What is Form SC3 for Paternity Pay and Leave?

- Adil Akhtar

- Feb 6, 2023

- 17 min read

Updated: Jul 11, 2025

Understanding Paternity Form SC3 and Its Role in the UK

Now, if you’re a new dad or a partner eagerly awaiting a little one, you’ve probably stumbled across the term “Paternity Form SC3” while figuring out your rights. So, what exactly is it? Paternity Form SC3 is an official HMRC document that UK employees use to formally request Statutory Paternity Pay (SPP) and Statutory Paternity Leave from their employer when they become a birth parent, adopt, or have a child via surrogacy. It’s your ticket to ensuring you get the time and financial support you’re entitled to during those precious early days. Let’s unpack this form, its purpose, and how it fits into the UK’s paternity system as of April 2025, with all the latest rules and rates.

What Does Form SC3 Actually Do?

Let’s get straight to the point: Form SC3 is your way of telling your employer, “Hey, I’m eligible for paternity leave and pay, and here’s the proof.” It’s a self-certification form where you confirm key details like your employment status, relationship to the child, and intended leave dates. Submitting it ensures your employer can process your Statutory Paternity Pay (currently £187.18 per week or 90% of your average weekly earnings, whichever is lower, for the 2025-2026 tax year) and approve your leave, which can be one or two weeks. The form is critical because, without it (or your employer’s equivalent), you might miss out on these statutory benefits. You can download it directly from the GOV.UK website, and it’s been updated as of 18 July 2022 to reflect current processes.

Who Needs to Use Form SC3?

So, who’s this form for? If you’re an employee expecting a child—whether you’re the biological father, the mother’s partner, or an adoptive parent—Form SC3 is your go-to. But there’s a catch: you need to meet specific eligibility criteria. You must:

Have worked continuously for the same employer for at least 26 weeks by the 15th week before the baby’s due date (known as the “qualifying week”).

Earn at least £125 per week (before tax) on average over an 8-week period ending with the qualifying week.

Be the child’s biological father, the mother’s partner (including same-sex partners), or have responsibility for the child’s upbringing.

Still be employed by the same employer when the baby is born or placed for adoption.

