Do You Need To File a Tax Return For Your Side Hustle Income?

- Adil Akhtar

- Jul 9

- 12 min read

The Audio Summary of the Key Points of the Article:

Understanding Your Side Hustle Tax Obligations in 2025-26

Do you need to file a tax return for your side hustle income in the UK? The short answer is: it depends on how much you earn. If your side hustle—whether it’s selling vintage clothes on Vinted, driving for Uber, or creating TikTok content—brings in more than £1,000 in gross income (before expenses) in the 2024-2025 tax year, you’ll likely need to register for Self Assessment and file a tax return. But there’s a lot more to it, especially with HMRC’s evolving rules. Let’s break it down so you can stay on the right side of the taxman.

What Exactly Counts as a Side Hustle?

Now, let’s get clear on what a side hustle is. HMRC defines it as any income-generating activity outside your main job, often through self-employment or trading. This could be freelancing on Fiverr, selling handmade crafts on Etsy, dog walking, or even renting out your driveway. The key is whether you’re trading—meaning you’re buying or creating goods/services with the intent to profit. If you’re just selling old clothes from your wardrobe on Vinted for less than you paid, that’s not trading, and you likely don’t owe tax. But if you’re buying vintage items to resell at a profit, HMRC considers that a business, and tax rules kick in.

Why the £1,000 Trading Allowance Matters?

Here’s a bit of good news: everyone in the UK gets a £1,000 trading allowance each tax year (6 April to 5 April). This means you can earn up to £1,000 in gross income from self-employment or casual work without paying tax or reporting it to HMRC. Gross income is the total money you make before deducting any expenses, like platform fees or materials. So, if you earn £800 from selling custom jewellery on Etsy, you’re in the clear—no tax, no paperwork. But if you hit £1,001, you’ll need to register as self-employed and potentially file a Self Assessment tax return, even if you don’t owe tax after expenses.

What’s This New £3,000 Threshold Everyone’s Talking About?

Now, you might’ve heard about a big change coming down the line. In March 2025, HMRC announced plans to raise the Self Assessment reporting threshold from £1,000 to £3,000 by the end of 2029. This means that, in the future, you won’t need to file a full tax return for side hustle income between £1,000 and £3,000—you’ll just report it through a new, simpler online service and pay any tax owed, possibly via your PAYE tax code if you’re employed. But here’s the catch: this change won’t kick in until 2029, and you’ll still owe tax on income above £1,000. For now, the £1,000 threshold for reporting and tax remains in place for the 2024-2025 tax year.

How Much Tax Will You Actually Pay?

So, let’s talk numbers. Your side hustle income gets added to your other income (like your day job salary) to determine your tax liability. The UK’s personal allowance for 2025-2026 is £12,570, meaning you pay no income tax on earnings up to this amount. Above that, you’ll pay:

Basic rate: 20% on income between £12,571 and £50,270

Higher rate: 40% on income between £50,271 and £125,140

Additional rate: 45% on income above £125,140

National Insurance contributions (NICs) also apply if you’re self-employed. For 2025-2026, you’ll pay Class 2 NICs (£3.45 per week, or roughly £179.40 annually) if your profits exceed £6,725, and Class 4 NICs (6% on profits between £12,570 and £50,270, 2% above that). If your side hustle pushes your total income into a higher tax band, you could face a bigger tax bill than expected.

Table 1: Income Tax and NICs for Side Hustle Income (2025-2026 Tax Year)

Income Range | Income Tax Rate | Class 4 NICs Rate |

£0 - £12,570 (Personal Allowance) | 0% | 0% |

£12,571 - £50,270 | 20% | 6% |

£50,271 - £125,140 | 40% | 2% |

Above £125,140 | 45% | 2% |

Note: Class 2 NICs (£3.45/week) apply if profits exceed £6,725. Source: GOV.UK Income Tax Rates

What Happens If You Don’t Report Your Income?

Be careful! HMRC is cracking down on side hustles, especially since January 2024, when platforms like eBay, Etsy, and Uber started reporting user earnings to HMRC. If you earn over £1,000 and don’t register for Self Assessment by 5 October after the tax year ends (e.g., 5 October 2025 for 2024-2025), you could face a £100 penalty for late filing, plus interest on unpaid tax. Worse, if HMRC finds you’ve deliberately underreported income, penalties can reach 100% of the tax owed. With 39% of UK adults now side hustling, adding £70 billion to the economy, HMRC’s got its eyes peeled.

