How to Calculate Class 4 NIC

- Adil Akhtar

- May 1, 2024

- 15 min read

Updated: 7 days ago

Understanding Class 4 National Insurance Contributions (NIC) for 2025-26

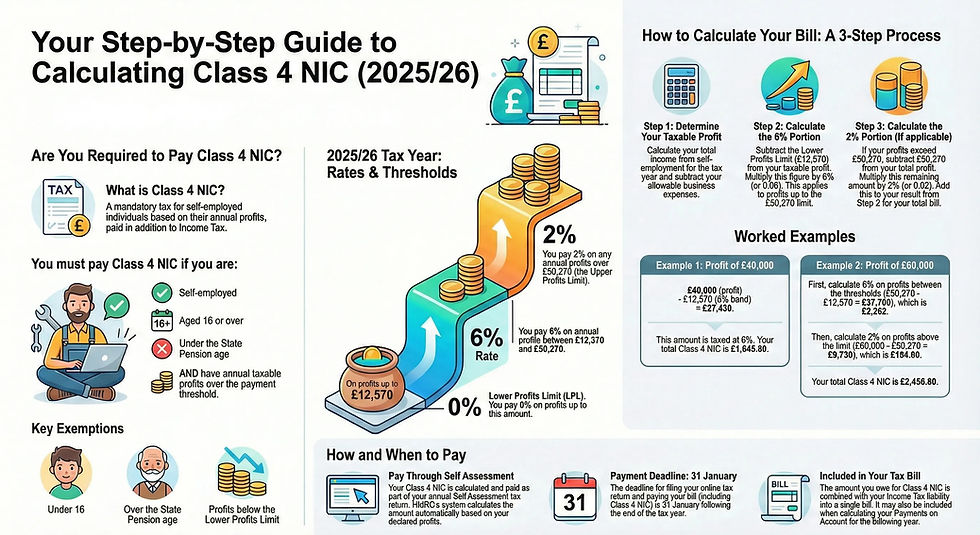

Class 4 National Insurance Contributions (NIC) are paid by self-employed individuals in the UK based on their annual profits. These contributions are calculated through Self Assessment tax returns and are a key part of the UK tax system. This article explores how these contributions are calculated for the 2025-26 tax year, following recent changes in legislation.

Eligibility and Rates

To be liable for Class 4 NIC, a self-employed person's profits must exceed the Lower Profits Limit (LPL), which for the tax year 2025-26 is set at £12,570. The rates applied to profits are twofold:

A 6% rate is charged on profits between £12,570 and £50,270.

Above £50,270, the rate decreases to 2%.

These rates reflect a significant reduction from previous years, intended to provide financial relief to the self-employed sector.

Calculating Class 4 NIC

The calculation of Class 4 NIC is integrated into the Self Assessment tax return process. Here’s how it typically works:

Determine your annual profits from self-employment.

Subtract any allowable expenses to find your taxable profits.

Apply the appropriate NIC rates to your taxable profits within the specified thresholds.

For example, if your taxable profits are £40,000, you first calculate the amount above the LPL:

£40,000 (taxable profits) - £12,570 (LPL) = £27,430.

NIC due: £27,430 x 6% = £1,645.80.

Reporting and Payment

Class 4 NIC, along with any Income Tax due, is reported and paid through the HMRC Self Assessment system. The deadline for online submissions and payments is January 31st following the end of the tax year. It’s important to keep accurate records of income and expenses, as these figures are essential for correct NIC calculation.

Tools and Resources

HMRC provides various tools and resources to assist with the calculation and payment of Class 4 NIC. Digital tools, such as tax calculators and accounting software, can help simplify this process, ensuring accuracy and compliance.

Key Changes and Implications

The reduction in Class 4 NIC rates from previous years marks a significant change in tax policy aimed at supporting self-employed individuals. This reduction, coupled with the abolition of Class 2 NIC (with credits for state benefits if profits are £6,845 or more), represents a shift towards simplifying the tax obligations of the self-employed.

