t really “use” 1257L—PAYE codes don’t apply.

But here’s the link:

● You still get the £12,570 allowance in your Self Assessment.

● If you also have PAYE income, HMRC sometimes adjusts your code to collect expected self-employment tax in-year.

Example: A freelance designer with a PAYE part-time role had code 875L. Why? HMRC reduced it by £3,700 to collect tax on her side income each month. It avoided a big January bill but gave her surprise smaller payslips.

Special note: Scottish and Welsh taxpayers

Scotland and Wales use the same allowance (£12,570) but have different rate bands.

Scotland 2025/26 (confirmed):

● Starter rate 19% up to £2,306 above allowance.

● Basic 20% up to £13,991 above that.

● Intermediate 21% up to £31,092.

● Higher 42% up to £125,140.

● Top 47% above £125,140.

So, an S1257L code means you still get the full allowance but Scottish rates apply.

Wales 2025/26: Currently mirrors England/Northern Ireland, but prefixed C (e.g., C1257L).

Pro tip: Don’t assume your rate band is the same as colleagues in London if you’re in Glasgow. I’ve had many confused Scots wondering why their take-home was smaller than their English peers.

Common pitfalls taxpayers face

Here are the slip-ups I see repeatedly with 1257L:

● Assuming “1257L = correct”. Not always!

● Not updating HMRC when jobs change.

● Forgetting to factor in benefits or allowances.

● Ignoring emergency codes for months.

● Not realising multiple jobs need split coding.

Quick worksheet: your tax code self-check

Grab a pen and tick through:

Is your tax code 1257L (or S1257L/C1257L) on your payslip?

Does HMRC’s Personal Tax Account show the same?

Is your gross-to-date pay consistent with HMRC’s figure?

Are benefits in kind correctly reflected?

Do you only get one personal allowance across all incomes?

Have Marriage Allowance transfers been coded?

Are you on a cumulative code, not W1/M1/X emergency?

Do your payslip tax deductions broadly match manual checks?

If you ticked “no” on any, it’s time to contact HMRC or an accountant.

Why this step-by-step matters

Be careful here—because I’ve seen clients trip up when they assume “HMRC will fix it”. Yes, they often do—but usually after a year-end review, not in time to protect your cash flow. A proactive check means:

● No surprise January tax bills.

● No hidden overpayments sitting with HMRC.

● Peace of mind your payslip is right.

Scenarios and Adjustments for the 1257L Tax Code

In this final part, we delve into specific scenarios where the 1257L tax code may need adjustments, common issues that taxpayers face, and strategies to maximize the benefits of your tax-free personal allowance. Understanding these nuances can help you navigate the UK tax system more effectively and ensure that your tax obligations are accurately managed.

When Your Tax Code Might Change

As life circumstances change, so too might your tax code. Here are some common scenarios where adjustments to the 1257L tax code are necessary:

Multiple Sources of Income: If you have more than one job, or if you receive income from both employment and a pension, HMRC may adjust your tax code to reflect how your personal allowance is distributed across these income sources. Typically, your main source of income will retain the 1257L code, while additional sources may be assigned different codes like BR (basic rate) or D0 (higher rate), which do not include a personal allowance.

Receiving Taxable Benefits: Benefits in kind, such as a company car, private healthcare, or other perks provided by your employer, are subject to tax. These benefits reduce your personal allowance, meaning your tax code will be adjusted accordingly. For example, if the taxable value of your company car is £2,000, your tax code might be reduced to 1057L to reflect this reduction in your tax-free personal allowance.

Marriage and Civil Partnerships: The Marriage Allowance allows you to transfer up to 10% of your personal allowance to your spouse or civil partner if they earn below the personal allowance threshold. If you apply for the Marriage Allowance, your tax code may change to include an "N" or "M" suffix, indicating that you’ve either transferred part of your allowance or received it from your partner.