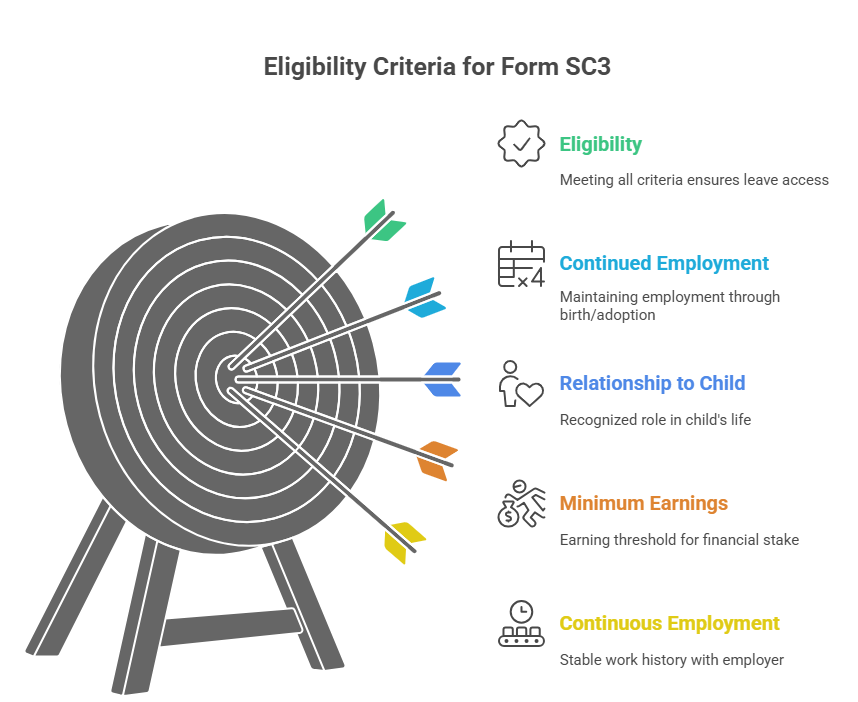

Eligibility Criteria for Form SC3

For example, let’s say Alastair, a warehouse manager in Bristol, has been with his employer for two years and earns £400 weekly. His partner is due in August 2025, so his qualifying week is mid-April 2025. He’s eligible to use Form SC3 to claim SPP and up to two weeks of leave. But if Priya, a freelance graphic designer, wants paternity leave, she’s out of luck—self-employed folks aren’t eligible for SPP or statutory leave, though they might explore other options like unpaid time off.

How Much Is Statutory Paternity Pay in 2025?

Now, let’s talk money. For the 2025-2026 tax year, Statutory Paternity Pay is £187.18 per week or 90% of your average weekly earnings, whichever is lower. This amount is taxable, so expect deductions for Income Tax and National Insurance, just like your regular wages. Your employer pays SPP directly, typically in line with your normal pay cycle (weekly or monthly). Some employers offer enhanced paternity pay, which could match your full salary—check your contract or speak to HR to confirm.

Here’s a quick table to break down SPP rates and eligibility:

Criteria | Details |

Weekly SPP Rate (2025-2026) | £187.18 or 90% of average weekly earnings, whichever is lower |

Minimum Earnings Requirement | £125 per week (average over 8 weeks before qualifying week) |

Employment Duration | 26 continuous weeks by the 15th week before the baby’s due date |

Tax and NI Deductions | Yes, deducted as per standard PAYE rules |

Leave Duration | 1 or 2 weeks (consecutive or two non-consecutive 1-week blocks as of April 2024) |

Deadline to Notify Employer | 15 weeks before the expected week of childbirth |

When and How to Submit Form SC3?

Be careful! Timing is everything with Form SC3. You need to submit it to your employer at least 15 weeks before the baby’s due date (or within 7 days of being matched with an adopted child). This gives your employer enough time to verify your eligibility and arrange payments. The form itself is straightforward—you’ll need to provide:

The baby’s due date or adoption placement date.

Your intended leave start date (must be within 56 days of the birth or placement, or the due date if the baby is early).

Whether you’re taking one or two weeks of leave.

A declaration that you’re eligible (e.g., you’re the father or partner with responsibility for the child).

You can’t save a partially completed SC3 form online, so gather all your details beforehand. Once filled out, download or print it and hand it to your employer. Some employers have their own version of the form, so check with HR first. If you’re adopting, you might need Form SC4 or SC5 instead, depending on the adoption type.

Why the Fuss About Timing?

Now, consider this: If you miss the 15-week notice period, you could still qualify for SPP and leave if you have a reasonable excuse (e.g., the baby arrives early). For instance, if Sophie’s baby is born prematurely in June 2025, her partner Raj can submit Form SC3 as soon as possible after the birth, stating the actual birth date. Employers are encouraged to be flexible in such cases, but it’s best to plan ahead to avoid hiccups. The GOV.UK paternity planner tool can help you pinpoint key deadlines based on your baby’s due date.

Tax Implications of Statutory Paternity Pay

None of us is a tax expert, but SPP’s tax treatment is worth understanding. Since SPP is treated like regular income, it’s subject to Income Tax and National Insurance contributions. If you earn £400 weekly and take two weeks of SPP at £187.18 per week, your total SPP of £374.36 will be taxed based on your current tax code. For the 2025-2026 tax year, the UK personal allowance is £12,570, with the basic rate (20%) applying to income between £12,571 and £50,270. If your SPP pushes your annual income over the personal allowance, you’ll pay tax on the excess.