Understanding how to calculate Class 4 NIC is crucial for all self-employed individuals in the UK. By staying informed of the current rates and thresholds and utilizing available resources for calculation, self-employed taxpayers can ensure they meet their tax obligations efficiently. The next section of this article will delve deeper into strategic planning for these contributions throughout the tax year.

Strategic Financial Planning for Class 4 NIC in 2025-26

Preparing for Payment

Financial planning for Class 4 NIC payments is crucial for self-employed individuals to manage their cash flows effectively throughout the year. Since these payments are calculated based on annual profits, it's important to set aside funds regularly to avoid financial strain at payment deadlines. Here are steps to ensure you are well-prepared:

Estimate Your Taxable Income: Regularly update your income estimates to account for any changes in your business that might affect your profits.

Calculate Estimated NICs: Use the current rates to calculate your potential NIC liability. For example, if you project your profits to be £35,000 for the year, your NIC would be calculated on the amount over the LPL, which would be £22,430, resulting in NIC payments of approximately £1,345.80.

Set Aside Money: It is advisable to set aside this amount gradually throughout the year, so you are not overwhelmed by a large bill.

Utilizing Digital Tools

Leveraging digital tools can greatly enhance your efficiency and accuracy in financial planning:

Accounting Software: Programs like Xero and FreeAgent offer features tailored for the self-employed, including automatic calculations for taxes and NIC based on real-time data inputs.

HMRC’s Online Services: HMRC provides various online tools that can help estimate your tax and NIC liabilities, ensuring that you remain compliant with current regulations.

Budgeting for NIC Payments

Creating a budget for your NIC payments involves understanding your cash flow and adjusting your savings accordingly:

Regular Savings: Instead of facing a large expense once a year, consider transferring a set amount monthly into a dedicated savings account.

Use of Budget Payment Plan: HMRC offers a Budget Payment Plan that allows you to make regular payments towards your estimated tax bill, helping spread the cost over the year.

Managing Fluctuating Incomes

If your business experiences seasonal fluctuations or irregular income streams, managing your NIC contributions might require a more dynamic approach:

Adjust Your Savings: Increase savings during peak months and reduce them during slower periods.

Review Regularly: Regularly review your profit projections and adjust your budget accordingly to avoid under or overpayments.

Professional Advice

Given the complexities associated with tax planning, consulting with a tax professional can provide personalized advice tailored to your specific financial situation. A professional can offer guidance on:

Tax Deductions and Allowances: Ensuring you claim all allowable expenses and deductions to minimize your taxable profits and thus your NIC liability.

Compliance and Updates: Keeping abreast of any changes to tax legislation that might affect your NIC payments.

Effective financial planning for Class 4 NIC is essential for managing your tax liabilities as a self-employed individual in the UK. By accurately estimating your profits, utilizing digital tools for budget management, and seeking professional advice, you can ensure that you meet your financial obligations without undue stress. The final section of this article will discuss the broader implications of Class 4 NIC for long-term financial health and planning strategies to optimize your tax positions.

Long-term Financial Health and Advanced Tax Planning with Class 4 NIC

Long-term Benefits and Considerations

While Class 4 National Insurance Contributions primarily function as a tax on earnings, they do not directly contribute to your state pension or other entitlements. Since the abolition of Class 2 NICs, credits are automatically applied if profits are £6,845 or more to protect entitlements. However, paying Class 4 NIC is still crucial as it forms part of your complete tax obligations. Understanding its impact on your overall financial health is vital.

Retirement Planning: Although Class 4 NICs do not count towards your state pension entitlements, they are integral to your overall financial planning as a self-employed individual. It's important to consider other retirement savings options, such as personal pensions or ISAs, to ensure a stable financial future.

Financial Stability: Regular payment of NICs ensures that you remain compliant with tax laws, avoiding penalties that could impact your financial stability.