Change in Employment Status: If you move from self-employment to employment, or vice versa, your tax code will be adjusted to reflect your new status. Self-employed individuals typically pay taxes through self-assessment, while employed individuals pay through PAYE (Pay As You Earn). Transitioning between these statuses can lead to temporary tax code changes, such as being placed on an emergency tax code until HMRC has all the necessary information.

Common Issues with the 1257L Tax Code

Even though the 1257L tax code is designed to be straightforward, several issues can arise that might lead to incorrect tax payments:

Emergency Tax Codes: If you start a new job and your employer doesn’t have your previous tax details, they might put you on an emergency tax code (such as 1257L W1 or M1). This means your personal allowance is applied to only one pay period, not the entire year, which could result in overpayment of taxes until the correct code is applied.

Incorrect Allocation of Personal Allowance: If you have multiple jobs and your personal allowance is not correctly allocated between them, you might end up paying too much or too little tax. For example, if your main job uses up all of your personal allowance and your second job is taxed at the basic rate without any allowance, you might overpay.

Unreported Changes in Circumstances: If you fail to inform HMRC about changes in your circumstances, such as receiving a new taxable benefit or changing jobs, your tax code might not be updated in time. This can lead to underpayment or overpayment of tax, resulting in a tax bill at the end of the year or a refund from HMRC.

Maximising Your Tax-Free Personal Allowance

To make the most of your tax-free personal allowance, it’s essential to keep your tax code up to date and take advantage of any available tax reliefs. Here are some strategies:

Review Your Tax Code Annually: At the start of each tax year, review your tax code on your payslip or through your HMRC Personal Tax Account. Ensure that it accurately reflects your current situation, including any benefits, additional income, or changes in employment status.

Apply for the Marriage Allowance: If you’re eligible, applying for the Marriage Allowance can reduce your overall tax liability by transferring part of your unused personal allowance to your spouse. This can be particularly beneficial if one partner earns below the personal allowance threshold.

Claim Tax Reliefs: Depending on your circumstances, you might be eligible for various tax reliefs, such as relief on pension contributions, charitable donations, or work-related expenses. These can further reduce your taxable income and maximise the benefit of your personal allowance.

Monitor Changes in Benefits and Income: Any changes to your taxable benefits or income levels should be reported to HMRC as soon as possible. This ensures that your tax code is adjusted in real-time, minimising the risk of overpaying or underpaying tax throughout the year.

Handling a Change from 1257L to Another Code

If your tax code changes from 1257L to another code due to changes in your circumstances, here’s what you should do:

Understand the Reason for the Change: HMRC typically provides a reason when they change your tax code. It could be due to receiving a taxable benefit, changes in your employment, or adjustments for previous underpaid tax. Understanding the reason helps you determine if the change is accurate.

Check the New Code: Compare your new tax code against your current financial situation. If the new code doesn’t seem right, or if you don’t understand the change, contact HMRC for clarification. They can provide a detailed explanation and correct any errors.

Plan for Adjusted Payments: If your new tax code results in higher tax deductions, plan your budget accordingly. Conversely, if you receive a higher personal allowance, you might see an increase in your take-home pay.

The 1257L tax code is central to the UK's PAYE system, providing most taxpayers with a straightforward way to manage their income tax obligations. However, life events, employment changes, and additional income sources can lead to adjustments in your tax code. By staying informed, regularly reviewing your tax code, and promptly addressing any discrepancies with HMRC, you can ensure that you’re paying the correct amount of tax throughout the year. Whether you're managing multiple income sources, receiving taxable benefits, or taking advantage of tax reliefs, understanding your tax code is key to effective financial planning.