Case Study: Aled’s Etsy Shop

Now, consider this: Aled, a 28-year-old graphic designer from Cardiff, earns £30,000 a year from his day job. In 2024, he started selling custom prints on Etsy, grossing £2,500. After deducting £500 for materials and fees, his profit is £2,000. Since his gross income exceeds £1,000, Aled must register for Self Assessment. His total income (£30,000 + £2,000 = £32,000) is taxed at 20% above the £12,570 personal allowance, so he owes £3,886 in income tax (£19,430 x 20%) plus £179.40 in Class 2 NICs. By claiming allowable expenses, Aled reduces his taxable profit, saving on tax. This shows why keeping records is crucial.

Navigating the Practicalities of Side Hustle Taxes

Now that you’ve got the basics of when and why you might need to file a tax return for your side hustle, let’s get into the nitty-gritty of how to actually do it. From registering with HMRC to claiming expenses and avoiding common pitfalls, this part is all about giving you the tools to stay compliant and keep more of your hard-earned cash. Whether you’re a freelancer in Manchester or a part-time dog walker in Devon, these steps will help you navigate the tax maze with confidence.

How Do You Register for Self Assessment?

Let’s start with the first step: registering as self-employed. If your side hustle income exceeds £1,000 in gross earnings in the 2024-2025 tax year, you need to tell HMRC by 5 October 2025. You can do this online via the GOV.UK Self Assessment registration page. It’s straightforward—fill in your details, get a Unique Taxpayer Reference (UTR), and you’re set to file your tax return by 31 January 2026 (online) or 31 October 2025 (paper). If you’re also employed, HMRC might adjust your PAYE tax code to collect any tax owed, but you’ll still need to file if your income is over £1,000.

Here’s a pro tip: register early. It can take up to 10 working days to get your UTR, and missing the October deadline could land you a £100 penalty, even if you owe no tax. In 2024, HMRC reported that 12% of new side hustlers missed this deadline, so don’t be one of them!

What Expenses Can You Claim to Reduce Your Tax Bill?

Now, here’s where you can save some serious money: allowable expenses. These are costs directly related to your side hustle that you can deduct from your income to lower your taxable profit. Think materials for your Etsy shop, fuel for your Uber drives, or even a portion of your home internet bill if you work from home. HMRC’s rules are strict, though—expenses must be “wholly and exclusively” for business use. For example, if you use your car for both personal trips and deliveries, you can only claim the business portion.

Common Allowable Expenses for Side Hustlers

Materials and supplies: E.g., fabric for crafts or ingredients for baking.

Travel costs: Fuel, train tickets, or parking for business trips.

Advertising: Social media ads or website hosting fees.

Office costs: Stationery, a percentage of your phone bill, or home office utilities (calculated using HMRC’s simplified expenses).

Professional fees: Accounting software or a bookkeeper’s fees.

Instead of claiming actual expenses, you can use the £1,000 trading allowance to simplify things. If your expenses are under £1,000, you can deduct the full allowance from your income instead of itemizing costs. For example, if you earn £1,500 and claim the trading allowance, you only pay tax on £500. But if your expenses are higher, itemizing could save you more.

Table 2: Comparing Trading Allowance vs. Actual Expenses (Example)

Scenario | Gross Income | Expenses | Taxable Profit (Trading Allowance) | Taxable Profit (Actual Expenses) |

Low expenses | £1,500 | £300 | £500 (£1,500 - £1,000) | £1,200 (£1,500 - £300) |

High expenses | £1,500 | £1,200 | £500 (£1,500 - £1,000) | £300 (£1,500 - £1,200) |

Source: Adapted from HMRC Trading Allowance Guidance

Step-by-Step Guide: Filing Your First Side Hustle Tax Return

So, you’ve registered, and now it’s time to file. Don’t panic—it’s easier than it sounds. Here’s a step-by-step guide to filing your Self Assessment for the 2024-2025 tax year:

Gather your records: Track all income (e.g., PayPal statements, platform reports) and expenses (receipts, invoices). Apps like QuickBooks or FreeAgent can help.

Log into HMRC’s online portal: Use your UTR and Government Gateway ID to access the Self Assessment section on GOV.UK.

Complete the self-employment section: Enter your total income and either claim the £1,000 trading allowance or list your expenses.