For example, let’s say Raj earns £30,000 annually. His SPP of £374.36 for two weeks is added to his income, taxed at 20% (assuming he’s in the basic rate band). This means about £74.87 in tax and roughly £44.92 in National Insurance (at 8%) could be deducted, leaving him with around £254.57 net for the two weeks. Use the GOV.UK calculator to estimate your exact take-home pay.

How to Fill Out Form SC3 for Paternity Pay: A Step-by-Step Guide

Step 1: Access the Form and Gather Information

Now, let’s get started. Visit the GOV.UK website to access the online form for Statutory Paternity Pay and/or Leave (commonly known as Form SC3). You can’t save a partially completed form, so collect all necessary details beforehand: your full name, National Insurance number, employer’s payroll number (if applicable), the baby’s expected week of childbirth (EWC) or adoption matching date, and evidence of your employment (e.g., payslips showing you earn at least £125 weekly and have worked for your employer for 26 weeks by the 15th week before the EWC).

Step 2: Provide Your Personal and Employment Details

Here’s where you identify yourself. The form requires:

Your full name: Enter your legal name as shown on payroll records.

National Insurance number: Find this on payslips or HMRC letters.

Employee payroll number: Check with your employer if you don’t know it.

For example, Alastair in Bristol enters “Alastair David Jones,” his NI number (e.g., QQ123456C), and his payroll number from his warehouse job.

Step 3: Enter Details About the Child

So, let’s talk about the baby. You need to provide:

Expected week of childbirth (EWC): Note the week your baby is due (e.g., 11-17 August 2025 for a 15 August due date).

Actual date of birth (if known): Include this only if the baby is born early, e.g., Raj enters 20 July 2025 for a premature birth.

Adoption details: For domestic adoptions, provide the date you were matched with the child. For overseas adoptions, use Form SC4 instead, as specified on the official page.

Step 4: Confirm Your Relationship and Eligibility

Be clear about your role. You’ll need to confirm that you’re:

The biological father, the mother’s husband/partner (including same-sex partners), or someone with responsibility for the child’s upbringing (e.g., in adoption or surrogacy cases).

You also confirm eligibility by stating:

You’ve been continuously employed by your employer for at least 26 weeks by the 15th week before the EWC.

You earn at least £125 weekly (averaged over 8 weeks before the qualifying week).

You’re taking leave to care for the child or support the mother/partner.

For instance, Priya’s partner confirms he’s the mother’s partner and meets the employment and earnings criteria.

Step 5: Specify Your Paternity Leave Dates

Now, consider this: when do you want your leave? You’ll need to:

Choose a start date: This must be within 56 days of the birth or EWC (e.g., 16 August 2025 for Alastair).

Select duration: Choose one or two weeks. Since April 2024, you can split two weeks into two non-consecutive one-week blocks within 52 weeks of the birth/adoption, but you must give 28 days’ notice for each block.

For example, Raj selects one week from 21 July 2025 and another from 10 November 2025, specifying both periods.

Step 6: Complete and Send the Form

Here’s the final stretch. Review all details for accuracy, as you’re declaring the information is correct. Once completed:

Download or print the form: The online system generates a completed form for you to send to your employer.

Submit to your employer: Send it at least 15 weeks before the EWC (e.g., by 2 May 2025 for an August due date) or within 7 days of the birth for early arrivals or adoption matching. Email or hand-deliver it, depending on your employer’s preference.

Check for employer-specific forms: Some employers use their own version, so confirm with HR first.

Keep a copy of the form for your records in case of disputes.