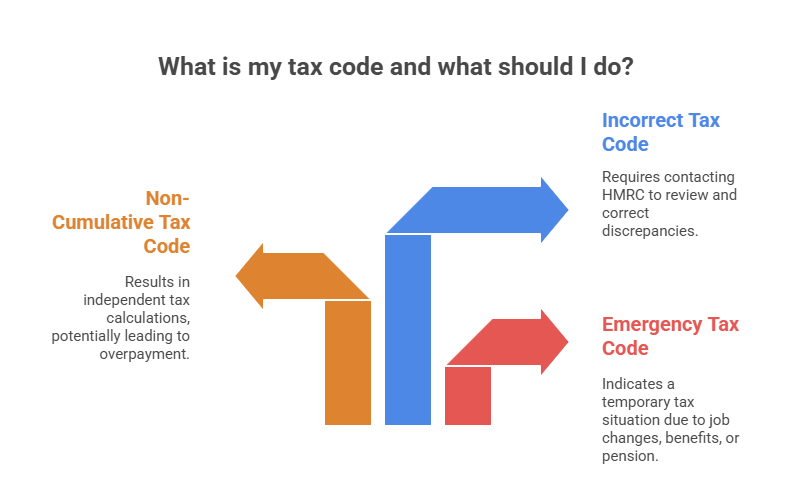

What Are the Emergency Tax Codes 1257 W1, 1257 M1, 1257 X?

If you have a tax number 1257W1, 1257M1, or 1257X, you are listed in the emergency tax number. This usually happens if you:

Start a new job and don't give the P45

Start working with your employer after leaving a free launch

Get business benefits, like company cars

Get a state pension

If your code is attached to W1 or M1, it is a non-cumulative tax code. The tax payable on each payment is determined regardless of the tax paid this year or the number of tax-free personal checks used. That is, it can lead to overpayments of taxes.

Although an emergency social security number is temporary because the necessary information is collected, this means that you will pay taxes on all of your income in addition to your personal benefit and will not receive any late payment of the personal benefit that you may be entitled to but not right.

If you close the tax year with a contingent tax number, HMRC will fill in the full amount of tax you paid and decide if you owe anything at the end of the tax year. They will then send you an HMRC tax identification notification letter called P800 detailing what you owe and how you will be compensated. If you are registered as a self-employed person, the money you owe will be credited to your tax account.

I Have a Tax Number 1257 For. Is My Social Security Number Incorrect?

Most employees have a correct 1257L tax identification number. A person with only one job and no tax-free benefits or allowance usually have the correct social security number. However, the tax code system can fail quickly. Common examples include:

• Change jobs, have more than one job, start, leave or retire during the year

• You have more than one source of income, such as a job and a pension.

• Changes to tax-free benefits, such as paying a professional fee.

• Changes in taxable profits, such as the supply of company trucks for private use.

Beyond the Basics: Business Owners, Tricky Cases, and Fixing Your Code

Why business owners need to look twice at tax codes

Now, let’s think about your situation if you’re running a business. You might assume PAYE codes like 1257L don’t matter if you’re drawing dividends or profit shares. But here’s where many directors and contractors get caught out: your PAYE code often becomes HMRC’s “balancing tool” for other income.

Example: I had a client—Amir, a director in Birmingham—who paid himself a small salary and dividends. HMRC adjusted his PAYE code down to 457L, collecting tax in-year against estimated dividend income. Trouble was, his dividends dropped sharply mid-year. He overpaid £2,300 and only got it back after a painful reclaim process.

Lesson: If your income mix shifts, check your code reflects reality, not HMRC’s old estimate.

CIS contractors and 1257L

If you’re a contractor in the Construction Industry Scheme (CIS), tax coding gets even trickier.

● Your contractor deducts 20% at source (or 30% if not verified).

● But HMRC may still give you a PAYE tax code if you’ve got a PAYE job alongside.

● Mistakes happen when HMRC assumes your CIS deductions cover PAYE—or vice versa.

Case study: A self-employed electrician had a part-time PAYE role coded 1257L. HMRC later discovered CIS tax hadn’t been credited properly, leaving him £1,700 underpaid. We had to chase contractor statements and amend the Self Assessment to sort it.