Advanced Tax Planning Strategies

To optimize your tax position and potentially reduce the amount of NIC you owe, consider the following strategies:

Income Spreading: If your business allows, you might consider spreading income over two tax years to keep annual profits below the upper threshold, thereby reducing the rate at which Class 4 NIC is charged.

Pension Contributions: Contributing to a personal pension can reduce your taxable profit, as these contributions are tax-deductible. This lowers your overall tax and NIC liability.

Capital Allowances: Invest in business assets that qualify for capital allowances. These allowances can reduce your taxable profits and consequently your Class 4 NIC obligations.

Marriage Allowance: If applicable, you could benefit from the Marriage Allowance, which allows lower-earning partners to transfer part of their personal allowance to their higher-earning partner, reducing their overall tax liability.

Dealing with Volatility and Uncertainty

The nature of self-employment can often mean dealing with fluctuating income and uncertain financial periods. Planning for such volatility is crucial:

Emergency Fund: Build an emergency fund that covers 6-12 months of expenses to cushion against periods of low income without needing to dip into funds set aside for tax obligations.

Diversification: Diversify your income streams if possible, to reduce reliance on one source of income, which can make financial planning more predictable and secure.

Seeking Professional Help

Due to the complexity of tax laws and the potential consequences of errors, seeking professional tax advice is highly recommended. A qualified tax advisor can provide:

Customized Planning: Tailored advice based on your specific financial situation, helping you make informed decisions that optimize your tax and NIC payments.

Updates on Legislation: Professional advisors are up-to-date on the latest tax legislation and can guide you on new laws that might affect your NIC calculations and payments.

Class 4 NIC is a significant consideration for self-employed individuals in the UK, affecting not only their compliance with tax laws but also their broader financial health. Effective management of these contributions, along with strategic tax planning, is crucial for ensuring long-term financial stability and minimizing tax liability. By staying informed, utilizing digital tools, and seeking professional advice, self-employed taxpayers can navigate their tax obligations confidently and efficiently, setting a solid foundation for future financial success.

From April 2026, self-employed individuals with qualifying income over £50,000 must comply with Making Tax Digital for Income Tax Self Assessment, involving digital record-keeping and quarterly updates to HMRC, replacing annual Self Assessment for those elements.

The Scenarios that Cause Variations in the Class 4 NIC Rates

The variation in Class 4 National Insurance Contributions (NIC) rates in the UK can be attributed to several scenarios, each influenced by policy decisions, economic factors, and legislative changes. Here's a detailed exploration of these factors:

Economic Conditions and Fiscal Policy

Economic conditions significantly influence fiscal policy decisions, including adjustments to NIC rates. For instance, to support self-employed individuals during economic downturns or periods of inflation, the government might adjust NIC rates to reduce the tax burden. Conversely, during periods of robust economic growth, rates might increase as part of broader fiscal tightening measures.

Government Policy and Budget Decisions

NIC rates are directly affected by government budget decisions. These decisions can reflect broader social and economic objectives, such as increasing public revenue to fund healthcare or social services. For example, in 2021, the UK government announced a 1.25% increase in Class 4 NIC rates, effective from April 2022, to fund health and social care needs heightened by the coronavirus pandemic. This increase was a temporary measure reflecting specific fiscal needs at the time.

Legislative Changes

Changes in NIC rates often occur through legislative updates. The National Insurance Contributions (Reduction in Rates) Bill 2023-24 illustrates this, where a reduction in NIC rates for both employed and self-employed individuals was legislated to provide tax relief and stimulate economic activity. Such legislative measures are typically influenced by current economic conditions, fiscal policy needs, and political objectives.

Threshold Adjustments

NIC rates are also affected by adjustments to income thresholds. Each tax year, these thresholds may be adjusted for inflation or in response to economic conditions. Changes in these thresholds can lead to variations in how much NIC individuals owe. For instance, in the 2025-26 tax year, the Class 4 NIC rate was adjusted from 9% to 8% for profits between the lower and upper profit limits, impacting the amount of NIC payable by self-employed individuals.

