Do You Pay Stamp Duty Land Tax (SDLT) on a Transfer of Equity?

- Adil Akhtar

- Feb 15, 2023

- 20 min read

Updated: May 3, 2025

Index:

The Audio Summary of the Key Points of the Article:

Understanding SDLT on a Transfer of Equity: Do You Need to Pay?

So, you’re wondering whether you’ll need to fork out for Stamp Duty Land Tax (SDLT) when transferring equity in a property in the UK? The short answer is: it depends. A transfer of equity—where you add or remove someone from a property’s title deeds—can trigger SDLT, but only in specific situations. It all hinges on something called “chargeable consideration,” which we’ll unpack in a moment. For now, know that if no money or value changes hands, you’re often in the clear. But let’s dive into the nitty-gritty to help you, whether you’re a homeowner or a business owner, figure out if SDLT applies to your situation as of April 2025.

What Exactly Is a Transfer of Equity?

Now, let’s get the basics sorted. A transfer of equity is when you change who legally owns a property without selling it outright. Think of it like tweaking the ownership pie chart—maybe you’re adding your partner to the deeds after getting married, or removing an ex after a breakup. It’s common in scenarios like:

Relationship changes: Adding a spouse or civil partner to the title, or removing one during a divorce.

Gifting: Passing a share of the property to a family member, like your kids or grandkids.

Business moves: Transferring property into or out of a company for tax planning or restructuring.

Unlike a full property sale, you’re not handing over the whole thing—just adjusting who holds a slice. But here’s the kicker: even though it’s not a “sale,” HMRC might still want a cut if there’s value involved. That’s where SDLT comes in.

When Does SDLT Kick In?

Right, here’s the deal: SDLT applies when there’s chargeable consideration—fancy HMRC lingo for anything of monetary value given in exchange for the transfer. This could be:

Cash payments: If you pay someone to take their share of the property.

Mortgage liability: If you take on part or all of an existing mortgage.

Other assets: Swapping land or another property as part of the deal.

If the chargeable consideration is above the SDLT threshold, you’ll need to pay tax on it. As of April 2025, the residential SDLT threshold drops to £125,000 (down from £250,000 until 31 March 2025), thanks to the end of temporary relief introduced in September 2022. For first-time buyers, the threshold is £300,000 (down from £425,000), but only for properties worth up to £500,000.

Here’s a quick table to show the SDLT rates for residential properties from 1 April 2025:

Property Value Band | SDLT Rate (Standard) | SDLT Rate (Additional Properties) |

Up to £125,000 | 0% | 5% |

£125,001–£250,000 | 2% | 7% |

£250,001–£925,000 | 5% | 10% |

£925,001–£1.5m | 10% | 15% |

Over £1.5m | 12% | 17% |

Source: GOV.UK SDLT Rates

Be careful! If you’re buying an additional property (like a second home or buy-to-let), you’ll face a 5% surcharge on top of the standard rates, up from 3% before 31 October 2024.

SDLT Rates on Residential Properties (2025)

A Real-Life Example to Make It Clear

Let’s paint a picture with a hypothetical case. Meet Priya, a Londoner who owns a flat worth £400,000 with a £200,000 mortgage. She’s getting married and wants to add her partner, Jamal, to the title deeds. Jamal will take on half the mortgage (£100,000). Here’s how SDLT works out:

Chargeable consideration: Jamal’s taking on £100,000 of the mortgage.

SDLT threshold: As of April 2025, the threshold is £125,000. Since £100,000 is below this, no SDLT is due.

But wait: If Priya’s flat was worth £700,000 with a £400,000 mortgage, and Jamal took on half (£200,000), the consideration would exceed £125,000. He’d owe SDLT at 2% on the £75,000 above the threshold, which is £1,500.

This shows how the numbers can shift quickly. Use the HMRC SDLT Calculator to crunch your own figures.

Gifts and Exemptions: When SDLT Doesn’t Apply

Now, here’s some good news. If you’re transferring equity as a gift—meaning no money, mortgage, or other value changes hands—SDLT usually doesn’t apply. Say you’re gifting a share of your home to your daughter, Elowen, with no mortgage involved. As long as she’s not paying you or taking on any debt, it’s SDLT-free.