Landlords and side hustles

Got rental income, or a side hustle on Etsy or Deliveroo? Don’t assume it’s invisible until January Self Assessment. HMRC often reduces your PAYE code mid-year to collect expected tax.

Example: If you earn £4,000 rental profit, HMRC might reduce your allowance by that amount—code dropping to 857L. Your payslip shrinks even though the rent is separate income.

Pro tip: Sometimes it’s better to ask HMRC not to “code in” side income, and settle via Self Assessment instead. That way, you keep consistent payslips and better cash flow.

High-income Child Benefit Charge

Here’s a pitfall I’ve seen repeatedly since the High-Income Child Benefit Charge (HICBC) came in:

● If you (or your partner) claim Child Benefit and your income tops £50,000, HMRC claws back some/all of it.

● They often use PAYE coding to do it.

Example: A client in Surrey earning £56,000 had their allowance reduced in-year, turning 1257L into 657L. But his income later dipped below £50,000. HMRC still clawed back the full Child Benefit—until we corrected it via Self Assessment.

Takeaway: Don’t assume HMRC’s estimate matches your final income. If your earnings fluctuate, you may be over- or under-charged.

Rare but costly scenarios

In my years, I’ve also seen:

● Redundancy pay taxed wrong: Codes not updated to reflect £30,000 exemption.

● Company cars swapped mid-year: Old benefit still coded alongside new one—double hit.

● Remote workers abroad: PAYE code still set as UK resident despite non-residency—thousands overpaid.

These are the cases where a routine payslip glance isn’t enough—you need to dig deeper.

How to fix a wrong code quickly

So, the big question: what if your 1257L—or any code—looks wrong?

Here’s the professional route I recommend:

Call HMRC’s Income Tax helpline (0300 200 3300). Have your NI number and payslip handy.

Explain the error—whether it’s wrong benefits, duplicate allowance, or income estimates.

Ask for a coding notice (P2)—HMRC must send you one showing the correction.

Check your next payslip—errors can take 1–2 months to update in payroll.

File Self Assessment to mop up anything missed.

How to correct a wrong tax code?

Pro anecdote: A client in Manchester waited months for HMRC to act until we sent a written correction with evidence. Within three weeks, the new code was issued—and a £900 refund released.

How a Tax Accountant Can Help You with Tax Code 1257L

You can absolutely do most checks yourself. But a seasoned tax accountant adds value where HMRC systems fall short:

● Spotting patterns: I’ve seen hundreds of cases, so I recognise when a car benefit looks inflated, or an emergency code’s been left too long.

● Negotiating adjustments: HMRC can be slow—accountants know how to word letters and escalate cases.

● Cash-flow planning: Sometimes it’s better not to code in income, but pay via Self Assessment—we help decide which is smoother.

● Business owner strategy: Balancing salary, dividends, benefits, and allowances is an art. A good accountant makes sure your coding supports—not sabotages—your plan.

If you’re ever unsure, think of it like fixing a car engine. You can tinker yourself, but sometimes it pays to let a mechanic with years of grease on their hands get it right the first time.

Summary of Key Points

1257L means full Personal Allowance (£12,570) in 2025/26 – most UK employees will see it if they have no adjustments.

○ It gives you £1,047.50 tax-free per month or £242.50 per week.

Always check your code against HMRC’s Personal Tax Account.

○ Don’t assume “1257L” means correct; coding errors are common.

Emergency codes (W1/M1/X) tax each period in isolation.

○ This can cause temporary overpayments or higher rate deductions.

Multiple incomes mustn’t have duplicate allowances.

○ Only your main job/pension should carry 1257L—others usually get BR, D0, or D1.

Marriage Allowance, benefits in kind, and Child Benefit charges change your code.

○ Watch for suffixes like M, N, or unusual reductions.

Scottish and Welsh taxpayers have different prefixes.

○ S1257L and C1257L apply—don’t compare take-home blindly with English peers.