Add other income: Include your salary, savings interest, or other side hustles.

Calculate your tax: HMRC’s system will estimate your tax and National Insurance based on your total income.

Pay by 31 January 2026: You can pay online via bank transfer or card. If you owe more than £3,000, you might need to make payments on account (advance payments for next year’s tax).

Keep records for 5 years: HMRC can audit you, so store digital or paper records until at least 2031.

Can You Avoid Overpaying Tax?

Now, consider this: many side hustlers get stung by emergency tax if HMRC adjusts their PAYE tax code incorrectly. For example, if you’re employed and your side hustle income is reported, HMRC might assume you’ll earn the same amount monthly, leading to overtaxation. In 2023, HMRC processed over 150,000 tax refunds for side hustlers who overpaid due to tax code errors. To avoid this, check your tax code regularly on your payslip or via GOV.UK’s tax checker. If it’s wrong, contact HMRC immediately to adjust it.

Case Study: Sioned’s Dog Walking Business

Let’s look at Sioned, a 35-year-old teacher from Swansea earning £28,000 annually. In 2024, she started a dog walking side hustle, grossing £4,000. Her expenses (pet supplies, fuel, advertising) total £1,500. Sioned opts to deduct actual expenses, so her taxable profit is £2,500 (£4,000 - £1,500). Her total income (£28,000 + £2,500 = £30,500) is taxed at 20% above £12,570, giving her a tax bill of £3,586 (£17,930 x 20%) plus £179.40 in Class 2 NICs. By keeping detailed receipts, Sioned saves £200 compared to using the trading allowance. However, she nearly missed the October registration deadline, risking a penalty.

What If You Have Multiple Side Hustles?

Here’s something a bit trickier: what if you’re juggling multiple gigs? Say you drive for Bolt, sell on Depop, and tutor on the side. You combine all your self-employed income into one Self Assessment return. If your total gross income from all side hustles is under £1,000, you’re exempt. But if it’s over, you must report everything. In 2024, HMRC’s platform reporting rules caught out 8% of multi-gig workers who didn’t realize their combined earnings triggered a tax return. Keep separate records for each hustle to make filing easier and ensure you claim all allowable expenses.

Summary and Advanced Considerations for Side Hustle Taxes

Now that we’ve covered the essentials and practical steps for managing your side hustle taxes, let’s tie it all together with a clear summary of the key points and dive into some advanced considerations. This section will help you understand the bigger picture, avoid costly mistakes, and plan strategically for your side hustle’s financial future. Whether you’re just starting out or scaling up, these insights will keep you ahead of the tax game.

