How to Improve Your Tax Compliance

- Adil Akhtar

- Jul 10, 2023

- 14 min read

Updated: Oct 11, 2023

Navigating tax compliance in the UK can seem a daunting task, given the intricacies of the country's tax laws. However, with careful planning and a few strategic steps, it is entirely manageable. In this article, we will explore how to improve your tax compliance in 2023 and beyond.

What Exactly is Tax Compliance and Why is it Important?

Tax compliance in the UK signifies the obligation of individuals, corporations, and other entities to abide by the country's tax laws and regulations. This involves accurately reporting all forms of income, claiming legitimate deductions and credits, and timely paying the correct amount of tax due. The responsibility for enforcing tax compliance falls to Her Majesty's Revenue and Customs (HMRC), the UK's tax authority.

The significance of tax compliance cannot be overstated. Not only does it ensure that the government has the necessary revenue to fund public services like healthcare, education, and infrastructure, but it also promotes a sense of fairness and integrity in the economic system. When all taxpayers fulfil their obligations, the tax burden is distributed more equitably, contributing to the overall health and stability of the UK's economy and society.

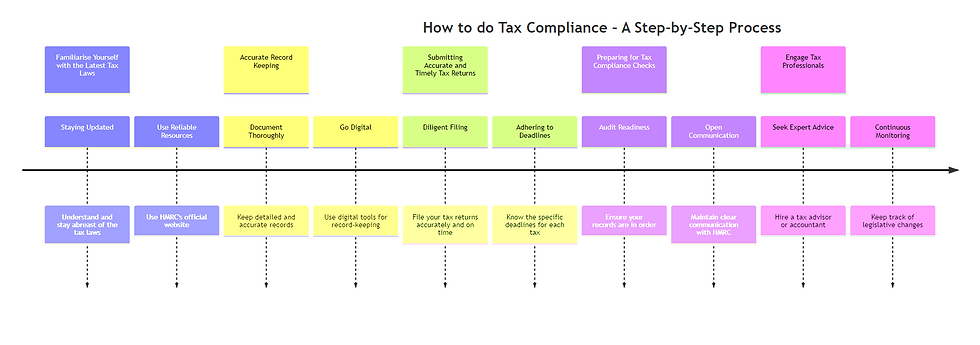

How to do Tax Compliance – A Step-by-Step Process

1. Familiarise Yourself with the Latest Tax Laws

Staying Updated: The initial step towards achieving tax compliance is to understand and stay abreast of the tax laws relevant to your circumstance. The UK's tax legislation is complex and constantly evolving, hence regular updates are vital.

Use Reliable Resources: HMRC's official website offers comprehensive, up-to-date resources for all taxpayers. It provides guidance on income tax, corporation tax, capital gains tax, VAT, and many other taxes. Subscribing to HMRC's updates or newsletters can also help you stay informed about any changes.

2. Accurate Record Keeping

Document Thoroughly: Keeping detailed and accurate records is central to successful tax compliance. This not only simplifies the process of preparing and filing tax returns but also equips you to handle any potential tax compliance checks.

Go Digital: The UK's Making Tax Digital initiative encourages taxpayers to maintain digital records. By 2023, using digital tools for record-keeping is standard practice. These tools help prevent errors, streamline your record-keeping process, and simplify the task of preparing tax returns.

3. Submitting Accurate and Timely Tax Returns

Diligent Filing: Filing your tax returns accurately and on time is critical to avoid penalties and interest charges. Double-check your returns for any errors or omissions before submission to ensure you're reporting your income correctly and claiming the appropriate allowances and deductions.

Adhering to Deadlines: Each tax has a specific deadline for filing returns and making payments. Familiarising yourself with these dates and planning your schedule accordingly helps ensure timely submission.

4. Preparing for Tax Compliance Checks

Audit Readiness: While not every taxpayer will face a tax compliance check, being prepared is beneficial. Ensure your records are in order, and you can justify all entries on your tax returns.

Open Communication: If you're selected for a tax compliance check, maintaining clear and timely communication with HMRC is essential. Respond promptly to their requests and provide the necessary information to expedite the process.

5. Engage Tax Professionals

Seek Expert Advice: Consider hiring a tax advisor or accountant to help you navigate the complexities of tax compliance. These professionals are well-versed in tax laws and can provide expert advice tailored to your circumstances, ensuring optimal tax planning and compliance.