Table: Key Requirements for Form SC3

Requirement | Details |

Personal Details | Full name, NI number, payroll number |

Child Details | EWC, actual birth date (if early), or adoption date |

Eligibility | Confirm 26 weeks’ employment, £125/week earnings |

Leave Details | Start date, 1 or 2 weeks (splittable), 28 days’ notice |

Submission Deadline | 15 weeks before EWC or 7 days after birth/adoption |

SPP Rate (2025-2026 |

Navigating Form SC3 in Practice: Tips, Edge Cases, and Employer Responsibilities

Now, let’s get into the nitty-gritty of using Form SC3 effectively. Whether you’re an employee planning your paternity leave or a business owner ensuring compliance, there’s more to this form than just filling it out and handing it over. From handling unusual situations like premature births to understanding how SPP interacts with your tax code, this part dives deep into practical applications and employer obligations, with real-world examples to make it crystal clear. We’ll also touch on recent changes to paternity leave rules as of April 2025, ensuring you’re up to speed with the latest regulations.

How Do You Fill Out Form SC3 Correctly?

Let’s start with the basics: getting Form SC3 right. The form, available on GOV.UK, asks for straightforward details, but a slip-up can delay your pay or leave. You’ll need to include:

Your name, National Insurance number, and payroll number.

The expected week of childbirth (EWC) or adoption placement date.

Your chosen leave start date (must be within 56 days of the birth or due date).

Whether you want one or two weeks of leave, and if you’re splitting it (more on that later).

A declaration confirming your eligibility (e.g., you’re the father or partner and meet the 26-week employment rule).

For example, take Alastair from Bristol again. His partner’s due date is 15 August 2025, so his EWC is the week of 11-17 August. He wants to take two weeks off starting the day after the birth, estimated for 16 August. On Form SC3, he notes the EWC, selects two weeks, and confirms he’s been with his employer for over 26 weeks by 25 April 2025 (the 15th week before the EWC). He submits it by 2 May 2025 to meet the 15-week notice deadline. Easy, right? But double-check your dates—errors can lead to disputes or delays.

What If the Baby Arrives Early or You’re Adopting?

Now, it shouldn’t be a surprise that life doesn’t always go to plan. If your baby arrives early, like in Sophie and Raj’s case from Part 1, you can still claim SPP and leave. You just need to notify your employer as soon as possible, ideally within 7 days of the birth, using Form SC3 or a written statement. The form allows you to update the actual birth date, and your leave can start from the birth or shortly after, as long as it’s within 56 days.

Adoption’s a bit different. If you’re adopting, you’ll use Form SC3 for domestic adoptions or Form SC4 for overseas adoptions. For example, Priya and her partner, adopting a child in 2025, must submit Form SC3 within 7 days of being matched with the child. The leave can start from the placement date or up to 14 days before. If you’re in a surrogacy arrangement, Form SC3 still applies, but you’ll need to confirm your parental responsibility (e.g., via a Parental Order). Always check with your employer for specific requirements, as some may need extra documentation.

Can You Take Paternity Leave in Non-Consecutive Blocks?

Here’s a game-changer: as of April 2024, UK paternity leave rules got a flexibility boost. You can now take your two weeks of paternity leave as two separate one-week blocks rather than one continuous period, as long as it’s within 52 weeks of the birth or adoption. This is a big deal for parents like Raj, who might want one week right after the birth and another when his partner returns to work. You’ll need to specify this on Form SC3, noting the exact weeks you plan to take. Be warned, though—your employer needs at least 28 days’ notice for each block, so plan ahead.

How Does SPP Affect Your Tax Code?

None of us loves dealing with taxes, but SPP can nudge your tax code in ways you might not expect. Since SPP is taxable, it’s processed through PAYE, just like your salary. If you’re on a standard 1257L tax code (for the £12,570 personal allowance in 2025-2026), your SPP will be taxed at your usual rate—20% for basic rate taxpayers. But if you’re already close to the higher-rate threshold (£50,270), SPP could push you over, triggering 40% tax on the excess.

For instance, let’s say Priya’s partner, earning £48,000 annually, takes two weeks of SPP (£374.36 total). This bumps his taxable income to £48,374.36. The first £12,570 is tax-free, £35,429 is taxed at 20% (£7,085.80), and the remaining £374.36 falls into the higher-rate band at 40% (£149.74). Add National Insurance (2% above £50,270), and he might lose about £160 of his SPP to deductions. If your tax code’s wrong—say, you’re on an emergency code like 1257L M1—overtaxing could happen. Check your payslip and use HMRC’s online tool to verify your code.