Business owners, landlords, and side hustlers often see reduced codes.

○ HMRC may “code in” estimates of dividends, rental profit, or freelance earnings.

Construction Industry Scheme (CIS) workers risk double-counting.

○ Check HMRC credits CIS tax correctly and PAYE coding isn’t skewing things.

Refunds can go back four years.

○ If you’ve been on the wrong code, you can reclaim—but you need evidence (P60s, payslips).

Professional advice pays off for complex cases.

● Accountants can prevent HMRC delays, plan cash flow, and optimise allowances across incomes.

Case Study: Dealing with Tax Code 1257L

Background

Meet James Whitfield, a 35-year-old software engineer living in Manchester, UK. James has been working with a tech company for the past five years and earns an annual salary of £40,000. His tax code is 1257L, which is the standard code used for most employees in the UK, indicating that he is entitled to the full personal allowance of £12,570 for the 2024/2025 tax year.

Discovering an Issue

In June 2024, James received his monthly payslip and noticed something unusual: the amount of tax deducted from his salary seemed higher than usual. His curiosity piqued, James decided to investigate further. He logged into his Personal Tax Account on the HMRC website and found that his tax code was still 1257L, which should have allowed him to receive £1,047.50 tax-free each month. However, his deductions were more aligned with a lower tax-free allowance.

Understanding the Tax Code

James learned that the numbers in the 1257L code represent his annual tax-free personal allowance (£12,570), which is divided across the year. The "L" simply indicates that there are no special circumstances affecting his personal allowance. This code is designed for individuals with straightforward tax situations, typically those with a single job and no untaxed income.

Identifying the Problem

James realized that his employer might have mistakenly applied an emergency tax code. Emergency tax codes are typically used when HMRC lacks sufficient information about an individual’s tax situation, often when someone starts a new job without providing their P45. In such cases, the personal allowance is applied to the current pay period only, not cumulatively, leading to potential overpayments.

To confirm his suspicion, James checked the specific figures on his payslip. His annual income of £40,000 should have been taxed as follows:

The first £12,570 should have been tax-free.

The remaining £27,430 should have been taxed at the basic rate of 20%, resulting in an annual tax bill of £5,486.

However, the amount of tax deducted suggested that a larger portion of his income was being taxed at a higher rate than expected. This discrepancy indicated that his personal allowance might not have been fully applied.

Taking Action

James knew he needed to resolve this quickly to avoid overpaying tax for the rest of the year. He contacted HMRC through their helpline, providing his National Insurance number, details about his income, and copies of his recent payslips. HMRC confirmed that an error had occurred: his employer had indeed used an incorrect tax code after a recent payroll system update.

HMRC issued a new coding notice to both James and his employer, correcting the tax code to 1257L. This change was reflected in James’s next payslip, where he noticed that the correct tax-free allowance was now being applied, and his tax deductions were in line with what they should have been.

Calculating the Impact

To understand the financial impact, James recalculated his tax payments for the first few months of the tax year. He found that due to the incorrect tax code, he had overpaid approximately £150 in tax. Fortunately, HMRC adjusted his tax code for the remainder of the year to account for this overpayment, meaning he would pay slightly less tax each month to correct the balance.

Learning from the Experience

This experience taught James the importance of regularly checking his tax code and payslips. He realised that even small errors in the tax code could lead to significant overpayments or underpayments over time. Going forward, he decided to make it a habit to review his tax situation annually, especially after any significant life changes, like a new job, marriage, or receiving additional income.

James’s case is a perfect example of how important it is to stay vigilant about your tax code. By understanding what his tax code meant and taking prompt action, James was able to correct an error that could have cost him hundreds of pounds over the course of the year. His proactive approach ensured that his tax deductions were accurate, reflecting his true financial situation.

For anyone in the UK, regular checks of your tax code, especially when you notice discrepancies in your payslip, can save you from potential headaches and financial loss. And if you ever find yourself in a similar situation, don’t hesitate to reach out to HMRC or seek the advice of a tax professional to get things sorted quickly.