There are also exemptions for specific situations:

Divorce or separation: If you’re transferring equity as part of a court order or agreement due to divorce, annulment, or legal separation, you’re off the hook for SDLT. This applies to married couples and civil partners.

Equal splits: If you and a co-owner (like a friend) jointly own a property and split it equally into separate parts (e.g., dividing a house into two flats), no SDLT is due, provided no cash or value is exchanged.

But hold on! If you’re unmarried and transferring to a partner, or if the split is unequal and involves compensation, SDLT might apply if the consideration tops £125,000.

Why April 2025 Changes Matter

Now, let’s talk about why 2025 is a big deal. The SDLT threshold changes coming on 1 April 2025 will make more transfers taxable. The drop from £250,000 to £125,000 means even modest mortgage assumptions could push you over the limit. For example, if you’re adding someone to a property with a £300,000 mortgage and they take on half (£150,000), you’d owe SDLT on £25,000 at 2% (£500). Before April 2025, this would’ve been tax-free.

Business owners, take note: transferring property into a company is a whole different beast. SDLT is often calculated on the market value of the property, not just the consideration. So, if you transfer a £500,000 property to your business with no mortgage, you could still face SDLT on the full £500,000. That’s a hefty bill—potentially £14,500 under standard rates.

Getting Ahead of the Game

So, what’s the plan? If you’re eyeing a transfer of equity, timing matters. Completing before 31 March 2025, could save you a chunk of change, especially if the consideration is close to or above £125,000. The process typically takes 4–6 weeks, but delays from lenders or solicitors can stretch this, so start early.

None of us is a tax expert, but you don’t need to be. A conveyancing solicitor or tax advisor can map out your SDLT liability and spot exemptions. For businesses, a tax accountant is crucial to navigate company transfers and avoid surprises. Check out HMRC’s SDLT guidance for the full rulebook.

UK Stamp Duty Land Tax (SDLT) on Transfer of Equity: Rates, Trends & Historical Data (2020-2025)

Navigating the Practical Side of SDLT on Transfers of Equity

So, you’ve got the basics of when Stamp Duty Land Tax (SDLT) might apply to a transfer of equity. Now, let’s roll up our sleeves and get into the practical stuff—how to figure out if you’re on the hook, what steps to take, and how to avoid costly mistakes. Whether you’re a homeowner tweaking ownership or a business owner shuffling assets, this section will arm you with actionable advice to keep your transfer smooth and tax-efficient as of April 2025.

How to Calculate Your SDLT Liability

Right, let’s start with the maths. SDLT on a transfer of equity hinges on the chargeable consideration—the value of what’s being exchanged, like cash or mortgage liability. But working out what counts as consideration isn’t always straightforward. Here’s a step-by-step guide to nail it:

Identify the consideration: Are you paying cash, taking on a mortgage, or swapping something else (like another property)? For mortgages, it’s the portion of the debt you’re assuming. If you’re adding a partner to a £600,000 property with a £400,000 mortgage, and they take on half (£200,000), that’s your starting point.

Check the threshold: From 1 April 2025, the residential SDLT threshold is £125,000. If your consideration is below this, you’re in the clear. Above it? You’ll owe tax on the excess.

Apply the rates: Use the residential SDLT bands (see Part 1’s table) unless it’s a commercial property, which has different rates (starting at 2% above £150,000). For our example, £200,000 means £75,000 is taxable at 2%, so £1,500 SDLT.

Factor in surcharges: If the transfer makes the new owner hold an additional property (e.g., they already own a home), add the 5% surcharge introduced in October 2024.