What Are Employers’ Responsibilities with Form SC3?

So, the question is: what does your boss need to do? Employers must process Form SC3 promptly, verify your eligibility, and pay SPP if you qualify. They can reclaim 92% of SPP costs from HMRC (or 100% if they’re a small business with annual NI liabilities under £45,000). Failure to pay SPP or grant leave can lead to tribunal claims, so most employers take this seriously.

For example, Alastair’s employer, a Bristol warehouse, checks his Form SC3 against payroll records to confirm his 26-week tenure and £400 weekly earnings. They approve his two-week leave and pay £187.18 per week, reclaiming £172.61 (92%) from HMRC. Employers must also keep records of SPP payments for at least three years and provide a written reason if they refuse your claim. If you’re an employer reading this, ensure your HR team knows the April 2024 flexibility rules—employees might request split leave, and you’ll need clear policies to handle it.

What Happens in Edge Cases Like Multiple Jobs or Disputes?

Be careful! If you work multiple jobs, SPP gets tricky. You can claim SPP from each employer if you meet the eligibility criteria for each job (26 weeks and £125 weekly earnings). For example, if Raj works 20 hours at a supermarket and 20 at a call centre, he could submit Form SC3 to both employers, potentially doubling his SPP to £374.36 per week (if both pay £187.18). However, the combined income will be taxed, so notify HMRC to avoid overtaxing.

If your employer disputes your eligibility, they must provide a reason in writing within 28 days. You can appeal to HMRC or, in extreme cases, an employment tribunal. For instance, in a 2024 case, a Manchester employee successfully claimed SPP after his employer wrongly argued he hadn’t worked long enough, citing incorrect payroll data. Always keep copies of your Form SC3 and payslips as evidence.

Table: Key Employer Responsibilities for SPP and Form SC3

Responsibility | Details |

Verify Eligibility | Confirm 26 weeks’ employment and £125 weekly earnings by qualifying week |

Process SPP | Pay £187.18/week (or 90% of earnings, if lower) for 1-2 weeks |

Reclaim Costs | Recover 92% (or 100% for small businesses) via HMRC’s PAYE system |

Record-Keeping | Retain SPP records for 3 years |

Handle Disputes | Provide written refusal reason within 28 days; risk tribunal if non-compliant |

Key Takeaways and Practical Insights for Paternity Form SC3

Now, let’s wrap things up with the most critical points about Paternity Form SC3 and Statutory Paternity Pay (SPP) in the UK. Whether you’re a new parent planning your leave or a business owner ensuring compliance, these insights distill everything you need to know into clear, actionable takeaways. We’ll also dive into some final practical tips and edge cases to make sure you’re fully prepared, with a focus on maximizing value for UK taxpayers and employers as of April 2025.

How Can You Ensure You Don’t Miss Out on SPP?

So, the question is: how do you make sure you get every penny you’re entitled to? Submitting Form SC3 correctly and on time is non-negotiable. The 15-week notice period (before the expected week of childbirth) is your deadline, but if life throws a curveball—like a premature birth—you can still claim by notifying your employer ASAP. For example, if Alastair’s baby arrives three weeks early in July 2025, he can submit Form SC3 within 7 days of the birth, ensuring he still gets his £187.18 per week. Double-check your eligibility (26 weeks with the employer, £125 weekly earnings) and keep payslips handy to prove it. If your employer offers enhanced paternity pay, don’t assume it’s automatic—ask HR to confirm.

What Should You Watch Out for with Tax and NI?