Continuous Monitoring: A tax professional can also offer ongoing tax compliance monitoring, keeping track of legislative changes, updating your tax strategy accordingly, and alerting you to any potential issues before they become problematic.

More Tips to Improve Tax Compliance

Advanced Record-Keeping Techniques

While the initial text covers the basics of record-keeping, there are advanced strategies that can further improve your tax compliance. One such method is to use specialized tax software that not only helps in recording financial transactions but also in understanding tax obligations. These software solutions often come with features like real-time tax liability calculations, reminders for tax deadlines, and even predictive analytics that can forecast your future tax obligations based on past data.

Utilizing Tax Compliance Software

Tax compliance software can be a game-changer. These platforms are designed to be user-friendly and can integrate with your existing accounting systems. They automate many of the tasks involved in tax preparation and filing, reducing the risk of human error. Some advanced software even offers features like data analytics, which can provide insights into your tax strategy and help identify areas for improvement.

Real-Time Reporting

The UK is gradually moving towards real-time reporting, where businesses report their income and expenses to HMRC as they occur, rather than at the end of the tax year. This approach makes it easier to keep track of your tax obligations and ensures that the information HMRC holds is current and accurate. Real-time reporting can be facilitated through advanced accounting software that offers this feature.

Behavioral Economics in Tax Compliance

Understanding the psychology behind tax compliance can offer unique insights into improving your own compliance. Behavioral economics suggests that people are more likely to comply with tax laws when they understand the societal benefits of taxation, and when they feel that the tax system is fair.

Social Proof and Tax Compliance

One interesting strategy to improve compliance is the use of social proof. This involves understanding the compliance levels within your industry or social circle. Knowing that a majority of your peers are compliant can serve as a strong motivator for you to also comply with tax laws.

Fairness and Transparency

Perceived fairness in how tax money is used can also influence compliance rates. The UK government has made strides in making the tax spending process more transparent. You can now easily access information on how tax funds are allocated, which can serve as an additional motivator for compliance.

Advanced Tax Planning and Risk Management

Tax planning doesn't have to be a once-a-year activity. With the right tools and advice, it can be an ongoing process. Advanced tax planning involves looking beyond the current year to understand your future tax liabilities and planning for them today.

Scenario Analysis

One effective method is scenario analysis, where you model different financial scenarios to understand their tax implications. This can include changes in revenue, expenses, or even tax laws. By understanding these implications in advance, you can make more informed decisions.

Risk Assessment

Conducting a tax risk assessment can also be invaluable. This involves identifying the various tax risks your business faces, quantifying them, and developing strategies to mitigate them. This proactive approach can not only improve your compliance but also help you prepare for any future changes in tax laws.

By implementing these advanced strategies into your tax compliance process, you can ensure that you're not just meeting your legal obligations, but also optimizing your financial strategy for the long term.

What is a Tax Compliance Check?

A tax compliance check, or tax audit, is an examination of an individual's or a business's tax returns by tax authorities to verify that the financial information and tax paid are accurate and in accordance with the tax laws. The aim of such a check is to ensure that taxpayers are meeting their tax obligations correctly.

The Importance of Tax Compliance Checks

Tax compliance checks, often referred to as tax audits, play a critical role in maintaining the integrity of the UK's tax system. Their importance is more prominent than ever, given the dynamic nature of the economy. Here are some of the reasons why tax compliance checks are vital:

Ensuring Fairness and Equity

Tax compliance checks help ensure that all taxpayers - individuals and businesses alike - are paying their fair share of tax. By identifying and rectifying underpayments, HMRC helps maintain a level playing field. This fosters a sense of fairness and equity, which is fundamental to sustaining public confidence in the tax system.

Safeguarding Public Revenue

The revenue collected through taxes is used to fund public services, infrastructure, social security, and other essential government functions. Tax compliance checks are vital in safeguarding public revenue, ensuring that the government has the funds it needs to serve the public effectively.

Deterrence Against Non-compliance

The prospect of a tax compliance check acts as a powerful deterrent against non-compliance. Knowing that their tax affairs may be scrutinised encourages taxpayers to ensure that their tax returns are accurate and that they're paying the correct amount of tax.

Detecting and Preventing Fraud

Tax compliance checks play a crucial role in detecting and preventing tax fraud, such as false claims for deductions or credits, understating income, or not declaring cash transactions. By identifying such activities, HMRC can take action against the offenders and protect the integrity of the tax system.