How Can an Online Tax Accountant Help with Your Tax Code?

Managing your tax code in the UK can be a daunting task, especially given the complexities of the tax system and the various circumstances that can lead to changes in your tax code. An online tax accountant can provide invaluable assistance in navigating these challenges. This article explores the ways in which an online tax accountant can help you with your tax code, ensuring that you pay the correct amount of tax and avoid potential issues with HMRC.

Understanding and Reviewing Your Tax Code

One of the primary services that an online tax accountant offers is the ability to thoroughly review and understand your tax code. Your tax code is a crucial part of your financial life, as it determines how much tax you pay on your income. The standard tax code for most employees in the UK is 1257L, which allows for a personal allowance of £12,570 in the 2024/2025 tax year. However, this code can vary based on numerous factors such as multiple sources of income, receipt of taxable benefits, or changes in personal circumstances like marriage or retirement.

An online tax accountant can review your current tax code by analyzing your income sources, benefits, and any other relevant financial information. They can determine whether your tax code accurately reflects your situation. If discrepancies are found, the accountant can advise on the necessary steps to correct them, thereby ensuring that you are not overpaying or underpaying taxes.

Identifying and Correcting Errors

Errors in tax codes are not uncommon, and they can lead to significant financial consequences if not addressed promptly. Common issues include being placed on an emergency tax code, incorrect allocation of personal allowance, or failure to update the tax code after a change in circumstances.

An online tax accountant has the expertise to identify these errors quickly. For example, if you start a new job and are placed on an emergency tax code like 1257L W1 or M1, an accountant can help rectify this by contacting HMRC on your behalf. They will ensure that the correct tax code is applied, which can prevent overpayment of taxes throughout the year. Similarly, if you have multiple sources of income, an online tax accountant can ensure that your personal allowance is allocated correctly across these incomes, avoiding the risk of being taxed at a higher rate unnecessarily.

Navigating Complex Situations

Life events and financial changes can complicate your tax situation, making it difficult to manage your tax code. For instance, receiving taxable benefits such as a company car, or entering into a marriage or civil partnership, can affect your tax code. Additionally, if you have more than one job or receive a pension alongside your salary, your tax code might need adjustments.

Online tax accountants are well-versed in handling these complexities. They can provide tailored advice on how these changes impact your tax code and what actions you need to take. For example, if you receive a company car benefit, an accountant can calculate how much this benefit reduces your personal allowance and ensure that your tax code is adjusted accordingly. In cases where your tax code needs to reflect a Marriage Allowance, they can guide you through the process of applying for this allowance and making the necessary adjustments to your tax code.

Assistance with HMRC Communications

Dealing with HMRC can be intimidating, especially if you need to correct a tax code error or respond to a tax inquiry. An online tax accountant can take on this responsibility, acting as an intermediary between you and HMRC. They can handle all communications, ensuring that your case is presented accurately and that any necessary corrections are made promptly.

For instance, if your tax code has changed unexpectedly, an online tax accountant can contact HMRC to understand the reason behind the change and, if necessary, contest it on your behalf. They can also ensure that any adjustments are made efficiently, preventing delays that could affect your tax payments. This service is particularly beneficial for individuals who may not have the time or expertise to deal with HMRC directly.

Optimizing Your Tax Situation

Beyond correcting errors and navigating complexities, an online tax accountant can help you optimize your overall tax situation. They can advise on how to make the most of your personal allowance, claim available tax reliefs, and plan your finances in a tax-efficient manner.

For example, if you are eligible for the Marriage Allowance, an online tax accountant can help you apply for it, allowing you to transfer part of your personal allowance to your spouse and reduce your combined tax liability. They can also advise on pension contributions, charitable donations, and other tax reliefs that can further reduce your taxable income. By optimizing your tax situation, an online tax accountant can help you save money and ensure that you are fully compliant with tax regulations.