Be careful! SPP is taxable, and it can mess with your tax code if you’re not paying attention. For the 2025-2026 tax year, SPP (£187.18 per week) is subject to Income Tax (20% for basic rate taxpayers) and National Insurance (8% or 2% depending on your income). If you’re on a high income, like Priya’s partner earning £48,000, SPP could nudge you into the 40% tax band, reducing your net pay. Always check your payslip after receiving SPP to ensure your tax code (e.g., 1257L for the £12,570 personal allowance) hasn’t been misapplied. If you spot overtaxing, use HMRC’s online portal to request a refund or adjust your code.

How Do Recent Rule Changes Affect You?

Now, consider this: the April 2024 paternity leave changes give you more flexibility. You can split your two weeks into two non-consecutive one-week blocks within 52 weeks of the birth or adoption. This is perfect for parents like Raj, who might want to stagger leave to support his partner later. But you’ll need to note this on Form SC3 and give 28 days’ notice for each block. Employers must adapt to this, so if you’re a business owner, update your HR policies to handle split requests smoothly. Check GOV.UK for the latest guidance on these changes.

What If You’re Self-Employed or Have Multiple Jobs?

Here’s a heads-up: if you’re self-employed, Form SC3 and SPP aren’t available to you. Instead, explore unpaid leave or other benefits like the Child Benefit (£25.60 per week for the first child in 2025). For those juggling multiple jobs, you can claim SPP from each employer if you meet the eligibility criteria for each. For instance, if Raj earns £200 weekly at one job and £180 at another, he could claim £187.18 from both, but the combined £374.36 will be taxed as part of his annual income. Notify HMRC to avoid tax code errors across multiple employers.

Table: SPP and Form SC3 Quick Reference (2025-2026)

Aspect | Key Information |

SPP Rate | £187.18/week or 90% of average weekly earnings, whichever is lower |

Leave Duration | 1 or 2 weeks (can be split into two 1-week blocks as of April 2024) |

Notice Period | 15 weeks before EWC or 7 days after birth/adoption if delayed |

Tax Implications | Taxed at 20% (basic rate) or 40% (higher rate); NI at 8% or 2% |

Employer Reimbursement | 92% (100% for small businesses) via HMRC |

Summary of the Most Important Points

Paternity Form SC3 is the official HMRC document employees use to claim Statutory Paternity Pay and Leave, confirming eligibility and leave dates.

You’re eligible for SPP if you’ve worked 26 weeks for the same employer by the 15th week before the baby’s due date and earn at least £125 weekly.

SPP for 2025-2026 is £187.18 per week (or 90% of earnings, if lower), paid for one or two weeks, and is subject to Income Tax and National Insurance.

Submit Form SC3 at least 15 weeks before the expected week of childbirth or within 7 days of adoption matching or premature birth.

As of April 2024, you can take two weeks of paternity leave in two non-consecutive one-week blocks within 52 weeks, with 28 days’ notice per block.

Employers must verify eligibility, pay SPP, and can reclaim 92% (or 100% for small businesses) from HMRC, keeping records for three years.

If you work multiple jobs, you can claim SPP from each eligible employer, but the combined income is taxed, potentially affecting your tax code.

For adoption or surrogacy, use Form SC3 (domestic adoption) or SC4 (overseas adoption), confirming parental responsibility.

SPP can push you into a higher tax band (e.g., 40% above £50,270), so check your tax code to avoid overtaxing.

Self-employed individuals aren’t eligible for SPP or Form SC3 but can explore other benefits like Child Benefit or unpaid leave.

FAQs

Q1: Can an employee claim Statutory Paternity Pay without submitting Form SC3?

A1: An employee may still claim Statutory Paternity Pay by providing written notice to their employer with the same details as Form SC3, but using the form ensures a standardized process and reduces the risk of errors or disputes.

Q2: What happens if an employee submits Form SC3 late?

A2: If an employee submits Form SC3 after the 15-week notice period, they may still qualify for Statutory Paternity Pay and leave if they have a reasonable excuse, such as a premature birth, but they should notify their employer as soon as possible.