Here’s a table to clarify how consideration translates to SDLT for a residential property post-April 2025:

Consideration Amount | SDLT Due (Standard Rate) | SDLT Due (Additional Property, 5% Surcharge) |

£100,000 | £0 | £0 |

£150,000 | £500 (2% of £25,000) | £6,500 (5% of £25,000 + 7% of £25,000) |

£300,000 | £3,500 (2% of £125,000 + 5% of £50,000) | £13,500 (7% of £125,000 + 10% of £50,000) |

£600,000 | £17,250 (2% of £125,000 + 5% of £175,000 + 10% of £100,000) | £37,250 (7% of £125,000 + 10% of £175,000 + 15% of £100,000) |

Source: Adapted from HMRC SDLT Guidance

Be careful! If you’re transferring to a company, SDLT is based on the market value of the equity share, even if no cash changes hands. A £1m property with a 50% share transfer could trigger £24,500 in SDLT.

SDLT for a residential property post-April 2025

SDLT Calculator For Transfer of Equity in the UK

How to Use the SDLT Calculator for Transfer of Equity:

Select a tab at the top (Standard Residential, Additional Property, First-Time Buyer, or Company Transfer) based on your situation.

Enter the relevant amounts: cash consideration and mortgage assumed for residential tabs, property value for First-Time Buyer (max £500,000), or market value for Company Transfer.

Click "Calculate SDLT" to view the total consideration, SDLT payable, and a bar chart showing tax per band.

Use the results to estimate your SDLT liability for 2025-2026, sourced from GOV.UK.

Disclaimer:

This calculator provides an estimate of SDLT for transfers of equity based on HMRC rates effective April 2025. It is for informational purposes only and may not account for specific exemptions, reliefs, or complex scenarios. Always consult a tax advisor or solicitor for accurate advice tailored to your circumstances.

Why SDLT Increases with a Mortgage:

Chargeable Consideration: In a transfer of equity, SDLT is calculated on the total value of the consideration given, which includes any cash payment and the portion of any mortgage debt assumed by the new owner. For example, if you add someone to the property title and they take on £100,000 of an existing mortgage, that £100,000 is added to the chargeable consideration.

Taxable Amount: If the total consideration (cash + mortgage) exceeds the SDLT threshold (£125,000 from April 2025), SDLT is charged on the amount above the threshold at the applicable rates (e.g., 2% for £125,001–£250,000). A larger mortgage increases the consideration, pushing more of it into taxable bands, thus increasing the SDLT.

HMRC Rules: Per HMRC guidance (GOV.UK SDLT Manual), assuming a mortgage is treated as a financial contribution to the transfer, equivalent to paying cash, so it directly adds to the SDLT liability.

Why It Doesn’t Decrease:

You might expect a mortgage to reduce SDLT because it represents debt rather than an asset, but SDLT is not based on the net equity or profit. Instead, it’s based on the value exchanged in the transaction. Taking on a mortgage is seen as giving value to the transferor (e.g., relieving them of debt), so it increases the taxable consideration, not reduces it.

For example, if you transfer a 50% share of a property and the new owner assumes £200,000 of the mortgage, the consideration is £200,000. Post-April 2025, this triggers SDLT of £1,500 (2% of £75,000 above £125,000). Without the mortgage, the consideration might be £0 (if no cash is paid), resulting in no SDLT.

Case Study: A Business Owner’s Transfer Gone Wrong

Let’s meet Sanjay, a Birmingham-based entrepreneur who owns a £750,000 commercial property through his company, Apex Ltd. In 2024, he decides to transfer it to himself personally to simplify his portfolio. There’s no mortgage, so he assumes no SDLT applies. Big mistake! HMRC assesses SDLT on the market value of the 100% share (£750,000). Commercial rates apply:

£150,000 at 0% = £0

£100,000 at 2% = £2,000

£500,000 at 5% = £25,000

Total SDLT: £27,000

Sanjay could’ve avoided this by consulting a tax advisor, who might’ve suggested restructuring differently, like keeping the property in a holding company. Lesson? Always check the SDLT implications before moving business assets.

Common Scenarios and How SDLT Plays Out

Now, let’s walk through some everyday situations to see when SDLT bites:

Adding a spouse: If you’re married and adding your spouse to a mortgage-free property as a gift, no SDLT. But if they take on a £300,000 mortgage share, you’re looking at £3,500 SDLT post-April 2025.

Divorce transfers: Transferring to an ex-partner under a court order? SDLT-free, even if there’s a mortgage. But if you’re unmarried and settle informally, any consideration over £125,000 triggers tax.