External Economic Factors

External economic factors such as inflation, wage growth, and unemployment rates can also lead to variations in NIC rates. For example, during periods of high inflation, thresholds and rates may be adjusted to alleviate the tax burden on lower and middle-income earners, thus maintaining consumer spending and economic stability.

These scenarios illustrate the complexity and responsiveness of the NIC system to a range of economic, legislative, and policy-driven factors. Each change in the NIC rate or threshold reflects a balancing act between raising necessary public funds and supporting economic activity among the self-employed population.

Case Study: Calculating Class 4 National Insurance Contributions in the UK for 2025-26

This hypothetical case study examines the process by which a self-employed individual in the UK calculates their payable Class 4 National Insurance Contributions (NIC) for the tax year 2025-26. We'll follow a self-employed graphic designer, "Alex", who has a taxable profit of £45,000 for the year.

Understanding Class 4 NIC

Class 4 NICs are paid by those who are self-employed, based on their annual profits. The rates and thresholds are set by the government and can vary each year depending on fiscal policies and economic conditions. For the tax year 2025-26, the rates are set as follows: No NICs on the first £12,570 (Lower Profits Limit or LPL). 6% on profits between £12,570 and £50,270. 2% on any profit over £50,270.

These figures reflect a decrease from previous years, aimed at reducing the tax burden on self-employed individuals.

Step-by-Step Calculation

Determine Taxable Profits:

Alex's total profits from self-employment for the year are £45,000.

Apply the Lower Profits Limit (LPL):

The first £12,570 of Alex's profits is not subject to Class 4 NIC.

Calculate NIC on Profits Between LPL and Upper Profits Limit (UPL):

Alex's remaining profit subject to the 6% rate: £45,000 - £12,570 = £32,430. NIC due at 6%: £32,430 × 6% = £1,945.80.

Total NIC Payable:

Since Alex's profits do not exceed £50,270, the 2% rate does not apply.

Therefore, Alex's total Class 4 NIC for the year is £1,945.80.

Variations and Considerations

The calculation of Class 4 NIC can vary significantly based on several factors:

Changes in Profits: If Alex's profits were higher or lower, the NIC calculations would adjust accordingly. For example, if the profits were £55,000, Alex would also owe 2% on any amount over £50,270.

Legislative Changes: Any changes in legislation that alter the rates or thresholds for Class 4 NIC would impact Alex's calculations. Historical changes have included increases to fund specific government initiatives or decreases to stimulate economic growth among self-employed individuals.

Economic Conditions: Economic downturns or recoveries can lead governments to adjust tax rates to manage economic activity. For instance, during economic recoveries, rates might be increased to replenish government coffers.

In this hypothetical scenario, Alex is able to calculate his Class 4 NIC obligations using the current thresholds and rates provided by the UK government for the tax year 2025-26. This case study not only illustrates the method of calculation but also highlights the potential variations and considerations that can affect how much a self-employed individual might owe in a given tax year. Understanding these nuances is crucial for effective financial planning and compliance with tax regulations.

How a Tax Accountant Can Assist with National Insurance Contributions

National Insurance Contributions (NICs) are a fundamental part of the UK’s tax system, affecting everyone in employment, whether they are employees or self-employed. Understanding NICs and ensuring the correct amounts are paid can be complex. This is where a tax accountant can be invaluable, offering expertise to navigate this intricate aspect of UK taxation efficiently and effectively.

Overview of National Insurance

National Insurance is a tax on earnings, set up originally to fund various state benefits such as the state pension, unemployment benefits, and the NHS. There are different classes of NICs, each relevant to different types of employment and earnings levels:

Class 1: Paid by employees earning above a certain threshold.

Class 2 and Class 4: Paid by self-employed individuals.