Q3: Can an employee take paternity leave before the baby is born?

A3: An employee cannot take paternity leave before the birth, but they can start it on the day of the birth or within 56 days after the birth or expected due date.

Q4: Is Statutory Paternity Pay available for same-sex couples?

A4: Yes, same-sex partners who meet the eligibility criteria (26 weeks of continuous employment and minimum earnings) can claim Statutory Paternity Pay using Form SC3 if they have responsibility for the child’s upbringing.

Q5: Can an employer refuse paternity leave if Form SC3 is completed correctly?

A5: An employer cannot refuse paternity leave if the employee meets all eligibility criteria and provides proper notice via Form SC3, but they must provide a written reason within 28 days if they believe the employee is ineligible.

Q6: Does Statutory Paternity Pay affect other benefits like Universal Credit?

A6: Statutory Paternity Pay is considered income and may reduce the amount of Universal Credit an employee receives, depending on their total household income.

Q7: Can an employee claim Statutory Paternity Pay for a stillbirth?

A7: An employee can claim Statutory Paternity Pay and leave if the stillbirth occurs after 24 weeks of pregnancy, provided they meet the standard eligibility criteria.

Q8: How does an employee calculate their average weekly earnings for SPP?

A8: Average weekly earnings are calculated by averaging the employee’s gross pay over the 8 weeks before the 15th week prior to the expected week of childbirth.

Q9: Can an employee take paternity leave if they’re on a zero-hours contract?

A9: Employees on zero-hours contracts can claim paternity leave and pay if they meet the 26-week continuous employment and minimum earnings requirements with the same employer.

Q10: What documentation is needed alongside Form SC3 for adoption cases?

A10: For adoption, employees may need to provide a matching certificate or official letter from the adoption agency alongside Form SC3 to confirm the placement date.

Q11: Can an employee change their paternity leave dates after submitting Form SC3?

A11: An employee can change their leave dates by giving their employer at least 28 days’ notice, or as soon as reasonably practicable in cases like premature births.

Q12: Is Statutory Paternity Pay available for employees working part-time?

A12: Part-time employees are eligible for Statutory Paternity Pay if they meet the same eligibility criteria as full-time employees, including the minimum earnings threshold.

Q13: Can an employee claim SPP if they’re on a temporary contract?

A13: Employees on temporary contracts can claim SPP if they’ve worked continuously for the same employer for 26 weeks by the qualifying week and meet the earnings requirement.

Q14: What happens if an employee’s baby is born abroad?

A14: An employee can still claim Statutory Paternity Pay and leave if they meet UK eligibility criteria and provide evidence of the birth, such as a birth certificate, alongside Form SC3.

Q15: Can an employer deduct Statutory Paternity Pay from an employee’s holiday entitlement?

A15: No, paternity leave is separate from annual leave, and employers cannot deduct SPP or leave from an employee’s statutory holiday entitlement.

Q16: Does an employee need to repay Statutory Paternity Pay if they leave their job?

A16: An employee does not need to repay Statutory Paternity Pay if they leave their job after receiving it, as it’s a statutory entitlement.

Q17: Can an employee claim SPP for twins or multiple births?

A17: Statutory Paternity Pay remains the same for multiple births, capped at £187.18 per week or 90% of average weekly earnings for one or two weeks.

Q18: How does an employee appeal if their SPP claim is rejected?

A18: If an employer rejects an SPP claim, the employee can request a written explanation and appeal to HMRC or an employment tribunal if the issue persists.

Q19: Can an employee take paternity leave if their partner is self-employed?

A19: An employee’s eligibility for paternity leave and pay depends on their own employment status, not their partner’s, so they can claim if they meet the criteria.

Q20: Is Statutory Paternity Pay affected by maternity pay received by a partner?A20: Statutory Paternity Pay is independent of maternity pay, and an employee’s entitlement is based solely on their own eligibility, regardless of their partner’s benefits.

.png)