Encouraging Voluntary Compliance

Finally, tax compliance checks play a role in encouraging voluntary compliance. By educating taxpayers during these checks, HMRC helps them understand their obligations, correct any misunderstandings or mistakes, and comply voluntarily with the tax laws in the future.

Tax compliance checks are essential for ensuring fairness and equity, safeguarding public revenue, deterring non-compliance, detecting and preventing fraud, and encouraging voluntary compliance. They play a crucial role in maintaining the integrity and effectiveness of the UK's tax system.

The Process of a Tax Compliance Check

A tax compliance check, often referred to as a tax audit, is an in-depth review of a taxpayer's accounts and financial information to ensure accuracy and adherence to tax laws. Here is the detailed process of a tax compliance check in the UK as of 2023.

Notification from HMRC

The process begins with a notification from Her Majesty's Revenue and Customs (HMRC), the UK's tax authority. HMRC will typically send a letter indicating that they intend to conduct a tax compliance check. This letter will include:

The tax years or periods under review.

The specific taxes being checked, such as income tax, corporation tax, VAT, etc.

The reason for the check, which could be random, is due to perceived discrepancies in a tax return, or as part of a broader campaign targeting a specific sector or issue.

Review of Financial Records

After the initial notification, HMRC will review the taxpayer's financial records. The review process might include:

Examination of tax returns for the specified period.

Analysis of the books and records of the business, such as invoices, bank statements, payroll records, etc.

Checks on specific transactions or specific aspects of the tax return.

The extent of the review will depend on the nature and complexity of the taxpayer's circumstances and the type of check HMRC is conducting.

Information Requests and Interviews

As part of the review process, HMRC may request additional information or documents. This can be done through written requests or in-person meetings. In some cases, HMRC may also wish to interview the taxpayer or their representative to gather more information or clarify certain points.

The Outcome of the Check

Once HMRC has completed their review, it will inform the taxpayer of the outcome. This could be one of three things:

No adjustments: If HMRC is satisfied that everything is in order, they will confirm this in writing, and the check will be concluded.

Adjustments: If discrepancies are identified, HMRC will outline these in a letter. The taxpayer may need to pay additional tax, interest, and possibly penalties.

In-depth investigation: If serious irregularities are identified, HMRC may decide to launch a more detailed investigation.

In conclusion, the process of a tax compliance check in the UK involves several stages, from initial notification to review of financial records, possible information requests and interviews, and finally, the outcome of the check. Understanding this process can help taxpayers be better prepared and reduce any potential stress or uncertainty.

How to Prepare for a Tax Compliance Check – A Step–by–Step Guide

Receiving notification of a tax compliance check from Her Majesty's Revenue and Customs (HMRC) can be daunting. However, with thorough preparation, the process can be much smoother. Here are some detailed steps to prepare for a tax compliance check.

Step 1: Understand the Scope of the Check

Upon receiving notification from HMRC, take time to understand the specifics outlined in the letter. Determine which taxes and periods are under review and the reason for the check. This will guide your preparation process.

Step 2: Organize Your Financial Records

Next, gather and organize your financial records for the period under review. These may include:

Tax returns and associated documents.

Business books and records, such as invoices, receipts, bank statements, and payroll records.

Records of specific transactions, if these have been mentioned in the HMRC letter.

Ensure that your records are complete, organized, and easy to understand. This will speed up the review process and make it easier to respond to any queries from HMRC.

Step 3: Review Your Returns

Go through your tax returns for the relevant periods. Check for any errors or discrepancies and be prepared to explain any unusual or complex transactions. If you identify any errors, it's better to disclose these proactively rather than wait for HMRC to find them.

Step 4: Seek Professional Advice

Depending on the complexity of your situation, you may wish to seek advice from a tax professional. A tax advisor can help you understand the implications of the check, prepare for meetings with HMRC, and advise on how to handle any potential issues.

Step 5: Respond Promptly to HMRC

HMRC may request additional information or documents as part of the check. Respond to these requests promptly and provide clear, complete information. This will help to establish a good relationship with HMRC and keep the check moving smoothly.

Step 6: Prepare for a Possible Interview

In some cases, HMRC may wish to interview you or your representative. If this is the case, prepare thoroughly for the interview. Review your tax returns and records, consider potential questions, and be ready to explain your financial situation and transactions.

preparing for a tax compliance check involves understanding the scope of the check, organizing and reviewing your financial records, seeking professional advice if necessary, responding promptly to HMRC, and preparing for a possible interview. With thorough preparation, you can navigate a tax compliance check more confidently and efficiently.