Class 3: Voluntary contributions to fill gaps in your NI record.

Each class affects taxpayers differently, influencing how much they need to pay and what benefits they are entitled to claim.

Calculation and Optimisation

One of the primary roles of a tax accountant is assisting with the accurate calculation of NICs. For self-employed individuals, determining the precise amount payable in Class 2 and Class 4 contributions can be particularly challenging due to fluctuating incomes. A tax accountant can:

Assess taxable income: They review financial records to accurately determine annual profits from which NICs are calculated.

Calculate contributions: Accountants apply the correct rates and thresholds to compute the amount of NIC due.

Advise on tax efficiency: They provide guidance on structuring finances to potentially reduce NIC liabilities legally, such as through timing of dividend payments or pension contributions.

Compliance and Deadlines

Tax accountants ensure compliance with HMRC requirements, helping clients avoid penalties for late or incorrect payments of NICs:

Filing Returns: Accountants assist with the annual self-assessment tax returns for self-employed clients, including the accurate reporting of earnings and calculation of NICs.

Advising on Deadlines: They keep track of critical dates, ensuring that NICs and other tax liabilities are paid on time.

Dealing with HMRC

Interaction with HMRC can be daunting. Tax accountants often handle communications with HMRC on behalf of their clients:

Handling Queries: They respond to any questions HMRC may have about a client’s NICs or tax returns.

Resolving Disputes: Should there be any discrepancies or disputes regarding NICs, a tax accountant can negotiate and resolve these issues with HMRC, often more efficiently than individuals due to their expert knowledge and experience.

Planning for Benefits

Beyond tax savings, NICs influence eligibility for state benefits. A tax accountant helps clients understand the implications of their NICs on future entitlements:

State Pension: Ensuring enough contributions are made to qualify for the full state pension.

Other Benefits: Advising on how NICs impact qualification for other benefits like maternity allowance or employment and support allowance.

Regular Updates and Changes in Legislation

Tax laws and NIC rates and thresholds can change frequently. Tax accountants keep abreast of these changes, ensuring clients always pay the right amount and benefit from any new tax reliefs or rules:

Legislative Updates: Accountants monitor changes in tax legislation and inform clients of how these changes affect their NICs.

Strategic Advice: Providing strategic advice on how to adapt to changes, optimizing both current and future tax and NIC liabilities.

Case Studies and Personalized Advice

Every individual and business has unique circumstances. Tax accountants provide personalized advice tailored to these specific conditions:

Case Studies: They might offer insights through relevant case studies, helping clients understand complex scenarios.

Future Planning: Advising on long-term tax planning, including how to manage NICs as part of a broader financial strategy.

A tax accountant plays a crucial role in managing National Insurance Contributions in the UK. By offering expert calculation, ensuring compliance, handling HMRC interactions, and providing strategic advice, they help clients navigate the complexities of NICs efficiently. This support is essential not only for meeting legal obligations but also for optimizing financial outcomes and planning for future benefits. Whether you’re self-employed or running a business, a tax accountant can provide invaluable guidance on all aspects of NICs, ensuring that you pay the correct amount and optimize your entitlement to future state benefits.

FAQs

Q1: What is the Lower Profits Limit (LPL) for Class 4 NIC in the UK for the 2025-26 tax year?

A: The Lower Profits Limit (LPL) for the 2025-26 tax year is £12,570. This is the amount up to which no Class 4 NIC is payable.

Q2: How is the Class 4 NIC calculated on profits above the Upper Profits Limit (UPL)?

A: For the 2025-26 tax year, any profits above the Upper Profits Limit of £50,270 are taxed at a rate of 2% for Class 4 NIC.

Q3: Can I deduct any expenses before calculating my Class 4 NIC?

A: Yes, you can deduct allowable business expenses from your gross income to determine your taxable profits, which are then used to calculate your Class 4 NIC.

Q4: Is there a cap on the amount of Class 4 NIC I can pay?