Regular Monitoring and Updates

The tax landscape is constantly changing, with updates to tax rates, allowances, and regulations occurring regularly. An online tax accountant can keep you informed of these changes and adjust your tax code as needed. They can also provide regular reviews of your tax situation to ensure that you remain on the correct tax code throughout the year.

For instance, if there are changes to the personal allowance or tax bands in the annual budget, an online tax accountant can update your tax code accordingly. This proactive approach helps prevent issues that could arise from outdated or incorrect tax codes and ensures that you are always paying the correct amount of tax.

An online tax accountant offers a range of services that can significantly ease the burden of managing your tax code in the UK. From reviewing your tax code for accuracy to correcting errors, navigating complex financial situations, and optimizing your tax position, an online tax accountant provides invaluable support. They ensure that your tax code reflects your current circumstances, helping you avoid overpayment or underpayment of taxes and ensuring compliance with HMRC regulations. By working with an online tax accountant, you can achieve peace of mind, knowing that your tax affairs are in expert hands.

FAQs About Tax Code 1257L

Q1: Can someone change their tax code if it appears to be wrong for their circumstances?

A1: Well, it’s worth noting that yes, you absolutely can ask HMRC to change it if it doesn’t fit your situation. If your payslip doesn’t reflect benefits, a side income, or a Marriage Allowance transfer, pick up the phone or login to your personal tax account. Provide the correct details, and HMRC will issue an updated code—usually a few weeks later.

Q2: Could a self-employed person ever see 1257L on a payslip?

A2: In my experience with clients, the key is that self-employed folks don’t typically receive a tax code, but if they have a part-time employer along the side, HMRC might apply a reduced code like 875L or 1057L to collect estimated tax. It’s purely to smooth their PAYE income, not to replace Self Assessment.

Q3: What happens to the personal allowance when someone has multiple jobs or pensions?

A3: It’s a common mix-up, but the personal allowance is only applied once. One job gets the 1257L code, and the other(s) will use BR, D0 or D1 depending on your combined income. I’ve seen shop owners get two allowances and later face HMRC reclaiming the overpaid amount—avoidable if flagged early.

Q4: How should landlords or gig economy workers monitor their code?

A4: If you’re earning rental income or doing Deliveroo runs, HMRC may slip that into your paycheck by reducing your tax-free allowance mid-year (code may change to 900L or similar). In my practice, I usually advise clients to ask HMRC not to “code in” such income, then settle via Self Assessment—that keeps your day-to-day cash flow steadier.

Q5: Can someone on Child Benefit be affected through their tax code?

A5: Yes—and it’s often overlooked. If your income nudges above £50,000, HMRC begins clawing back via your code, dropping from 1257L to something like 957L. If your income dips later in the year, you’ll need to correct it or end up paying back a fair chunk unnecessarily.

Q6: Is an emergency code like 1257L W1 or M1 definitely bad?

A6: It’s not a red alert, but it’s not ideal either. It means HMRC doesn’t have your full details, so they tax just that week or month without spreading your allowance. It’s often rectified once your P45 lands or starter details upload—but meanwhile, you could be temporarily overpaying.

Q7: What’s the effect of receiving benefits in kind on tax code?

A7: In simple terms, benefits like a company car or private health insurance eat into your allowance. So instead of 1257L, you might get 1057L or lower. I once had a client who didn’t realise both employer and HMRC were taxing a car benefit—he ended up overpaying for months until we spotted the double hit.

Q8: Can someone reclaim overpaid tax if they’ve been on the wrong code?

A8: Definitely. HMRC may re-credit you for up to four years. One client got nearly £900 back because their code hadn’t accounted for a marriage allowance until half way through the year. The key is keeping payslips and P60s as evidence.

Q9: Would a higher-rate taxpayer ever have 1257L?