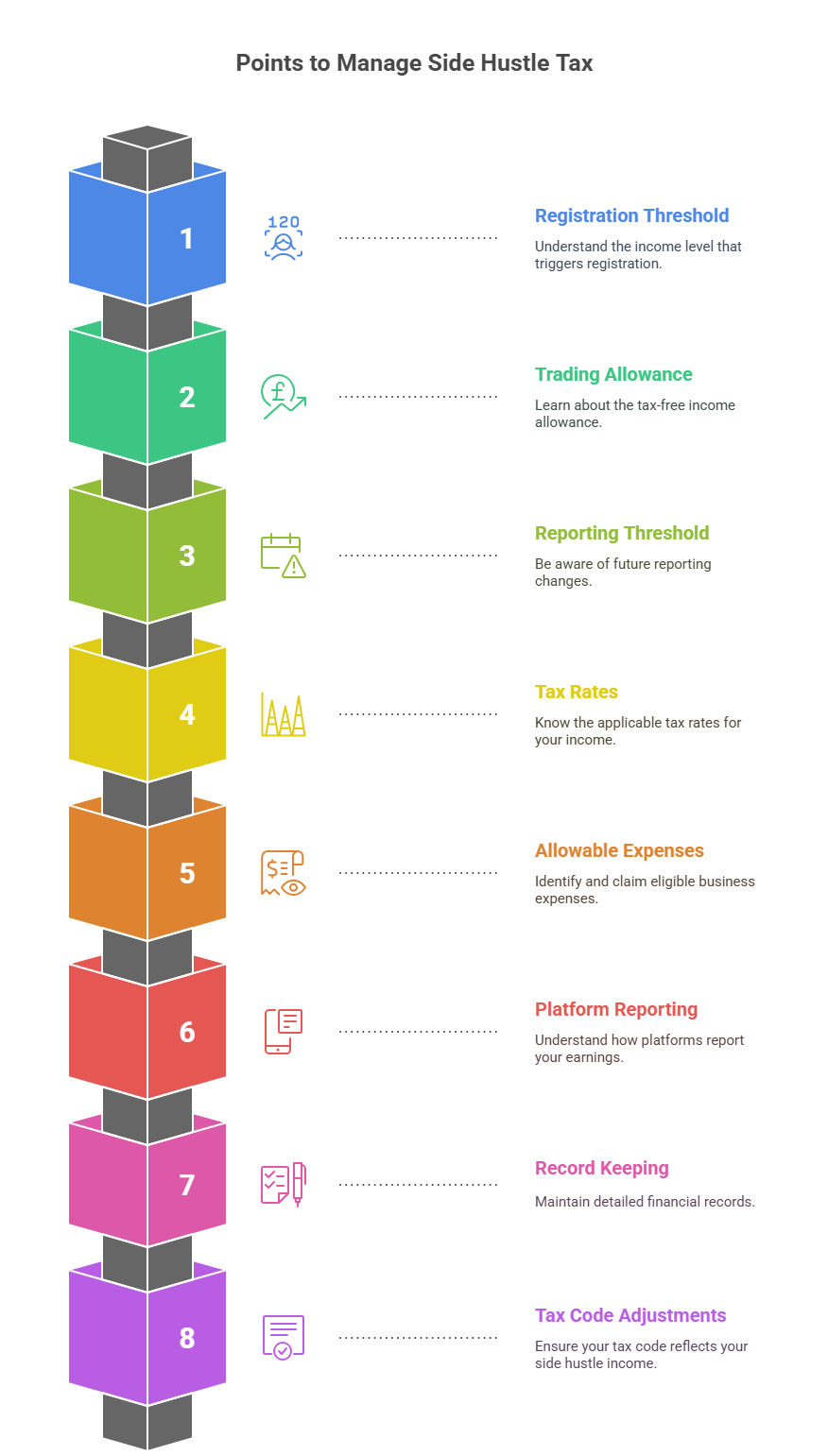

Summary of the Most Important Points

You must register for Self Assessment if your side hustle gross income exceeds £1,000 in the 2024-2025 tax year, with registration due by 5 October 2025.

The £1,000 trading allowance lets you earn up to £1,000 tax-free without reporting, but you’ll need to file a tax return if you exceed this.

HMRC’s new £3,000 reporting threshold, set to start in 2029, will simplify reporting for incomes between £1,000 and £3,000, but tax still applies above £1,000.

Side hustle income is added to your other earnings, taxed at 20% (basic rate), 40% (higher rate), or 45% (additional rate), with National Insurance contributions if profits exceed £6,725.

Claiming allowable expenses (e.g., materials, travel) or the trading allowance can reduce your taxable profit, potentially saving hundreds.

Platforms like Etsy and Uber report earnings to HMRC since January 2024, increasing the risk of penalties (up to £100 for late filing) if you don’t comply.

Registering early for Self Assessment (via GOV.UK) ensures you get your UTR and avoid penalties.

Keep detailed records of income and expenses for 5 years to prepare for HMRC audits and simplify tax filing.

Check your PAYE tax code to avoid emergency tax if you’re employed, as HMRC may adjust it based on side hustle income.

Multiple side hustles are combined into one Self Assessment return, so track each separately to claim all allowable expenses.

What Are the Long-Term Tax Implications?

Now, let’s think about the future. If your side hustle grows, you might face bigger tax bills or even need to register for VAT if your taxable turnover exceeds £90,000 (as of April 2025, per GOV.UK VAT thresholds). For example, if you’re a freelance graphic designer earning £15,000 from your side hustle now, but it scales to £50,000, you’ll hit the higher tax band (40%) and owe Class 4 NICs at 6%. Planning ahead—say, by setting aside 25-30% of your income for taxes—can prevent a nasty surprise when HMRC’s bill arrives.

Another thing to watch: if your side hustle becomes your main gig, you might lose benefits like employer pension contributions or paid leave. In 2024, 15% of UK side hustlers transitioned to full-time self-employment, according to HMRC data, but many underestimated their tax liability. A simple trick is to use HMRC’s tax calculator to estimate your bill monthly and save accordingly.