How to Respond to the Outcome of a Check

If you disagree with the outcome of a compliance check, you can challenge it. The first step is to discuss your concerns with HMRC. If this doesn't resolve the issue, you may consider an independent review or appeal to the tax tribunal.

a tax compliance check is an essential aspect of the taxation system. It aims to ensure the fairness and integrity of the system, deter tax evasion, and maintain steady government revenue. Good record-keeping, understanding tax laws, and cooperating with tax authorities can make the process of a tax compliance check less daunting. If the outcome of a check is disputed, there are procedures in place to challenge it. By understanding what a tax compliance check involves, taxpayers can better navigate the taxation system and fulfil their obligations.

What is a Tax Compliance Certificate?

A Tax Compliance Certificate is a formal document provided by Her Majesty's Revenue and Customs (HMRC) in the UK, serving as evidence that an individual or a business has met all their tax obligations. It certifies that the taxpayer is up-to-date with all their tax payments and has no outstanding tax liabilities or ongoing issues with HMRC.

The Importance of a Tax Compliance Certificate

A TCC has several implications, and its importance is underscored in numerous situations:

Trust and Credibility: The certificate establishes an individual's or business's credibility, showing that they are responsible and compliant with tax laws.

Tendering for Contracts: Many public and private sector entities require a TCC when tendering for contracts. It proves the taxpayer's financial integrity, a crucial element in business relationships.

Regulatory Compliance: Some regulatory bodies require a TCC as part of their licensing process, especially for businesses in specific industries.

Immigration Purposes: For immigration or visa processes, a TCC can serve as a necessary document, demonstrating the applicant's financial credibility.

How to Obtain a Tax Compliance Certificate in the UK: A Step-By-Step Guide

Obtaining a Tax Compliance Certificate (TCC) in the UK involves several crucial steps. The process involves ensuring tax compliance, applying to HMRC, and awaiting the review. Here is a step-by-step guide to help you navigate this process.

Step 1: Ensure Your Tax Compliance

Before you apply for a TCC, you need to ensure that all your tax obligations are up-to-date. This includes:

Filing all your tax returns. This may include income tax, corporation tax, VAT, and any other taxes that are relevant to your personal situation or business.

Making sure you've paid any tax due in full. Check your payment status in your HMRC online account to ensure no outstanding amounts are due.

Settling any disputes with HMRC regarding previous tax assessments. Your request for a TCC will likely be rejected if there are ongoing disputes.

Step 2: Apply to HMRC

Once you have confirmed your tax compliance, you can formally apply for a TCC. This involves:

Writing a letter to HMRC requesting a Tax Compliance Certificate. This letter should include:

Your full name, address, and contact details.

Your Unique Taxpayer Reference (UTR) or VAT registration number.

The reason why you're requesting the TCC.

The tax periods for which you require the certification.

Sending your letter to the appropriate department of HMRC. Make sure to keep a copy of your letter for your records.

Step 3: HMRC Review

Once HMRC receives your application:

They will review your tax records. This process involves checking whether you have filed all necessary tax returns and paid all taxes due.

The duration of the review process can vary but typically takes several weeks.

If HMRC identifies any issues or requires further information, they will contact you.

Step 4: Receipt of the Tax Compliance Certificate

After a successful review:

HMRC will issue your Tax Compliance Certificate. This document confirms that you're up-to-date with your tax obligations.

The TCC is typically sent by post. Once you receive it, keep it safe, as you may need it to apply for contracts, licenses, or visas.

Obtaining a TCC involves making sure you're compliant with your tax obligations, applying to HMRC, and waiting for their review process. Although it can take some time and effort, the benefits of having a TCC can far outweigh these initial inconveniences, especially for business owners and those needing to demonstrate their financial integrity.

Uses of a Tax Compliance Certificate

Business Contracting

In the realm of business contracting, particularly in the public sector, a TCC can be a vital document. Government agencies and certain private corporations often require potential contractors to provide a TCC when bidding for contracts. It serves as proof that the business is financially responsible and compliant with the law, thus fostering trust in the business's operations and financial health.

Licensing and Regulatory Compliance

Certain industries are subject to regulatory oversight, where a TCC may be needed. For instance, the finance and real estate sectors often require businesses to demonstrate their tax compliance as part of the licensing process. A TCC can be a prerequisite for obtaining or renewing a license, ensuring that businesses in these sectors are financially responsible and compliant with their tax obligations.