Parent to child: Gifting a 25% share of a £400,000 home to your son, Idris? No SDLT if it’s a pure gift. If Idris pays you £100,000, it’s below the threshold, so still no tax.

Business restructuring: Moving a property into a limited company? SDLT applies on the market value, which can be a shock. A £500,000 property could cost £14,500 in SDLT, plus other taxes like Capital Gains Tax.

None of us wants a surprise tax bill, so map out the consideration and get professional advice for complex transfers.

Timing Your Transfer to Save Money

Now, here’s a savvy tip: timing is everything. The SDLT threshold drop to £125,000 on 1 April 2025, makes transfers pricier. If your consideration is near or above this, completing before March 2025 could save you thousands. For example, a £200,000 mortgage assumption is tax-free under the current £250,000 threshold but costs £1,500 after April.

But don’t rush blindly. Lenders often need to approve transfers (especially if there’s a mortgage), which can take weeks. Solicitors also need time to update the Land Registry. Start the process 2–3 months early to avoid missing the deadline. Use the GOV.UK SDLT Calculator to compare costs before and after April.

Paperwork and Reporting: Don’t Skip This

So, you’ve figured out if SDLT applies—what’s next? If there’s any chargeable consideration, you must file an SDLT return with HMRC within 14 days of the transfer’s effective date (usually completion). Even if no tax is due (e.g., consideration below £125,000), you might still need to file a “nil return” unless the transfer is exempt (like a divorce settlement).

Here’s what you need:

Details of the transaction: Property address, title number, and consideration.

Parties involved: Names and addresses of transferors and transferees.

Tax calculation: Use HMRC’s online portal or a solicitor to submit this.

Miss the deadline, and you’ll face a £100 penalty, rising to £200 after three months, plus interest on late tax. A conveyancer can handle this for you, typically charging £200–£500 for the whole process.

Worksheet: Check Your SDLT Liability

Here’s a quick worksheet to help you estimate your SDLT:

What’s the consideration?

Cash: £______

Mortgage assumed: £______

Other (e.g., property swap): £______

Total: £______

Is it below £125,000? If yes, likely no SDLT (check exemptions).

If above, calculate tax:

£125,001–£250,000 at 2%: £______

£250,001–£925,000 at 5%: £______

Higher bands as needed.

Surcharge? Add 5% if it’s an additional property.

Total SDLT: £______

Run this by a solicitor to confirm, especially for business transfers.

How to Check Your SDLT Liability

Advanced SDLT Considerations and Planning for Transfers of Equity

Now that you’ve got a handle on calculating SDLT and the practical steps for a transfer of equity, let’s dig into the trickier bits—rare scenarios, tax planning strategies, and how to sidestep pitfalls that could cost you thousands. Whether you’re a homeowner juggling personal finances or a business owner restructuring assets, this section will give you the edge to make smart, tax-efficient decisions as of April 2025.

Rare Scenarios That Could Trigger SDLT

So, you think you’ve seen it all? Not quite. Some less common situations can catch you off guard with SDLT. Let’s explore a few:

Partnership transfers: If you’re transferring property held in a partnership (common for business owners), SDLT might apply based on the market value of the share transferred, even if no cash changes hands. For example, moving a £600,000 property from a partnership to a partner personally could trigger SDLT on the full value—potentially £17,250.

Trusts and nominees: Transferring equity into or out of a trust? If the beneficiary pays or assumes a mortgage, SDLT applies on that consideration. If a nominee (someone holding the property for another) transfers it back, it’s usually SDLT-free, but only if no value is exchanged.

Linked transactions: Be careful! If you’re doing multiple transfers (e.g., splitting a property portfolio), HMRC might treat them as “linked” and calculate SDLT on the total consideration. Say you transfer two properties worth £150,000 each to your kids separately. If linked, SDLT is assessed on £300,000, not £150,000 each, pushing you into the 2% band (£3,500 total).

None of us wants to be blindsided, so flag these with a tax advisor if they sound like your situation. HMRC’s SDLT Manual is a goldmine for the fine print.