How Can You Maximise Tax Savings?

Here’s a clever move: optimise your expenses. Beyond the obvious (like materials or fuel), consider less common deductions. For instance, if you attend a trade show to sell your crafts, claim the ticket and accommodation costs. If you use a room in your home exclusively for your side hustle, you can claim a portion of your rent or mortgage interest using HMRC’s simplified expenses (e.g., £6/week for 25-50 hours of home use). In 2023, side hustlers who claimed detailed expenses saved an average of £450 more than those using the trading allowance, per a MoneySavingExpert survey.

You could also explore pension contributions. Self-employed income can be contributed to a personal pension, reducing your taxable income. For example, contributing £1,000 to a pension lowers your taxable income by £1,000, saving £200 if you’re a basic-rate taxpayer. Just ensure contributions don’t exceed your annual allowance (£60,000 for 2025-2026).

Table 3: Simplified Expenses for Home Office Use (2025-2026)

Hours of Business Use per Month | Flat Rate per Month | Annual Deduction |

25–50 hours | £10 | £120 |

51–100 hours | £18 | £216 |

101+ hours | £26 | £312 |

Source: HMRC Simplified Expenses

What If HMRC Investigates Your Side Hustle?

Be careful! HMRC’s platform reporting rules mean they’re getting data directly from eBay, Vinted, and others. If your reported earnings don’t match your tax return, you could face an audit. In 2024, HMRC issued 10,000 compliance checks to side hustlers, with 20% resulting in penalties for underreporting. To stay safe, use accounting software to track every transaction: you might be surprised how affordable it can be to hire an accountant for a one-off review. A 2023 case saw a Birmingham freelancer fined £2,000 for unreported £10,000 in eBay sales—don’t let that be you.

If audited, provide clear records of income and expenses. Digital tools like Xero or Wave can generate HMRC-compliant reports, making audits smoother. Always respond promptly to HMRC letters, as delays can escalate penalties.

Case Study: Idris’s Crypto and Delivery Gigs

Let’s talk about Idris, a 30-year-old barista from Leeds with two side hustles: crypto trading and food delivery. In 2024, he earned £3,000 from crypto profits and £2,500 from Deliveroo, totaling £5,500 in gross income. His crypto expenses (software subscriptions, electricity) were £800, and delivery expenses (bike maintenance, fuel) were £700. Idris deducts £1,500 in expenses, leaving a taxable profit of £4,000. His day job earns £20,000, so his total income (£24,000) incurs £2,286 in tax (£11,430 x 20%) plus £179.40 in Class 2 NICs. Idris nearly faced a penalty when HMRC flagged his crypto income via platform data, but his detailed records saved him. This highlights the importance of tracking complex income sources like crypto.

Should You Get Professional Help?

So, the question is: when is it worth hiring an accountant? If your side hustle earns less than £5,000 annually, you can probably manage with HMRC’s online tools and free resources like GOV.UK’s tax guides. But if you’re juggling multiple gigs or earning over £10,000, an accountant can save time and money. The average cost for a basic Self Assessment is £100-£200, but they can spot deductions you might miss, like training courses or professional subscriptions. In 2024, 25% of side hustlers used accountants, per a Simply Business survey, and 80% reported lower stress levels.

About The Author:

Adil Akhtar, ACMA, CGMA, CEO and Chief Accountant of Pro Tax Accountant, is an esteemed tax blog writer with over 10 years of expertise in navigating complex tax matters. For more than three years, his insightful blogs have empowered UK taxpayers with clear, actionable advice. Leading Advantax Accountants as well, Adil blends technical prowess with a passion for demystifying finance, cementing his reputation as a trusted authority in tax education.

Email: adilacma@icloud.com

Disclaimer:

The information provided in our articles is for general informational purposes only and is not intended as professional advice. While we strive to keep the information up-to-date and correct, Pro Tax Accountant makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained in the articles for any purpose. Any reliance you place on such information is therefore strictly at your own risk. Some of the data in the above graphs may to give 100% accurate data.

We encourage all readers to consult with a qualified professional before making any decisions based on the information provided. The tax and accounting rules in the UK are subject to change and can vary depending on individual circumstances. Therefore, Pro Tax Accountant cannot be held liable for any errors, omissions, or inaccuracies published. The firm is not responsible for any losses, injuries, or damages arising from the display or use of this information.

.png)