A: No, there is no upper cap on the amount of Class 4 NIC you can pay. It is calculated based on your profits, with specific rates applied to different portions of your income.

Q5: What happens if I also have employment income in addition to self-employed profits?

A: If you have both employment and self-employed income, you may need to pay both Class 1 NIC on your employment income and Class 4 NIC on your self-employed profits. However, special rules apply to ensure you do not overpay NIC across different classes.

Q6: How do I report and pay my Class 4 NIC?

A: Class 4 NIC is reported and paid through your Self Assessment tax return, which is due annually.

Q7: Are there any exemptions from paying Class 4 NIC?

A: Yes, if your profits are below the Lower Profits Limit (£12,570 for 2025-26), you are exempt from paying Class 4 NIC.

Q8: What should I do if I made an error in calculating my Class 4 NIC?

A: If you realize you have made an error in your Self Assessment return regarding Class 4 NIC calculations, you can amend your tax return within 12 months of the original deadline or inform HMRC to make the correction.

Q9: Can I defer Class 4 NIC payments if I am facing financial difficulties?

A: HMRC may offer options such as a payment plan if you are facing financial difficulties. It's important to contact them as soon as possible to discuss your specific situation.

Q10: Does Class 4 NIC contribute towards my State Pension entitlement?

A: No, Class 4 NIC does not count towards your State Pension entitlement or most other social security benefits, which are typically covered under Class 2 NICs.

Q11: What is the deadline for paying Class 4 NIC?

A: The deadline for paying Class 4 NIC is the same as the deadline for your Self Assessment tax return, which is January 31st following the end of the tax year.

Q12: Can I reduce my Class 4 NIC liability through any reliefs or allowances?

A: While specific deductions directly reducing Class 4 NIC are not available, effectively managing your business expenses and utilizing capital allowances can reduce your taxable profits and thus lower your Class 4 NIC.

Q13: What are the penalties for late payment of Class 4 NIC?

A: Late payment of Class 4 NIC can result in interest and penalties. The specific charges depend on how late the payment is made.

Q14: How do recent changes to Class 4 NIC rates affect self-employed taxpayers?

A: Recent changes, such as the reduction of rates or adjustments to profit thresholds, can affect the amount of NIC payable, potentially reducing the tax burden on self-employed individuals.

Q15: Where can I find a calculator to estimate my Class 4 NIC liabilities?

A: HMRC offers online tools and calculators on their website that can help you estimate your Class 4 NIC liabilities based on your self-reported profits.

Q16: What should I do if I disagree with an HMRC decision on my Class 4 NIC?

A: If you disagree with a decision made by HMRC regarding your Class 4 NIC, you have the right to appeal. HMRC provides guidance on how to go about this process on their website.

Q17: How does being part of a partnership affect my Class 4 NIC?

A: If you are part of a partnership, you still need to pay Class 4 NIC on your share of the profits, calculated in the same way as for sole traders.

Q18: Are there any special considerations for Class 4 NIC for newlyself-employed individuals in their first year of business?

A: For newly self-employed individuals, understanding when to start paying Class 4 NIC is crucial. You need to register with HMRC for Self Assessment as soon as you start your business. However, your actual Class 4 NIC payments will only begin once your profits exceed the Lower Profits Limit in a tax year.

Q19: Can I voluntarily pay more Class 4 NIC to cover for other benefits?

A: No, Class 4 NIC payments cannot be voluntarily increased to cover for other benefits. However, you may choose to pay Class 2 NIC voluntarily to maintain entitlements like the State Pension.

Q20: How can I ensure that my Class 4 NIC contributions are accurately recorded by HMRC?

A: To ensure your Class 4 NIC contributions are accurately recorded, keep detailed and accurate financial records and ensure that your Self Assessment tax return is correctly filled out and submitted on time. Regularly check your National Insurance record through your personal tax account on HMRC’s website to make sure your contributions are being recorded correctly.

.png)