Case Study: A Family Gift With a Twist

Let’s meet Gwen, a retiree in Cardiff who wants to gift a 50% share of her £500,000 home to her son, Rhys, in 2024. There’s a £200,000 mortgage, and Rhys agrees to take on half (£100,000). Gwen assumes it’s SDLT-free since it’s a gift, but here’s the reality:

Consideration: Rhys’s £100,000 mortgage assumption.

Threshold: Pre-April 2025, the £250,000 threshold means no SDLT. Post-April, the £125,000 threshold makes it tax-free too, as £100,000 is below.

But here’s the twist: Gwen’s home is a second property (she owns a holiday cottage). If Rhys already owns a flat, the 5% additional property surcharge applies, making £100,000 taxable at 5% (£5,000).

Gwen could’ve avoided this by transferring before Rhys bought his flat or restructuring the gift differently. A solicitor’s advice saved her from a similar misstep with Capital Gains Tax.

Tax Planning Strategies to Minimise SDLT

Now, let’s get clever. You can often reduce or avoid SDLT with some forward thinking. Here are strategies to consider:

Time it right: Complete transfers before 31 March 2025, to use the £250,000 threshold instead of £125,000. For a £200,000 consideration, this saves £1,500.

Gift strategically: If possible, gift equity without consideration. For example, adding a spouse to a mortgage-free property avoids SDLT entirely.

Split mortgages carefully: If adding someone to a property with a mortgage, check if the lender can limit their liability to keep consideration below £125,000.

Use exemptions: Divorce-related transfers or equal splits (e.g., dividing a duplex) are often SDLT-free. Ensure paperwork reflects these conditions.

Business owners, beware: Transferring to a company triggers SDLT on market value. Consider alternatives like transferring shares in a property-holding company, which might avoid SDLT but could involve other taxes.

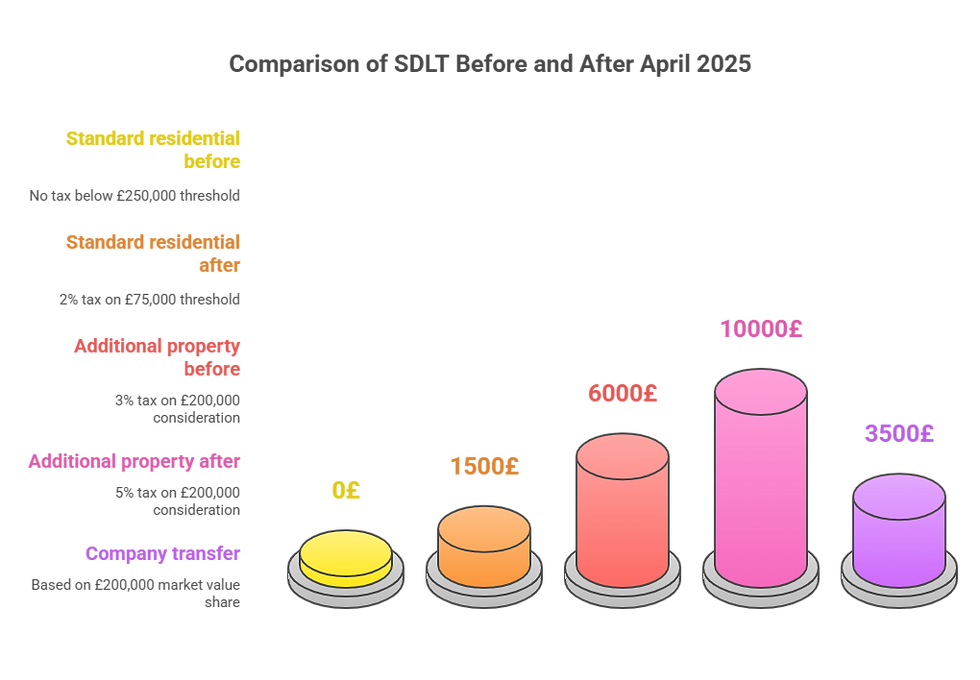

Here’s a table comparing SDLT outcomes for a £200,000 consideration under different scenarios:

Scenario | SDLT Before 31 Mar 2025 | SDLT After 1 Apr 2025 | Notes |

Standard residential | £0 (below £250,000) | £1,500 (2% of £75,000) | Threshold drop increases liability |

Additional property | £6,000 (3% of £200,000) | £10,000 (5% of £200,000) | 5% surcharge applies post-Oct 2024 |

Company transfer | £3,500 (market value) | £3,500 (market value) | Based on £200,000 market value share |

Source: GOV.UK SDLT Rates

Comparison of SDLT Before and After April 2025

Avoiding Common Pitfalls

Right, let’s talk about dodging trouble. Transfers of equity seem simple, but mistakes can sting. Watch out for:

Underestimating consideration: Forgetting to include mortgage liability or non-cash assets (like land swaps) can lead to an incorrect SDLT return and penalties.

Missing the 14-day deadline: File your SDLT return on time, even for nil returns. Late filing means a £100 fine, escalating to £200 after three months.

Ignoring linked transactions: Multiple transfers to the same person or group can be aggregated, hiking your SDLT bill.

Assuming exemptions: Divorce exemptions only apply to court orders or formal agreements, not informal splits. Unmarried couples often miss this.

So, the question is: how do you stay safe? Hire a conveyancing solicitor (fees typically £200–£500) and, for complex cases, a tax accountant. They’ll ensure your SDLT return is spot-on and explore reliefs you might’ve missed.

Business Owners: Special Considerations

Now, if you’re running a business, transfers of equity get extra spicy. Moving property into or out of a company often triggers SDLT on the market value, not just the consideration. For example, transferring a £1m property to your company could cost £39,500 in SDLT, even with no mortgage. Plus, you might face:

Capital Gains Tax (CGT): If the property’s value has risen since you bought it, CGT could apply.

Corporation Tax: Companies deduct SDLT as an expense, but other tax implications (like VAT) might arise.

Consider this: instead of transferring the property, you could sell shares in a property-holding company, which might avoid SDLT but requires careful structuring. A tax advisor is non-negotiable here—check HMRC’s Business Guidance for specifics.

Tools and Resources for Planning

Here’s a handy toolkit to keep you on track:

HMRC SDLT Calculator: Crunch your numbers at GOV.UK.

Land Registry: Verify title details and update deeds post-transfer (fees £50–£200).

Solicitor checklist: Ensure they handle lender consent, SDLT filing, and Land Registry updates.

Tax advisor: Essential for business transfers or complex scenarios like trusts.

Now, it shouldn’t surprise you that planning ahead saves money and stress. Use these resources to map out your transfer and double-check your SDLT liability.

Summary of All the Most Important Points Mentioned In the Above Article

A transfer of equity in the UK may trigger Stamp Duty Land Tax (SDLT) if there’s chargeable consideration, like cash or mortgage liability, exceeding £125,000 from April 2025.

SDLT is not due on gifts or exempt transfers, such as those under divorce court orders or equal property splits with no consideration.

The SDLT threshold drops from £250,000 to £125,000 on 1 April 2025, increasing tax liability for many transfers.

A 5% surcharge applies to additional properties, impacting transfers where the recipient already owns a home.

For business transfers to a company, SDLT is calculated on the market value of the property share, not just the consideration.

Timing transfers before 31 March 2025 can save tax due to the higher threshold.

An SDLT return must be filed within 14 days of the transfer, even if no tax is due, to avoid penalties starting at £100.

Linked transactions, like multiple transfers to the same person, are taxed on their total value, potentially increasing SDLT.

Tax planning, such as gifting without consideration or using divorce exemptions, can minimise or eliminate SDLT.

Complex scenarios, like partnership or trust transfers, often require a tax advisor to navigate SDLT on market value or other rules.

How a Tax Accountant Can Help You With Stamp Duty Land Tax

In the context of the complex and nuanced nature of Stamp Duty Land Tax (SDLT) in the UK, especially when dealing with transfers of equity, the role of a tax accountant becomes increasingly pivotal. This article delves into how a tax accountant can assist individuals and businesses in navigating the intricacies of SDLT, thereby ensuring compliance and optimizing financial outcomes.