A9: Generally no—higher earners over £50,270 may keep 1257L, but the excess income is taxed at the higher or additional rate, it’s not about the code. However, above £100K your allowance slowly tapers, and code may change entirely rather than show 1257L.

Q10: Does location matter—like Scotland or Wales—for this tax code?

A10: It certainly does. Scots get S1257L and use differing rate bands (19%, 21%, 42%, etc.), while Welsh residents see C1257L. I’ve had Glasgow clients puzzled why their take-home was lower than mates in Manchester—once we factored in Scotland’s starter-rate it made sense.

Q11: How can someone in redundancy or severance check if their code needs adjustment?

A11: Redundancy payments often include a tax-free lump sum, but if your code isn’t updated, you may get taxed twice. Do a quick check in your personal tax account or call HMRC to confirm any Exempt Lump Sum details are properly handled.

Q12: Can an employer correct the code, or does it have to be HMRC?

A12: Employers typically rely on HMRC to issue codes. But if your payroll team flags something off—a mistaken BR code or emergency tax—they can push HMRC to send a new coding notice. I’ve helped clients get corrections faster through a payroll ally.

Q13: What about pensioners—do they still get 1257L?

A13: Most do, unless they have multiple private pensions or untaxed income. If they do, one pension might carry 1257L and the others BR. But watch for adjustments—if they start a second job, it often lodges into code matters quickly.

Q14: Can Changing Salary Mid-Year affect this code?

A14: Yes—large pay rises or drops mid-year can make HMRC’s projected income outdated, resulting in over- or under-tax. I usually run a mid-year manual estimate for clients to flag the need for code review.

Q15: What’s the common sign that someone is paying too much tax via 1257L?

A15: I often ask them: “Are your deductions lining up with your manual estimate?” If tax-to-income ratio is higher than expected, or HMRC sends a P800, there’s usually a mis-code lurking.

Q16: Is it possible to ask HMRC not to use your allowance mid-year—even if they normally would?

A16: Yes. You can request they don’t code in estimated side income or rental profits but instead let you settle in one lump at year-end through Self Assessment. That gives you better control of your cash flow.

Q17: How often should someone check their code in a year?

A17: Every tax year I tell clients: check after April, after any pay change, after benefits shift, or side income appears. Even once every quarter is better than letting an error drag for months.

Q18: Could freelancing affect a standard 1257L unannounced?

A18: It can—HMRC may assume freelance earnings and immediately reduce your code without telling you. One client thought nothing changed, only to find their July pay shrunk. Prompt checks can catch these silent adjustments.

Q19: Do directors or business owners need to watch PAYE codes differently?

A19: Often the PAYE salary is just a balancing figure, especially when dividends make up most profit. Directors must watch that HMRC isn't overcoding PAYE based on assumed dividends—otherwise you might prepay tax you won’t owe.

Q20: What’s a subtle sign of a K-code hiding behind 1257L?

A20: If your code starts with a ‘K’, it means HMRC expects negative allowance—usually because of benefits or prior underpayment. A code like K200 indicates you’re effectively taxed on extra income. If that replaces 1257L and you didn’t notice, you could face a big bill.

About the Author:

Adil Akhtar, ACMA, CGMA, serves as CEO and Chief Accountant at Pro Tax Accountant, bringing over 18 years of expertise in tackling intricate tax issues. As a respected tax blog writer, Adil has spent more than three years delivering clear, practical advice to UK taxpayers. He also leads Advantax Accountants, combining technical expertise with a passion for simplifying complex financial concepts, establishing himself as a trusted voice in tax education. Email: adilacma@icloud.com

Disclaimer:

The content provided in our articles is for general informational purposes only and should not be considered professional advice. Pro Tax Accountant strives to ensure the accuracy and timeliness of the information but makes no guarantees, express or implied, regarding its completeness, reliability, suitability, or availability. Any reliance on this information is at your own risk. Note that some data presented in charts or graphs may not be 100% accurate.

.png)