Financial Transactions and Investments

In large financial transactions or investments, a TCC may be requested to ensure the financial credibility of the parties involved. Whether it's securing a loan, purchasing property, or making a significant investment, having a TCC can provide reassurance to the other parties that the individual or business is financially reliable and up-to-date with their tax obligations.

Immigration Processes

For certain immigration or visa applications, individuals might need to provide a TCC. It can serve as evidence of the applicant's financial responsibility and compliance with UK tax laws. Demonstrating this financial credibility can be instrumental in successful visa applications or in obtaining residency status.

International Business Operations

For businesses operating internationally or considering expanding overseas, a TCC can be important. Some countries require foreign businesses to demonstrate their tax compliance in their home country as part of the business registration process. Having a TCC can help facilitate these international business operations.

A Tax Compliance Certificate has broad uses in the UK, from business contracting and licensing to financial transactions, immigration processes, and international business operations. It's a valuable document that demonstrates an individual's or a business's financial responsibility and compliance with tax laws, thus fostering trust and credibility.

How a Tax Compliance Accountant Can Help You Improve Your Tax Compliance

Tax compliance is a crucial aspect of managing personal or business finances. It involves understanding complex tax laws and ensuring that all tax obligations are met accurately and on time. A tax compliance accountant, a professional specialising in tax laws and procedures, can play a significant role in improving your tax compliance. Here's how.

Detailed Understanding of Tax Laws

Simplifying Complexities

Tax laws can be complex and constantly changing. A tax compliance accountant is knowledgeable about these laws and stays updated on any changes. They can help you understand the intricacies of the tax system, simplify complexities, and ensure you're aware of your tax obligations.

Tailoring Tax Strategies

Beyond understanding the tax laws, a tax compliance accountant can develop tailored tax strategies that fit your personal or business circumstances. They can identify tax credits, deductions, and allowances you may be eligible for, helping to reduce your tax liability while ensuring full compliance.

Accurate and Timely Tax Filing

Preventing Errors

A tax compliance accountant has the expertise to handle your tax returns accurately. They can prevent costly errors that could result in penalties or additional scrutiny from tax authorities. This could include incorrect calculation of tax liabilities, overlooking taxable income, or misunderstanding the rules around deductions.

Meeting Deadlines

Tax compliance isn't just about paying the correct amount of tax, it's also about paying it on time. Late submission can lead to penalties and interest charges. A tax compliance accountant will ensure that all tax returns are prepared and submitted before the deadlines, avoiding any late filing penalties.

Assistance During Tax Compliance Checks

Preparing for Checks

If you're selected for a tax compliance check or audit, a tax compliance accountant can help you prepare. They can review your records and returns, identify potential issues, and guide you on how to present your information to the tax authorities.

Guiding Through the Process

During a tax compliance check, having a professional who knows the process can be invaluable. A tax compliance accountant can attend meetings with you, answer questions on your behalf, and help negotiate any adjustments or penalties. Their expertise can help make the process less stressful and more manageable.

Long-Term Tax Planning

Future-Proofing Your Tax Position

A tax compliance accountant doesn't just help with current tax obligations, they can also assist with long-term tax planning. They can provide advice on the tax implications of different financial decisions, helping you to plan for the future and manage your long-term tax position.

Ensuring Ongoing Compliance

Tax compliance is an ongoing obligation. A tax compliance accountant can ensure you stay compliant year after year, adapting to any changes in your circumstances or the tax laws. This can provide peace of mind and free up your time to focus on other aspects of your personal finances or business.

A tax compliance accountant can be a significant asset in improving your tax compliance. They offer a detailed understanding of tax laws, ensure accurate and timely tax filing, provide assistance during tax compliance checks, and contribute to long-term tax planning. By working with such a professional, you can navigate the complexities of the tax system with confidence, knowing that your tax affairs are in safe and expert hands.

Conclusion

In conclusion, improving tax compliance in the UK requires a multi-pronged approach that includes education, simplification of the tax filing process, stringent enforcement, promoting voluntary compliance, and efforts to reduce the tax gap. By implementing these strategies, the government can increase its tax revenue and thereby improve public services. In turn, this would reinforce citizens' trust in the system, creating a positive feedback loop that encourages further compliance.

.png)