Understanding SDLT and Its Implications

SDLT, a tax levied on property transactions in the UK, can significantly impact financial decisions related to property ownership. Its applicability varies based on the transaction's value, the property type, and the circumstances under which the transfer occurs, such as in cases of divorce, inheritance, or gifting. A tax accountant plays a crucial role in deciphering these complexities. They provide clarity on when SDLT is applicable, calculate the precise amount payable, and help understand various thresholds and reliefs that might apply.

Expert Guidance Through the SDLT Process

Tax accountants offer expert advice tailored to individual situations. For instance, in the transfer of equity, where the tax implications hinge on factors like the value of the equity transfer and any outstanding mortgage, a tax accountant can accurately calculate the SDLT due, if any. They also guide through exemptions, such as those applicable in cases of divorce or civil partnership dissolution, where SDLT might not be payable.

Navigating Complex Transactions

In more complex scenarios, such as adding a partner to property deeds or transferring property shares for debt settlement, the expertise of a tax accountant is invaluable. They can provide insights into how these transactions impact SDLT liabilities, considering both current tax laws and the specific details of the transaction.

SDLT Planning and Compliance

A tax accountant assists in SDLT planning, ensuring transactions are structured efficiently from a tax perspective. This planning is crucial for minimizing tax liabilities legally and effectively. Additionally, they ensure compliance with all HM Revenue & Customs (HMRC) regulations, thereby avoiding potential penalties and legal issues.

Assistance with Documentation and Filing

Handling SDLT involves meticulous documentation and adherence to filing deadlines. Tax accountants aid in preparing and submitting all necessary documents, including the SDLT return. Their expertise ensures that all information is accurate and complete, providing peace of mind that all legal obligations are met.

Advisory on Tax Reliefs and Exemptions

Tax accountants are well-versed in various reliefs and exemptions available under SDLT regulations. For example, they can advise on Multiple Dwellings Relief or First-Time Buyers Relief, potentially leading to significant tax savings. Their knowledge extends to understanding the implications of transferring property as a gift, where SDLT may not apply, and the conditions under which such exemptions are valid.

Handling Disputes and Queries

In case of disputes or queries from HMRC regarding SDLT payments, a tax accountant acts as an intermediary, handling communications and resolving issues efficiently. They bring expertise in tax law to the table, which is crucial in negotiating and settling any disagreements with the tax authorities.

Continuous Updates on SDLT Changes

Tax laws, including those pertaining to SDLT, are subject to change. A tax accountant stays abreast of these changes, ensuring clients are always informed about the latest regulations and how they might affect their property transactions.

In summary, a tax accountant is an indispensable resource in managing SDLT in the UK, especially for those dealing with transfers of equity. Their expertise ensures accurate calculation, efficient planning, compliance, and a thorough understanding of the complex SDLT landscape. By leveraging their knowledge and skills, property owners and businesses can navigate SDLT obligations with confidence and efficiency, ultimately leading to optimized tax outcomes and compliance with legal requirements.

FAQs

1. Q: Can you claim a refund for SDLT paid on a transfer of equity if you overpaid?

A: Yes, you can apply for a refund from HMRC within 12 months of the filing deadline if you overpaid SDLT, provided you submit evidence like an amended return or proof of exemption.

2. Q: Does SDLT apply to a transfer of equity for a leasehold property?

A: SDLT may apply to leasehold transfers if there’s chargeable consideration, such as taking on a mortgage, but not for the lease itself unless it’s a premium or new lease agreement.

3. Q: Can you defer SDLT payments for a transfer of equity in financial hardship?

A: HMRC does not typically allow deferral of SDLT for transfers of equity, but you can negotiate a Time to Pay arrangement if you can’t pay immediately, subject to approval.

4. Q: How does SDLT on a transfer of equity affect inheritance tax planning?

A: Transferring equity can reduce your estate’s value for inheritance tax, but SDLT may apply if consideration is involved, so consult a tax advisor to balance both taxes.

5. Q: Can you use a nominee arrangement to avoid SDLT on a transfer of equity?

A: Using a nominee to hold property temporarily might avoid SDLT if no consideration is paid, but HMRC scrutinises such arrangements to prevent tax avoidance.

6. Q: What happens if you don’t pay SDLT on a transfer of equity on time?

A: Late payment incurs interest at 7.75% annually (as of April 2025) plus potential penalties, starting at £100 for late filing, escalating to £200 after three months.

7. Q: Does SDLT apply to a transfer of equity for a property abroad?

A: SDLT only applies to UK land and buildings, so transfers of equity for foreign properties are not subject to SDLT, but local taxes may apply.

8. Q: Can you appeal an HMRC decision on SDLT for a transfer of equity?

A: Yes, you can request a statutory review or appeal to the Tax Tribunal within 30 days of HMRC’s decision, providing evidence to support your case.

9. Q: How does VAT interact with SDLT on a commercial property transfer of equity?

A: SDLT applies to the consideration or market value for commercial transfers, while VAT may apply if the property is opted to tax, requiring separate calculations.

10. Q: Can you transfer equity to a minor and avoid SDLT?

A: Transferring to a minor is possible, but SDLT applies if there’s consideration; a trust is often used, and legal advice is needed to ensure compliance.

11. Q: What records do you need to keep for SDLT on a transfer of equity?

A: Retain the SDLT return, payment receipts, mortgage documents, and transfer agreements for at least six years, as HMRC may audit your transaction.

12. Q: Can you claim SDLT relief for a transfer of equity to a charity?

A: Transfers to registered charities may qualify for SDLT relief if no consideration is paid, but partial relief applies if consideration exists, per HMRC rules.

13. Q: How does SDLT apply to a transfer of equity in a shared ownership scheme?

A: SDLT may apply if you take on additional equity with consideration, calculated on the payment or mortgage share, but staircasing reliefs might reduce the tax.

14. Q: Can you backdate a transfer of equity to avoid SDLT changes in April 2025?

A: Backdating is illegal and considered tax evasion; the effective date is when the transfer is completed, and HMRC uses this for SDLT calculations.

15. Q: Does SDLT apply to a transfer of equity in a property with a life interest?

A: SDLT may apply if the life interest holder pays consideration to transfer equity, based on the value exchanged, but trusts complicate this—seek legal advice.

16. Q: Can you offset SDLT paid on a transfer of equity against other taxes?

A: SDLT is not directly offsettable against other taxes like income tax, but businesses may deduct it as an expense for corporation tax purposes.

17. Q: How does SDLT on a transfer of equity affect first-time buyer relief?

A: First-time buyer relief doesn’t apply to transfers of equity, as it’s only for purchasing a main residence, but check if the transferee qualifies for other reliefs.

18. Q: Can you transfer equity to avoid repossession and still avoid SDLT?

A: Transferring to a third party to avoid repossession may trigger SDLT if consideration (like mortgage liability) is involved, and lender consent is required.

19. Q: What’s the SDLT implication for transferring equity in a mixed-use property?

A: Mixed-use properties (e.g., shop with flat) are taxed at commercial SDLT rates (0% up to £150,000, 2% to £250,000, 5% above), based on consideration or market value.

20. Q: Can you use a loan instead of a mortgage to avoid SDLT on a transfer of equity?

A: A loan separate from the property doesn’t count as chargeable consideration, but HMRC may challenge this if it’s structured to avoid SDLT—consult a tax expert.

Click on the above arrow to expand the text

Disclaimer:

The information provided in our articles is for general informational purposes only and is not intended as professional advice. While we strive to keep the information up-to-date and correct, Pro Tax Accountant makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the website or the information, products, services, or related graphics contained in the articles for any purpose. Any reliance you place on such information is therefore strictly at your own risk. The graphs may also not be 100% accurate.

We encourage all readers to consult with a qualified professional before making any decisions based on the information provided. The tax and accounting rules in the UK are subject to change and can vary depending on individual circumstances. Therefore, Pro Tax Accountant cannot be held liable for any errors, omissions, or inaccuracies published. The firm is not responsible for any losses, injuries, or damages arising from the display or use of this information.

.png)